Monthly reducing the monthly supply reduction of nearly 100 yuan 5 -year LPR reduced 15 base points again

Author:Cover news Time:2022.08.22

Cover Journalist Zhu Ning

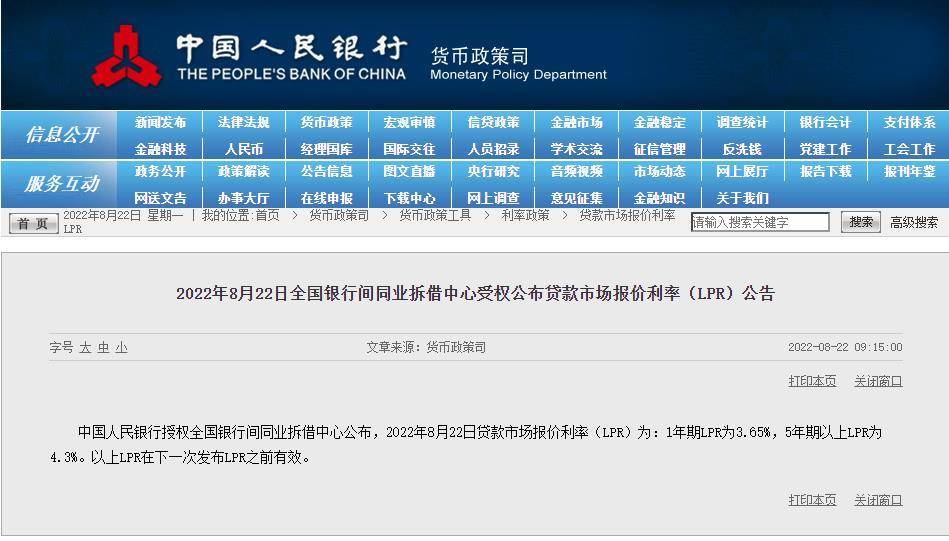

On August 22, the People's Bank of China authorized the National Bank of China Interbank Borrowing Center announced that in August, the loan market quotation interest rate (LPR) per year was 3.65%, which was 5 basis points down from the previous month. 15 basis points from last month.

According to estimates, if the commercial loan quota is 1 million yuan, the loan is 30 years, and the equivalent principal and interest repayment method is calculated, the LPR decreases 15 basis points, the monthly supply decreases by 88.48 yuan, and the cumulative 30 -year monthly supply decreases by 31,800 yuan.

LPR down reduction is in line with market expectations

Earlier, due to the 400 billion yuan interim borrowing convenience (MLF) operation and 2 billion yuan open market reverse repurchase operation on August 15, the mid -term borrowing convenience (MLF) operation and the public market inverse repurchase operation were all Fall 10 basis points. In the case of changes in the foundation foundation, the market generally expects that LPR offers this month will decline.

Subsequently, the executive meeting of the State Council held on August 18 further clarified that the LPR offer this month will be reduced. The State Frequently pointed out that it is necessary to improve the formation and conduction mechanism of market -oriented interest rates, give full play to the guidance of the loan market quotation interest rate, support the recovery of valid demand for credit, and promote the reduction of comprehensive financing costs of enterprises and personal consumer credit costs.

It is worth noting that this is the third time LPR has lowered this year. Cumulative point of view, since this year, the cumulative 1 -year LPR and 5 -year LPR have decreased by 15 basis points and 35 basis points. Before the LPR adjustment window is opened, in January this year, the 1 -year LPR dropped 10 basis points. 5 The LPR above the period drops 5 basis points; the LPR of the May 5th year is reduced by 15 basis points.

The loan market quotation interest rate (LPR) is calculated by each quotation bank based on the public market operating interest rate (mainly referring to the convenient interest rate of medium -term lending), which is calculated by the National Banking Interbank Borrowing Center to provide a price reference for bank loans. At present, LPR includes two varieties of 1 -year and 5 -year.

LPR interest rate reduction helps reduce the cost of buying a house

The change of LPR is also the most concerned about many buyers. According to estimates, the average monthly supply expenditure is reduced according to the loan amount of 1 million yuan, a term of 30 years, and an equivalent principal and interest repayment estimation estimation. The monthly supply expenditure will be about 88.48 yuan, and the interest expenses will be reduced by about 31,800 yuan in the next 30 years.

At the same time, the price of a mortgage interest rate is refreshed again. Earlier, the Central Bank and the China Banking Regulatory Commission issued the "Notice on Adjusting the Issues Related to Differential Housing Credit Policy", which adjusted the lower limit of the first set of first-set commercial personal housing loans from LPR to LPR-20bp, and the two sets of housing loan interest rates lower limit on the interest rate of the two sets of housing loan interest rates. Keep LPR+60bp.

This also means that with the re -reduced LPR, the interest rate of the first home loan will be as low as 4.1%.

In this regard, Zhou Maohua, Financial Analyst of Everbright Bank, said: "LPR interest rate reduction helps to guide financial institutions to reduce the cost of personal and enterprise financing, stabilize the market expectations of the market for economic recovery, and boost personal and enterprise financing needs. Among them, 5 -year LPR The interest rate will be reduced, which will directly reduce the cost of buying housing in the manufacturing industry and residents' commercial housing. "

Promote demand recovery or the main cause of LPR down

Regarding the reason for the LPR reduction, Zhou Maohua said: "This LPR interest rate is reduced, which is in line with market expectations. It is mainly due to market expectations. The central bank was anchored by the central bank last week. At the same time, recently announced data show that financial institutions are also facing the problem of weak real economy financing. Through moderately reducing interest rates, financial institutions help stimulate financing to recover; currently at a critical stage of economic recovery Demand accelerate recovery. "

Zhou Maohua explained that the asymmetric lowered LPR interest rate, on the one hand, financial institutions comprehensively reduce the cost of real economic loan, intended to stimulate wide credit and promote accelerated recovery of domestic demand; on the other hand At present, the economic recovery has prominent problems, and the financial support of the stabilization market has been strengthened.

In addition, Wen Bin, chief economist of Minsheng Bank, also publicly stated that in the second quarter, real estate development loans and mortgage loans were not well performed, and the overall downward pressure continued to increase. In the context of the reduction of residents 'income and a large debt burden, reducing policy interest rates and guiding LPR reduction will also help to release bonus bonuses for mortgage loans and increase residents' consumption expectations.

According to the analysis of CITIC Securities, after the LPR downgrade, the credit or pulse of August: First, the experience proves that LPR reduction will bring rapid repair to credit. Looking back at history, corporate credit growth is more affected by LPR. As the impact of the epidemic faded, LPR reduction will have a good effect on loans.

- END -

The Provincial Department of Finance attended the press conference to introduce the financial support of the summer grain and the acquisition of summer grain and the acquisition of summer grain

On June 14, the Provincial Government News Office held a press conference to intro...

China Release 丨 National SASAC's regulatory enterprise in ten years has increased by 11.14 trillion yuan over GDP, an average annual growth rate of 2.3 percentage points

China Net, June 17th. On June 17, the Propaganda Department of the Central Committ...