Multi -country central banks raise interest rates to fight inflation, why do Turkey "do not follow the usual way"

Author:Xinmin Evening News Time:2022.08.20

"Erdogan may think that the inflation rate continues to rise and the lira exchange rate continues to fall. He looks forward to the improvement of economic growth expectations and can reverse the current situation. This is the core of 'Erdogan Economics'."

Most of the state central banks are increasing interest rates to fight against soaring inflation rates, but Turkey cuts interest rates again.

As the inflation rate soared to nearly 80%, the Turkish central bank once again decided to lower the policy interest rate to 13%.

The operation of this sword is really unclear.

Interest rate is reduced by 100 basis points

Economy is not before, inflation continues. Faced with global inflation that climbed to a high level, many central banks "you chase me" raised interest rates.

The Minutes of the Federal Reserve Conference announced on Wednesday showed that the United States will continue to raise interest rates and tighten monetary policies until inflation relieves significantly. The Norwegian central bank raised its interest rate 50 basis points on the 18th and stated that similar measures will continue to take September. Esabel Schunabel, a member of the Central Bank of China Board of Directors, said that since the interest rate hike in July, the inflation prospect of the euro zone has failed to improve. She will support the next month to raise interest rates again, even if this may exacerbate the risk of economic recession. In Asia, the Philippines also launched the fourth rate hike this year.

But Turkey chooses "not to take an unusual path."

This week, the Turkish central bank reduced the interest rate of 100 basis points from 14%to 13%. "The indicators in the third quarter show that economic activities have lost some motivation." In the statement, the Turkish central bank explained the reasons for the interest rate cut. It is conducive to the financial environment that stabilizes the growth momentum of industrial production. "

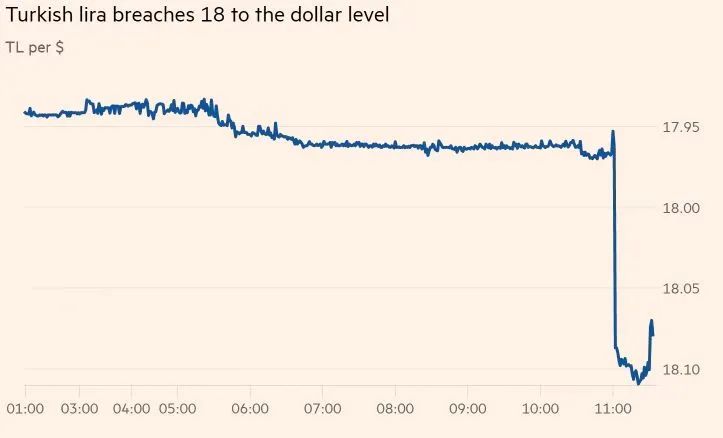

On the day of the Turkish central bank announced that the day of the Rica fell to the US dollar at a low of 18.14. Picture source: ft

Three central bank governors have been expelled

But this approach runs counter to the mainstream views of economics. What's more, Turkey's inflation rate has approached 80%at the moment.

"The goods we imported only needed 10 miles in the past, and now we need to pay 50 lira." Abdulla Ebokaku, who runs a shoe shop in the capital Ankara, looked at the shoes in the shop, "One morning, I am, I I didn't sell anything. "

Because of this, foreign media have described Turkey's interest rate cuts in words like "accidents". A Australian media even described the country's reverse operation in front of inflation with "Turkey launched an unusual test".

The inflation rate of Turkey has approached 80%. Picture source: ft

However, Turkish President Erdogan does not agree with the saying that "the best way to control inflation is to increase interest rates." "Don't pay attention to the nonsense of those who are just watching the world from London or New York." He called those who interacting interest rates and inflation in their mouths as "illiterate and traitor."

In fact, in the past four years, Erdogan has fired three central bank governors because they always try to increase interest rates.

The current Turkish central bank governor Kavjeglu support Erdogan's alternative theory. Kaifjogru, who started to take charge of the Turkish central bank last year, began to reduce interest rates from September, from 19%to 14%in the end of 2021, and maintained 14%in the first half of this year until this week.

Everything is targeting economic growth

According to Xu Mingqi, deputy director of the Shanghai International Economic Exchange Center and a special researcher at the Shanghai Institute of International Finance and Economics, Turkish President Erdogan has his own set of logic against inflation.

Xu Mingqi pointed out that Turkey's inflation rate in history has exceeded 100%. In Erdogan's view, nearly 80%of inflation is still available.

On the contrary, a series of negative effects that the interest rate increase may bring, which is about to usher in the election next year.

"Turkey's economic growth data in the first quarter decreased month -on -month, and it is expected to be lower than the first quarter in the second quarter. The export growth rate has also declined." Xu Mingqi pointed out that in the face of inflation, the traditional approach of central banks in various countries is to push up borrowing through interest rate hikes to borrow loans through interest rate hikes. Cost, suppress non -necessary consumption, thereby reducing the entire society's demand for goods and services, and slowing down the pressure of inflation. However, interest rate increases can also cause problems such as slowing economic growth and rising unemployment rates.

Although interest rate cuts constitute a pressure on the exchange rate of Turkish currency lira, which led to further depreciation of Lichel, this is not within the consideration of Erdogan's consideration. It is what he wants to reduce interest rate cuts, reduce the international turnover deficit, and promote economic growth.

Because of this level of consideration, Erdogan insisted on restricting interest rate cuts regardless of the depreciation of Licha and domestic inflation.

In addition, Xu Mingqi said that under the background of Russia and Ukraine's conflict, Turkish asset prices have been significantly reduced, and the domestic affairs bureau is relatively stable. Erdogan may look forward to attracting capital backflow by improving economic growth expectations, thereby supporting the stability of the lira exchange rate. According to data from the Turkish Ministry of Finance, in recent weeks, the foreign exchange reserves of the Turkish central bank have increased significantly. This seems to mean that the return of funds that Erdogan expects may appear.

"Erdogan may think that the inflation rate continues to rise and the lira exchange rate continues to fall. He looks forward to the improvement of economic growth expectations and can reverse the current situation. This is the core of 'Erdogan Economics'." Xu Mingqi said.

Such a retrograde move is destined to adventure. And this adventure is not worth it, only to wait for the answer to the future.

Produced deep -sea district studio

Written Qi Xu editor deep sea shell

- END -

Li Baodi, deputy dean and senior deputy manager of the South China Training Center of the Construction Bank Training Center

Zhongxin Jingwei, July 6th. The website of the Central Commission for Discipline Inspection Commission reported on the 6th that according to the Central Commission for Discipline Inspection, the State

Agricultural issuance of Nanyang Branch regulating the "three -in -one" commissioner's performance and management

In order to solve individual disciplinary inspection, internal control compliance, and risk management three -in -one specialist who still exists to a certain extent, there is still a situation wher