The market value exceeds trillions, revenue is 100 billion yuan, and the growth rate is double -digit.

Author:Costrit Finance Time:2022.08.22

On August 24, 2020, the bells of the first batch of enterprises listed on the GEM registration system sounded at the Shenzhen Stock Exchange. In the following two years, more and more enterprises listed on financing in Shenzhen GEM to share the reform dividends, including a number of enterprises in the biomedical industry of people's livelihood and national security.

According to reporters from the Cubs Association, as of July 31 this year, a total of 96 biomedical companies were listed on the GEM, accounting for nearly 60 % of the number of biomedical companies in the Shenzhen Stock Exchange, with a total market value of 1.73 trillion yuan. Drinking, from genetic detection to in vitro diagnosis, from biological vaccine to blood products, from medical equipment to medical services, etc. The entire industrial chain system.

创业板改革并试点注册制深入贯彻创新驱动发展战略,适应发展更多依靠创新、创造、创意的大趋势,主要服务成长型创新创业企业,支持传统产业与新技术、新产业、新业态、新Mode deep fusion.

Since the 18th National Congress of the Communist Party of China, the Party Central Committee has placed the people's health in a more prominent position, and the "Healthy China 2030" plan has issued a call to build a healthy China, which clarifies the political policy and action program for building a healthy China. In the national new drug creation of major science and technology projects, drug supervision reform, the reform of the reform of the medical insurance system, and the innovation of science and technology financial innovation, the research and development results of the GEM biomedical enterprises have been abundant. The situation of rising.

Data show that from 2019 to 2021, the average operating income growth rate of GEM biomedical enterprises was 17.73%, 29.68%, 22.98%, and the annual growth rate during the period was 19.68%. In 2021, the overall realization of operating income was nearly 213.489 billion yuan, and the net profit attributable to the shareholders of the parent company was nearly 45.355 billion yuan.

Why is the biomedical company keen to GEM, especially the GEM under the reform of the registration system. Some people in the industry said in the interview that since the establishment of the GEM, the listed company has further "dreams" through the GEM, and the scale of income has continued to expand. The level of profit is continuously improved. After the reform and pilot registration system, its innovation has been improved again, providing a better development platform for many innovative companies. "The biomedical industry is an emerging industry of innovation as a lifeline. Enterprises share the dividends of the registration system reform and better serve the national strategy."

According to the reporter's understanding, the biomedical industry, as a typical technology dense and innovative -driven industry, has the characteristics of "long R & D cycle, large investment amount, uncertain R & D results". Before the implementation of the registration system, many innovative drug research and development enterprises could not meet the "threshold" of the A -share market for the approval of the enterprise in terms of profitability. In the end, they could not use the capital market to obtain sufficient funds to break through the bottleneck of R & D and growth. After the reform of the registration system, the issuance conditions were streamlined and optimized, and the expected market value, income, net profit and other indicators were comprehensively considered to provide enterprises with a diversified listing path to support the needs of different growth stages and different types of enterprises.

Re -developing and developing innovation, many medical segments emerging from the GEM

The reform of the GEM registration system is opened, and the biomedical industry with high -tech as the core has become the mainstay of GEM. The reporter noticed that since the reform of the GEM reform and pilot registration system, many biomedical subdivided leaders and innovative companies have emerged, including Mai Rui Medical, Beida Pharmaceutical, Zhifei Biological, Tiger Medicine, Stable Medical, and so on. The registration system has greatly improved the tolerance of biomedical enterprises, and provided great help for biomedical innovation.

It is understood that during the rapid growth of income volume, Mai Rui Medical's maintenance of high investment in R & D is the core of constituting the company's endogenous growth. Over the years, the company has insisted on investing in about 10%of their revenue each year, and its R & D investment in 2021 has reached 2.7 billion yuan. As of the end of 2021, the company had about 3,500 R & D engineers and accumulated more than 7,400 patent reserves, of which more than 5,300 invention patents continued to expand the innovation boundary of medical devices.

In the field of biopharmaceuticals, Zhifei Biological adheres to innovation as a driver, and continuously improves the product layout through the continuous construction and improvement of research and development and innovation capabilities, and accelerates the progress of the research and management line project. A year -on -year increase of 69.4%, currently 29 funded research and development pipelines are available, forming a number of product categories such as tuberculosis, rabies, respiratory viruses, pneumonia, intestinal diseases and meningitis. Its independently developed injection of Bacteria (Micro Card) was approved in June 2021 to increase the indications, and the new disease prevention of tuberculosis infected people occurred. In addition, the company's self -developed reorganized tuberculosis protein (EC) obtained drug registration approval in April 2020 to achieve listing and sales.

Watson Biological has a benchmarking global frontier technology in R & D and innovation. Since 2019, the cumulative investment in R & D has reached 2 billion yuan. The company's 8 -person vaccine products (12 product regulations) that have been listed in the company are independent research and development. Among them, the "13 -valent pneumococcal polysaccharide vaccine" independently developed in 2019 is the first category pneumonia vaccine developed in China. It The successful listing has changed the situation where the important domestic patent drug market has been monopolized by foreign companies for a long time, filling the domestic gap, successfully realizing import substitutions, and laid the foundation for the research and development of domestic pneumonia vaccines. In the field of pharmaceutical technology research and development services, since its establishment, Tiger Medicine has cooperated with more than 1,200 clinical trial institutions in China to establish a large -scale and full -scale clinical research service network in key cities. one. Tiger Medicine is the leader in domestic CROs to carry out global expansion. By the end of 2021, the company has more than 1,000 professional teams in more than 50 countries overseas, and its business covers major continents. There are 132 clinical trials in a single area. There are 50 clinical trials, including tumors, vaccines, central nervous systems, cardiovascular disease and rare diseases.

Share the registered reform dividend, and growth companies usher in new opportunities for development

It is not difficult to find that continuous R & D investment and talent team building are important reasons for the rise of these biomedical companies. Because of this, vaccine and new drug research and development have been continuously obtained, and they gradually break through the monopoly of overseas pharmaceutical giants to the domestic market. Essence On this basis, the enterprise chose the GEM listing, and then shared the registered reform dividend, and the development of the enterprise went to a new level to better fulfill social responsibility and mission.

Beida Pharmaceutical is the first innovative pharmaceutical research and development company in GEM. It has been nearly six years since landing in GEM in November 2016. The company pointed out that in the past six years, the company has been listed from the market to Bemeina and Bianetin from single product Kamina Yongtong market to achieve the breakthrough of the "one to three" of the listing product. 100 million yuan, inseparable from the GEM for the company's innovation and development.

It is understood that in 2016, the company used the company's first -market funds to upgrade the R & D center equipment to provide hardware support and sufficient funds for the new drug research and development project. The new plant has been expanded to provide production capacity support for the sales of innovative drugs. In 2020, the company issued shares to specific objects to raise funds for projects such as new drug R & D and R & D equipment upgrades. Beida Pharmaceutical said that the launch of the GEM has consolidated the foundation of the company's high -speed development, and the fixed -increase project provides a rich "blood" for its expansion of the R & D pipeline.

It is understood that Watson Biological is the first listed company in the GEM in Yunnan Province. After the company was listed, it received the strong support of the capital market through the characteristics of the GEM focus on serving the strategic emerging industry.

Through the construction of the IPO fundraising project in 2010, Watson Biological has improved the company's capabilities for the development, production and sales of the company's vaccine, and has been improved by the entire industrial chain capacity. Bad pneumonia combined with heavy products such as vaccine, 23 -valent pneumonia polysaccharides. In addition, the company issued the total amount of funds for the purchase of assets and raised supporting funds to raise funds of 598 million yuan in 2016. With the continuous landing of multiple projects, it provides the basic research, application technology research and project development capabilities of Watson bi vaccine. Important support.

The reporter noticed that for innovative enterprises that have been listed, many innovations in the three major capital tools of the GEM registered system have played a vital role in the development of the company's three major capital tools.

Mai Rui Medical pointed out that the reform of the GEM registration system has enhanced the service capabilities of innovation and entrepreneurship, improved the efficiency of reinstatement, and provided convenient financing channels for private enterprises; while supporting the company's deepening of the main business, it is Provide financing support. In addition, after the reform of the GEM registration system, the equity incentive system has been greatly optimized, which further stimulated the internal growth potential of listed companies, bringing new opportunities for development of high -quality growth companies, and allowing the company to have greater elastic space and more when implementing specific plans. Flexible operation methods are conducive to achieving better incentives.

In January 2022, Mai Rui Medical launched the first phase of employee holding plan after listing, which was mainly incentives for R & D personnel. In this regard, Mai Rui Medical said that the implementation of the employee's shareholding plan enables employees to share the results of the company's sustainable development, and the company fully enjoy the innovation dividends such as equity incentives and achieve good results.

Steady medical care has also benefited from the reform of the registration system, and the company's internal cohesion has been further improved. It is understood that the company's application for listing coincides with the implementation of the registration system for the Shenzhen Stock Exchange. Thanks to the GEM, the company's core employees participated in the starting subscription of the company's stock through strategic matching plans. The company also adopted a second type of restricted stocks to incentive core employees.

The company stated that the second type of restricted stocks did not need to contribute and discount granted in the early stage of the stock, which has a good incentive for core employees. The interests of core employees are bound to the company to inject more vitality into the company and achieve higher levels and higher quality development.

With the continuous development of the GEM platform, listed companies better serve national strategic reporters noted that the "spotlight" effect of the GEM platform allows listed companies to share the original intention of serving the national strategy while sharing the reform dividends.

Watson Biological said that the reform of the GEM reform further improves the institutional arrangements of re -financing issuance conditions and issuance pricing mechanisms, has become more market -oriented, greatly reduces the time limit and link of the audit, reduces the approval time of enterprise reinstatement, and strengthens the establishment of market -oriented issuance. The underwriting mechanism enriches financing tools to meet different preferences of investment and financing. The company can make full use of the fast and convenient financing function of the GEM market, adopt more targeted financing methods in different stages of development, and introduce well -known domestic and foreign strategic investors to optimize the company's investor structure, but also provides sufficient development of the company's sustainable development. Fund support. The company will continue to work with the GEM to strive to be an important practitioner of innovation -driven development, and help Chinese science and technology self -reliance.

Mai Rui Medical pointed out that the company will continue to focus on the main business in the future, adhere to innovation -driven, transform forward -looking high -tech technology into actual productivity, and actively use capital market tools such as mergers and acquisitions to help the company to achieve leapfrog development, continuously improve the company's development quality It contributes more to promoting high -level cycle of technology and the real economy.

From the perspective of Beida Pharmaceutical, as an innovative pharmaceutical research and development enterprise, it has the characteristics of "long cycle, large investment, high risk", and the GEM provides an important open capital platform for the company's development. In the future, the company will make full use of the financing channels provided by the GEM platform, and actively try to raise development funds by increasing and issuing convertible bonds to establish high -level R & D centers and high -level production bases; expand the research and development pipeline, accelerate acceleration Promote the test and declaration of new drugs; actively integrate industry resources and seek strategic cooperation. Establish an efficient management team and professional sales team. Through stock options incentives and restricted stock incentives, etc., it is effective to motivate employees with effective incentive mechanisms and continuously enhance cohesion and combat effectiveness.

Zhifei Bio said that its own development is inseparable from the cultivation of the capital market. In the past two decades, the company has continued to adhere to entrepreneurial innovation and creation of driving development, adheres to the "technology+market" two -wheel drive, and promotes each other The capital market allows Zhifei to strengthen its bones and achieve high -quality development. The company has fully enjoyed the dividend brought by the capital market's help. In the future, it will continue to adhere to compliance, fully transparent in accordance with the relevant requirements of the capital market, respect the market, respect the market, and use the capital market to be better and strong, and continue to strengthen the company's core competition Force, return investors with performance and development, strengthen the company's high -quality development, and promote the company's long -term, stable and sustainable development.

- END -

Maiquer: The local regulatory authorities have entered the company and are working hard to cooperate with the testing agency sampling testing work

In the evening of today (June 30), Meloel (SZ002719, the stock price of 7.98 yuan, a market value of 1.39 billion yuan) issued an announcement saying that the two batches of products involved in the r

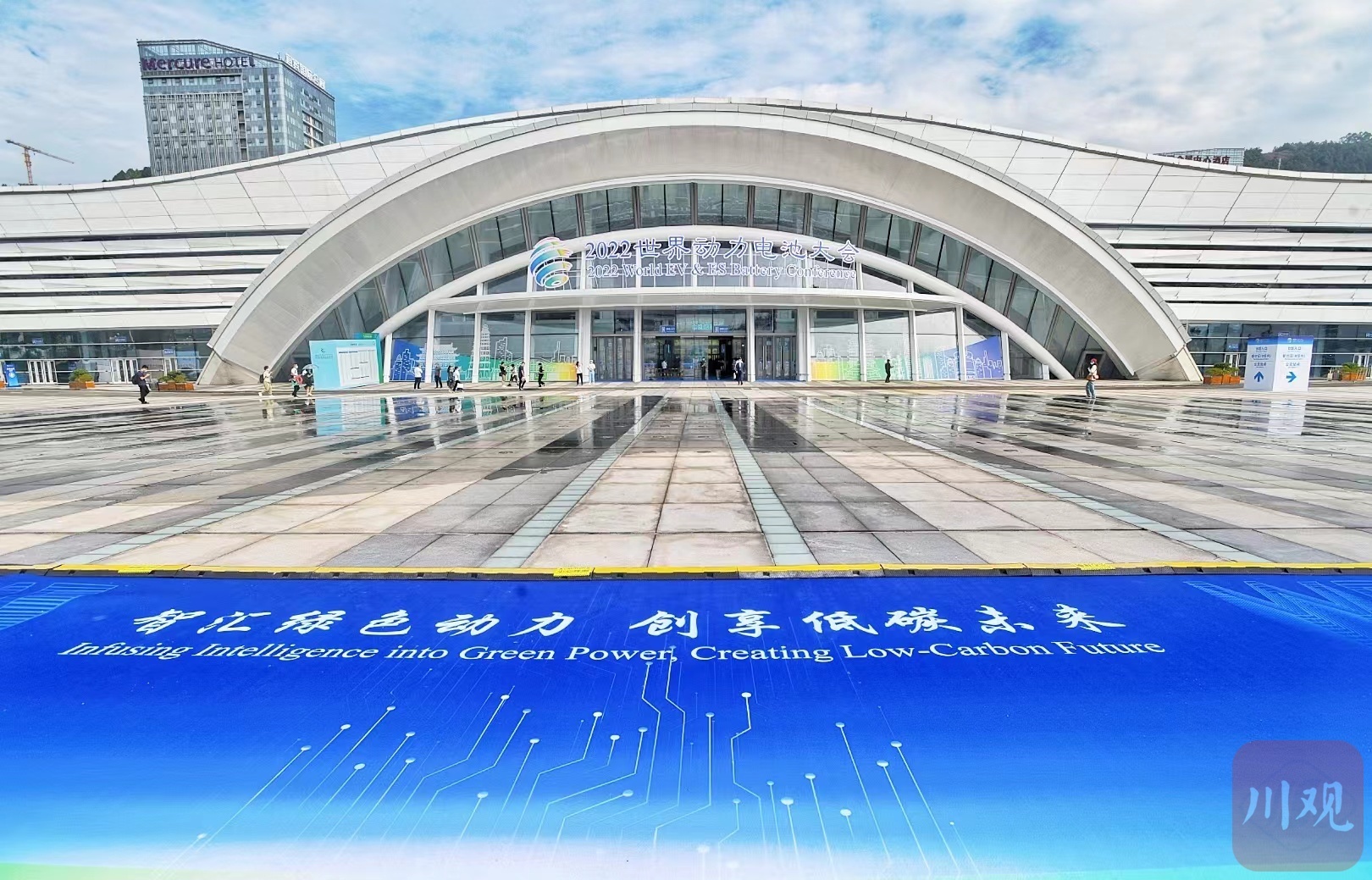

Economic Observation 丨 The "second half" of power batteries is ready for Sichuan?

Chuanguan News reporter Zhang Yexi Tang Zewen Photography Hua XiaofengIn the Ningd...