Continue to fall!Will international oil prices return to the 100 yuan mark?

Author:Jilin Daily Time:2022.08.18

Recently, international oil prices have continued to decline.

Since the beginning of this year, international oil prices have been adjusted repeatedly, twists and turns. Since the rapid increase of international oil prices at the beginning of the year to $ 100 per barrel, oil prices have continued to fluctuate, and once broke through the $ 120 mark per barrel.

However, in recent times, due to the decline of the global economy, the crude oil market has performed sluggish, and international oil prices have returned to the $ 90 gate per barrel.

International oil prices have continued to fall. Is the general trend? Will you return to the 100 yuan mark?

The supply is tight and relieved, the oil price declines

As of the closing on the 15th, the price of light crude oil futures delivered in September of the New York Commodity Exchange fell 2.68 US dollars to close at $ 89.41 per barrel; $ 95.10.

On the news, the petroleum giant Saudi Arabia said on Sunday that if necessary, Saudi Arabia can produce oil with the maximum capacity and continuous investment in the oil industry. Saudi Arabia can increase its output to 12 million barrels per day at any time.

In addition, in the early morning of Beijing time, Iran said that it had issued a formal response on the textbook text proposed by the European Union. Expert analysis pointed out that once the nuclear agreement is restored, Iranian oil export sanctions are lifted, and the global market supply due to sanctions by Russia will also be relieved.

Based on Saudi Arabia's preparations for production increase, the progress of the Iran nuclear agreement, and the recent factors such as the restoration of the production of the Bay Maritime drilling platform in Mexico and the Cuban oil storage base, the concerns of the current interruption of oil supply have eased. It is expected that the future crude oil market will be The supply is too demand, resulting in the lower oil price on Monday.

Global economic singing decline, oil prices are under pressure

However, analyzing the in -depth reasons for the recent continued decline in international oil prices, the industry generally believes that this is mainly affected by the market's concerns about economic prospects.

Data show that the consumer price index (CPI) in the United States in July increased by 8.5%year -on -year, lower than the expected value of 0.2 percentage points, away from the 9.1%high of the previous month.

The analysis believes that the slowdown in US inflation has slowed down. In addition to the sharp interest rate hike measures of the Fed, it is significantly related to the downlink of energy prices under the global economic recession. Nevertheless, American inflation is still running high, and considering that the core CPI has not declined significantly, it does not rule out the possibility of the US CPI rising later.

Affected by the recession, OPEC and other institutions have lowered the prediction of crude oil demand this year. The OPEC Monthly reported that the global crude oil demand growth forecast in 2022 was 3.1 million barrels per day, and the previous 3.36 million barrels per day were further cool down for oil prices.

SETH Carpenter, chief global economist at Morgan Stanley (MS), wrote a few days ago that the global economic recession is gathered. In the second quarter, the US economy fell into a "technical recession"; the euro zone's economic recession had intensified.

In the context of the general decline of the global economy, international oil prices are facing large upward resistance. At present, the global multinational monetary policy is accelerating, the central bank generally raises interest rates, and the global economic recession is expected to increase. Investors are worried that the tension of the energy market has exacerbated the energy market, resulting in the continuous shock of oil prices.

Can you return to the 100 yuan mark?

Although the current oil prices have fallen, overall, it is still strong. Expert analysis pointed out that in the near future, "OPEC+" has limited oil production. G7 countries are still considering embracing Russian oil globally, and the decline in drilling data in the international crude oil market.

Looking forward to the market outlook, can international oil prices return to the 100 yuan mark?

Data show that the number of non -agricultural employment in the United States increased strongly in July, and the unemployment rate was lower than expected; China's crude oil imports rose in July.

"The improvement of some economic data relieves investors' concerns about economic recession to a certain extent. In addition, energy supply still exists, and Russia has supported the price of oil prices through Ukraine crude oil pipes." Lianchuang crude oil analyst Han Zhengji said.

However, he also reminded that international oil prices are still at a low valley for nearly six months, and investors' concerns about poor demand prospects have not yet completely faded. The debt problems of the economic downturn in the United States and European economy and emerging market economies have increased, and the prospects of energy demand are still covered.

Haitong Futures point out that in general, the current position of oil prices lacks the motivation for continuous ride. In terms of macro, although some data showed economic toughness and inflation pressure to alleviate interest rate hike expectations in the short term, it helps to improve market risk preferences, but the subsequent may be swayed at any time due to subsequent update factors, and the downward pressure and flow of economic economic downward economic periods may Sexual tightening will cause continuous pressure on the prices of commodities.

Nevertheless, Goldman Sachs is still optimistic about future oil prices, saying that the reason for the current rise in oil prices is still sufficient, and market shortage is more serious than expected in recent months. Goldman Sachs is expected to rebound to the long -term market level. The prediction of the third and fourth quarters is now $ 110 to 125 per barrel.

Source: China News Network

- END -

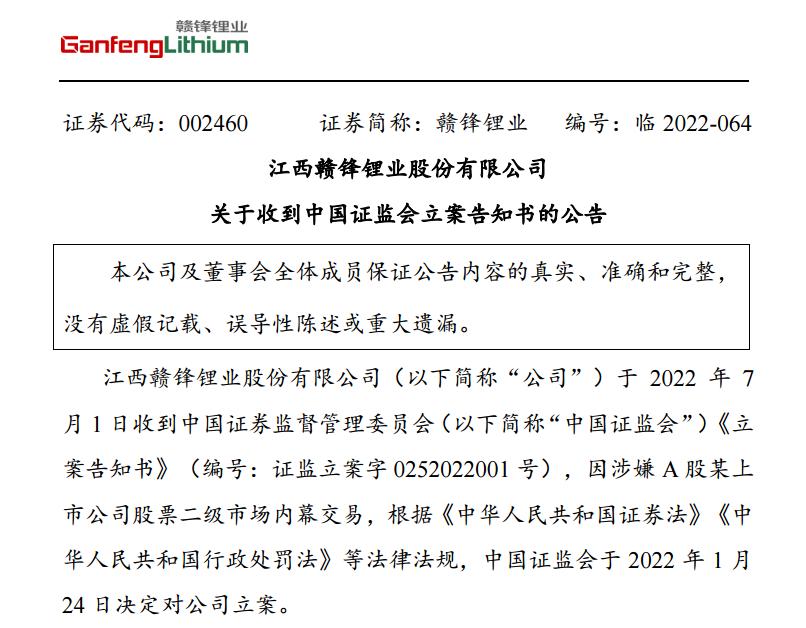

Thunder on the weekend!The two hundred billion giants were set up, suspected of the inside story of the company's company's stock!Exclusive response of the chairman →

On July 3rd, Ganfeng Lithium (SZ002460, a stock price of 15.697 yuan, and a market...

Gansu and Zhengxian Power Supply Company: Serve the practical service to help local vegetable planting

Uncle Liu, the equipment for vegetable water spray pumps and the distribution box ...