Brokers 2022 medium -term transcripts: total assets exceeded 11 trillion

Author:Dahe Cai Cube Time:2022.08.25

The market market is sluggish, and the brokerage company "watching the sky" also handed over a bleak mid -2022 transcript.

The China Securities Industry Association recently released the business data of the securities company in the first half of 2022. The securities company did not have audited financial statements, showing that 140 securities companies achieved operating income of 205.919 billion yuan in the first half of 2022, a year -on -year decrease of 11.4%; net profit was 81195 billion yuan, a year -on -year decrease of 10.06%. This is also the first time that the securities company has doubled in revenue and net profit for the first time since 2018.

Among them, 115 securities companies have achieved profit, accounting for 82.14%of the total, and 25 brokers have not made a large loss. Compared with 15 in the same period of the previous year, this data means that the loss broker in the first half of this year may increase by 10 by 10 Family.

Nevertheless, in terms of capital strength, the securities industry has made a significant breakthrough in the first half of the year. According to the China Securities Association data, as of June 30, 2022, the total assets of 140 securities companies reached 11.22 trillion yuan, an increase of 5.76%year -on -year, exceeding the 11 trillion mark. In the vertical comparison, the total assets of the securities industry in June 2019 three years ago were 7.1 trillion yuan, in just three years, the total assets of the securities industry increased by 57.75%.

25 brokerage companies lost money in the first half of the year

According to statistics from the China Securities Association, in the first half of 2022, in the 140 brokerage firms, a total of 115 brokerage firms achieved profit, that is, 25 brokerage companies will not be profitable. 10.

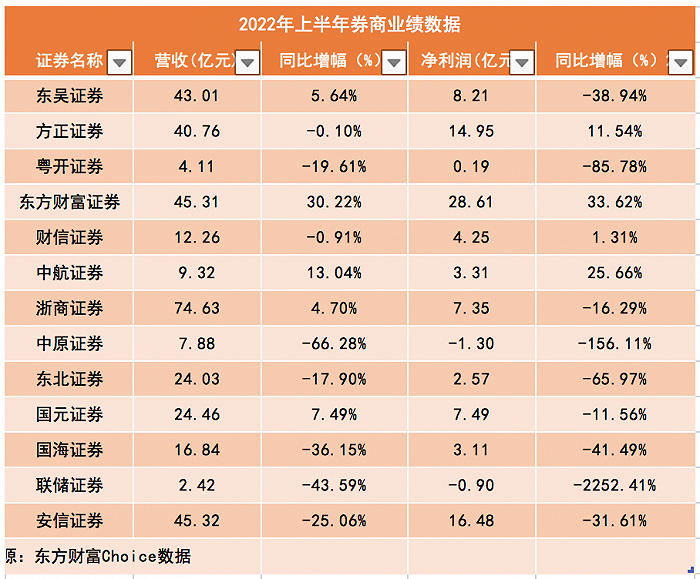

Choice Financial terminals show that as of August 24, 13 brokers have released mid -term results in the first half of 2022. Among them, there are 5 revenue year -on -year revenue, and 4 net profit has grown up year -on -year. There are only Oriental Fortune Securities and AVIC Securities in revenue and net profit.

In terms of operating income, Oriental Wealth Securities, AVIC Securities, Guoyuan Securities, Soochow Securities, and Zhejiang Business Securities have increased, with a year -on -year increase of 30.22%, 13.04%, 7.49%, 5.64%, and 4.70%.

Founder Securities, Caixin Securities, Northeast Securities, Yuekai Securities, Anxin Securities, Guohai Securities, Fed Securities, and Central Plains Securities have declined, with a decrease of 0.10%, 0.91%, 17.90%, 19.61%, 25.06%, 36.15% , 43.59%and 66.28%.

In terms of net profit, Oriental Fortune Securities, AVIC Securities, Founder Securities, and Caixin Securities have increased, with an increase of 33.62%, 25.66%, 11.54%, and 1.31%, respectively.

国元证券、浙商证券、安信证券、东吴证券、国海证券、东北证券、粤开证券、中原证券净利润分别下滑11.56%、16.29%、31.61%、38.94%、41.49%、65.97%、 85.78%, 156.11%. It is worth noting that the net profit of the Fed of Securities has declined 22 times and led the brokerage firms.

Self -employment becomes the biggest constraint

Judging from the data of each line, 140 securities companies realized the net income of agency trading securities business (including the lease of the trading unit seat) of 58.307 billion yuan, realizing the net income of securities underwriting and sponsorship business of 26.771 billion yuan, and the net income of financial consulting business 3.137 billion yuan The brokerage business and investment banking business basically remained stable, and the scale of income was the same as the same period last year.

In terms of asset management business, the securities industry achieved net income of 13.319 billion yuan in the first half of the year, a year -on -year decrease of 7.94%. In terms of credit business, the net interest income of 140 securities companies was 29.659 billion yuan, a year -on -year decrease of 3.87%. The net income of investment consulting business was 2.818 billion yuan, a year -on -year increase of 17.37%. In terms of self -employed business, securities investment income (including changes in fair value) 42.979 billion yuan, a year -on -year decrease of 38.41%.

The self -operating business of "watching the sky" is still the "culprit" of poor securities firms in the first half of the year. Generally speaking, the A -share market has not performed well. As of the end of June, the Shanghai Composite Index, Shenzhen Stock Exchange Index, CSI 300, and GEM fingers fell 6.63%, 13.20%, 9.22%, and 15.41%, respectively.

Among the securities firms that have recently disclosed their performance, they have basically failed to avoid the impact of performance brought by self -employment. For example, on August 20th and 23rd, the semi -annual report of Guohai Securities and Guoying Securities showed that the net profit in the first half of the year fell 47.49%and 11.57%, respectively. In addition, Soochow Securities, Central Plains Securities and Zhejiang Business Securities have declined by more than 50%year -on -year in the first half of this year.

According to the above -mentioned brokers, due to factors such as the securities market fluctuations in the first half of the year, the company's equity investment and other business revenue decreased year -on -year, resulting in a decline in net profit attributable to shareholders of listed companies.

Responsible editor: Gao Shuai | Review: Li Zhen | Director: Wan Junwei

- END -

23 key projects of Hebei Free Trade Zone "Cloud Investment Promotion"

On June 26, the work office of the Hebei Free Trade Zone cooperated with the Bank of China Hebei Branch, the China Construction Bank Hebei Branch, the Industrial and Commercial Bank of China Hebei Bra

After daily, Youxian has not given a refund plan for users and suppliers to suffer multiple parties and other parties.

After experiencing the difficulty of the annual report, the unavailable in the app...