Nongfu Spring, I dare not spend money randomly

Author:New entropy Time:2022.08.26

@新 新 新

Author 丨 Bai Yan

Edit 丨 Monthly

Within a year, the temperature of the soft drink market has changed sharply.

On August 24, Nongfu Spring issued a midterm performance report. In the first half of this year, Nongfu Spring achieved operating income of 16.599 billion yuan, an increase of 9.4%year -on -year, and net profit was 4.608 billion yuan, an increase of 14.8%year -on -year. On the first trading day after the financial report was released, Nongfu Shanquan's stock price rose 0.87%.

From the performance data, Nongfu Spring still maintains the myth of "water". However, compared with the same period last year, Nongfu Spring's revenue growth rate was 31.44%, and the net profit growth rate was 40.09%. The momentum of high growth has not been maintained, and compared with the 12%stock price of this year, the semi -annual report has also failed to reshape the capital market's confidence in Nongfu Spring.

In the financial report, Nongfu Spring attributed the decline in performance to the price of raw materials caused by the turbulence of the international environment and the impact of the new crown epidemic on the consumer market. But outside of these factors, there are more problems to be solved by Nongfu Spring.

The "Bronze Age" of Nongfu Spring

The reputation of "Shuimao" Nongfu Spring is derived from the powerful profitability.

From the perspective of revenue, the revenue of Nongfu Spring was less than 30 billion yuan last year, and Master Kang's total revenue in the same period was 74.08 billion yuan, of which drink revenue was 44.802 billion yuan. However, from the perspective of market value, the current market value of Nongfu Spring is about 50 billion yuan, and Master Kang's market value is about 80 billion yuan.

The difference is the profit level. The prospectus submitted to the Hong Kong Stock Exchange in April 2020 showed that the comprehensive gross profit margin of Nongfu Spring exceeded 55%, of which the bottle water and gross margin rate reached 60%, while the comprehensive gross profit margin of Master Kang was only about 30%.

Among them, the low production cost determines the profitability of both parties. The prospectus of Nongfu Shanquan shows that from 2017 to 2019, the company's water collection and treatment costs were 116 million yuan, 131 million yuan and 135 million yuan, respectively. PET costs were 2.23 billion yuan, 3.04 billion yuan, and 3.38 billion yuan. The cost of taking water from Nongfu Spring is not only very low, but also the fluctuations are very small. From the perspective of cost structure, Nongfu Spring is not a water -making company, but a bottle company.

However, from the second half of last year, the gross profit margin of Nongfu Spring has declined. By the first half of this year, the gross profit margin decreased from 60.9%in the same period last year to 1.6%to 59.3%. The financial report shows that the gross profit margin is mainly affected by the increase in PET procurement prices under oil prices.

The raw materials that are rising are not only PET. The financial report of Dongpeng beverages in the first half of the year shows that the average price of white sugar procurement rose 7%year -on -year; the commonly used sugar glycol alcohol and trichlorite in the drink also appeared rapidly last year. With the intensification of the beverage market, the upstream raw material market is shifting more pressure to midstream brand manufacturers.

The downturn on the consumer end limits the price of the manufacturing side to the market. According to the data of Fhstana, it is expected that from 2019 to 2024, the compound annual growth rate of the market size of my country's soft beverage industry will reach 5.94%. According to Nielsen data, in the first half of 2021, the overall sales of the beverage industry increased by 15.7%year -on -year, and sales increased by 17.6%year -on -year. But in the first half of this year, Nielsen data showed that the industry's sales decreased by 6.8%year -on -year, and sales decreased by 5.5%year -on -year. Market digestive beverage products have become worse.

A set of data can show the countermeasures of Nongfu Spring in market fluctuations. In the first half of this year, Nongfu Spring's inventory decreased from 1.809 billion yuan at the end of last year to 1.722 billion yuan, and the number of days of inventory rolling decreased from 54.8 days to 47.7 days. On the surface, Nongfu Spring's products turn faster and sales have become more unblocked. The fact is that Nongfu Spring actively shrinks the product matrix, reducing the production capacity and launch of marginal product. In the first half of the year, the sales and distribution expenses of Nongfu Spring decreased by 1.6%year -on -year, and the advertising costs were reduced.

Taking one of other products as an example, the department is responsible for Nongfu Spring's non -core products, including soda drinks, gas -containing beverages, coffee beverages, etc. In the first half of this year, the revenue of other products in Nongfu Spring fell from 84.6 billion yuan in the same period last year to 64.5 billion yuan, a decrease of 23.8%.

In the background of the market, priority chooses to shrink to the core category, which shows the fear of the market value management of Nongfu Spring. For Nongfu Mountain Spring, the market for the bubble water that is attracted to the fire is "face", and bottled water and tea beverage products are "lili".

Building high walls, extensive grain

With the improvement of market uncertainty, Nongfu Spring's willingness to stay in the "comfort zone" has increased significantly.

What is the basic disk of Nongfu Spring? On the raw material side, it is the layout of natural water sources in the early years; on the capacity end, it is nearly 14 billion (as of the first half of 2022), and the assets of factory buildings and equipment accounting for about 70 % of the net assets; Consumer mind.

From the perspective of product structure, the core categories of Nongfu Spring have a long history of development. Bing water was listed in 1997. The functional drinks represented by the scream are listed in 2003 with the fruit juice represented by the Nongfu Orchard. The beverage was listed in 2011, which formed the four major categories of Nongfu Spring. The above categories are not the first of Nongfu Spring. Taking sugar -free tea as an example, unification was launched in the king of sugar -free tea beverage tea in 2004, and exited the stage after the market was cold. In contrast, the "King of Marketing" is better at entering the venue with differentiated products and increasing the existing products. In the sugar -free bubble water market, Nongfu Spring has adopted an approximate strategy. Sugar -free gas -free water is considered a emerging category that emerged in recent years, and has achieved a good balance between health and taste. Nongfu Mountain Spring released soda foaming water products in 2020, which comprehensively paid the elemental forest in packaging and taste. By March this year, Nongfu Spring "resurrected" the steam tea released in 2005, continuing differentiated play on the basis of bubble water. The difference is that the main concept of low sugar tea is the concept of low sugar, not sugar.

Synchronization with the product is a freezer war between Nongfu Spring and the Vitality Forest. The war was named "God of Wealth", and the founder of Nongfu Spring led himself. According to Sina Technology report, offline retail stores display a bottle of farmer mountain springs in the vitality forest freezer, and you can get a bottle of long white snow mineral water priced at 3 yuan. Mainly provided by Nongfu Spring manufacturers.

This means that Nongfu Spring will point the target user of the offensive spear to the vitality forest. As long as there are stores with vitality forest freezers, they will be impacted by Nongfu Spring's competing products. All consumers who buy vitality forests at the store can see the bubble water and auto tea products of Nongfu Spring. Essence

However, with the strategic contraction of Nongfu Shanquan to the core items this year, the dominant position of the vitality forest in the sugar -free bubble water market has been further steady. Relevant announcements show that the revenue of the vitality forest in the first quarter of this year increased by 50%year -on -year.

Where is the strategic resource of Nongfu Shanquan? The financial report gave the answer. In the field of bottled water, functional beverages, and juice beverages, Nongfu Spring has maintained normal marketing actions. In the field of tea beverages, Nongfu Spring's attention has increased significantly. The sugar tea product tea π launched two new products of citrus lemon tea and Qingsi Wulong tea, and released 900 ml packaging to the two old flavors; sugar tea products without sugar tea products Oriental leaves released new spring tea in spring. At the same time, the new steam tea was included in the tea beverage sequence and released three flavors in one breath.

At this point, the strategic planning of Nongfu Spring has gradually become clear -in the sugar -free bubble water market, with the advantages of channels to follow the strategy of the air -driven air outlet, core resources are gathered in the field of tea beverage. Realized the effect of the "hedge" "hedging" waveless market.

If the research and development and marketing of new products are regarded as leverage, last year, Nongfu Spring's play was to move radio leverage and fight channels; and in this year's market fluctuations, Nongfu Spring had to bow to the market status quo and modify the strategic modification strategy to modify the strategic modification It is "building walls, high grains, and primitive kings."

There is not much space left to Nongfu Spring

Nongfu Spring's enemy is not just the raw material of fluctuations.

The current beverage industry is characterized by "curled up and warming". In front of the shrinking market, various brands generally face the problem of unable to sell products. At the same time, the success of new items is becoming more and more difficult, and head players are returning to large items. For example, Unification and Master Kang have strengthened marketing efforts to super single such as green tea, ice black tea.

Taking unified as an example, the semi -annual report shows that unified promotion and advertising costs decreased by more than 20 % year -on -year to 850 million yuan. They are 45 days, 46 days, and 40 days, respectively. The specific method is to reduce the inventory of circulation links and avoid unnecessary channel expenses, which once triggered a wide range of dealers.

In contrast, Master Kang, who is weaker in inventory management, is facing the extension of the inventory cycle. The data at the same time is 17.73 days, 18.35 days and 19.21 days. In addition, due to sales costs increased by 12%in the first half of the year, Master Kang's semi -annual report profits were less than market expectations.

At the same time, Nongfu Spring's new enemies are also increasing. According to data from the China Business Industry Research Institute, from 2018 to 2020, the market size of China's current tea industry, which has statistics from retail consumption value, increased from 70 billion yuan to 114 billion yuan, with an average annual compound growth rate of 17.7%. The year -on -year growth rate in 2021 reached 27.19%. This is significantly higher than the growth rate of the beverage market in the same period.

In the past, bottled beverages led the innovation of the entire market. For example, the "water spray gun" design of Nongfu Spring's functional beverages once triggered the favor of young people. Wahaha Nutrition Express once replaced milk to become some consumer breakfast choices. Now, the protagonist of the leading taste innovation has become the current tea industry. Take cheese juice/fruit tea as an example. Players such as Xixue's tea, Honey Xuebing City and other players have launched a new "arms competition" developed by new products. Due to the restrictions of product form, bottled drinks are almost impossible to make cheese top effects Essence

Another competition is reflected at the level of pricing. The main theme of the pursuit of growth of bottled beverages is price increase. Nongfu Spring's new water new product long snow is positioned in the mid -to -high -end, with a retail price of 3 yuan; new tea beverage of steam tea, retail price is about 6 yuan. In the field of tea, some of the products of sinking brands have also reached this price range. This means that the upper limit of the price of bottled beverages hit the price and lower limit of the current tea. When the narrow road meets, the room left to both parties is getting smaller and smaller. Regardless of the taste or price, the rapidly growing tea industry has "capped" bottled beverages. Although the consumption scenarios of both parties have certain differences, the status of bottled beverages is still irreplaceable in some specific occasions such as banquets and business conferences. But in outdoor, office and other scenarios, the status of bottled beverages is no longer reliable.

This represents a new state of the consumer market -more products, more segmented categories, and more differentiated consumer tastes. The strategic -level new products released by the head company are more difficult to accumulate a solid user reputation in a short period of time. Taking sugar -free bubble water as an example, the popularity of the vitality forest has driven a large number of similar competitions, and the freezer war set off by Nongfu Spring and the vitality forest also shows that no brand has absolute product strength advantages, and must rely on channels to achieve the right way to achieve right. Consumer binding.

For Nongfu Spring, market fluctuations make it return to large products and advantages. The new high -end bottled water and tea beverages seem to bring new growth space for Nongfu Spring, but still lack of performance proof. And Nongfu Spring's habit, a new product has detonated the entire market, has gone forever.

- END -

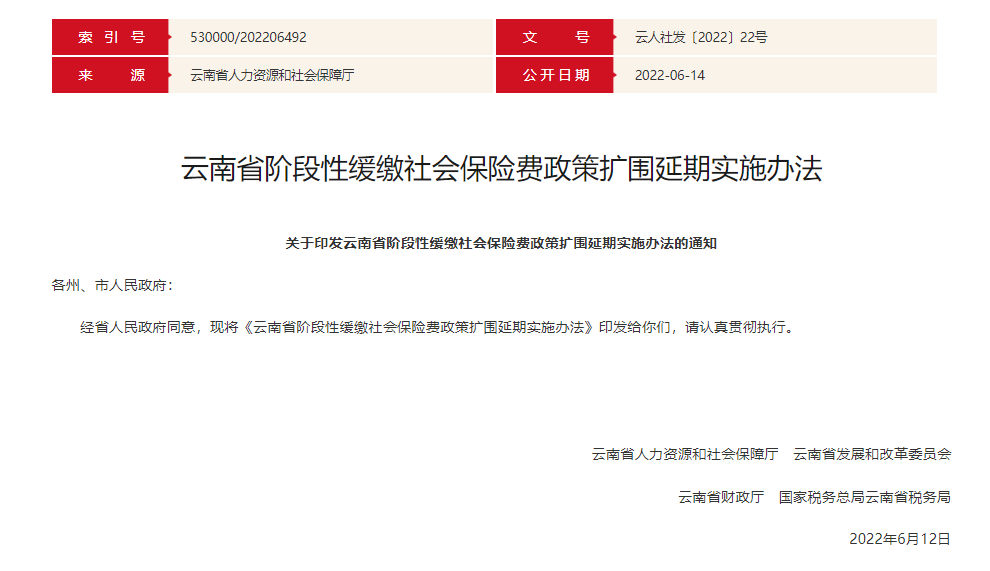

Expansion!postpone!Difficulties in these industries in Yunnan will enjoy policies and favors

Recently, the Yunnan Provincial Department of Human Resources and Social Security,...

Hard core strength!Huangshi starting attention

14thThe roar of the whistleA railway train with 22 cabinet cargoSlowly drive from ...