Agriculture, branch small, and multiple special re -loans, the central bank detailed structural monetary policy tools

Author:China Economic Network Time:2022.08.19

China Economic Net, Beijing, August 19th. The official website of the People's Bank of China announced the introduction of structural monetary policy tools today. The central bank said that my country's structural monetary policy tool is a tool for the People's Bank of China to guide financial institutions to invest in credit direction, exert accurate drip irrigation and leveraged prying effects. Credit investment reduces corporate financing costs. Structural monetary policy tools have both the two functions and structural dual functions. On the one hand, structural monetary policy tools establish an incentive compatibility mechanism, link central bank funds from financial institutions to the credit of specific fields and industries. Unique advantages; on the other hand, structural monetary policy tools have the basic currency investment function, which helps maintain a reasonable and abundant liquidity of the banking system and support the steady growth of credit.

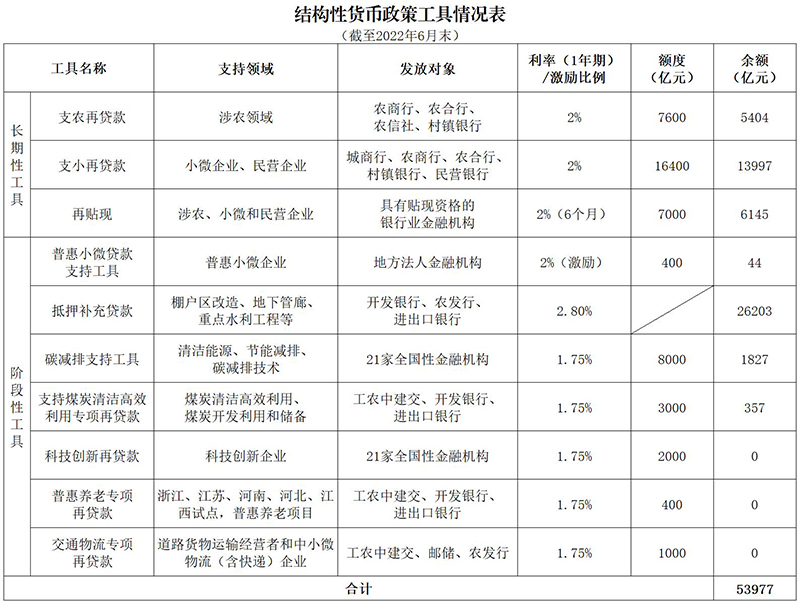

There are 10 structural monetary policy tools, namely long -term tools, supporting agricultural re -loans, small re -loans, and discounting; staged tools, inclusive small and micro loan support tools, mortgage supplementary loans, carbon reduction reduction reductions Supporting tools, support for coal cleaning and efficient use of special re -loan, scientific and technological innovation re -loan, special loan of inclusive pensions, and special re -loan of transportation and logistics.

Structural monetary policy tool introduction

I. Overview

In recent years, the People's Bank of China has conscientiously implemented the decision -making and deployment of the Party Central Committee and the State Council, and exerts the dual functions and structural dual functions of monetary policy tools. High -quality development has gradually built a structural monetary policy tool system suitable for my country's national conditions.

(1) Give full play to the dual functions and structural dual functions to promote the stable growth of total credit

my country's structural monetary policy tools are the tools for the people's bank to guide financial institutions to invest in credit direction, exert accurate drip irrigation and leverage leverage. By providing re -loan or funding incentives, financial institutions will support financial institutions to increase credit investment in specific fields and industries. , Reduce corporate financing costs.

Structural monetary policy tools have both the two functions and structural dual functions. On the one hand, structural monetary policy tools establish an incentive compatibility mechanism, link central bank funds from financial institutions to the credit of specific fields and industries. Unique advantages; on the other hand, structural monetary policy tools have the basic currency investment function, which helps maintain a reasonable and abundant liquidity of the banking system and support the steady growth of credit.

(2) Establish a multi -department linkage working mechanism to form a policy joint force

Structural monetary policy tools have established the mechanism of "independent loan lending, lending management, the People's Bank of China afterwards, the total amount of the People's Bank of China, the relevant departments clearly use the use and random inspection" mechanism, and connect the financial institution loan and the central bank's re -loan "two accounts. "It is conducive to motivating financial institutions to optimize the credit structure and achieve the effect of precisely tilted in the fields of green development and scientific and technological innovation.

First, the People's Bank provides funds to financial institutions in accordance with the "first loan and then borrowing" model, rather than issuing loans directly to enterprises. Financial institutions independently issue loans and management accounts to enterprises in accordance with the principles of marketization and rule of law, and then apply to the People's Bank of China for re -loan or incentive funds. Provide incentive funds.

Second, the area or industry scope of supported by the industry authorities. Relying on the industrial foundation of the competent departments of industry authorities such as the National Development and Reform Commission, the Ministry of Science and Technology, the Ministry of Industry and Information Technology, the Ministry of Industry and Information Technology, the Ministry of Ecology and Environment, the Ministry of Transport, and the State Energy Administration, the financial department uses the existing statistical system or establish a special ledger to clarify the area or industry of loan support. Give full play to their respective advantages and form a policy joint.

The third is to establish a mechanism for post -after -verification and error correction. The industry authorities jointly randomly random inspections with the financial department after the incident, and the audit supervision and social supervision followed up afterwards. If the loan accounts of financial institutions exceeded the scope of support, measures will be taken to supplement the poor accounts and recovered the re -loan to avoid financial institutions from illegal settlement and then recruitment before taking it out before they can be collected before taking it out. Loan funds.

(3) Rich toolboxes, precise drip irrigation real economy

The current structural monetary policy tools can be divided from the following three dimensions:

The first is long -term tools and staged tools. Long -term tools mainly serve the construction of the long -term mechanism of inclusive finance, including supporting agricultural support small re -loan and re -discount. The staged tools have a clear period of implementation or exit arrangement. Except for supporting agricultural support small re -loan and re -discounting, other structural monetary policy tools are staged tools.

Second, the tools and branches managed by the head office. The Management of the People's Bank of China is mainly staged tools, which is characterized by national financial institutions and "fast forward and fast out" to ensure that the policy is increasing efficiently and exiting in time. In addition to inclusive small and micro loan support tools in phased tools, they are all managed by the head office. The branch management is mainly long -term tools, such as small re -loan and re -discounting of agricultural branches, and there are also phased tools. For example, inclusive micro -loan support tools are characterized by local legal person financial institutions to ensure that the policy is close to the grassroots and inclusiveness sex.

The third is to provide tools for re -loan funds and to provide incentive funds. The tool for providing re -loan funds requires financial institutions to provide credit support to specific areas and industries. The People's Bank of China will provide a certain percentage of re -loan fund support based on the credit issuance of financial institutions. This model is adopted outside the support tools. The tools that provide incentive funds require financial institutions to continue to provide credit support to specific areas and industries. The People's Bank of China will also incentive funds based on the incremental percentage of the credit balance of financial institutions. At present, the inclusive micro loan support tools adopt this model. 2. Specific tool introduction

1. supporting agriculture re -loan. Since 1999, supporting agriculture re -loan has been issued to local legal person financial institutions to guide them to expand the offering of agricultural credit and reduce the financing costs of "agriculture, rural areas, and rural areas. The target is rural commercial banks, rural cooperative banks, rural credit cooperatives and village and towns banks. The loan that meets the requirements will be supported at 100%of the loan principal. It belongs to long -term tools.

2. Small and re -loan. Since 2014, Zhixian Remiss loan has been issued to local legal person financial institutions to guide them to expand small and micro and private enterprises loans to reduce financing costs. The issuance objects include urban commercial banks, rural commercial banks, rural cooperative banks, village and town banks and private banks. The loan that meets the requirements will be supported at 100%of the loan principal. It belongs to long -term tools.

3. Cash again. The discounting is the discounting business of the discounting notes held by the People's Bank of China on the discounting bills. Since its opening in 1986, it has been operated in 2008. It has begun to play structural functions in 2008. It focuses on supporting the expansion of agricultural, small and micro and private enterprises financing. The issuing objects include national commercial banks, local legal person banks, and foreign banks with discounted banking financial institutions. It belongs to long -term tools.

4. Pratt & Whitney Loan Loan Support Tools. According to the decision of the State Council Executive Meeting, in December 2021, the People's Bank of China created an inclusive small and micro loan support tool. The supporting object was a local legal person financial institution. The inclusive small and micro loan issued by it provided incentive funds at 2%of the balance of the balance. , Encourage the continuous increase of inclusive small and micro loans. The current implementation period is from 2022 to the end of June 2023, and it is operated on a quarterly. Belongs to staged tools.

5. Mortgage supplementary loan. In 2014, the People's Bank of China created a mortgage supplementary loan. Mortgage supplementary loans mainly serve key areas such as shantytown renovation, underground pipe corridor construction, major water conservancy projects, and "going global". The distribution objects are development banks, agricultural issuance and import and export banks. For loans that are supported by support, fund support is based on 100%of the loan principal. Belongs to staged tools.

6. Carbon emission reduction support tools. According to the decision of the Executive Meeting of the State Council, in November 2021, the People's Bank of China jointly created a carbon emission reduction support tool for the National Development and Reform Commission and the Ministry of Ecology and Environment. Focus on the field of carbon reduction. For loans that meet the requirements, low -cost funding support at 60%of the loan principal. The current implementation period is from 2021 to the end of 2022, and it is operated on a quarterly. Belongs to staged tools.

7. Support coal clean and efficient use of special re -loan. According to the decision of the Executive Meeting of the State Council, in November 2021, the People's Bank of China jointly established a special re -loan to support coal clean and efficient utilization, and issued the target to develop banks, import and export banks, ICBC, Agricultural Bank of China, Bank of China, CCB, and Bank of Communications. Family national financial institutions have clearly supported seven coal clean and efficient utilization areas including large -scale clean production and clean combustion technology, as well as supporting coal development utilization and enhancing coal reserve capabilities. For loans that meet the requirements, low -cost funding support at 100%of the loan principal. The current implementation period is from 2021 to the end of 2022. Monthly operates. Belongs to staged tools.

8. Scientific and technological innovation re -loan. According to the decision of the Executive Meeting of the State Council, in April 2022, the People's Bank of China jointly established a scientific and technological innovation and re -loan loan to the Ministry of Industry and Information Technology and the Ministry of Science and Technology. , National technological innovation demonstration enterprises, manufacturing single champion companies and other technological innovation enterprises; for loans that meet the requirements, 60%of the loan principal gives low -cost funding support and operate quarterly. Belongs to staged tools.

9. Prosperous pension special re -loan. According to the decision of the Executive Meeting of the State Council, in April 2022, the People's Bank of China and the National Development and Reform Commission created a special re -loan of inclusive pensions, and issued the target to develop banks, import and export banks, ICBC, Agricultural Bank of China, Bank of China, CCB, and Bank of Communications a total of 7 national financial institutions. , Clarify the inclusive pension institution project that meets the standards. In the early stage, the selection of five provinces in Zhejiang, Jiangsu, Henan, Hebei, and Jiangxi to conduct pilots. For loans that meet the requirements, they will be supported by 100%of the loan principal. The period is tentative for two years and operate on a quarterly. Belongs to staged tools.

10. Special loan of transportation and logistics.According to the decision of the Executive Meeting of the State Council, in May 2022, the People's Bank of China jointly established a special re -loan of transportation and logistics, and issued a total of 7 national financial institutions of Agricultural Issuance, ICBC, Agricultural Bank, CCB, CCB, Bank of Communications and Postal Savings Banks., Clarify the road cargo transport operator and small and medium -sized logistics (including express delivery) enterprises.For loans that meet the requirements, low -cost funding support at 100%of the loan principal. The current implementation period is 2022, which is operated on a quarterly.Belongs to staged tools.

- END -

Jimosar County and Dalong.com sign signed a contract to build a cross -border e -commerce industry chain ecosystem

On July 1, the People's Government of Jimusal County and Chongqing Dalong.com Tech...

Since 2023, Johnson & Johnson's baby's cool body powder will be suspended globally!

On the 11th local time, Johnson Johnson announced that it would stop selling baby...