During the year, the listed company issued a set of insurance announcements 983 companies participating in derivatives transactions became more and more standardized

Author:Securities daily Time:2022.08.19

19AUG

Our reporter Wang Ning accompanied the semi -annual report successively, and the reasons for the significant improvement of some A -share listed companies have also surfaced. According to Wind data, as of August 18, the number of announcements for A -share listed companies to participate in the hedging of A -share companies during the year reached 983, far exceeding 826 in the same period last year. Among them, many listed companies have released risk control measures, reflecting the increasingly standardized enterprises in participating in derivatives' transactions. Listed companies actively participate in derivatives and trades Su Yanjing's main products are salt, industrial salt, and soda. The company recently issued a semi -annual performance express report. It is expected that the non -net profit range belonging to shareholders is 435 million to 522 million yuan, and the year -on -year growth range is 266.24%to 339.48%. The company said that the main reason for the pre -increased performance is that the company's product sales prices have increased year -on -year, profits continue to increase, and the product structure has been further optimized. Since the beginning of this year, benefited from the sharp rise in pure alkali prices, and the performance of related listed companies has obviously returned. In addition to the god of Su Yanjing, the two listed companies, Shandong Haihua and Xueyan Salt Industry, also have a large net profit increase in the first half of the year. Among them, the net profit of Xuetian salt industry in the first half of the year increased by more than 600%. Chen Xiaobo, a researcher at Huishang Futures Industrial Products, told a reporter from the Securities Daily that the performance of related listed companies in the first half of this year has increased significantly, mainly benefiting from high product prices. Taking pure alkali as an example, on the one hand, the supply end of the supply side is limited during the year, and the output loss of the summer maintenance peak provides obvious support for pure alkali prices; on the other hand, the production energy output of the downstream demand side increases faster In addition, the frequent launch of the photovoltaic glass production line has further promoted the tight market pattern of pure alkali supply. The high product prices are only one of the reasons for the significant improvement of listed companies. The flexible use of derivatives tools also provides effective help for the growth of listed companies. "Securities Daily" reporter learned that after the "Administrative Measures for the Setting During the Preservation of Metal Estatement of Commodity Futures of Jiangsu Suyanjing God Co., Ltd." in August last August, it has actively participated in the hedging business of pure alkali, coke, and power coal futures. The announcement shows that the current participation of funds does not exceed 200 million yuan. According to Wind data, as of August 18, A -share listed companies issued as many as 983 announcements on participating in the preservation of the set period, far exceeding 826 in the same period last year. Moreover, the preservation of the futures of listed companies is becoming more and more standardized. On August 18th, stable medical care announced that the company launched exchange rate derivatives such as long -term and options for the purpose of setting up the value preservation of not more than 1 billion yuan (or equivalent foreign currency). The company's foreign exchange sets of value preservation business does not do speculative and arbitrage trading operations. At the same time, the company's risk control measures include four aspects: one is to adhere to the principles of safe, stable, moderate and reasonable; the other is to establish the "Foreign Exchange Settlement System Management System"; the third is to strengthen the research and analysis of the exchange rate, adjust the business strategy in a timely manner, adjust the business strategy in a timely manner ; Fourth, based on the specific business business, business operations are strictly carried out in accordance with the provisions of the "Foreign Exchange Setting During the Management System". Also on August 18th, ST remotely released the "Remote Cable Co., Ltd. Futures Set During the Management System", which made a number of clear requirements for the standardized operation of the operation set period. Multiple measures help the quality improvement of listed companies. From the overall situation of A -share listed companies participating in futures derivatives, most companies can flexibly use the on -site and off -site derivatives trading tools. More mature. "Listed companies are more flexible and changeable to use derivatives. They are no longer limited to the hedging operation during the set period. The proportion of internal and off -site options and the use of rights containing trade has increased. Relevant persons in the business institute told the "Securities Daily" reporter that the Great Business Institute attaches great importance to the relevant work of improving the quality of listed companies, and continuously organizes the "DCE · Industrial Bank" to enter the special cultivation activities such as listed companies to promote the establishment of many listed companies "The Cultivation Base for the Industrial and Finance of the Great Commerce". According to reports, this year's "Big Business Enterprise Plan" carried out by Dashang includes three sections: futures, intra -field options, and off -site options, covering 18 markets and 7 options in the large business institute. , Improve project support standards and other methods to promote the participation of various types of enterprises. At present, 209 companies have completed 248 projects for record, of which 12 listed companies have participated. In addition, 29 listed companies have joined the cultivation base of large businessmen, leading upstream and downstream and surrounding enterprises to make good use of derivatives, and drive the relevant industrial chain to achieve common prosperity in the form of "big hands and small hands". Relevant persons in the business institute told reporters that the next step will continue to promote the use of the futures company to use the futures market to achieve stable operations. On the one hand, focusing on the personalized risk management needs of listed companies, providing customized services, creating a market service system of "seeing and sending the door", and promoting more listed companies to test water financial derivatives through the "Great Business Enterprise Style Plan" 2. In a pre -combination, we can improve the level of corporate risk management; on the other hand, actively promote the hedging audit mechanism, optimize the deposit rules, improve the convenience of physical enterprises to participate in the futures market, and reduce the cost of participating in the hedging of enterprises.

Recommended reading

The first mention of "recession"! The minutes of the Federal Reserve's July meeting said that the risk of "excessive" interest rate hikes in the future or the risk of interest rate hikes!

Youyou food, only "claws" are fresh, how can you "eat all over the sky"?Picture | Bag Picture Network Station Cool Hero Production | Liu Zhizhi

- END -

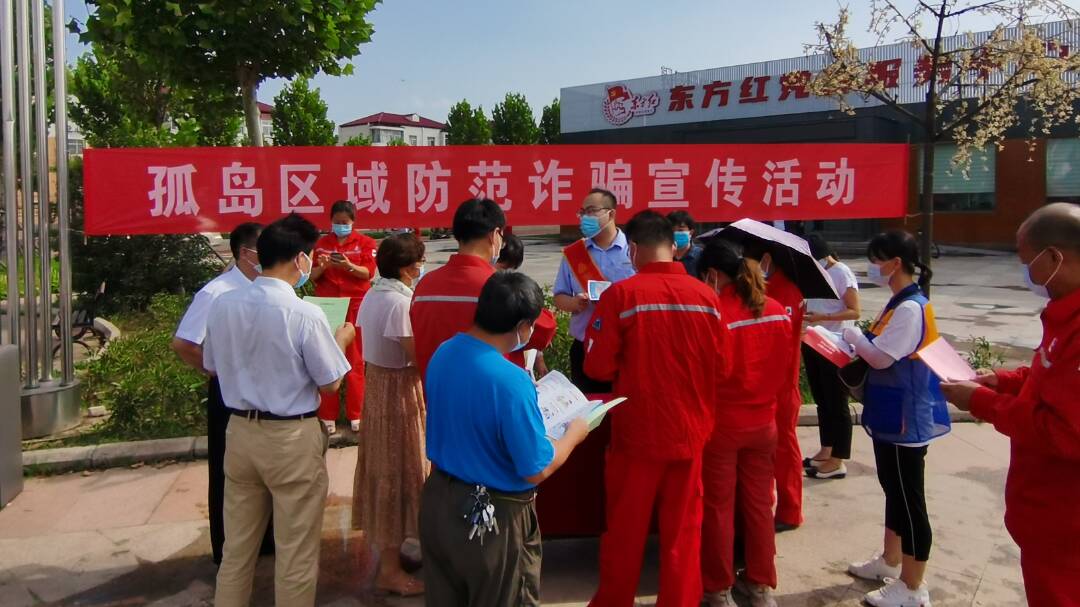

Land Island Town Carrying out the propaganda work of preventing fraud

In order to thoroughly implement the deployment requirements of the superior depar...

Review of the Gold and Silver Coin Market in June -see which one is more profitable!

In June, most parts of the country have entered the summer. In sharp contrast to t...