Reading from the real -time report of the real -life enterprise | The affiliates are still suspected, and the Ya Life is hard to speak lightly.

Author:21st Century Economic report Time:2022.08.18

21st Century Business Herald reporter Wu Shuying Guangzhou reports

When the real estate industry overall downlink and the property service industry was difficult to be alone, Ya Life Service handed over a mid -2022 report that was not good or bad.

On the basic financial data, elegant life services have maintained a certain increase.

According to the announcement, in the first half of this year, Ya Life Service achieved revenue of about 7.62 billion yuan, an increase of 22.0%year -on -year; gross profit was about 2.053 billion yuan, a year -on -year increase of 9.5%, and the gross profit margin was about 26.9%. Although the year -on -year decline, it remained still in High level.

The main contribution of disassembly revenue comes from property management service revenue of 4.904 billion yuan, an increase of 23.3%year -on -year; the value -added service revenue of the owner was 1.084 billion yuan, an increase of 34.3%year -on -year; ; Extension value -added service revenue was 990 million yuan, a year -on -year decrease of 24.0%.

However, in the performance of net profit, Ya Life has recorded a decline in incompatible with revenue growth.

In the first half of this year, the shareholders of Ya Lifeng should account for about 1.058 billion yuan, a decrease of 7.4%year -on -year; net profit was about 1.15 billion yuan, a decrease of 10.3%year -on -year; the net profit margin was 15.4%, a year -on -year decrease of 5.4 percentage points.

According to the intuitive reflection of the elegant life interim report, the direct impact on profit performance is mainly from the following aspects.

One is that the amount of impairment of financial assets has expanded. In the first half of this year, the loss was 270 million yuan, while the same period last year was only about 40.4 million. In addition, in the first half of this year, the net income of Ya Lian was only 197,000 yuan, and 60.91 million yuan in the same period last year, the difference was obvious.

As a property company in the forefront of the scale of the scale, Ya Luan still has a good growth in the first half of this year.

As of June 30, 2022, the area of Ya Lian services in the pipe area and contract area was about 529 million square meters and about 707 million square meters, respectively.

Among them, third -party projects maintain a certain expansion speed through market expansion and acquisition integration. The contract area (including controlling members) reached 558.5 billion square meters, and the new contract area exceeded 43.2 million square meters, an increase of 8.4%over the end of last year, accounting for 8.4%, accounting for 8.4%, accounting for 8.4%, accounting for accounting 79.1%of the total contract area.

According to the information released by Ya Life, in the first half of this year, its third -party market expanding the new contract area exceeded 35 million square meters, corresponding to the amount of newly added contracts exceeding 1.2 billion yuan, ranking among the forefront of the industry.

As a comprehensive property service provider, Ya Life Life has achieved small achievements in the two areas of residence and non -residence in the first half of this year.

In the format of the residence, Ya Lianhuo has obtained more than 25 residential stock projects in Shanghai, Guangdong, Shandong, Fujian Province, etc. In addition, Ya Life also acquires cooperation to integrate some Beijing super large communities projects, and consolidate the front line. The layout of the city.

In the non -living format, the projects with a new contract with more than 100 million yuan in Ya Lianhuang covered the government office, high -end business writing, universities, rail transit and public venues, and continued to consolidate its advantages in the layout of diversified formats in the country.

The above -mentioned data can be seen that the external extension capabilities of Ya Life are still quite recognized in the market.

In fact, as an industry for light asset operations, from the perspective of business logic, if it is not affected by other factors, its main driving force should come from scale expansion, improvement of management capabilities, and the potential of value -added business. Moreover, because of the continuous cash inflow and relatively stable income, the certainty and sustainability of their performance are also strong.

At present, the performance of Ya Lian's revenue can basically form a logical closed loop.

But since this year, the main development of property service companies comes from the uncertainties of related parties.

Due to the overall downward impact of the real estate industry, the deeper dependence on real estate companies will face the decrease in the area continuously transported by the parent company in the future. This is a factor. Maintain independently to avoid becoming a cash machine for the parent company. Because there are many precedents before, the capital market is also particularly concerned about this.

Ya Life Management has always shaped its relatively independent image with the parent company.

Before that, Ya Life also "helped" a major shareholder at a critical moment.

On November 17, 2021, Yajule and Ya Life Service jointly issued an announcement saying that the total subsidiary of Yajule agreed to issue bonds with a total principal of 2.418 billion Hong Kong dollars, with a term of 5 years and an annual interest rate of 7%. According to the agreement, this bond can be exchanged about 87.9913 million shares of Ya Life Service, accounting for about 6.2%of the current issued shares.

At the annual performance meeting of 2021 in May this year, Huang Fengchao, co -chairman and executive director of Ya Life, said that Ya Life has never appeared in affiliated transactions and funds that have never been disclosed with the major shareholder Yajule.

Even so, in the first half of this year, the impact of Yajule on Ya's life is still very obvious.

The annual interim report shows that in the first half of this year, Ya Luan's trade receivable from related parties was 2.67 billion yuan, an increase of more than 1 billion yuan from the same period last year; Rouge.

This is the most concerned about investors.At the performance meeting on the 18th, Ya Life Management also once again stated that as the debt pressure of related parties gradually relieved, the related account receivables should be improved.Objective analysis, this statement has a certain credibility.

As of now, Yajule's overseas bonds in the second half of this year only expired the principal bill with a principal of $ 400 million at the end of August. At present, the market has also had good expectations for this bill.If the payment of this bill is completed, the pressure of Yajule in the short term will be much easier.

Ya Lian's past relying on Yaju's brand power and the steady service development, the capital market has also reported affirmation.At the beginning of the listing, after the elegant life snake swallowed into the green space property, it became a classic case of becoming bigger and stronger through the acquisition of mergers and acquisitions.

Now, with the decline in the real estate industry, the parent company's contribution to it has gradually dispersed, and the era of large -scale collection and acquisition of the property service industry has also quietly walked away.

- END -

British Finance | On the risk of US economic recession, can the United States avoid economic recession?

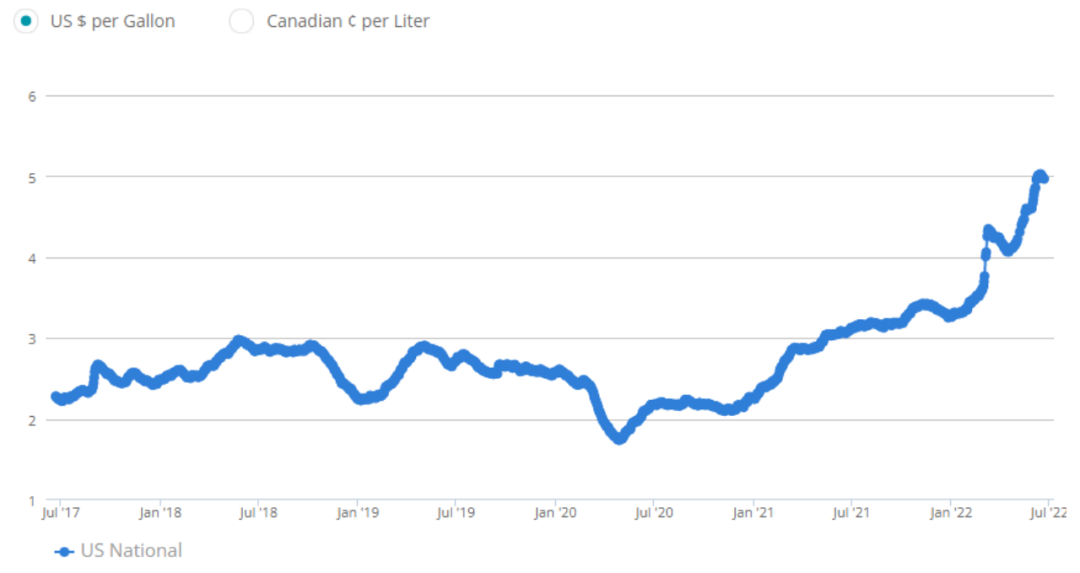

In May, the United States inflation reached 8.6%. In addition to a 40 -year high, ...

The lecture and entrepreneurial empowerment symposium of the Liwan District Entrepreneurship Competition was successfully held

In order to further promote the development of the Liwan District Entrepreneurship...