Every time it goes, it will be known (evening version) 丨 The net outflow of the funds of the north is 6.615 billion on the day; 18 shares of the Dragon and Tiger List funds are raised;

Author:Daily Economic News Time:2022.08.24

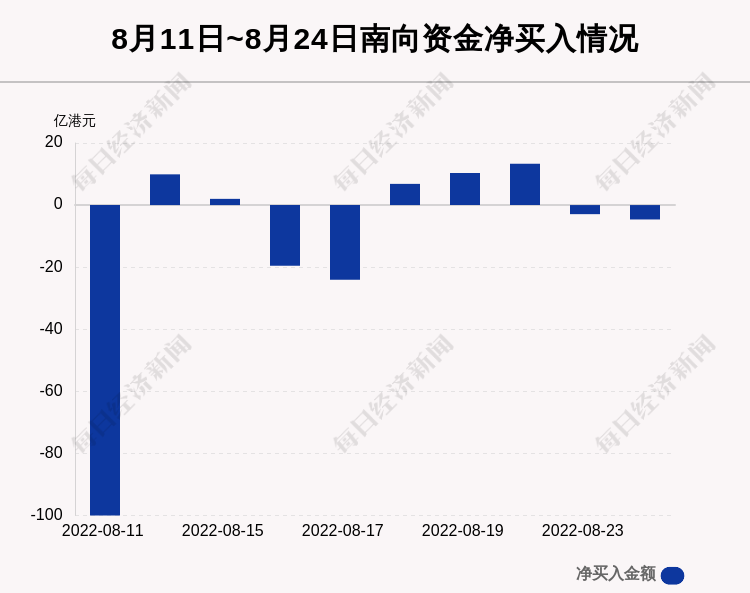

On August 24, the Hang Seng Index fell 1.20%. Southbound funds sold 464 million Hong Kong dollars today.

In the active stock list of the southbound capital transaction, there are 7 net stocks. The most amount is China Ocean Petroleum (0883.HK, the closing price: HK $ 10.32), net purchase 435.4 million Hong Kong dollars; Only Meituan-W (3690.HK, closing price: 164.1 Hong Kong dollars), the net sold, sells 1.037.2 billion Hong Kong dollars.

The net flow from the north of the north was 6.615 billion yuan. The first five industries are 1.75%of insurance. The top five industries were motor-5.85%, semiconductor-5.44%, consumer electronics -4.9%, wind power equipment -4.83%, and small metal -4.8%.

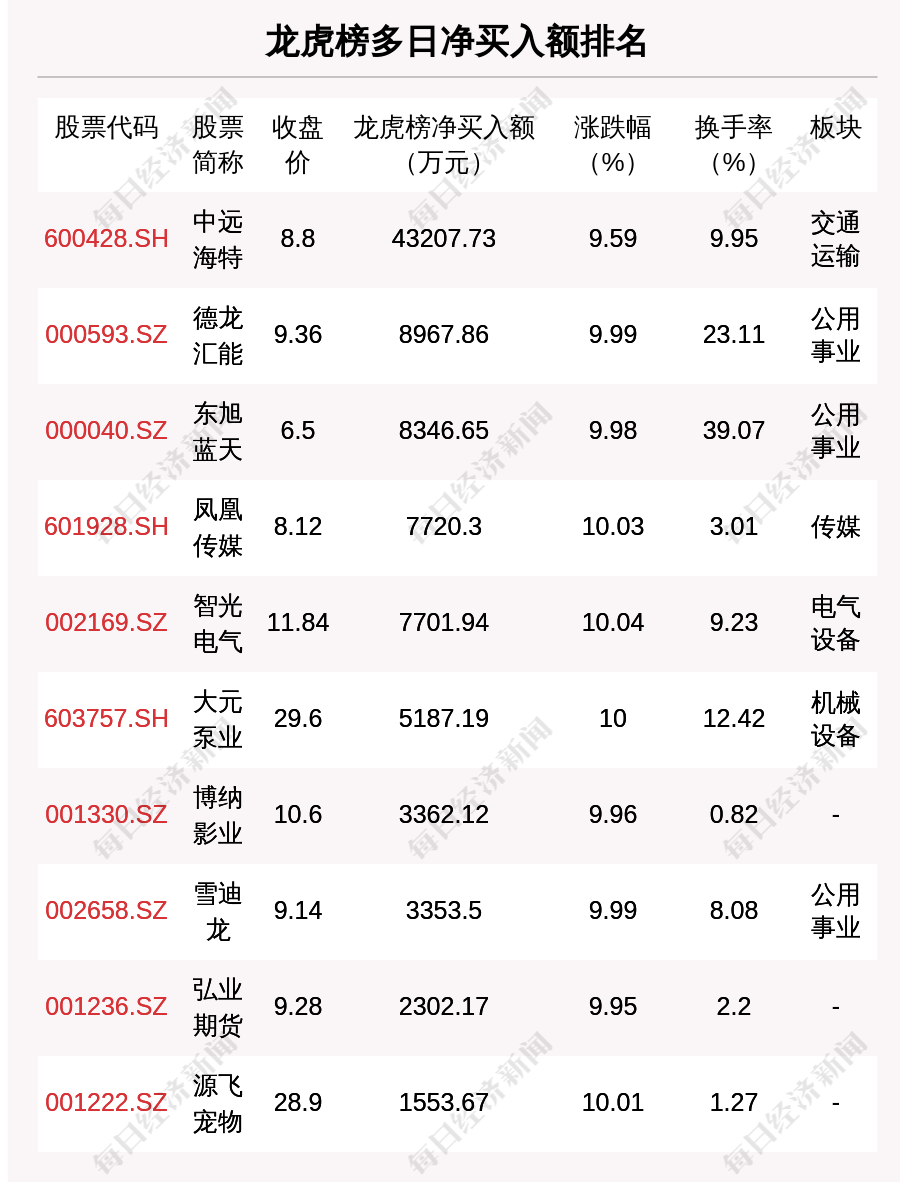

On August 24th, a total of 32 stocks on the list were on the list.

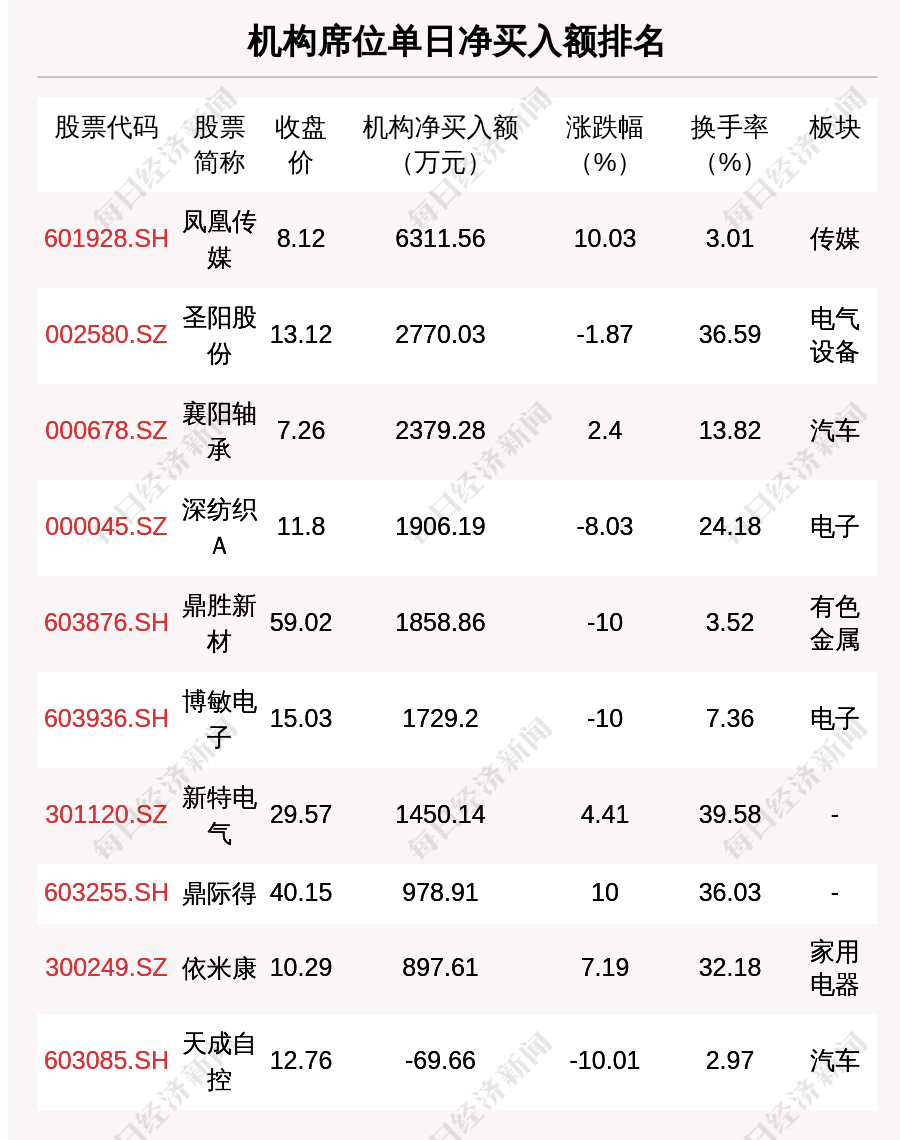

In the Dragon and Tiger List, there are 18 stocks involving a special seat in the institution. The top three of the net purchase are Phoenix Media, Shengyang shares, and Xiangyang Bearing, which are 63.1156 million yuan, 27.70 million yuan, and 23.7928 million yuan.

Huayang Group (002906.SZ) said on August 24th on the investor interactive platform that the company's AR-HUD products have been mass-produced, and this year has obtained multiple fixed-point projects. It is expected that the penetration rate will continue to increase.

Longyu Technology (603906.SH) said on August 24th on the investor interactive platform that the actual output of lithium iron phosphate in the first half of the year was about 45,000 tons. The company's manganese -phosphate iron lithium positive material is currently doing the verification of customer applications and has not yet supplied downstream customers.

Ophi Guang (002456.sz) said on August 24th on the investor interactive platform that we have firm confidence in the company's future development. Based on the steady development of the optical industry, the company will accelerate the development of innovative businesses such as smart cars and new areas, extend to the upper reaches of the industrial chain, open up new markets, build the business architecture system of the three major sectors of smartphones, smart cars, and new areas. With the core competitiveness of its own industrial chain, it provides customers with one -stop optical services.

Wanshun New Materials (300057.SZ) said on the investor interactive platform on August 24 that the company's high -precision electronic aluminum foil production project has been put into operation at the end of December last year. Essence

Taiji (300046.SZ) said on August 24th on the investor interactive platform that the company's power semiconductor devices are widely used in electrical control systems and industrial power equipment, and the application of power supply and photovoltaic inverter in photovoltaic polysilicon equipment.

Kangda New Material (002669.SZ) said on August 24th on the investor interactive platform that ITO (oxidation tin) target is a key material for OLED LCD display and touch screen production. Performance, new technology products and technology reserves can be applied to your field. As for the VR industry, it is its downstream, and the company's main cooperation unit is to display panel companies.

Mankun Technology (301132.SZ) said on August 24th on the investor interactive platform that the company's PCB products are widely used in multiple fields such as communication electronics, consumer electronics, industrial control security, and automotive electronics. In the future On the basis of consolidating existing high -quality customers, new customers have been continuously developed and new products are developed.

Tuo Ri Xinneng (002218.SZ) said on August 24th on the investor interactive platform that part of the photovoltaic glue film equipment acquired by the company has been put into production, with an average daily capacity of about 100,000 square meters. After the comprehensive completion of the Xi'an polymer industrial park, the production capacity It will achieve rapid expansion. The EVA product produced by the company has good anti -PID performance and high customer recognition. Components used by the company's film products have passed various certifications of Nande and TUV. At present, the company's mass -produced photovoltaic glue membrane has been supplied to some large domestic component manufacturers; in addition, major mainstream components and glass customers are in testing, certification and import, and the proportion of exports of photovoltaic glue film in the future will gradually increase.

Tibet Mining (SZ 000762, closing price: 52.37 yuan) released the semi -annual performance report on the evening of August 24 that the operating income in the first half of 2022 was about 1.221 billion yuan, an increase of 439.2%year -on -year; 100 million yuan, an increase of 1018.3%year -on -year; the basic earnings per share were 0.9129 yuan, an increase of 1018.75%year -on -year. It is proposed not to send it, no red stocks, and no increase.

Yinghe Technology (SZ 300457, closing price: 30.8 yuan) released the semi -annual performance report on the evening of August 24 that the operating income in the first half of 2022 was about 4.623 billion yuan, an increase of 166.33%year -on -year; 264 million yuan, an increase of 155.3%year -on -year; basic earnings per share was 0.41 yuan, an increase of 156.25%year -on -year. It is proposed not to send it, no red stocks, and no increase.

He Sheng Silicon Industry (SH 603260, closing price: 132.44 yuan) released the semi -annual performance report on the evening of August 24 that the operating income in the first half of 2022 was about 13 billion yuan, an increase of 67.87%year -on -year; the net profit attributable to shareholders of listed companies was about 35.45 100 million yuan, an increase of 48.68%year -on -year; the basic earnings per share were 3.3 yuan, an increase of 29.92%year -on -year. The company does not make profit distribution and the provident fund is transferred to the share capital. Guangxin Co., Ltd. (SH 603599, closing price: 27.39 yuan) released the semi -annual performance report on the evening of August 24 that the operating income in the first half of 2022 was about 4.503 billion yuan, an increase of 79.44%year -on -year; 1.243 billion yuan, an increase of 97.23%year -on -year; the basic earnings per share were 1.91 yuan, an increase of 96.91%year -on -year.

Meibang (SH 605033, closing price: 20.05 yuan) released the semi -annual performance report on the evening of August 24 that the operating income in the first half of 2022 was about 618 million yuan, an increase of 29.71%year -on -year; the net profit attributable to shareholders of listed companies was about 1.17.17 100 million yuan, an increase of 68.45%year -on -year; the basic earnings per share were 0.87 yuan, an increase of 27.94%year -on -year.

Zhongnan Media (SH 601098, closing price: 9.31 yuan) released the semi -annual performance report on the evening of August 24 that the operating income in the first half of 2022 was about 6.255 billion yuan, an increase of 13.4%year -on -year; the net profit attributable to shareholders of listed companies was about 8.33 profit of 8.33 100 million yuan, an increase of 9.1%year -on -year; the basic earnings per share were 0.46 yuan, an increase of 6.98%year -on -year. The company does not make profit distribution and the provident fund is transferred to the share capital.

Wanan Technology (SZ 002590, closing price: 9.05 yuan) released the semi -annual performance report on the evening of August 24 that the operating income in the first half of 2022 was about 1.368 billion yuan, an increase of 1.09%year -on 2.78 million yuan, a year -on -year decrease of 79.33%; the basic earnings per share were 0.01 yuan, a year -on -year decrease of 66.67%. It is proposed not to send it, no red stocks, and no increase.

Tai Chi Industrial (SH 600667, closing price: 7.03 yuan) released the performance trailer on the evening of August 24. It is expected that the net profit attributable to shareholders of listed companies in the semi -annual 2022 year was 89.2661 million yuan. Compared with the same period last year 314 million yuan, a year -on -year decrease of 77.85%. The main reason for the change in performance is that the Development Reform Commission of Ulanchabu, Ordos, and Xilingule League need to abolish the five -person investment -based projects that change the investment entity of the audit. The document involves five centralized photovoltaic power stations including the subsidiary 11th Technology Inner Mongolia 10MWP photovoltaic power generation project. The above power stations will no longer enjoy electricity bills. Yuan. The prepaid amount paid paid by the subsidiaries 11 of the subsidiary 11 of the subsidiary is 810.501 million yuan in credit impairment losses.

Jinlong Magnetic (SZ 300748, closing price: 38.25 yuan) released the semi -annual performance report on the evening of August 24 that the operating income in the first half of 2022 was about 3.304 billion yuan, an increase of 82.65%year -on -year; the net profit attributable to shareholders of listed companies was about 4.64 100 million yuan, an increase of 110.51%year -on -year; basic yield per share was 0.55 yuan, an increase of 71.88%year -on -year. It is proposed not to send it, no red stocks, and no increase.

Nanhua Instrument (SZ 300417, closing price: 10.56 yuan) released the semi -annual performance report on the evening of August 24 that the operating income in the first half of 2022 was about 58.5 million yuan, a year -on -year decrease of 47.26%; the net profit attributable to shareholders of listed companies was about 245 10,000 yuan, a year -on -year decrease of 85.51%; basic earnings per share was 0.0179 yuan, a year -on -year decrease of 85.48%. It is proposed not to send it, no red stocks, and no increase.

Pu Nai (SZ 002225, closing price: 5.42 yuan) issued an announcement on the evening of August 24 that the company recently received some members of the controlling shareholder and actual controller Liu Baikuan family Liu Baikuan, Liu Baichun, Liu Baiqing, Huo Wuyin, Liu Guoyong, Yan Yan, Yan Yan The "Notification of Shareholding Shop Plan" issued by Ruijie and Yan Ruiming, the relevant 7 people intend to reduce the company's shares by concentrated bidding by about 19.61 million shares, accounting for 1.941%of the company's total share capital. During the disclosure of this announcement, the window period shall not be reduced within 6 months after the disclosure of this announcement.

Yueyang Xingchang (SZ 000819, closing price: 24.25 yuan) released the semi -annual performance report on the evening of August 24 that the operating income in the first half of 2022 was about 1.561 billion yuan, an increase of 131.35%year -on -year; 30.38 million yuan, an increase of 152.97%year -on -year; the basic earnings per share were 0.102 yuan, an increase of 155%year -on -year. It is proposed not to send it, no red stocks, and no increase.

Metal Investment (SZ 000633, closing price: 8.57 yuan) released the semi -annual performance report on the evening of August 24 that the operating income in the first half of 2022 was about 104 million yuan, an increase of 46.2%year -on -year; the net profit attributable to shareholders of listed companies was about 640 10,000 yuan, an increase of 1299.41%year -on -year; the basic earnings per share were 0.0166 yuan, an increase of 1283.33%year -on -year. It is proposed not to send it, no red stocks, and no increase. Sanchao New Materials (SZ 300554, closing price: 29.98 yuan) issued an announcement on the evening of August 24 that Nanjing Sanchao New Materials Co., Ltd. held the seventh meeting of the third board of directors on August 23, 2022, and the third board of directors, the third third meeting, and the third third board of directors. The seventh meeting of the Supervisory Committee reviewed and approved the "Proposal on the" Three Super Convertibles "in advance". From August 1st, 2022 to August 23, 2022, the company's shares have closed for 15 trading days. The price is not less than 130%(that is, 22.27 yuan/share) at the current conversion price, and the agreed conditions for redemption have been triggered. Cinda Securities' inspection opinions on the right to redeem the right to redeem the "Three Super Convertibles" in Nanjing Sanchao New Materials Co., Ltd.

① As of 19:54 Beijing time, the Dowed Futures rose 0.03%, the S & P 500 Index futures rose 0.09%, and the NASA futures fell 0.05%.

② The White House lowered the US economic forecast, which greatly reduced the actual GDP growth rate in 2022 from 3.8%in March to 1.4%; the actual GDP growth rate in 2023 decreased from 2.5%in March to 2%;

③ Goldman Sachs: Hedge fund re -bet on large technology stocks, and the concentration of heavy positions has reached the highest in 2020.

④ According to Tesla (TSLA, the stock price is US $ 889.36, the market value is 928.9 billion US dollars), the company will hold 2022 AI Day on September 30th in North America time at Paroloto, California, USA.

⑤ On August 23, Eastern Time, Apple (AAPL, a stock price of $ 16.723, a market value of US $ 2.69 trillion) released the iPados16.1beta test version for developers.

⑥ Volkswagen (VWAGY, a stock price of US $ 18.48, a market value of 92.639 billion US dollars) and Mercedes-Benz reached a battery material cooperation agreement with Canada with rich mineral resources on Tuesday to ensure sufficient supply of important raw materials such as nickel, lithium and cobalt.

⑦ Foreign media quoted people familiar with the matter saying that Korean chip manufacturer Samsung Electronics (005930.KS, a stock price of 59,000 won, a market value of 39.6479 trillion won) is expected to invest about $ 74 billion to expand semiconductor production capacity in South Korea to meet Global long -term growth needs.

⑧ Morgan Chase private bank global foreign exchange strategy director Sam Zief: If inflation continues to rise, the pound may fall to 1.14 against the US dollar.

According to the data released by the Spanish Ministry of Energy, as of the week of August 23, the water storage capacity of the Spanish hydropower station reservoir was only 36.9%of the warehouse capacity, the lowest since 1995.

Daily Economic News

- END -

Four companies have paid attention to the performance of the China Reporter Super -expected section

(Reporter Liu Yang) With the acceleration of disclosure of the semi -annual report...

The highest prize is 15 million yuan!500 square meters of office housing rent -free!Zhengzhou "enlarged moves"!