Silicon material rising Tongwei shares soaring soaring by 312% to invest 28 billion to expand production or the risk of the price

Author:21st Century Economic report Time:2022.08.18

21st Century Business Herald reporter Han Xun Shanghai report

How much money does the silicon industry make? Perhaps the performance of Tongwei (600438.SH) can explain everything.

On the evening of August 17, Tongwei disclosed the semi -annual report of 2022. The company realized operating income of 60.339 billion yuan, an increase of 127.16%year -on -year; net profit attributable to mothers was 12.224 billion yuan, an increase of 312.17%year -on -year.

The Zeng Duohong team of Soochow Securities believes that Tongwei shares in the first half of the year "performance exceeds market expectations".

Affected by this good news, on August 18, Tongwei's stock price opened directly at 55.10 yuan, up to 57.44 yuan, and eventually increased by 4.32%to close 57.17 yuan, and the company's market value rose to 257.4 billion.

At the same time, Tongwei announced its expansion plan. The company intends to invest 200,000 tons of high pure crystal silicon and supporting projects in Baoshan City and Baotou City. The investment amount of the two projects is 14 billion yuan, which is expected to be completed and put into operation within 2024.

A single ton silicon material net profit is about 130,000 yuan

On the day of Tongwei's disclosure of the performance, the Silicon Industry Association disclosed the latest silicon material data. The price range of the single crystal remedy was 30.0-31 million yuan/ton, and the average transaction price was 305,300 yuan/ton. The increase of 0.36%; the price range of the single crystal dense material was 29.8-308 million yuan/ton, the average transaction price was 303,200 yuan/ton, and the period ratio increased by 0.33%.

The latest data from PV Infolink on the evening of August 17 showed that the average price of polycrystalline silicon -dense materials reached 300 yuan/kg (300,000 yuan/ton), an increase of 0.3%over the previous week.

"Tongwei's performance growth in the first half of the year is so super -expected that the price of silicon material rises too hard in the first half of the year." An analyst of a new industry industry in a securities company told the 21st Century Economic Herald reporter that the average price of polycrystalline silicon dense materials in early January this year was per ton per ton. 230,000 yuan, "18%in the first half of the year, and now it has risen by 30%. If the price has risen by more than 250%compared to early January 2021, silicon material companies will definitely make a lot of money."

Tongwei shares in the semi-annual report of 2022 show that the company's current business is mainly divided into two pieces, one is "feed and industrial chain business". From January to June this year, it achieved operating income of 14.382 billion yuan, an increase of 61.26%year-on-year. The other is the "photovoltaic new energy business", of which the "high -pure crystalline silicon business" capacity utilization rate reached 119.28%, and the output of high pure crystal silicon was 107,300 tons, an increase of 112.15%year -on -year, and the domestic market share was nearly 30%; Battery sales were 21.79GW, a year -on -year increase of 54.55%; the "photovoltaic power generation business" new installed grid -connected grid -connected scale was 433.38MW, an increase of 34%year -on -year.

Although there is no specific sales data, the Everbright Securities Research Report predicts that the average sales price of silicon material in Tongwei in the first half of this year this year is about 250 yuan/kg (250,000 yuan/ton), which has also increased significantly year -on -year.

The price increase of silicon materials is directly reflected in the performance of Tongwei in the first half of this year, especially in the second quarter.

Financial data shows that in the second quarter of this year, Tongwei shares achieved operating income of 35.65 billion yuan, an increase of 123.6%year -on -year, and a month -on -month increase of 44.4%; net profit attributable to mothers was 7.03 billion yuan, an increase of 231.8%year -on -year, an increase of 35.3%month -on -month.

Soochow Securities Research reports that the gross profit margin of Tongwei shares in the first half of this year was 35.1%, an increase of 10.8 percentage points year -on -year, of which the gross profit margin in the second quarter was 35.7%, an increase of 9.15 percentage points year -on -year, and an increase of 1.61 percentage points month -on -month. Silicon material shipments were shipped about 88-93,000 tons, an increase of 98%year-on-year, of which about 58-62,000 tons were shipped in the second quarter, and equity shipments were about 49-51,000 tons, an increase of 20%month-on-month.

As the price of silicon material continued to rise in the second quarter of this year, Soochow Securities calculated that the average tax inclusions of Silicon material in Tongwei in the second quarter of Tongwei Co., Ltd. were about 250,000 yuan/ton, and a single ton net profit was about 130,000 yuan+, a record high.

Production capacity will be tripled in the next four years

While disclosing the performance, Tongwei also announced the expansion plan, that is, "intended to invest in Baoshan City and Baotou City, the annual output of 200,000 tons of high pure crystal silicon and supporting projects. Completed and put into production within 2024. "

Tongwei shares in the semi -annual report of 2022 show that the company has formed 230,000 tons of high -pure crystal silicon capacity.

Soochow Securities predicts that Tongwei's silicon material "shipped in 2022 will reach 220,000 tons+(about 200,000 tons of equity shipments). +100 million yuan! "

In the investor inquiry on August 15th, Tongwei stated that "Based on the broad development prospects of the photovoltaic industry, the company intends to further increase its investment in high -pure crystalline silicon business, and planned the size of the company's high -purity silicon production capacity in 2024-2026 to reach 80 -1 million tons. "

According to Baichuan Yingfu data, as of June 2022, the national silicon material capacity was only 755,500 tons.

"If the above two projects are put into production smoothly, it means that Tongwei Co., Ltd. will add 400,000 tons of production capacity two years later, and the 120,000 tons of Leshan's third phase of Leshan has been opened at the end of July. The production capacity. "The above -mentioned analysts of the new brokeragepage industry told the 21st Century Business Herald reporter that if the maximum expansion plan is planned by 1 million tons, the production capacity of Tongwei shares will expand by about 3.3 times in the next four years. However, for Tongwei, the expansion plan is "dangerous" and "machine" or coexist.

"The price of silicon material may be seen next year," said the new industry analyst of the new securities company.

In his opinion, the price of silicon materials rose in the first half of this year. There are two reasons. One is the mismatch of production capacity, and the other is the impact of external factors. As a result, when the rapid outbreak of demand in the next reaches, the production capacity of the upstream silicon material cannot meet the increase in demand, which leads to the mismatch of production capacity. In addition, there are too many external factors in the first half of this year, epidemic, safety accidents, industry maintenance, etc., so silicon materials, so silicon materials, so silicon materials, so silicon materials The price will continue to rise. "

Indeed, in the third quarter of this year, the price of silicon materials did not decline. From July 1st-August 17th, the average price of polycrystalline silicon tight materials has increased by 28,000 yuan/ton, an increase of 10.3%.

"The influence of the third quarter is mainly a safety accident in a silicon material company, which has caused more industry inspection and affecting production capacity." A person in a light -voric industry in Jiangsu told the 21st Century Business Herald reporter that the recent continuous high temperature weather has led to the power generation in the concentrated area of hydropower and electricity. The quantity is limited, and the demand for electricity continues to rise. "In some regions, the limited electricity situation may once again affect the supply of silicon materials. Therefore, we judge that the supply of silicon materials in the third quarter is still tight, and the price will rise in the short term. But the increase is relatively limited. "

However, Wang Yanqing, a researcher at CITIC Investment Futures, predicts that if the amount of photovoltaic installation machines in accordance with the forecast of the photovoltaic association this year, the demand for polysilicon from 78-96 million tons throughout the year will continue to maintain a tight balance under the capacity conditions of 965,000 tons, so it is expected that silicon is expected to be silicon The price was expected to be at the earlier in 2023. "But if you consider the issue of cost sales pressure on the near future, with the upward transmission of negative feedback, the price of silicon material may be earlier than the market expectations."

However, the optimists also abound. Everbright Securities has raised the profit forecast of Tongwei Co., Ltd. on August 17th. "The company is the leading rhythm industry as the absolute leader of the silicon material. The market share will be further increased in the future. /The layout of the component link is also expected to bring an additional increase to the company's profit. "

- END -

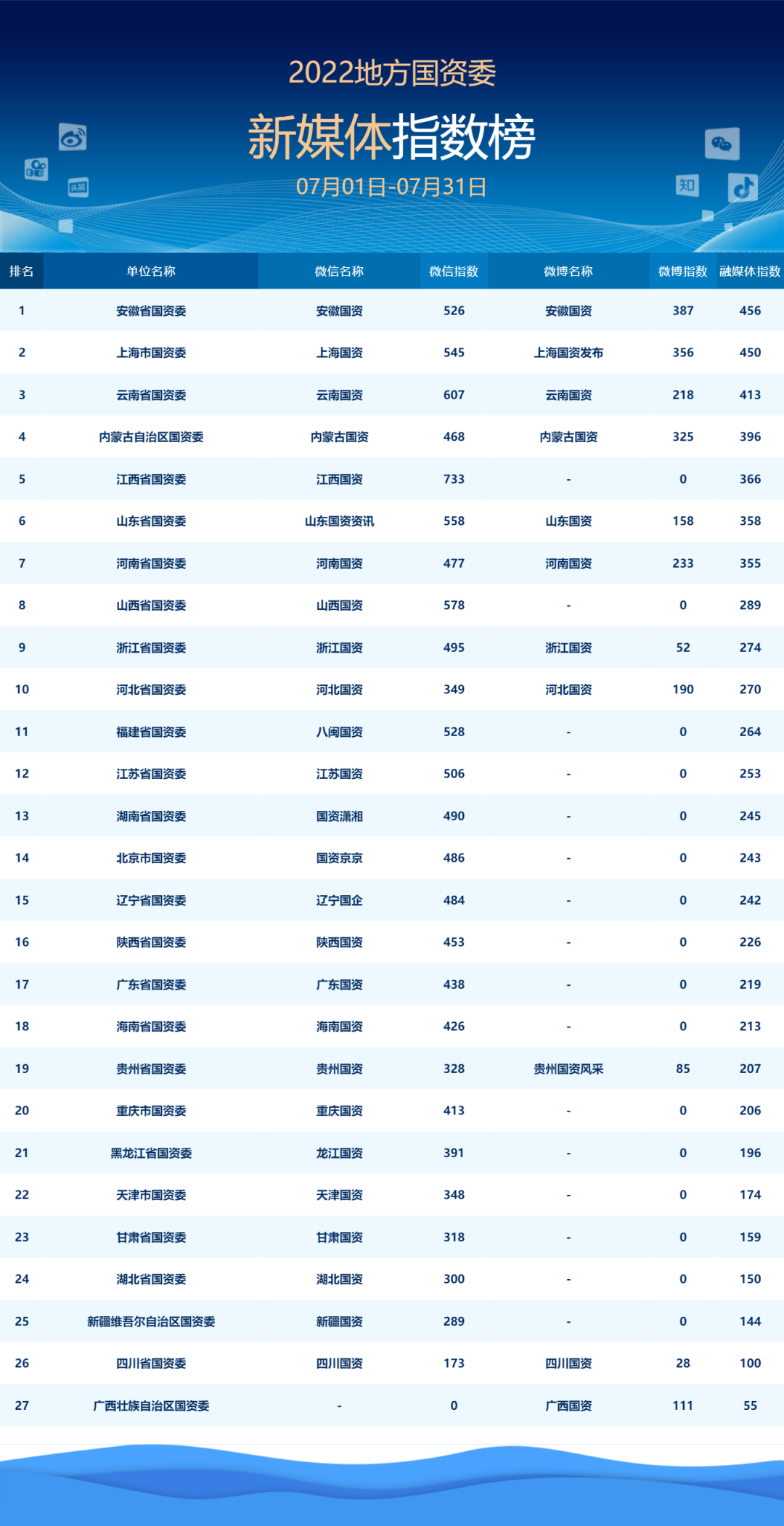

Local SASAC New Media Index List (July 2022)

SASAC News Center (@国 小 国) United Tsinghua University Journalism Research Cente...

Beijing introduced 17 measures to promote the high -quality development of the human resources service industry

In order to implement the Opinions on Promoting the High -quality Development of Human Resources Services Industry in the New Era, including the Ministry of Human Resources and Social Security, and