The financial industry accurately helps the province's economic stability and recovery

Author:Jiangnan Times Time:2022.08.18

In the first half of 2022, Jiangsu's banking insurance industry conscientiously implemented the major requirements of "the epidemic should be defended, the economy must be stabilized, and the development should be safe". The financial needs of key groups, comprehensively improve the level of service levels of key links, and accurately help the province's economic stability and recovery. At the end of June, the balance of various loans in the province's banking industry was 1.98 trillion yuan, an increase of 1.79 trillion yuan from the beginning of the year, an increase of 9.92%; the province's insurance industry provided various types of risk protection of 35.258 trillion yuan, an increase of 81.74 trillion over the same period last year last year. Yuan, an increase of 30.18%.

Steady growth cycle--

Fully guarantee financial supply in key areas

The Jiangsu Banking Regulatory Bureau focuses on a solid policy of the State Council's solid stability of the economy, and has issued financial support for freight logistics and keeping the security and further strengthening financial support to help epidemic prevention and control to promote the sustainable and healthy development of the economy and society. Notice and other documents to propose a package of financial measures that help companies to relieve difficulties. The provincial banking industry and the insurance industry association jointly issued the "Keep Mission to Mission to Funeral, and to fully implement the financial relief and help and stabilize action", and make every effort to promote the implementation of the State Council's stability of the economy. All banking institutions actively implement differentiated extension of the principal and interest payment policy to ensure that they should delay and continue. In the first half of the year, a total of 475,000 enterprises should handle the projection of 701.3 billion yuan in principal and interest of the loan. Relevant insurance institutions cooperate with local governments to formulate the insurance plan for the business interruption of the catering service industry, and launch products such as "Re -Employment and Reinforcement Ephampoen Prevention Insurance", "Store Worry -free Insurance" and "Logistics Epidemic Prevention Insurance".

At the same time, the Jiangsu Banking Insurance Regulatory Bureau focused on the annual investment plan of major provincial and municipal projects, improved the financing reporting system of financing situation, promptly pushed major project information to the banking institutions, organized on -site visits to 58 major projects, urging banking institutions to do high -efficiency docking, accurate accurate docking, accurate accuracy Serve.

Stabilize enterprises to benefit people's livelihood-

Effectively meet the financial needs of key groups

In the first half of the year, the Jiangsu Banking Insurance Regulatory Bureau issued a notice of further strengthening the development of small and micro enterprises in financial support, and put forward the requirements for optimizing resource allocation, deepening bank -enterprise docking, and improvement of long -term mechanisms. Monthly monitor and report on a quarterly basis for the promotion of inclusive small and micro enterprise loans. Give full play to the role of "command sticks" such as small and micro supervision evaluations and advanced selection of inclusiveness to promote reform in order to promote improvement.

Continue to consolidate the results of the special operation of the first loan expansion of small and micro enterprises. In the first half of the year, the total loan of 103.6 billion yuan was issued to a total of 32,500 small and micro -enterprises. At the end of June, the balance of inclusive small and micro enterprise loans (excluding bills) of the province was 2.38 trillion yuan, an increase of 18.21%over the beginning of the year, which was 8.85 percentage points higher than the growth rate of various loans.

The Suzhou Banking Insurance Regulatory Bureau established the first private enterprise financial assistance expert library in the province to introduce many experts from universities, courts, financial institutions and other units to provide think tank services; Yancheng, Nantong, Zhenjiang and other local Banking Regulatory Supervision Bureau continued to carry out consultation assistance assistance , And to look back at some of the help companies, continue to stabilize the financing environment of private enterprises. Construction Bank Jiangsu Branch clearly proposed that the goal of adding no less than 40 billion yuan in private enterprise loans in 2022. At the end of June, the balance of loans of private enterprises in the province was 5.49 trillion yuan, an increase of 12.81%over the beginning of the year.

The Jiangsu Banking Insurance Regulatory Bureau continues to promote the optimization services of bank insurance institutions and consolidate the effectiveness of the pilot demonstration of rural revitalization. As of the end of June, a total of 1,146 financial consultants were equipped with 1,144 pilot towns. Guide bank insurance institutions to do a good job of ensuring food safety and important agricultural supplies, and deploy the province's grain -producing counties to open three major main grain crops in the province.

Promoting upgrade and increasing energy--

Comprehensively improve the level of service levels of key links

The Jiangsu Banking Regulatory Bureau and the Provincial Development and Reform Commission and other departments have issued policies such as the notice of the stable growth of the industrial economy, and continued to monitor and notify bank institutions to support the high -quality development of the manufacturing industry according to quarterly monitoring. All bank insurance institutions focus on key areas and key areas and key links such as advanced manufacturing clusters and strategic emerging industries to optimize resource allocation and increase support.

In terms of supporting industrial upgrading, the banks within their jurisdictions actively connect with the province's manufacturing intelligent transformation and digital transformation three -year action plan, and launch special products such as "intelligent transformation and loan". At the end of June, the balance of technology transformation and upgrading projects in major banking institutions in the jurisdiction was 245.3 billion yuan, an increase of 15.35%over the beginning of the year. In terms of supporting advanced manufacturing clusters, institutions within their jurisdiction have launched a series of products such as "special loans of stuck neck", "high -enterprise loan" and "investment and financing loan" to expand intellectual property pledge financing subjects from patents, trademarks, etc. Circuit cloth design, etc.

The reporter noticed that the Jiangsu Banking Insurance Regulatory Bureau issued the "Jiangsu Banking Insurance Industry Deepening Science and Technology and Financial Services Action Plan", which proposed 16 measures from five aspects such as the main goals, optimizing financing supply, and innovative insurance services. United Jiangsu Province Science and Technology Department carried out special actions for financing docking of technology -based SMEs, promoting bank institutions to visit 72,300 small and medium -sized enterprises in the province, and specially developed the docking platforms to produce QR codes. At present, a total of more than 20,000 customer managers in the province's banking industry have participated in special actions of financing docking and have visited more than 70,000 small and medium -sized enterprises in science and technology.

Each bank insurance institution conscientiously implements the guidance of the Banking and Insurance Regulatory Commission on the support of high -level technology to support high -level technology, and formulate a detailed work plan or implementation plan in accordance with the actual situation. At the end of June, the balance of high -tech enterprises in major banking institutions in the jurisdiction was 954.1 billion yuan; the balance of loans of technology -based SMEs was 412.6 billion yuan. In addition, the Jiangsu Banking Insurance Bureau promoted insurance institutions within their jurisdiction to actively carry out activities such as "disaster prevention and mitigation", "safety production month" and "food safety publicity week", and give full play to the in -depth participation of social governance in the advantages of insurance. Continue to increase the promotion and guidance of the "Huimin Bao" business, the number of underwriters in the province's "Huimin Bao" project exceeded 10 million. 11 insurance companies in the province participated in the 2022 major illness insurance project in our province. The province's agreement underwent 68.4 million people. By participating in major illness insurance, the proportion of reimbursement of actual medical expenses in the insurance masses increased by 13.36 percentage points. Actively promote the pilot work of exclusive commercial pension insurance, encourage insurance institutions to actively participate in the construction of the elderly community, and guide insurance funds to be used in the pension industry. At the end of June, the province's exclusive commercial pension insurance insured was 13,400.

Jiangnan Times reporter Sun Haiyan

- END -

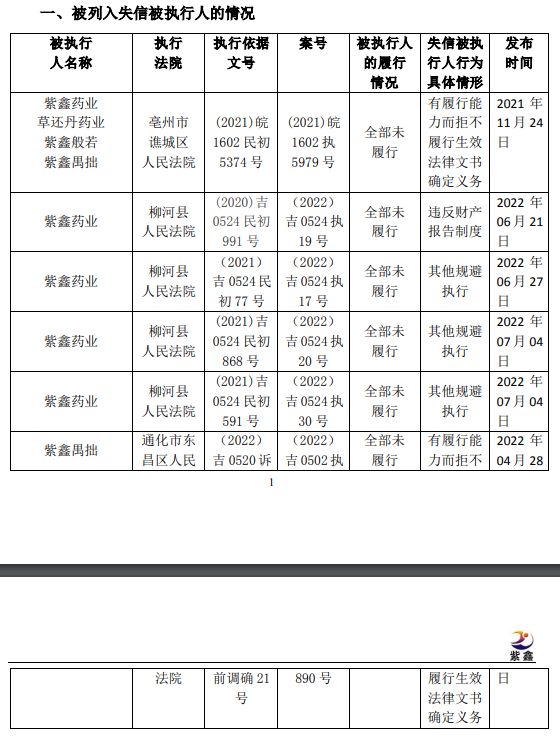

V Guan Finance Report | Zixin Pharmaceutical and many subsidiaries have become "Lao Lai", which lost nearly 1 billion last year

Zhongxin Jingwei, July 18th. Zixin Pharmaceutical issued an announcement on the 18...

Every hot review 丨 Analyst's remarks are frequent and troubled by the industry's profit model

Recently, the seller's research field was quite calm. First, Fu Mingfei, the Western Securities and Communication Industry, caused controversy on Nanjing Bank. Nanjing Bank called the police. Later, Z...