The graphics card giants Q2 game business income decreased by 33%. Q3 performance guidelines are far inferior to expected. Before the announcement of the financial report, the "Mi Sister" sells for $ 51 million in stock

Author:Daily Economic News Time:2022.08.25

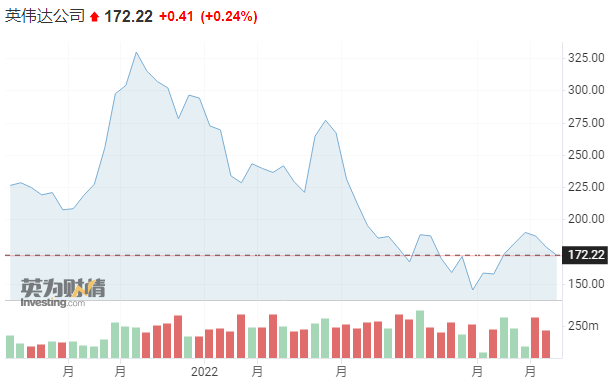

After the market on August 24th (Wednesday) in the United States, the game graphics giant Yingwei (NVDA, a stock price of $ 17.2.22, a market value of US $ 431.2 billion) announced the second fiscal quarter of the fiscal year of the 2023 fiscal year as of July 31 this year.

During the reporting period, Nvidia recorded revenue of US $ 67.04 billion, an increase of 3%year -on -year, a decrease of 19%month -on -month; a net profit of $ 656 million, a decrease of 72%year -on -year, a decrease of 59%month -on -month; The year -on -year decrease of 72%; the revenue per share (EPS) after adjustment was $ 0.51, a year -on -year decrease of 51%.

After the financial report was announced, Nvidia fell more than 5%after the trading of Wednesday.

"Daily Economic News" reporter noticed that the transaction data showed that the "Mujiao Sister" Casey Wood's fund reduced the company's shares before Nvidia announced its performance. Specifically, the ARK Innovation ETF (ARKK) sold Nvidia stocks worth $ 40 million on Tuesday. The ARK Next Generation ETF (ARKW) also sold about $ 11 million in Nvidia stocks on the same day.

According to the business division, the revenue of Nvidia Data Center in the second quarter was US $ 3.81 billion, an increase of 61%year -on -year; the game business revenue was 2.04 billion US dollars, a year -on -year decrease of 33%, and the decrease exceeded the company's own expectations. Nvidia said that game business revenue has declined sharply due to the sales and decline of game products, which are mainly used for computer graphics cards. In addition, professional visualized business revenue was US $ 496 million, a year -on -year decrease of 4%; automobile business revenue was 220 million US dollars, a year -on -year increase of 5%.

Nvidia recorded 43.5%of the gross profit margin in the second quarter, a year -on -year decrease of 21.3 percentage points, and a decrease of 22.0 percentage points from the previous month. Regardless of certain one -time projects (not in accordance with the US GM Accounting Standards), the gross profit margin after the adjustment of Nvidia's second quarter was 45.9%, a year -on -year decrease of 20.8 percentage points, and a decrease of 21.2 percentage points from the previous month.

Huang Renxun, CEO of Nvidia, said in a statement: "We are in a challenging macro environment, and we will spend this difficulty." Nvidia CFO Kles Cres said at the call with analysts, "(During the reporting period), the downside pressure of the global macroeconomic has caused consumers' demand for the company's game products to suddenly slow down."

The Q2 financial report announced by Nvidia is consistent with the preliminary performance announced two weeks ago. The company warns that its future performance will continue to be inferior to analyst expectations, and due to the disappointment of game sales promoted by the macroeconomic environment, its growth has slowed down significantly, which will also lead to a decline in gross profit margin. Nvidia predicts that the revenue of the third quarter of fiscal 2023 will reach US $ 5.90 billion, floating up and down by 2%, and this performance is far inferior to analysts' previous expectations. Yahoo Financial data shows that 27 analysts expect the average revenue of Nvidia's third fiscal quarterly revenue will reach US $ 6.95 billion.

Nvidia said that as the original equipment manufacturer (OEM) and channel partners decrease the inventory level to meet the current demand level and prepare for Nvidia's new generation of products, the revenue of games and professional visual services is expected to decline from the previous month. However, the company also predicts that the month -on -month growth of data centers and motor vehicle business will partially offset this decline.

Nvidia said that the price of product prices will be adjusted with retailers to cope with the "challenging market environment" facing the game industry. The company said that such a situation is expected to continue in this quarter. However, it should be pointed out that the data center business of Ying Weida in the second fiscal season performed well. This is mainly due to the company's "large -scale" customers, namely large cloud service providers.

At the beginning of the year from the beginning of the year, the closing price of Nvidia had fallen by 41.43%, which made it one of the worst shares of the Philadelphia Semiconductor Index. During the same period, its competitors Chaowei Semiconductor (AMD, a stock price of $ 92.73, and a market value of $ 149.7 billion) had a cumulative decline of 33.32%.

In the early days of the new crown pneumonia's epidemic in 2020, the trend of office at home promoted the sharp rise in the prices of a group of graphics cards and server chip manufacturers headed by Nvidia, and also created a 61%revenue growth of Nvidia 2022.

However, it has been more than two years since the new crown pneumonia. In May this year, Nvidia said that the macroeconomic challenge will slow down the pace of recruitment.

Image source: Yingwei Caiqing

Cover picture source: Daily Economic News (data map)

Daily Economic News

- END -

Two projects of Rizhao, signing on the spot!

Organization in our cityYoung Entrepreneurs Innovation and Development Internation...

Pig "heaven"?The Development and Reform Commission shot!Take measures such as reserve adjustment in time to prevent the price of pigs from rising excessively

In response to the recent rapid rise in the price of pigs, the Price Department of the National Development and Reform Commission organized industry associations, some breeding enterprises and slaught