Elevator room with anxiety: Focus Media's net profit decline exceeded 50 % of friends who are close to who is "savior"

Author:Huaxia Times Time:2022.08.18

China Times (chinatimes.net.cn) reporter Yan Xiaohan Lu Xiao Beijing Beijing report

In the first half of this year, the epidemic situation was repeated and the downturn in consumption was superimposed in some industry policies. Companies of various industries were more cautious in use, and the advertising industry was severely impacted. After the market on August 16, the 2022 semi -annual report released by Focus Media showed that its revenue of 4.85 billion yuan in the first half of the year decreased by 33.77%year -on -year; net profit of 1.4 billion yuan decreased by 51.6%year -on -year.

As of the close of August 18, Focus Media's stock price fell 1.18%to 5.85 yuan, a decrease of more than 30%from the highest point of 52 weeks.

Net profit in the second quarter dropped by nearly 70 % year -on -year

Judging from the second quarter of the epidemic, the net profit of Focus Media fell by 69%year -on -year net profit in a single quarter.

This means that the impact of the epidemic to Focus Media is huge. Even in the initial 2020 of the epidemic, the net profit of Focus Media fell more than 80 % year -on -year in the first quarter, but since then it seized market opportunities in industries such as daily consumer goods, online education, etc. Essence

On the one hand, the impact of the epidemic is reflected in the operation of Focus Media itself. On the other hand, in the environment of consumption, advertisers have tightened their wallets and greatly reduced advertising expenses.

Focus Media said in the financial report that due to the influence of the epidemic situation since March, the advertising market demand is weak. Especially in April and May, some key cities in the company were released normally, and business activities were greatly affected.

From the perspective of the advertising industry as a whole, since the beginning of the year, factors such as instability and epidemic in domestic and foreign markets have impacted the overall advertising market, while outdoor release channels have been affected most. According to data from CTR Media Smart News, the cost of traditional outdoor advertisements in the first half of 2022 decreased by 34.6%year -on -year, which is the largest year for spending since 2016.

Another important reason for the decline in the performance of Focus Media is that its second largest source of income sources on the Internet industry and education and games are affected by supervision and reduced advertisements to reduce advertising and reduce various expenses.

The income of Focus Media is divided into buildings and theater screen advertising media according to the product. The former contributed 91.8%of its revenue in the first half of the year. The industries covered by these two products include daily consumer goods, Internet, transportation, commercial and services, entertainment and leisure.

Among them, in the building media of Focus Media, the income of the Internet industry in the first half of the year fell by more than 70 % year -on -year. This is the industry with the largest decline in it. Essence

It should be mentioned that in recent years, with the gradually disappearing of Internet dividends, the Internet industry's contribution to the revenue of Focus Media has declined significantly.

According to the research report released by Ping An Securities, the probability of the extreme events of the major cities 'advertisements in the second half of the year is very small, but from the current tracking situation, customers' advertisements have been repaired or expanded to be highly related to macroeconomic expectations, profit repair needs time.

Internet analyst Ge Jia holds the same view. He told the reporter of the Huaxia Times that the external environment is too large, and advertisers generally hesitate and cautious. Before the prosperity does not really improve, everyone is watching. In the second half of the year, even if the epidemic improves, it does not mean that the advertising industry can maintain continuous growth. The heating rate of advertisers is relatively slow, and it is reflected in its performance.

They are all looking for "Salva"

The daily consumer goods industry, which occupies the half -wall of Focus Media, has the smallest income in the first half of the year. Behind this, consumer advertisers have increased significantly on elevator advertising, and they are considered an industry that can bring stable income to Focus Media.

Soochow Securities stated in the research report in January this year that Internet companies have fluctuated largely, and the strategy of consumer advertising advertisements is very regular. Even in a poor period of economy, it can be guaranteed to be launched. In the future The proportion of consumer advertisements is expected to continue to increase, and the volatility of focus performance will also weaken significantly.

In addition, the proportion of the daily consumer goods industry of Focus Media accounted for 43%of the previous year to 53.07%in the first half of this year.

In fact, the proportion of revenue in the consumer industry has increased significantly since 2019. One of the reasons is that the mobile Internet industry has ended high growth in that year, and consumer Internet financing opportunities have been greatly reduced.

"Previously, the main customers of the public were startups. At that time, many startups hoped to achieve the effect of brand communication through ladder media to financing and listing. This industry demand and high profits. Reduce prices and absorb more customers in the fast -moving consumer industry. "Ge Jia said.

He believes that the fast -moving consumer industry is a market that is not sufficiently done by Focus Media, but is now in the "remedy" stage, and there is still room for growth in the future.

It should be mentioned that while Focus Media adjusts the customer structure, competitors are also accelerating their market share.

Unlike Focus Media's points focusing on high -end office buildings, in 2017, Xinchao Media cut in from community buildings, and it launched a "elevator war" in 2019. Affected by this, the gross profit margin of Focus Media fell sharply.

Judging from the number of points, in the first half of this year, there were 848,000 units in Focus Media Elevator and 18.17 million elevator posters. A total of 700,000 elevator smart screens and about 150,000 posters. Last year, Xinchao Media received $ 400 million in financing led by JD. It announced that in the next 5 years, it will invest 10 billion yuan to install 2 million elevator smart screens. He also said that it is necessary to build the first media traffic platform in the community. Ge Jia's analysis of the "Huaxia Times" believes that competitors are robbing the market share of Focus Media is also one of the reasons for the sharp decline in the performance of the public. "Its main competitors trendy media, mainly covering residential residential buildings, low prices and large faces, so that there is a Matthew effect. Focus has not made low -end points, it is also a strategic error. Now there is a strong business foundation for new tide. , Formed a catch -up effect on the people. "

On August 17, the reporter of the Huaxia Times used the issue of ordering and the number of plans for the order, and the advertiser's selection of the emphasis was issued to the Focus Media's Secretary Office to interview the outline. As of press time, it has not received a reply. On the same day, the reporter called the secretary of the director many times, and no one answered.

Editor -in -chief: Editor Yu Yujin: Hanfeng

- END -

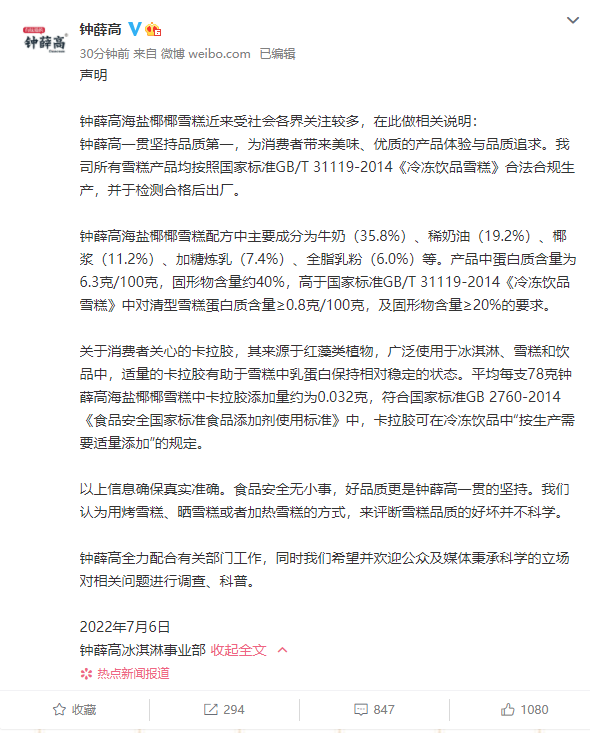

Zhong Xuegao responded to "ice cream can not burns": All ice cream products are legally compliant and compliant

This summer is a bit hot, and Zhong Xuegao is also a bit fire.Recently,#近 近 近 ...

Experts interpret Lenovo Financial Report: PC business has declined but it is still better than expected. Innovative business is expected to hedge the effect

Cover reporter Wu YujiaOn August 10, Lenovo Group announced the performance of the first fiscal quarter of the fiscal year 2022/23 (April-June this year): revenue of nearly 112 billion yuan, an increa