International financial institutions are optimistic about the three major reasons for China's economy

Author:Xinhuanet Time:2022.06.18

Recently, a number of international financial institutions have released data and reports that the impact of the epidemic will not have a long -term impact on the Chinese economy. The long -term fundamental fundamentals of the Chinese economy have not changed, and they have given three major reasons for the Chinese economy.

Reasons 1: Import and export trade is affected by the epidemic situation limited

According to Reuters, data released by the German Federal Statistics Bureau recently showed that Germany's trade with China in April was hardly affected by the "sealing measures" of China's new crown epidemic and the chaos caused by the supply chain.

Data show that in April, Germany imported products with a total value of 16.7 billion euros in China, an increase of 52.8%year -on -year. Among them, the import of chemical products increased by 6 times, which became the main factor driving the increase in the total value of German imports. The situation of great growth.

On February 18, 2022, the Central European trains (Qilu) in China -Germany Manheim two -way bidirectional starting train departed from the Qingdao Multi -type transportation center of the Shanghe Demonstration Zone. Xinhua News Agency (Photo by Wang Zhaosi)

In fact, China's import and export trade has not been seriously impacted by the epidemic as some Western media reports.

Data from the General Administration of Customs show that China's import and exports to major trading partners such as ASEAN, the European Union and the United States have increased. In the first five months of 2022, the total value of China's goods trade import and export was 1.604 trillion yuan, an increase of 8.3%over the same period last year. Among them, in May, the total value of China's goods trade import and export was 3.45 trillion yuan, a year -on -year increase of 9.6%. Among them, exports were 1.98 trillion yuan, an increase of 15.3%; imports were 1.47 trillion yuan, an increase of 2.8%.

Reason 2: Long -term growth momentum is still there

According to US Consumer News and Business Channels, Tilman Lael, a global market strategist at JP Morgan Chase Asset Management Company, said recently that although the short -term uncertainty still exists, the "clear zero" policy, tightening fiscal policy and strict strictness The supervision and other supervision are periodic, not structural, which means that China's long -term growth momentum remains unchanged.

"Compared with the central banks of Europe and North America, the Central Bank of China has greater flexibility to support the economy. At the same time, China's fiscal policy is also adjusted. Facilities projects, as well as tax cuts and stimulating car consumption, "Said said," The Chinese stock market is becoming more attractive. "

The picture shows the head office of the People's Bank of China. Xinhua News Agency

Morgan's global fixed income strategy director Mels Brad Shaw believes that Chinese Treasury bonds are the "most exciting part of the global market."

"The economy is slowing and interest rates are rising, but China has not relaxed its monetary policy. For the fixed income investors in European and American countries, Chinese assets are a good diversified investment option." Bradley said.

Reasons 3: Green industry potential is huge

According to Singapore's "Lianhe Zaobao" report, the report issued by UBS recently shows that the carbon -secret industry in China will make green finance the main factor for Chinese banks to grow in revenue in the next 10 years.

UBS estimates that by 2031, the income from green loans and green bonds may increase to an average annual US $ 200 billion, about 15%of the overall income of the Chinese banking industry.

"Although so far, the influence of (China) green finance is still small, but we think its scale potential is huge," said UBS analysts.

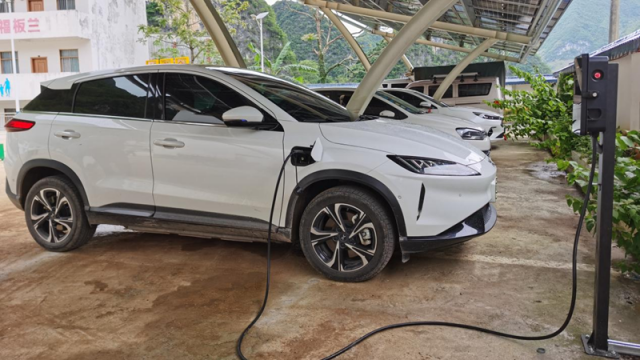

According to data from the Ministry of Industry and Information Technology, last year, in the face of the complex and changing economic situation and pressure from the supply chain, China's new energy vehicle sales completed 3.521 million units, ranking first in the world for 7 consecutive years.

On May 9, 2022, a new energy vehicle was charging in Banlan Village, Beijing Town, Dahua County, Guangxi. Xinhua News Agency (Photo by Zhang Ailin)

According to data from the China Automobile Association, in the first quarter of this year, China ’s new energy vehicles were produced and sold for 1.293 million and 1.257 million units, a year -on -year increase of 1.4 times, and the market share reached 19.3%. New energy vehicle production and sales performance is significantly better than the industry.

The latest issue of the China Economic Report released by the World Bank recently believes that the growth momentum of China's economy is expected to rebound in the second half of the year.

- END -

The "Mulan" project sends 3.08 million public welfare insurance for women in difficulty

Yunnan Net News (Reporter Peng Xi) On June 23, the four anniversary projects of the Mulan project jointly sponsored by the China Women's Development Foundation and Ant Group's Mulan project summar...

Demand stretching weakness and not as much as expected, black futures continue to be sharply adjusted sharply

21st Century Business Herald reporter Peng Qiang Beijing reportOn June 20, the black futures continued the decline in the previous few days, and continued to call back sharply. Compared with the phase