What signal?The brokerage firms recently investigated 242 companies, and the three major sections have the highest attention!These three securities firms have investigated the most diligent this year

Author:Broker China Time:2022.08.24

The semi -annual report of listed companies was released one after another, and the survey of securities firms was non -stop.

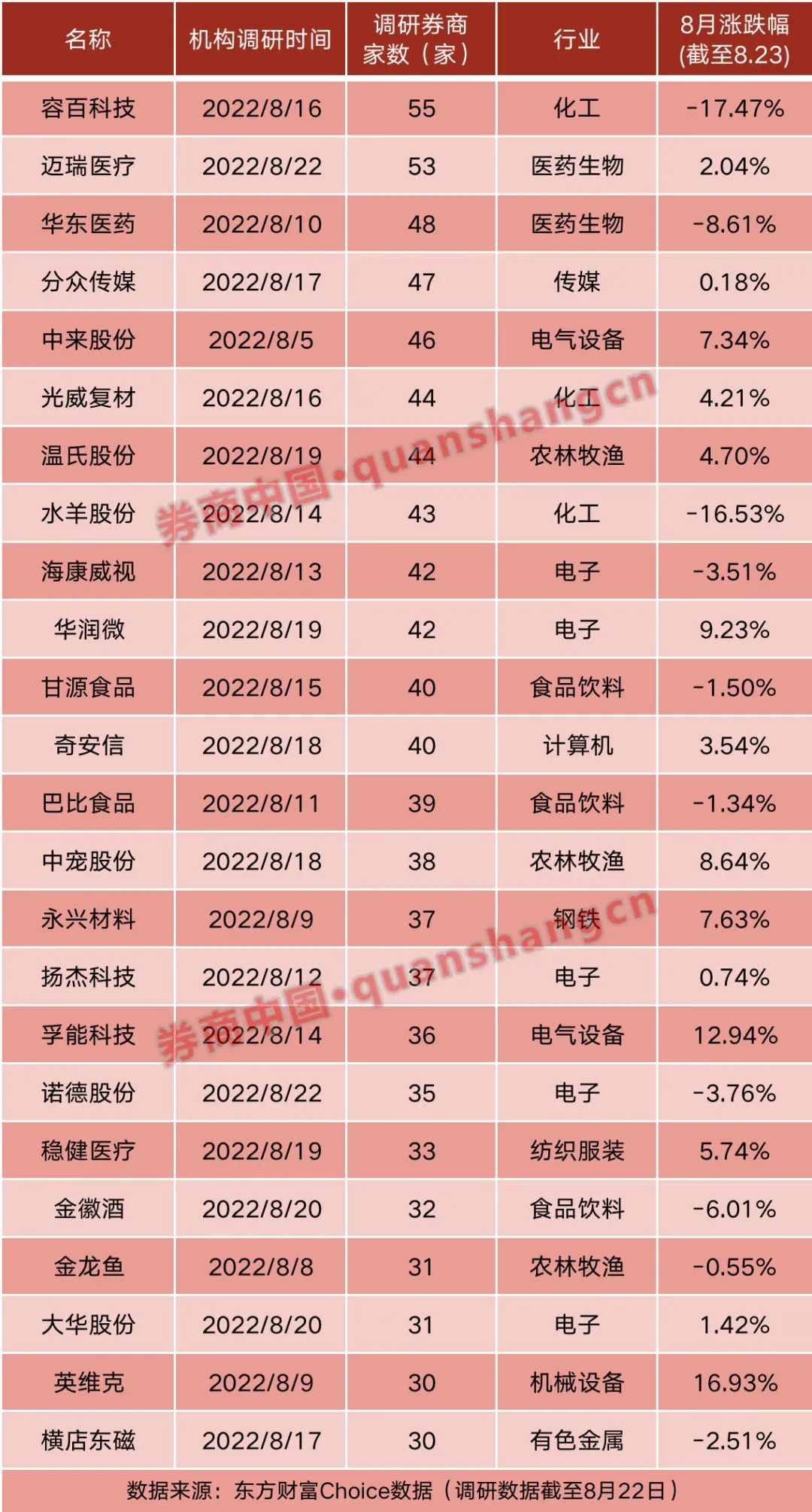

Choice data shows that since August, a total of 242 listed companies have been investigated by brokers, mainly concentrated in chemical industry, electronics, pharmaceuticals, machinery and equipment, electrical equipment and other fields.

Some listed companies have been investigated by brokers, such as Rongbai Technology, Guangwei Fuwu Materials, and Water Sheep Shares in the chemical sector, Mai Rui Medical, East China Pharmaceuticals of the Medicine and Biological Plates, Hikvision and China Resources Micro of Electronic Plate 40 brokerage investigations. From the perspective of the research content, the company's operating conditions and the sustainability of subsequent performance are the focus of securities firms.

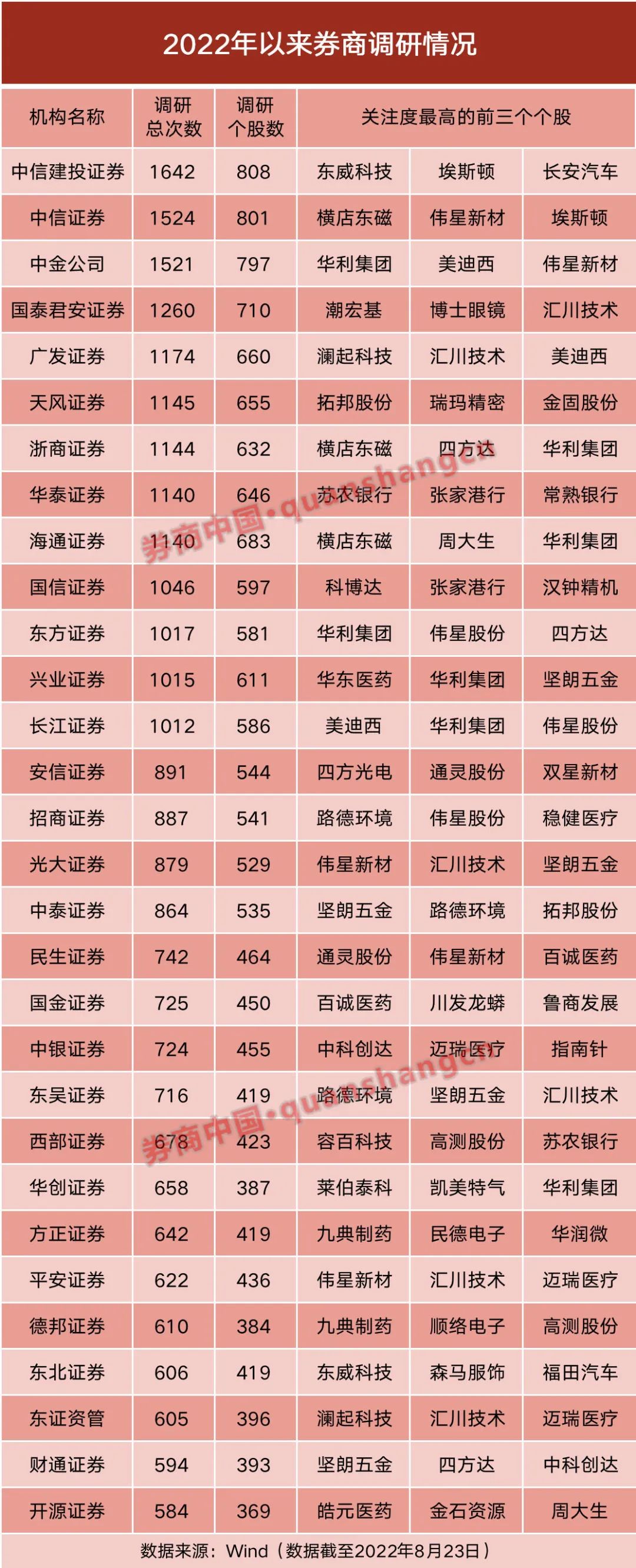

From the perspective of the investigation of securities firms during the year, a total of 13 brokerage trading has exceeded 1,000 times during the year.

Since August, securities firms have investigated 242 listed companies

Choice data shows that since August, as of August 22, a total of 242 listed companies have been investigated by securities firms, mainly concentrated in chemical industry, electronics, pharmaceuticals, machinery and equipment, electrical equipment and other fields.

A total of 24 listed companies have been investigated at no less than 30 securities firms since August. Among them, Rongbai Technology, Guangwei Fuwu Materials, and Water Sheep shares of the chemical sector, Mai Rui Medical, East China Pharmaceuticals, East China Pharmaceuticals, East China Pharmaceuticals, Electronic Plates, Hikvision and China Resources Micro were surveyed by more than 40 securities firms. In addition, the number of merchants in the reception survey also includes Focus Media, Zhonglai, Wen's, Ganyuan Food, Qi Anxin and other companies.

The focus of the first half of the performance and sustainability brokerage firm's attention

Judging from the content of the survey, the disclosure season of the semi -annual report, the operating conditions in the first half of the year and the sustainability of subsequent performance are still the focus of the securities firm's attention. Specifically, the income growth of the company's business and changes in gross profit margin, the views of future industry development trends, raw material prices and inventory changes, domestic and foreign demand, equity incentives, etc.

On August 22, the Mai Rui Medical Performance Brigade Sessions received a total of 476 institutions, including 53 brokers including Huachen Securities, Huatai Securities, and Minsheng Securities. In the first half of this year, Mai Rui Medical's net profit attributable to mothers was 5.29 billion yuan, an increase of 21.7%year -on -year. The company said that in terms of section, the domestic market has achieved a rapid growth of 21.8%in the first half of the year; the international market increased by 17.7%in the first half of the year, benefiting from the complete recovery of international conventional business. The growth of international in vitro diagnosis and medical imaging in the first half of the year was nearly 60%and respectively. Nearly 25%, international life information and support have also returned to nearly 20%of the growth rate in the second quarter.

Regarding the development trend of the medical device industry generally concerned about institutions and how the company maintains a high -speed growth problem, Mai Rui Medical said that the tight medical expenses and the lack of money in hospitals are now a common phenomenon in the world, but the demand for consultation will still grow steadily. The new medical infrastructure led by China has brought greater increase to the industry. The global medical device industry will continue to grow steadily in the future, and China and developing countries will continue to grow high. In addition, according to the company's draft employee shareholding plan this year, the performance assessment targets are the annual net profit of 20%of the annual profit of 20%from 2022-2024. At the same time, the company also put forward the goal of entering the top 20 of global medical devices in 5-10 years. From the perspective of the stock price performance, Mai Rui Medical fell about 21.5%during the year.

Rongbai Technology is one of the most watched companies in the near future. On August 16, 534 institutions were received, including Caitong Securities, Oriental Securities, Soochow Securities and other 55 brokers. Rongbai Technology is mainly engaged in lithium battery positive materials and its related businesses. The company has recently formulated an increase of not more than 5.428 billion yuan. The company issued a preview of performance on July 13. It is expected that the net profit attributable to mothers will be 710 million yuan to 760 million yuan in the first half of the year, a year-on-year increase of 121.18%-136.76%.

In the exchange and interaction, the progress of the two new products of manganese -lithium and sodium ion batteries that the institution cares about, Rongbai Technology said that the company's new debugging of the new production line of manganese -phosphate iron phosphate is successful, and the recent shipping growth rate is obvious. Reach 200 tons/month. The company has many years of technical accumulation in sodium electricity materials. Both mainstream technologies have reserves, especially on layer -like oxides. At present, they have received dozens of tons per month. Stable shipments. The company's sodium -electricity material card has a relatively obvious advantage. It is expected that starting from the end of this year, larger shipments can be achieved.

Wen's shares are also one of the targets of recent investigations in securities firms. On the evening of August 18, Wen's shares issued a semi -annual report with a loss of 3.524 billion yuan in the first half of the year. On August 19, Wen's shares received a total of 277 institutions for investigations, including 44 brokers including Guotai Junan, CITIC Securities self -employed, and Guangfa Securities.

Regarding the huge loss of the first half of the year, Wen's shares stated that the cause of losses was mainly due to a large loss in the first quarter. Since the second quarter, the production and operation of the pig industry has continued to improve, the comprehensive costs have been effectively controlled, and the competitiveness of the poultry industry has been further improved. With the improvement of pigs and chickens since the second quarter, the company achieved a net profit of about 240 million yuan in net profit in the second quarter (the inventory price preparation for inventory fell at the end of the first quarter was about 1 billion yuan). It is worth mentioning that the stock price of Wen's shares has risen by more than 30%since this year, especially on the second day of the semi -annual report (August 19), the company rose 7.65%.

Hikvision also recently received more than 370 institutions for surveys, including 42 brokers. Hikvision achieved a net profit of 5.759 billion yuan in net profit in the first half of the year, a year -on -year decrease of 11.14%, which was the first half -year report in recent years. In response, Hikvision responded: "There is indeed a decline in the profit of the interim reporting in the year. I think that the morning and evening of this day will come, and it will not be able to grow high, and there will always be fluctuations. The changes in the environment, because the volume becomes larger, it is difficult to support some small actions. In terms of company positioning, we think very clearly, that is, AIOT, no longer the original security. "Hikvision is in the investigation. In the next 2-5 years, the dimension has been looking forward to, saying that it will maintain a stable business style in the second half of the year. The person in charge of the company also said: "We believe that now in the opportunity period of development. The development of many Chinese companies is from opportunity to problem orientation to strategic orientation. The core of strategic orientation is to return to innovation. Drived companies. Averse globalization, on the one hand, it brought pressure, on the other hand, it actually opened some unlikely business opportunities for Chinese companies. We can see this opportunity, so we think it is the opportunity period for development. ","

13 brokerage companies survey over a thousand times in the year

Wind data shows that as of August 23, the brokerage firms have investigated more than 40,000 times since 2022.

From the perspective of the number of investigations, a total of 13 brokerage companies surveyed over 1,000 times during the year. CITIC Investment Investment, CITIC Securities, and CICC were ranked among the top three with more than 1,500 surveys. The number of survey stocks was 808, 801, and 797. At the same time, Guotai Junan, Guangfa Securities, Tianfeng Securities, Zhejiang Business Securities, Huatai Securities, Haitong Securities, Guoxin Securities, Oriental Securities, Xingye Securities, and Changjiang Securities also surveyed more than 1,000 times.

From the perspective of the sub -sector, the main board of Shenzhen Main Board has received the largest number of securities firms. At the same time, individual innovation boards and GEM stocks are also favored by securities firms.

The stocks of the Bei Stock Exchange have also attracted attention from some securities firms. From the perspective of the number of stocks of the Beijing Stock Exchange, the number of shares of the Bei Stock Exchange in Anxin Securities, Zhongtai Securities, and Open source Securities Investment are 22, 15, and 13 respectively. All ranked after 10.

Editor: Lin Gen

- END -

Directly hit the "San Xia" production: Harvest Harvest Harvest frequently spreads the intensive drums of summer broadcasts

Xinhua News Agency, Beijing, June 17th. The Economic Reference News published on J...

Inject "living water" in finance!Agricultural distribution of two infrastructure funds in Wenzhou Branch Single September Fund to support major project construction

On August 16th, Agricultural Issuance of Wenzhou Branch launched two special infra...