Zhu Jiaming: After 2008, there will be no "King of Currency", thinking in 400 years

Author:Report Time:2022.08.26

The Ex Building in Washington is the Federal Reserve Headquarters

[Introduction] The world is not a big change in turbulence and change. To understand the world economy, we must understand the currency, and we must understand that the currency must understand the central banks of various countries. Zhu Jiaming, a well -known economist and the chairman of the Academic and Technical Committee of Hengqin Digital Financial Research Institute, wrote a preface to the first "King of Currency" for young economist Xu Jin's currency trilogy. Mr. Zhu Jiaming's order is often a more penetrating extension, based on books and surpassing books.

After authorization, the sequence of 5,000 words in the lecture hall can understand the history of the "King of Currency" throne in 400 years. You can see the financial crisis of financial innovation. The dilemma of the financial system faced by humans in the 21st century. "The error originated from the direction, the direction originated from cognition, and the cognition originated from thought." I hope that dear readers will benefit a lot.

The history of financial evolution during 400 years

Preface to Xu Jin's book, whether it is the "Silver Empire" a few years ago, or the current "King of Currency", is a comprehensive challenge to intelligence, knowledge and text skills, and a test of professional level.

From the US, the Netherlands, the Netherlands, the United Kingdom to the United States, 400 years later

Human monetary history, like the history and political history of human beings, is king.

*By the formation of watershed by 2008, human beings ushered in the era of "no currency king"

The 15th century was a century of transformation in all directions. Not only did the "Centennial War" and "Rose War" occurred. From the economic re -combination of the Economic to Western European countries in the United Kingdom, the medieval manor began monetization. Expansion, countless wealth and resources are entered into Europe, and humanism, science and art have been fully revived. As the "King of Currency", the Midi family began to enter the heyday. Florence is a world financial town.

Entering the 17th century, all of this began to change. In 1737, the Midi family died in the last ruler of Florence, Jane Gaston, and the crown of the "King of Currency" landed. The former "Maritime Carrier" Netherlands, although the Amsterdam Stock Exchange was created, it also quickly declined.

William was originally the rulers of the Dutch Republic. His arrival brought the financial concept of the Netherlands to the United Kingdom, which gave birth to the series of financial changes in Bank of England

Britain, because of the glorious revolution, took the lead in establishing a bourgeois agency system, completed the scientific revolution of religious reforms, Newton's scientific revolution, the business revolution led by industrialists, the financial revolution promoted by bankers, and mutual influence, and building a complete capitalist dominant framework. The industrial revolution that is desperate has obtained huge funding guarantee and forms a strong internal motivation. In 1776, Adam Smith's "National Fortune Theory" was published, and its economic ideas were spread and deeply rooted in the hearts of the people. Britain is on the eve of the industrial revolution. In such a large historical scene, the Bank of England, founded in 1694, determined the fixed exchange rate of gold and the British pound in 1717, and became a new "King of Currency". London began to become a new world financial center.

The 20th century was the United States of the United States, the United States of the two World War, and became the "King of Currency" in the modern world. The "Bretton Forest Conference" in 1944 was also a coronation ceremony for the new "King of Currency". New York replaces the status of the world financial center in London.

Today, with the 2008 world financial crisis as the historical watershed, the global monetary system, banking system, and financial system, entered an unprecedented historical moment of large -scale division, reorganization, and transformation. It can be foreseen without suspense: the "King of Currency" in the United States is unsustainable, and humans will usher in an era of no "King of currency".

In 2008, the "Fire Fire Three" was composed of Paulson (third from left) with the Federal Reserve President Berknan (first from the first from left) and Gatner (then the president of New York Reserve Bank, and successively served as the Minister of Finance). At the beginning of the financial crisis, President Bush Bush, with Berknan, Paulson, etc. in the White Rose Garden in the White House

*The commonality of the financial crisis: the non -balanced trend of the system and the greed of human nature

Since the 18th century, the financial crisis has been so continuous. What commonality exists? There are two points: the first, institutional reasons. "Capitalism is a continuous and endless growth system." Economic growth has unlimited demand for financial resources. Therefore, there is always a serious non -balanced trend between the real economy supported by financial resources and financial resources. The real economy and financial resources have long been swaying in shortage and excess. When the shortage of financial resources and excess exceeds one limit, the financial crisis will cause the financial crisis. Second, the reason for human nature. Each financial crisis is broken by the balance of greed and rationality, and greedy abducting rational results. The financial crisis and capitalism follow the result, which is the result of the interaction between systems and human causes.

The four cases show that financial innovation is essential, but the Yisheng financial crisis

The monetary finance system has evolved in continuous innovation. The following are the cases of financial innovation factors of different times, but directly and indirectly derived the financial crisis:

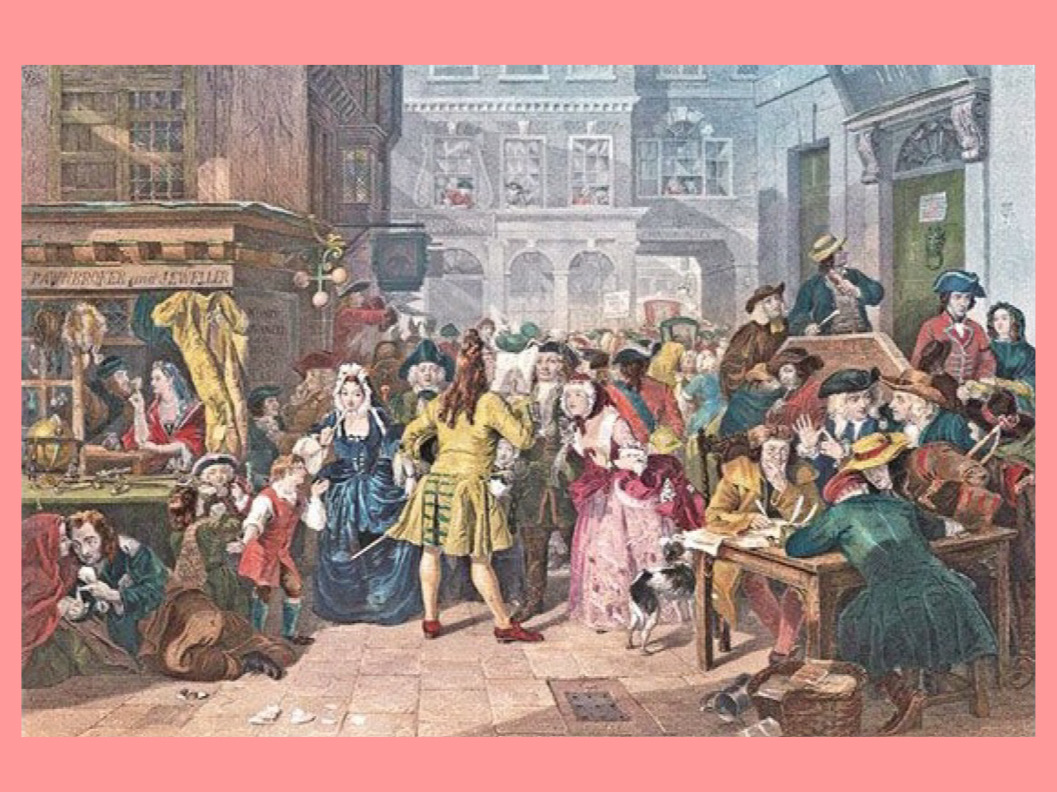

Case 1, "South China Sea Bubble". In 1720, the British government cooperated with the South China Sea Company, which has the right to trade monopoly in South America to issue a large number of stocks to collect cash, causing a crisis in the "South China Sea Bubble". The Minister of Finance was in jail, and physicist Newton was a well -known victim of the "South China Sea Bubble" crisis. On the one hand, the British capital at that time was abundant, the industrial revolution had not yet arrived, the amount of stock issuance was very small, the investment opportunities were insufficient, and the capital was excess. With the "BRICS and silver blocks" returned to Britain, the investment will get a huge return. If the South China Sea company, by increasing the stock price and absorbing new capital, it is indeed used in South America's resources development and developing South American mineral resources. Under the historical conditions at that time, it was a financial innovation. From the 18th century to the present, cases similar to the "South China Sea Bubble" have continued to occur. The British "South China Sea Bubble Incident" and "Mississippi Bubble Incident" and "Tulip Fragrance" are also known as the "three major economic bubbles" in Europe

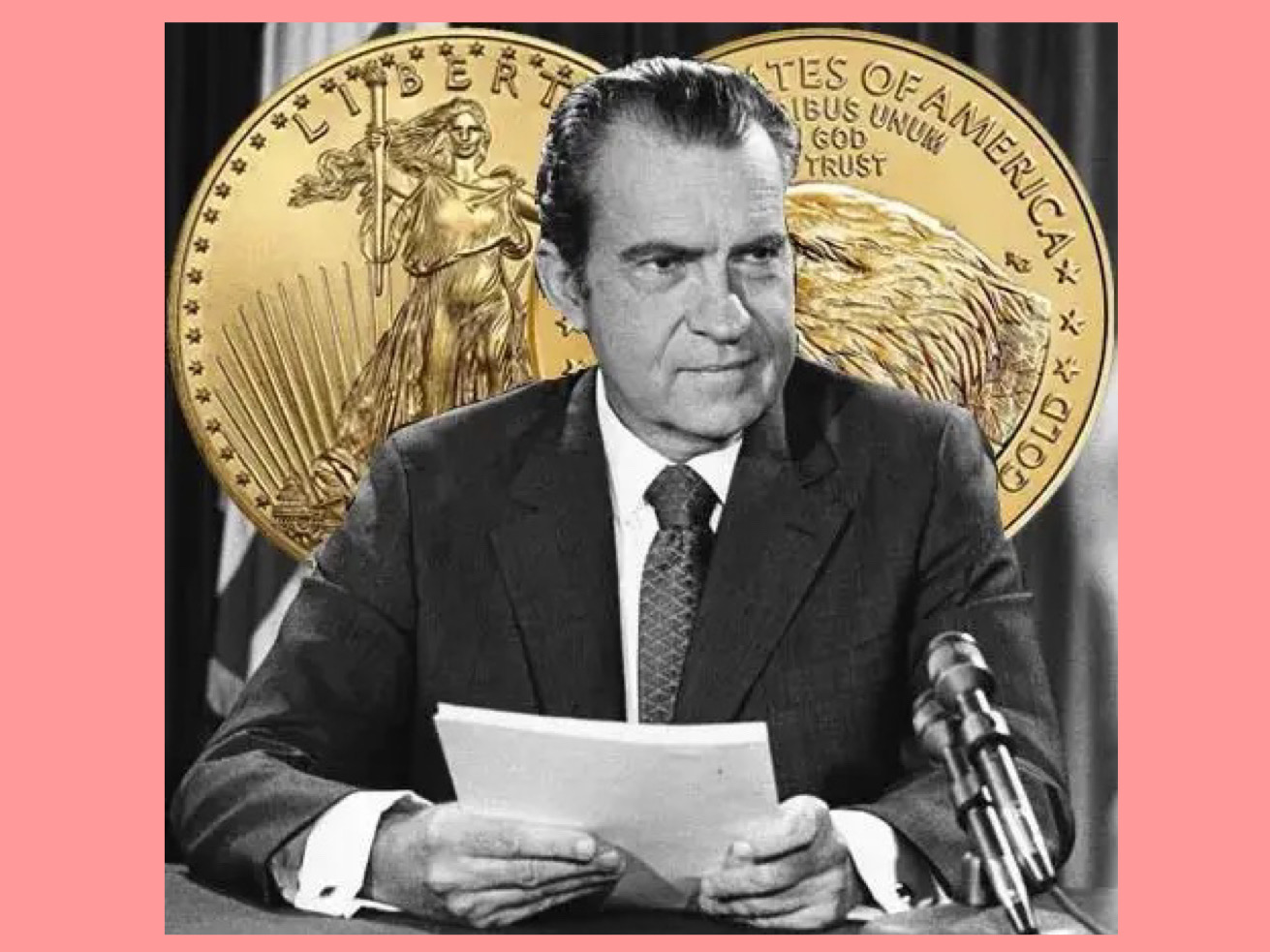

Case 2, Nixon closed the US dollar and gold windows. In July 1944, the representatives of 44 countries signed the "Bretton Forest Agreement" in New Hampshire, USA, and identified the post -war international currency financial system: the US dollar linked to gold, the members of the member country and the US dollar linked, and the adjustable fixed fixed fixed fixed fixed fixed Exchange rate system; cancel foreign exchange control of frequent household transactions. 27 years later, Nixon closed the US dollar and gold windows. This means that the US dollar no longer has inherent value, just because of the US government's decree, forced the world to accept the floating exchange rate system. Since then, currencies of various countries have rely on national credit. The main consequences are: the status of the central bank is rising, and the monetary policy is crucial; the government has the absolute monopoly right of printed currency, the currency tax expansion; the super -issuing currency, the depreciation of the currency, the inflation, and the inflow of currency into real estate and other financial assets. In short, Nixon introduced the world into the "Bretton Forest Agreement" era, that is, a new currency finance era based on a thorough "legal currency" and characterized by floating exchange rates. It cannot be denied that the floating exchange rate system is a financial system innovation, but it has since opened the normalization of the "Pandora Box" with the normalization of the world financial crisis.

In 1971, President Nixon announced the closure of US dollars and gold windows. Since then, after entering, the Bretton Forest Times Network

Case III, Derivatives. Beginning in the 1970s, in the future, the risk of inflation, interest rates and exchange rate risks in the future; communication technology, information processing technology and mathematical tools are combined with the financial industry; derivative tool valuation models and technologies have made breakthroughs; The characteristics of the characteristics are super development and application. The essence of financial derivative products is financial contracts based on basic financial instruments, which has strong derivative ability and high leverage. The basic types of contracts include: long -term contracts, futures, swaps (swaps) and options. Financial derivatives also include hybrid financial tools of one or more characteristics of different contracts. Because the cross -seizure, linkage and uncertainty of financial derivatives, if the transaction is improper, it may lead to huge risks, even a catastrophic financial crisis. For example, in the 1990s, the United States Orange County went bankrupt, British Balin Bank bankruptcy, LTCM bankruptcy and acquisition were typical incidents of failure of application financial derivatives.

Case 4, the dotcom crisis in 2000. On March 10, 2000, the Nasdaq comprehensive index of the United States reached its peak. A few days later, the Nasdaq Composite Index began to decline, the stock market lost more than $ 4 trillion, and the number of unemployed online companies reached at least 112,000. Essence By the end of April, the gap was 31%, and the worst losses in history occurred. On September 21 of the same year, the NASA index fell to 1088 points, setting the lowest record in the past three years. Compared with the historical peak on March 10, 2000, it fell 78.8%, and returned to the level before 1998. The historical environment of this crisis is

The results of the expansion of financial wealth driven by the ITC Revolution.

In short, the financial crisis and financial innovation, including financial systems and financial technology and tool innovation, have an inseparable relationship. Before each financial crisis, financial innovation was existed, which led to a prosperity. After being alienated, financial innovation surpassed Xiong Peter's "destructive innovation" boundary, from the positive destructive to negative destructiveness. Each financial system changes in history and the modernization of financial instruments must always pay.

This is the core feature of monetary finance is unavoidable liquidity and absorption. Lobricity will not be limited by time and space, and can achieve ALL in. After the 2008 World Financial Crisis, monetary financial supervision before and after governments in various countries led to a low decline in the financial industry. It is precisely because of this background that non -state -controlled encrypted digital finance was born, creating a manufacturing model of new wealth. The so -called "God closed a door, but opened a window."

The rise and weak history of central banks, especially the Federal Reserve, especially the Federal Reserve. IMF has begun to decline simultaneously

The French war led to the fiscal crisis of William III, and it made a group of businessmen's dreams of wealth. The originator of the modern central bank, the Bank of England was established here

Because of the Bank of England, Britain not only achieved the "let the country's return to the country, the king's return to the king" in the financial system, but also achieved the status of the Bank of England's central bank. The Bank of England was in a comprehensive crisis of politics, economy, and society in the 17th century. The direct background of the Federal Reserve is Friedman's "Gold Inflation" from 1897-1914, especially the banking crisis in 1907, forming one of the worst five or six tightening in American history since 1779. However, history has proven that the Bank of England and the Fed are not capable, and it is not possible to effectively foresee and avoid any financial crisis.

With the central bank system represented by the United Kingdom and the United States, it has popularized countries around the world, or in the middle and late 20th century. From the perspective of worldwide, the status of the central bank has increased significantly after the 1970s, because the world's major countries have officially entered the "legal currency" and the era of floating exchange rates that are inseparable. The government has unprecedented power in the field of monetary finance. Take the Fed as an example: "The Federal Reserve purchased the Treasury Coupon 'borrowing' money to the US government, and then lent the government owed currency to the bank to monetize the US bonds." Become the core feature of modern currency finance, and it is also the core function of banks.

The "Occupy Wall Street Movement" in 2011 crushed the existing image of the Federal Reserve

The 2008 World Financial Crisis erupted, and the Central Bank represented by the Federal Reserve has an irresistible responsibility. Since then, the golden age of the central bank has ended. The "Occupy Wall Street" campaign in 2011 marks the crushing of the Fed's position in the hearts of the people. The decline of the central bank of the developed countries represented by the Federal Reserve is even more: (1) the central bank is unable to deal with the issue of currency financial scale because of the central bank itself, and the inflation pressure caused by it; Independent industrial departments of the real economy; (3) The complex world financial system formed and solidified by financial globalization, transcending the sovereign boundary, and the influence of any central bank has sovereign boundaries; Has been formed, the rise of digital currency and digital economy.

While the central bank was declining, the IMF began to decline. Basic reasons include at least, the IMF fund share and voting rights share are inconsistent with the economic importance of various member states; IIMF's resources are insufficient, and the cost of obtaining resources is also high; the ability of IMF to regulate the balance of balance of payments is insufficient. Equipment. Also, the International Settlements (BIS, Bank for International Settlements), as the "central bank", is also marginalized. Now, the complexity of contemporary finance makes the design concepts of institutions such as IMF and BIS appear old and vicissitudes.

It is worth noting that the European Central Bank of China in 1998 was the first central bank in the world to manage super national currencies. It did not accept the instructions from the EU leadership and was not supervised by the governments of various countries. The power of monetary policy guarantees the independence and authority of the central bank's central bank to formulate monetary policy, so it shows more and more obvious vitality.

Established in 1998, the European Central Bank in Frankfurt, Germany. The sign in front of the building is a model of the euro symbol and decorated with the twelve star logos like the EU flag.

Two irreversible failed facts: zero interest rate or negative rate, MMT explicitization

During the World Financial Crisis in 2008 and after, on the one hand, all national governments need to strengthen the governance power in the field of monetary finance. The marginal benefits of the main central bank's monetary policy are significantly low, and the effective time of utility is shortened and the running range is reduced.

In fact, globally, the following two irreversible existing facts are more worthy of thinking:

First, almost all developed countries have implemented the "Easy Monetary Policy". The core of this policy is to increase market currency supply. Including direct issuance of currency, public market purchase bonds, reducing the reserve ratio and loan interest rate, and even zero interest rates and negative interest rates. The negative interest rate is undoubtedly the "response to the shrinking" in "King of Currency", and it is still fear of shrinking. Because for almost all modern governments, shrinkage may affect the legitimacy of power more than inflation.

After several years of practice of currency easing policies, the current trend is obvious: the most effective means to stimulate the macroeconomic economy is the currency loose policy, and it is the long -term policy of avoiding economic depression. The difference between the rich and the poor will be transformed from daily forms to a few people with assets and most people without assets. In the case of zero interest rate negative rate, commercial banks did not have the phenomenon of savings loss. Because the people do not have more choices, they will survive under the dual pressure of currency depreciation and inflation for a long time.

Proposal of modern currency theory, American economist L. Randall Wray Network

Second, almost all the country chooses to rely more on the financial department. Modern currency theory (MMT) is "explicitized". According to the MMT theory, the essence of the modern currency system is a government credit monetary system. Because fiscal expenditures created currency circulation, the government recovered currency through taxation. Therefore, MMT advocates that the central bank and fiscal are one. The fiscal deficit is equivalent to currency issuance. The reserve currency and government bonds are sovereign debts, providing monetary tools with different liquidity, term and interest rates. That is, fully employment through reasonable fiscal deficit guarantee, as well as reasonable debt levels to achieve interest rate targets. Because of the extensive and in -depth application of the MMT theory, the media described by the media is a kind of redemption that only does not say, which eventually leads to two currencies in the facts, namely "central bank currency" and "fiscal currency", and the two do not have real realities. boundary. The direct result is that the government has continued to expand the power of currency generation, issuance and governance. For example, in the past years, Russia and Venezuela have been able to overcome the monetary financial crisis. The fundamental reason is to strengthen the country's intervention and control of monetary finance.

Four trends in the post -epidemic era: an unconditional basic income system occurs

Author Xu Jin

In the era of no king in the financial field, finance will become more diverse, diversified and complicated. Four aspects of the world currency and financial situation and trend of focusing on the post -epidemic era are important:

First, the relationship between currency supply, interest rates, exchange rates, inflation and currency tightening is closer, currency depreciation, asset prices have risen, further strengthening, and accumulating social contradictions.

Second, human beings move towards a welfare society and a quasi -welfare society and accelerate. The benefits of finance will be an increasingly important part of a welfare society and a quasi -welfare society. Some countries have begun to establish a system of unconditional basic infme, that is, any local residents can get a basic income without any conditions and qualifications. This system advocates that unconditional basic income will be public necessities in the common stage of the society in the future, and it is likely to deeply change the monetary finance system. During the epidemic period, some countries' governments directly issued cash to the public, which is a specific test of the basic income model.

Third, the mutual influence of different financial sectors in the world. The reason why the Icelandic crisis and the Greek crisis were resolved after the World Financial Crisis in 2008 because the monetary financial system in the euro zone unconsciously applied the DAO system concept.

Fourth, digital currencies and digital finance based on digital technology, blockchain and computing power, including stablecoin, DEFI, NFT, and the irresistible development of the Yuan universe. North America will become the center of digital finance innovation. Recently, the United States issued the "Administrative Order to Ensuring the Development of Digital Assets Responsible for Responsible" is an important signal.

This book is recommended by many economists

From historical derivation today and the future, its trajectory is multi -dimensional, not a single dimension. The incorrect ideological method and the incorrect cognition will lead to the direction of errors. This is especially in the field of highly complex currency finance.

This is exactly the inspiration of "King of Currency" to leave readers.

Li Nian is excerpted from the preface "End of the King of Currency King", 7000 words in the original text

Author: Zhu Jiaming

Photo: In addition to the signature, from the publisher poster and books (in the book)

Edit: Li Nian

Editor in charge: Li Nian

- END -

Bei Stock Exchange: Pay close to the "key minority" supervision four aspects to keep the risk bottom line

On August 19, the reporter learned from the Bei Stock Exchange that the actual controller of the listed company and the key minority of the high and the director of the directors and supervisors playe

Made in Wuyi to the Netherlands!"Yixin Ou" (Jinhua -Tyranian Fenlow) trains bidirectional first opening

Zhejiang News Client, the reporter, the reporter, Ye Mengting, Pan Qiuya correspon...