The first batch of two listed securities firms were released: net profit declined in the second quarter of the second quarter of investment income, which improved the performance of recovery in the second quarter

Author:Securities daily Time:2022.08.22

Reporter reporter Zhou Shang 者

On the evening of August 19, the first batch of Soochow Securities and Guohai Securities were reported in the semi -annual report of 2022.

In the first half of the year, Soochow Securities realized operating income of 4.301 billion yuan, an increase of 5.64%year -on -year; net profit attributable to shareholders of the parent company was 818 million yuan, a year -on -year decrease of 38.82%. Guohai Securities realized operating income of 1.684 billion yuan, a year -on -year decrease of 36.15%; the net profit attributable to shareholders of listed companies was 241 million yuan, a year -on -year decrease of 47.49%.

Although the performance of the two listed brokers in the first half of the year decreased year -on -year, the performance in the second quarter has improved significantly compared with the first quarter. Among them, the net profit in the second quarter of Soochow Securities increased by 519%month -on -month, and the net profit of Guohai Securities increased by 262%from the previous quarter.

Judging from the business line of 2 brokerage firms. In the first half of the year, Soochow Securities realized the income of investment trading business by 33.23%year -on -year, investment banking's business revenue increased by 6.74%year -on -year, and the revenue of wealth management business increased by 6.33%year -on -year; while its asset management business revenue and international business revenue decreased by 37.48%year -on -year, respectively, respectively, respectively, respectively. 95.31%. In the first half of the year, Guohai Securities realized the revenue of retail wealth management of 570 million yuan, an increase of 0.88%year -on -year; the credit business revenue was 169 million yuan, an increase of 19.75%year -on -year; Investment management business income was 575 million yuan, a year -on -year decrease of 24.59%.

Regarding the significant growth of investment transaction business income, Soochow Securities stated that the company insists on the overall idea of pyramid -type asset allocation in terms of equity investment, and consolidates the bottom warehouse by increasing the allocation of low -correlation assets and smooth performance; In terms of research and guidance, in -depth analysis of macro -environment and market factors, timely adjusting strategies based on market changes, optimizing the positioning structure, improving the yields of the underlying assets, and building investment security zones; promoting new businesses such as bills, sales transactions, and expanding their income channels.

In the first half of the year, Guohai Securities was affected by factors such as the securities market fluctuations. The company's equity investment and other business revenue decreased year -on -year. The company's net profit attributable to shareholders of listed companies fell year -on -year.

As of press time, in addition to the 41 A shares listed securities firms, in addition to the Soochow Securities and Guohai Securities, which have disclosed the semi -annual report, 14 brokers have released semi -annual performance trailers or performance reports. Liu Li, assistant to the director of the Shanxi Securities Institute and non -silver financial analyst, said, "It is expected that most listed brokers will have a decline in the first half of the year, but it has improved significantly in the second quarter. It is recommended to pay attention to the second quarter performance recovery and relatively good performance."

Faced with the complex operating environment in the first half of the year, the performance of the listed brokers was relatively sluggish, but six brokers had achieved a profit in the second quarter, and the overall profit was achieved in the first half of the year. Among them, five of the five -year -old performance reports have disclosed the performance of the semi -annual performance express report. Grow 9.29%.

The chief analyst of the non -silver financial industry of open source securities said, "Overall, investment income is the core of the second quarter performance of the brokerage firms. Profit elasticity is greater. "

Taking Guoyuan Securities, which released the first semi -annual performance of the listed securities firm as an example, the first quarter achieved operating income of 583 million yuan, a year -on -year decrease of 36.71%; the net profit attributable to shareholders of listed companies was 120 million yuan. However, after entering the second quarter, as the A -share market has risen steadily, the National Yuan Securities adjusts the investment structure, strictly controls investment risks, and has decreased by securities investment losses. Driven by the recovery of performance in the second quarter, Gu Yuan Securities' performance in the first half of the year improved significantly, achieving operating income of 2.474 billion yuan, an increase of 8.73%compared with the same period last year; the net profit attributable to shareholders of listed companies was 749 million yuan. Compared with 11.5%compared to the same period.

- END -

The State -owned Assets Supervision and Administration Commission of the State Council conducts questions on the "Notice on the Circulation of State -owned Assets Transactions"

In order to meet the needs of state -owned capital layout and structural adjustment in the new development stage, improve the efficiency of state -owned asset allocation, continue to regulate the tran

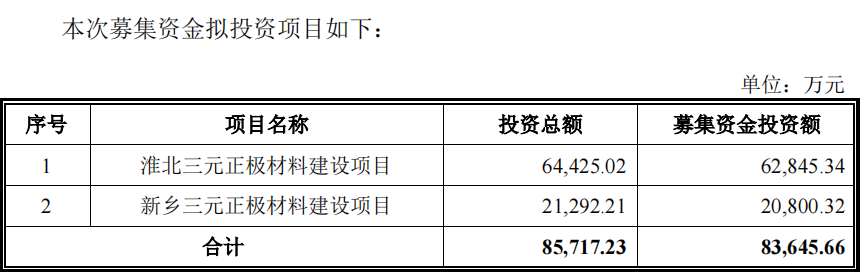

Tianli Lithium Energy: The GEM IPO will be purchased on August 17th. It is expected that the net profit in the first nine months will increase by 3 times

[Dahecai Cube News] On August 7, Tianli Lithium released the first public offering...