Design and main interpretation of rapeseed oil and peanuts contract: personalized design is closer to market demand

Author:Henan Daily Client Time:2022.08.26

Henan Daily client reporter Wang Yinan

A few days ago, Zhengzhou Commodity Exchange announced the rules of rapeseed oil and peanuts. It is understood that the design of rapeseed oil and peanut rights contracts not only draws on the design convention of international commodity option market contracts, and refers to the operating experience of the option markets such as white sugar, cotton, rapeseed meal, but also combined with the characteristics of relevant varieties. Added a certain "personalized configuration".

According to the relevant person in charge of Zhengshang Institute, during the design and formulation of rapeseed oil and peanuts contracts, Zheng Shang has conducted research on industrial enterprises, investment institutions, futures companies, and municipal businessmen. In the design of rights, trading units and quotation units, etc., further close the needs of the real market, and take into account market liquidity on the basis of ensuring risk control.

Specifically, rapeseed oil and peanut options trading units are 1 -handed rapeseed oil futures contract and 1 -hand peanut futures contract. The rapeseed oil and peanut option quotation unit and the end of the rising and fall are also consistent with the target futures to facilitate investors The risk of the overcurrency period; the monthly regulations of the two varieties of options contracts are two active months of two months and positions of more than 5,000 hands (unilateral), which is consistent with the setting of sugar, cotton, and rapeseed meal options to meet market transactions in time Demand is also conducive to concentrating on market liquidity and improving the efficiency of market operation; the last trading date of rapeseed oil and peanut options is the third trading day of the futures contract of the target futures contract. Consistent, meet the needs of industrial customer packages, avoid risks to the operation of the delivery month.

At the same time, in the design of exercise prices, in order to ensure that the price of the rights of the options can cover the target price fluctuations, even when the futures price reaches the stop, it can still provide the market with a suitable flat value, real value, and virtual value option contract, rapeseed oil oil, rapeseed oil The contract of the contract price of peanut options to cover the contract on the previous trading day of the settlement price is 1.5 times the price range corresponding to the rise and fall of the day. In terms of exercise, referring to the international commodity option market practice and the experience operation experience of white sugar. The setting of rapeseed oil and peanuts rights and the right to periodical of peanut periods is American. Objective buyers can do it on the date of date and the previous trading date, which is conducive to conducive Maintaining more correlation with options and futures prices will provide traders with flexible choices and reduce the impact of the target market operation on the target market.

In addition, the reporter noticed that compared with the listing options, rapeseed oil and peanut rights contracts have obvious personalized design in many ways. First of all, the number of rapeseed oils and peanuts in the number of seizures increases. It is understood that the number of options is too large, which is not conducive to centralized market liquidity; if the number is too small, it cannot effectively cover the range of futures price fluctuations. Therefore, according to the characteristics of the operating experience of the listing options and the characteristics of the price of rapeseed oil and peanut futures, Zhengshang Institute will hang out 19 to see the bullish options and 19 declines on the first day of the listing of rapeseed oil and peanuts. Options (that is, 9 real values, 1 flat value, and 9 virtual options, corresponding to 19 lines of rights), can reach the price range corresponding to the increase in the limit of the day and fall of the day and down 1.5 times on the day and bottom of the daybage.

Secondly, the minimum change price of rapeseed oil and peanut options is 0.5 yuan/ton. The design of the minimum change price of options mainly considers the "sliding point" risk, the cost of transaction fees and price fluctuations in the investment of options. From the perspective of the operation of the domestic option market, the deficiency value and flat value option contracts are more active. The Delta value is between 0.2 and 0.5, and the option price fluctuations are about 1/5 to 1/2 of the futures. The ratio of rapeseed oil and peanut options to the minimum change of futures is 1/2, 1/4, respectively, both in a reasonable range, which can better meet the needs of the combination of rapeseed oil and peanut options and futures market.

Finally, rapeseed oil and peanut options adopt a applicable design in the spacing of exercise prices to balance the liquidity of the market and meet the needs of more traders. From the data point of view, since the launch of rapeseed oil futures, the price fluctuates in interval from 5400 yuan/ton to 16,000 yuan/ton. Since the listing of peanut futures, the price has fluctuated in interval from 8,000 yuan/ton to 12,000 yuan/ton. According to the operating range of rapeseed oil and peanut futures, the two options set by Zheng Shang set up unsealed prices for 5,000 yuan/ton and 10,000 yuan/ton segments. The ratio of the price distance between the rights of rapeseed oil and peanuts is between 1%and 2%, which is basically the same as domestic commodity options and international mature market practices.

The relevant person in charge of Zhengshang Institute said that the early period of Zheng Shang has done all the preparations before the listing of rapeseed oil and peanut options. The listing of rapeseed oil and peanut options can better meet the diverse and refined risk aversion needs of physical enterprises, enrich the oil and oil derivative tool system, improve the quality of the relevant variety futures market, promote the smooth operation of the futures market. The safety of national fat oil supply is of great significance to serve the national food security strategy.

- END -

Leelwei: Planning the acquisition of Xinantong 80%of the equity, the stock suspension

On July 5th, Capital State learned that A -share company Ra Elwei (301016.SZ) announced that it is planning to issue 80%equity of Nanjing Xinantong Intelligent Technology Co., Ltd., and the company's...

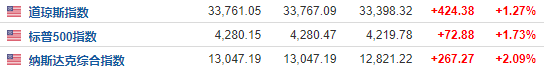

U.S. stocks closed: Three major indexes rose four consecutive surrounding five companies to retire from the municipal Chinese enterprises collectively closed down

U.S. stocks opened high on Friday (August 12), and the three major indexes increas...