360 Division 2 quarterly report: growth rate reduction, promoting loans of 98.28 billion yuan

Author:Zero One Finance Time:2022.08.19

Source | Zero One Finance

Author | Yao Li

On August 18th, Eastern time, Nasdaq's 360 Digital (NASDAQ: QFIN) released the second quarterly report of the unveiled 2022.

According to the financial report, the business scale and performance of the 360 Division in the second quarter continued the speed reduction since the first quarter: the second quarter promoted the loan of 98.28 billion yuan, an increase of 11.1%year -on -year, and a slight decrease of 0.6%month -on -month. 4.5%, a decrease of 3.2%month-on-month; net profit of 970 million yuan, a year-on-year decrease of 40.9%, and a decrease of 1.6%month-on-month; NON-GAAP net profit was 1.02 billion yuan, a year-on-year decrease of 36.7%, and a decrease of 16.7%month-on-month.

In addition, due to the influence of the industry's environment, the 90 -day+overdue rate of 360 matches at the end of the second quarter increased by 0.22 percentage points to 2.62%. 53.3 billion yuan in the first quarter, accounting for 53.96%.

In the first and second quarters, it promoted the loan of 98.28 billion yuan, an increase of 11.1%year -on -year, a slight decrease of 0.6%month -on -month, and the 90 -day+overdue rate rose to 2.62%

According to the financial report, the performance of the 360 Division in the second quarter of 2022 continued the speed reduction since the first quarter. In the second quarter, operating income was 4.18 billion yuan, an increase of 4.5%year -on -year, and a decrease of 3.2%month -on -month. Fall 40.9%, a decrease of 1.6%from the previous month; Non-Gaap net profit was 1.02 billion yuan, a year-on-year decrease of 36.7%, and a 6.7%decrease from the previous month.

The financial report shows that the reserve subjects have a greater impact on the year -on -year changes in net profit in costs: 1.2 billion yuan in the second quarter or debt reserves (Provision for Contingnt Liability), compared with 462 million yuan in the same period last year; financial receivable assets The provision for Financial Assets Receivable was 1.037 billion yuan, and the same period last year was 585 million yuan. The changes in these two subjects reflected the "reserve method that consistent with the loan situation"; in addition, due to In the growth of loans in the table and loan reserves, it has increased from 247 million yuan in the same period last year to 416 million yuan in the same period last year.

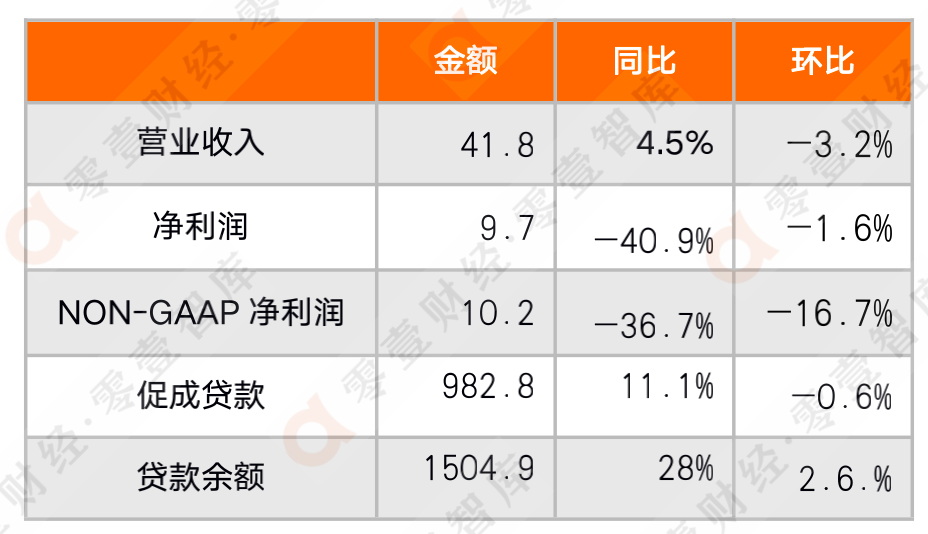

Table 1 360 Division of the second quarter of 2022

(Unit: 100 million yuan)

Source of data: 360 Division 2022 Two Seasons Report, Zero 1 Think Tank

From the perspective of loan scale, 360 Division is currently the largest online online loan platform in China, which has maintained a high growth rate. Since 2022, the growth rate has declined. In the first quarter of 2022, the 360 Division of Division promoted the loan of 98.83 billion yuan, an increase of 33.29 %% year -on -year, an increase of 1.98%month -on -month; the loan was 98.28 billion yuan in the second quarter, an increase of 11.1%year -on -year, the growth rate decreased from the first quarter, and a slight decrease from the first quarter. Essence As of the end of the second quarter, the amount of loans contributed by the 360 Division reached 150.49 billion yuan, an increase of 28%year -on -year, and an increase of 2.6%month -on -month.

The second quarter report disclosed that the platform of 360 Division connects 133 financial institutions and a total of 198 million customers with potential loan needs. The number of customers increased by 12.5%year -on -year.

In terms of asset quality, as of the end of the second quarter, the 90 -day+overdue rate was 2.62%, an increase of 0.22 percentage points from the previous quarter at the end of the first quarter.

2. Business structure: In the first quarter, small and micro -loan was 4.9 billion yuan, a decrease of the month -on -month. The platform model promoted the loan of 54.78 billion yuan, accounting for 55.7%.

According to the financial report, in terms of small and micro loans, the cooperative financial institutions of the 360 Division in the first quarter of 2022 provided 4.9 billion yuan to small and micro enterprises through the platform, a decrease of 7.4 billion yuan in the first quarter.

The 360 Digital Division has been transformed to light capital or platform models that do not bear credit risks since 2019, and quickly advanced. By 2021, the proportion of business scale has been more than half in the 2021 young capital model.

The financial report shows that in the second quarter of 2022, the light capital model, intelligent credit engine and other technical solutions contributed a loan of 54.78 billion yuan, accounting for 55.7%; 53.96%from 53.33 billion yuan in the first quarter increased. At the end of the second quarter, the loan balance was 82.58 billion yuan, accounting for 54.9%, which also increased from 78.8 billion yuan at the end of the first quarter.

Corresponding to business models, 360 Division discloses income in two parts. First, Credit Driven Services that undertake credit risk, one is the platform service income (Platform Services) without credit risk. Platform service revenue mainly includes loans in light capital models to promote and service fees, as well as relatively small promotion service fees and other service fee income. The financial report shows that the platform revenue of the platform in the second quarter of 2022 was 1.24 billion yuan, accounting for 29.5%; a year -on -year decrease of 22.6%, including the decline in loan scale in light capital models and reduction in fees; 1.4 billion yuan in the first quarter, accounting for 32.39 32.39 %Compared with, the scale and proportion of platform revenue in the second quarter also declined, mainly including fees. Third, the performance guidance of 410,000 to 450 billion yuan was promoted in 2022, and the dividend of 0.09 US dollars/share in the second quarter

The 360 Division continues the previous performance guidelines. It is expected that the loan will be 410 billion yuan to 450 billion yuan in 2022, an increase of 15%to 26%year -on -year.

The 360 Digital Division announced the first quarterly dividend policy in the third quarterly report in 2021. Starting from the third quarter of 2021, it will be announced in each financial quarter and distributed regular cash dividends. The amount is 15%to 20%of the net profit after tax. According to the dividend policy, the 360 Digital Division announced a quarterly dividend of $ 0.11/share or $ 0.22/ADS in the first quarter report. In the second quarterly report, the 360 Division announced the second -quarter dividend of $ 0.09/share or $ 0.18/ADS, which will be issued on October 28.

End.

Zero One Financial Digital Economic Decision Service Platform provides services such as media communication, digital internal reference, research consulting, conference activities, etc. At present, more than 400 institutions have been served; more exciting content, please log in to the website: 01Caijing.com. 2901 original content public account

- END -

[Jilin News Network] The construction of the Puchai Railway in the Tonghua area of Shenbai High -speed Railway started construction

A few days ago, the construction of the Puchai Railway in the Tonghua area of ...

The highlights of the Longjiang Exhibition Hall are not enough

The blue sea and blue sky, coconut wind and sea rhyme. On the 25th, the 2nd China ...