V Guan Finance Report | "Raising Pig Brother" Wen's shares in the first half of the year expanded by 41.07% year -on -year

Author:Zhongxin Jingwei Time:2022.08.18

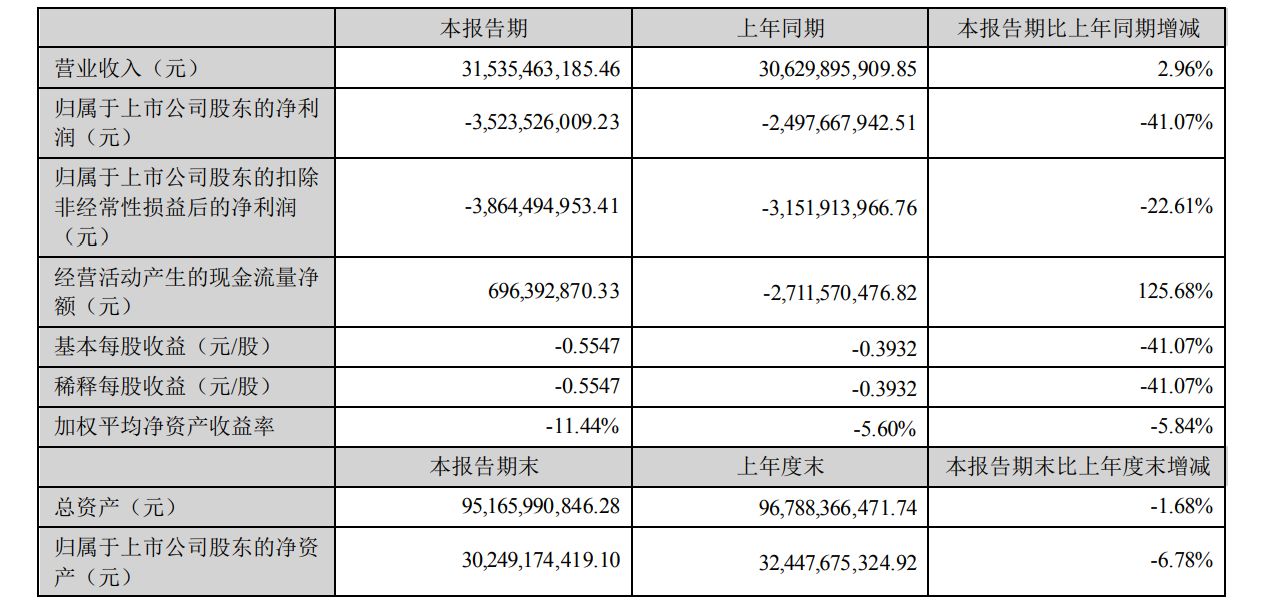

Zhongxin Jingwei, August 18th. The "Pig Raising Brother" Wen's shares released on the 18th of the 2022 Half -annual report showed that the net profit loss attributable to the owner of the parent company in the first half of the year was 3.524 billion yuan. The net loss of 2.498 billion yuan in the same period last year The year-on-year expansion of 41.07%; operating income of 31.535 billion yuan, an increase of 2.96%year-on-year; the basic earnings per share was -0.5547 yuan, and the basic earnings per share of -0.3932 yuan in the same period last year.

The main businesses of Wen's shares are the breeding and sales of meat chickens and meat pigs; they also also operate the breeding of meat ducks, dairy cows, eggs, pigeons, etc. and their products. At the same time, around the upstream and downstream of the livestock and poultry breeding industry chain, it is equipped with business operations such as livestock and poultry slaughter, food processing, modern agricultural and animal husbandry equipment manufacturing, veterinary drug production, and financial investment.

Wen's shares said that during the reporting period, Wen's shares sold 488 million pheasant (including chicken, fresh products and cooked food), 8006 million meat pigs (including hair pigs and fresh products), 24.329 million meat ducks (including hairy duck ducks (including hairy ducks ducks With fresh products), operating income was 3.1535 billion yuan, and the total profit loss was 3.431 billion yuan. The net profit loss attributable to shareholders of listed companies was 3.524 billion yuan, and the net profit attributable to shareholders of listed companies decreased by 41.07%year -on -year. The company's operating income mainly comes from the sales revenue of meat chicken products and meat pork products. The two account for 47.09%and 44.80%of operating income, respectively.

Wen's shares said that during the reporting period, the main performance driving factors were the following:

First, the production of pig industry has improved, and in June, it achieved a profit. Pig prices have risen steadily from March, but generally lower. During the reporting period, the average sales price of Mao pig in Wen's shares was 13.59 yuan/kg, a year -on -year decrease of 41.74%. However, the company's pig industry has re -constructed the disease prevention and control system in the past two years, continued to optimize the structure of pig breeding, strongly grasped production management, and continuously promoted cost reduction and efficiency. At present, the results have begun to appear. While overcoming the pressure of the price of feed raw materials, the cost of breeding of the company's meat pigs continued to decline. In June, with the rise of pig prices, the company's pig industry achieved monthly losses after a year of loss.

The second is that the poultry industry achieves overall profit. During the reporting period, the company's poultry industry achieved a high level, with a market rate of 94.9%, and the cost control industry was leading. During the reporting period, the price of the chicken was generally stable. The average sales price of the company's chicken was 13.88 yuan/kg, an increase of 0.43%year -on -year. Although the price of feed raw materials has continuously increased the cost of breeding, the company's chickens and duck poultry industry still achieve overall profit.

Third, during the reporting period, in accordance with the relevant provisions and requirements of corporate accounting standards, amortization of equity incentives is 374 million yuan.

Fourth, during the reporting period, it was the capital reserves that cope with the continuous increase in the industry's downturn period, and the interest expenditure was 867 million yuan.

In terms of assets and liabilities, at the end of the report period, the overall financial situation of Wen's shares was good, with an asset -liability ratio of 65.7%. The company began to implement the new leasing standards and issued convertible corporate bonds in 2021, increasing the debt of the report period by 14.830 billion yuan, and the asset -liability ratio was increased by about 4%.

In the secondary market, as of the close of August 18, Wen's shares closed at 22.61 yuan, down 2.12%, with a total market value of 148 billion yuan. (Zhongxin Jingwei APP)

Pay attention to the official WeChat public account of JWVIEW (JWVIEW) to get more elite financial information.

- END -

The pig farmers realized 1.6 million in two months! The pig price rebounded and hidden in the four major changes.

Wind Financial Reporter Wang HaoRecently, in addition to the temperature, there ar...

Sanhehu Town, Binzhou, Shandong: One Village and One Pin, a special industry strong village rich peo

Recently, the fruits and vegetables in the eight major agricultural industrial are...