With the effort to "reduce costs and increase efficiency", how far is the domestic business single -quarter profitable quickly from the overall profit?

Author:Daily Economic News Time:2022.08.24

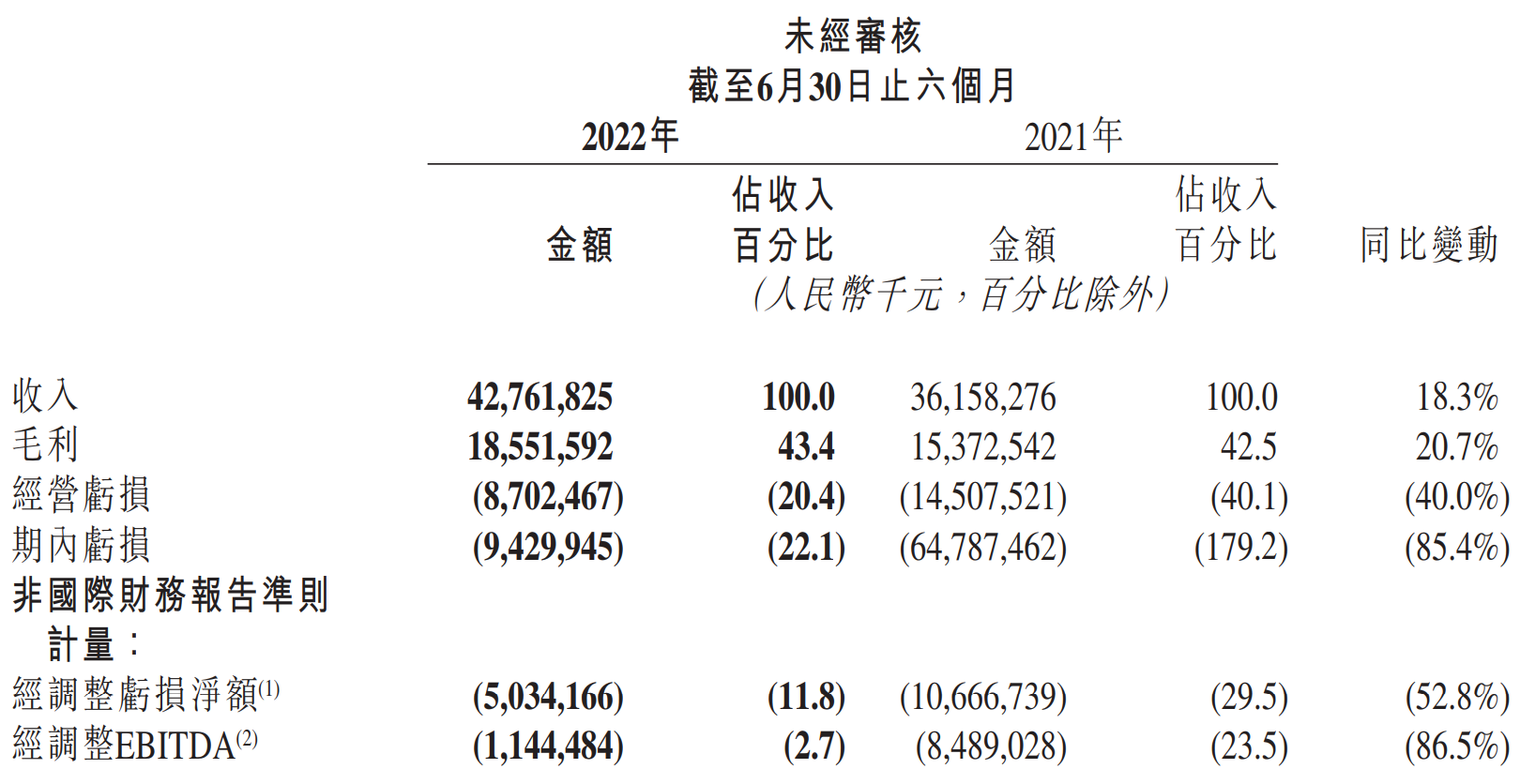

On the evening of August 23, Kuaishou Technology (HK1024, HK $ 69, a total market value of HK $ 296.3 billion) released its performance in the first half of 2022. The financial report data shows that the fast -handed revenue in the first half of this year was 42.76 billion yuan, an increase of 18.3%year -on -year; after adjustment, the net loss was 50.03 billion yuan, a year -on -year loss of 52.8%. In the second quarter of this year, fast -handed revenue increased by 13.4%year -on -year to approximately 21.695 billion yuan; after adjustment, the net loss was about 1.312 billion yuan, a year -on -year loss of 73.8%.

However, this transcript has attracted market attention to the point that the fast -moving domestic business has achieved a quarterly profitability in the second quarter of this year, and its operating profit has reached 93.623 million yuan. This is the first quarter -quarter profit of the domestic business since its listing.

Since the second half of 2021, many Internet companies have survived all ways to "reduce costs and increase efficiency". "Accelerating profitability" has become the primary goal of Internet companies in 2022. Of course, the fast hand with "short video" is no exception. Behind the quarterly profit of fast -handed domestic business, the "cost reduction and efficiency" zone is inseparable The effect.

As of now, the average DAU (daily active users) in the second quarter of Kuaishou increased by 18.5%year -on -year. In the first half of the year, I won the right to broadcast the Olympic Games, NBA, etc., and spent a lot of money inviting star live broadcasts such as Jackie Chan and Jay Chou, adding short dramas, and making efforts to "recruit work" ... For fast hands, how to achieve long -term profitability in the future?

Profit in a single quarter, more dependent cost control and control optimization

In March of this year, at the conference call of the financial report, it was quickly said that the net profit after the realization of domestic business adjustment in the quarter this year was very confident. Now more than 5 months have passed, and at the telephone conference, Kuaishou CFO Jin Bing said: "We have made breakthroughs in the second quarter. At the same time, the domestic business has achieved profitability at the operating level in the two quarters in advance, which is indeed very excited. "

Photo source: Shotshot of the Fast Hand of the first half of the performance

"Daily Economic News" reporter noticed that behind the advancement of fast -moving domestic business, it is not a significant increase in revenue, and it is more of the effect of "reduction of cost reduction and efficiency".

Data show that in the second quarter of this year, Kuaishou technology sales and marketing expenditure costs from 11.3 billion yuan in the same period last year to 8.8 billion yuan this year, and the proportion of revenue also decreased from 58.9%to 40.4%, mainly due to restraint and more effective effectiveness Ground control users' acquisition and retention costs; R & D expenditure decreased from 3.9 billion yuan in the same period in 2021 to 3.3 billion yuan in the second quarter of 2022, mainly due to the decrease in employee benefits (including related shares -based salary expenses).

At the conference call, Jin Bing explained that the optimization mainly reflected several aspects. First, in terms of gross profit margins, with the gradual volume of core business, the company has optimized a more effective division mechanism, which has reduced the overall division cost accounting ratio of 2.5 percentage points on the month -on -month. At the same time, on the server technology side The refined governance, in the first half of this year, the cost of long -term bandwidth in the country has decreased significantly year -on -year, and bandwidth and server costs have decreased by more than 3 percentage points. Second, in terms of sales and marketing expenses, through the adjustment of organizational structure, efficiency optimization, technical iteration, etc., the cost of obtaining customer customer acquisition and the cost of maintenance costs for single DAU have maintained a decline.

"In the second quarter of this year, under the circumstances of maintaining a high -speed growth and high -speed users, the company's sales and marketing expenses accounted for 18.5 percentage points year -on -year." Jin Bing said that the company's loss was obvious.

Advertising supports the "Half of the Mountains and Mountains". Can the business business become a new growth point?

In the first half of 2022, advertising revenue still supported the "half of the country" of fast -handed revenue.

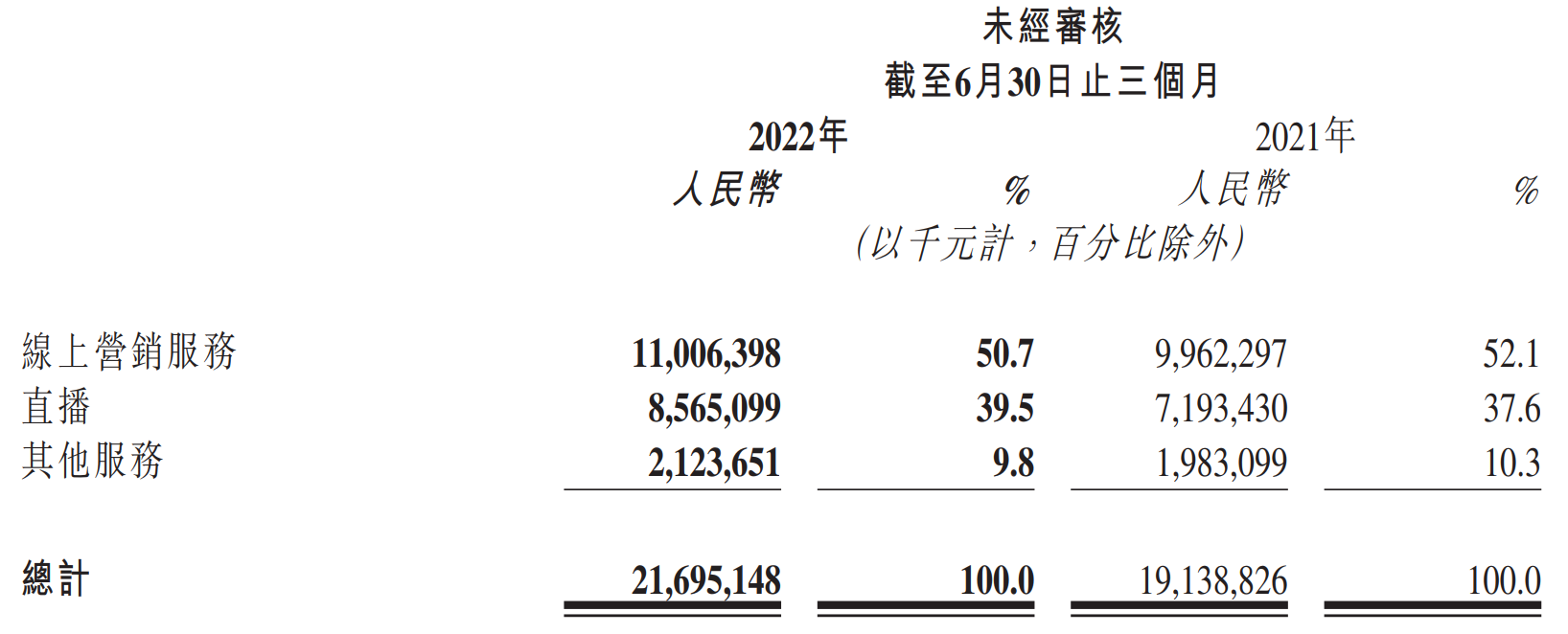

Data show that the total revenue of Kuaishou in the second quarter increased by 13.4%year -on -year to 21.7 billion yuan. Among them, online marketing services (that is, advertising), live broadcast and other services (including e -commerce) contributed to income to 50.7%, 39.5%, and 9.8%, respectively.

Photo source: Shotshot of the Fast Hand of the first half of the performance

Specifically, the advertising revenue of Kuaishou in the second quarter was 11 billion yuan, an increase of 10.5%year -on -year. Thanks to the continuous improvement of services, product functions and advertising effects, in the second quarter, the number of advertising owners of the Kuaishou platform increased by more than 90%year -on -year. In terms of brand advertising, the overall revenue growth rate of brand advertising in the second quarter.

Advertising the "basic disk" has maintained growth, and fast -handed e -commerce has also achieved high growth. In the second quarter of this year, the total amount of fast -handed e -commerce transactions increased by 31.5%year -on -year to 191.2 billion yuan. For several years, the live broadcast business, which has been reducing revenue, in the second quarter of this year, about 8.6 billion yuan, an increase of 19.1%year -on -year.

Picture source: Daily Economic News Map

It is worth noting that during the financial report and conference call released by Kuaishou, the "Quick Recruitment" business that was launched on the live recruitment platform that was launched earlier this year was frequently mentioned and pushed to the front.

Cheng Cheng, the founder and CEO of Kuaishou Technology, revealed that the number of monthly active users of the "Quick Recruitment" section of the Kuaishou live recruitment platform has reached 250 million, an increase of 90%from the first quarter. In the second quarter, the number of daily delivery times of resumes exceeded 360,000, and the platform had reached cooperation with over 100,000 companies. In his opinion, the population of blue -collar workers exceeded 450 million, accounting for 50%of the national labor population. With the disappearance of the demographic dividend and "labor shortage", the blue -collar recruitment market has transformed into a supply or user -driven industry.

"This year we will continue to polish business and content, enlarge the scale of registration, improve the efficiency of traffic use, and run the business model. We expect that the infiltration rate of blue -collar line can reach 30%from 2025 to 2026, and online blue -collar recruitment marketsThe scale is also expected to reach 100 billion yuan. We hope to increase the online rate as soon as possible and get a leading share in the 100 billion market recruitment of online blue -collar recruitment in the future. "Cheng Yixiao said.Cover picture Source: Screenshot of the Annual Environment, Social and Governance Report of 2021

Daily Economic News

- END -

Guangdong Nongke and Yidian Company reached a comprehensive strategic cooperation

On August 12, the Guangdong Farmers Reclamation Group Corporation (the General Adm...

Agricultural distribution opens full horsepower to increase the efficiency of Binnan to stabilize the economic market to see the results

Agricultural distribution opens full horsepower to increase the efficiency of Binn...