Daily Gold | What impact of the Minutes of the Fed Conference on gold prices?

Author:China Gold News Time:2022.08.18

Today's guest:

Gold Investment Analyst Wu Di

In terms of fundamental terms, at 2 am this morning, the Fed disclosed on time to disclose the Minutes of the Integration Meeting of the Open Market Committee in July, and shared the considerations behind the 75 basis points of the policy maker. After the interest rate hike in July, the federal fund interest rate range also reached 2.25%to 2.5%, close to the "neutral interest rate" in traditional cognition. Therefore, the subsequent interest rate hike path is also the information that the capital market is waiting.

At this policy meeting, the Federal Reserve decision makers reiterated to continue to raise interest rates and believe that to curb high inflation, they must turn monetary policy to a limited level that slows economic slowdown, and maintain this level until inflation is significantly accelerated. The minutes of the meeting mentioned that, in view of the constant changes in the economic environment and the lagging of the economy of monetary policy, the risk of over -tightening the monetary policy of the Federal Reserve is also the first time that the Fed has mentioned "excessive tightening" this year.

In the minutes of this meeting, the Fed also continued to emphasize the rate of interest rate hikes based on data. Before the next interest rate meeting in mid -September, the market could at least see CPI and employment data in August. In addition, at the Federal Reserve Jackson Hall Annual Conference next week, investors can hear the guidance of fresh policy makers.

In addition, US retail sales, known as "horror data", remain unchanged from the previous month, which is significantly less than expected and previous. Specific data shows that the retail sales in the United States in July were the same as that in June and a new low in the past two months. Not only is it lower than the previous market expected increase of 0.1%, but it has also decreased significantly compared with the increase in June by 1%. From a year -on -year, retail sales rose by 10.3%in July.

From a technical point of view, the bulls are still more than 1,800 US dollars per ounce. After the price of gold in the early week of the week, the gold price fell below $ 1793/ounce this week, and the short power increased. With the cooperation of the news yesterday, the price of gold fell below the first support of $ 1777/ounce in the week, and a slight rebound was slightly rebounded after the minimum of $ 1760/ounce.

From a structural point of view, the price of gold has entered the short model again, and the center of gravity moves down. The upper resistance pays attention to $ 1777/ounce. The short position can be lined up near this location. Location, gold price or testing 1740 US dollars/ounce. Making high in high -level is currently the main transaction strategy. The above suggestions are personal views and are for reference only.

(The above content does not constitute an investment suggestion or operating guide, entered the market according to this, and the risk is on its own)

- END -

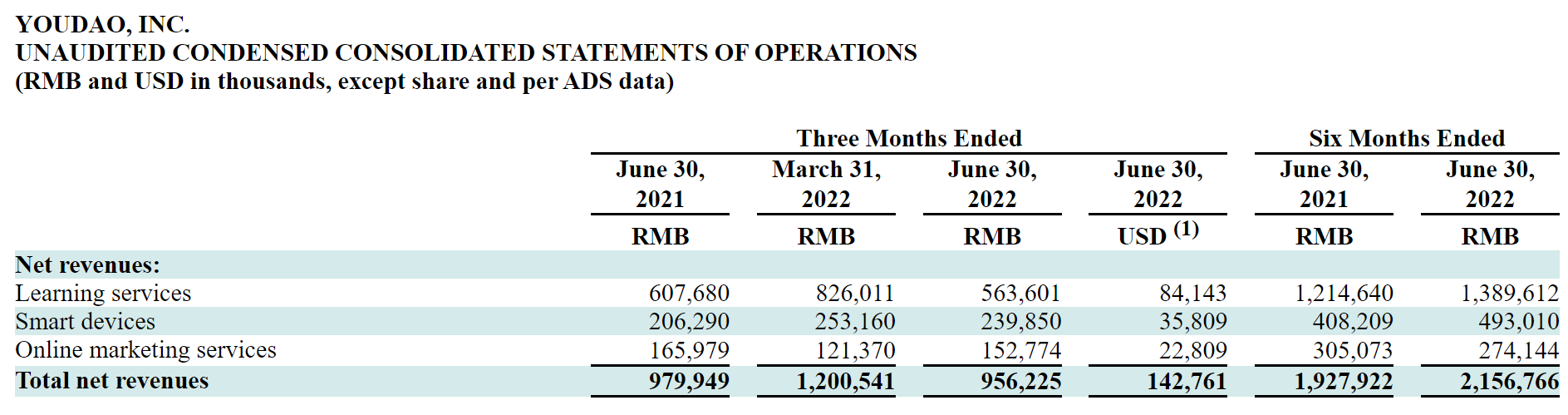

NetEase Youdao's net revenue in the second quarter of 2022 decreased by 2.4%year -on -year to 956 million yuan

On August 18, 2022, Dao.us, a US listed company, announced the second quarter of 2...

The application area of Shanxi Solar Light and thermal Building is more than 49 million square meters

Shanxi Economic Daily reporter Wang LongfeiThe reporter learned from the Provincia...