Reading Group's net profit in the first half of the year decreased by 80 % year -on -year, and the stock price in the past year has fallen by more than 60 %

Author:Radar finance Time:2022.08.17

Radar Finance Hongtu Products | Editor Wu Yanrui | Deep Sea

On August 15, the Reading Group issued a mid -term performance announcement. In the first half of 2022, the operating income and gross profit of the Reading Group decreased by about 6 percentage points compared with the same period last year, and net profit dropped by 80 %.

Radar Finance combed and found that the net profit of the Reading Group declined sharply, mainly due to the 2021 Yuewen Group's sale of other revenue of 1.077 billion yuan, and in the first half of this year, there was no large amount of non -recurring profit and loss.

In the first half of this year, the company promoted free policies on its own platform products and self -operated channels to improve user activity. The average monthly paid users during the reporting period decreased year -on -year.

On the next day, the stock price of the Reading Group fell, and the market fell over 10%, and the closing of the market still fell 7.06%.

According to the same flowers of the same flower, the company's stock price has fallen by 54.52% in the past year, and the market value has evaporated about 36 billion Hong Kong dollars.

The assets of the company without selling the company, the net interest rate returns to normal

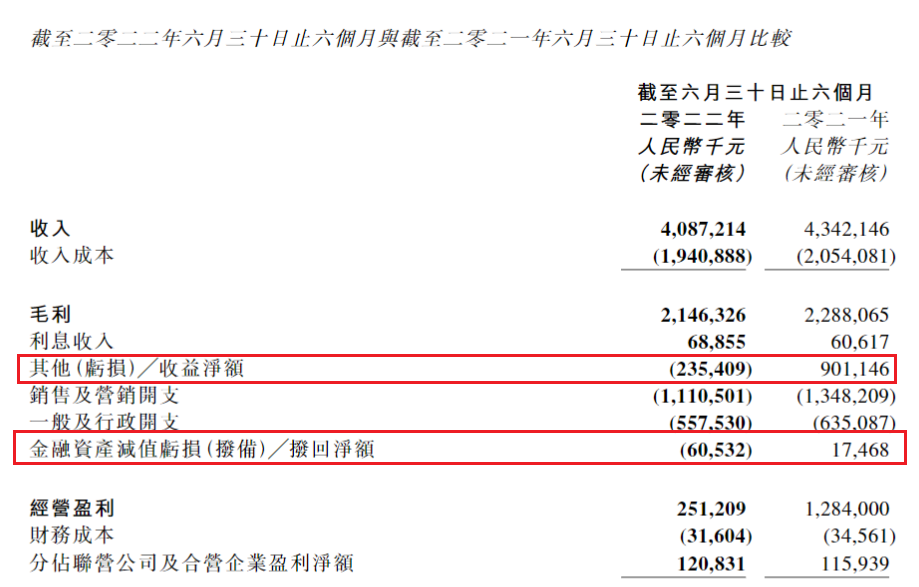

In the first half of 2022, the Reading Group recorded revenue of 4.087 billion yuan, a year -on -year decrease of 5.87%; gross profit was 2.146 billion yuan, a decrease of 6.19%year -on -year; operating profit was 251 million yuan, a year -on -year decrease of 80.4%.

Why the company's operating performance and gross profit have fallen by about 6 percentage points, but net profit has fallen by 80 %. The preparation for other income and financial asset impairment is the main reason why the net profit of this reading group decreases by 80 %.

The semi -annual report mentioned that the difference in net income was mainly due to the year -on -year differences due to the revenue generated by the company held by the company held by the company held by the company in the first half of 2021. At the same time, other losses mainly include the fair value of the company's investment company's decreased valuation of RMB 373 million.

In January 2021, the Reading Group issued an announcement on selling 39.8821%equity related to Shenzhen Lazy Sales. The Reading Group indirectly wholly wholly -owned subsidiary Tianjin Reading to sell 39.8821%of Shenzhen's lazy people at TME Affiliated Corporation, with a transaction amount of 1.077 billion yuan.

Among them, the TME subsidiary is an indirect subsidiary of Tencent, the controlling shareholder of the Reading Group, and the sale constitutes a related transaction.

Judging from the value -related values that affect net profit, gross profit, interest income, sales and marketing expenses, general and administrative expenses are not much different from the same period last year. The company's other net income was 901 million yuan in the first half of 2021 to a loss of 235 million yuan in the first half of 2022, a decrease of 1.137 billion yuan. The recovery of the impairment of financial assets also changed from 17.468 million yuan to -60.532 million yuan, a decrease of 78 million yuan.

Regarding the financial asset impairment preparation account in the first half of 2022, the financial report stated that the net amount of bad accounts receivable was 60.5 million yuan, which was mainly related to film and television projects.

Free mode daily life increases, and paid users decrease

According to the data, in 2002, the starting point of the Chinese website was established and in October of the following year, the VIP paid reading system was launched. In September 2006, the average daily view of the Chinese website of the starting point exceeded 100 million, becoming the first website in the industry to view over 100 million yuan. In December 2010, the QQ reading client went online and entered the era of mobile reading. In November 2017, the Reading Group was officially listed on the Hong Kong Joint Exchange.

The Reading Group divides the income into online business and copyright operations and others. Among them, online business revenue mainly reflects the income obtained from the income obtained from the income of online payment, online advertising, and distributing third -party online games on the company's platform. Copyright operations and other income mainly reflect the income from production and distribution of TV series, online dramas, animations, movies, issuing copyrights to operate self -operated online games and selling paper books.

In the first half of 2022, the online business revenue of the Reading Group accounted for 56.4%of the company's total revenue, and the copyright operation and other proportion accounted for 43.6%. During the same period, the gross profit margin of online business revenue reached 41.4%, and the copyright operation and other gross margin were 60.2%.

In the online business income, the decrease in online business income of its own platform products is mainly due to the company's measures to optimize costs and improve operating efficiency on the online business in the first half of 2022, thereby reducing users to obtain related marketing expenses; Tencent's products are self -operated. Channel online business income is mainly due to the impact of the advertising realization efficiency of free reading content due to the impact of the macro environment; the third -party platform online business revenue decreased by 35.8%year -on -year. Essence

The income of online business has achieved a certain degree of decline. On the supply side, about 300,000 writers and 600,000 novels were added to the online literature platform of Reading Group, with a number of new words 16 billion. While the user, the free reading business brings users, the average monthly paying users are decreasing.

In the first half of 2022, the average monthly active user of its own platform products and self -operated channels increased by 13.8%year -on -year, and the average monthly paid users decreased by 12.9%year -on -year. According to the financial report, the average daily active user of the company's free reading business increased from 13 million people in June 2021 to 14 million in June 2022.

In the first half of 2022, the company's copyright operation business decreased by 1.2%year -on -year, and the income was roughly stable.The company's TV series, online dramas, movies, copyright authorization and animation revenue has grown steadily.At the same time, the above -mentioned income growth was offset by the reduction of the income of self -operated online games.Other income is mainly from paper book sales, a year -on -year decrease of 21.2%.

In addition, the financial report mentioned that for the six months ended June 30, 2022, the company's income generated by several TV series and films was about RMB 9.231 million.Xinli Media, which was acquired by the company in 2018, was mainly engaged in TV series, online dramas and film production and distribution in China.During the reporting period, the income was RMB 966.7 million and the company's equity holders accounted for a profit of RMB 208.5 million.

- END -

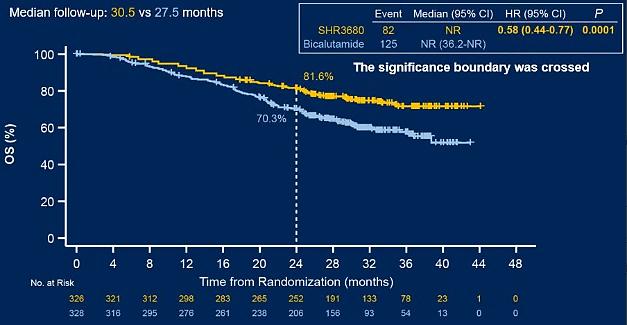

Hengrui Pharmaceutical's new AR inhibitor is approved by patients with prostate cancer to usher in a new choice

Zhongxin Jingwei, July 2nd. On June 29th, Hengrui Pharmaceutical Announcement anno...

Guangxi Nanning 20 billion parent funds, here

This time, it was Nanning's turn.The investment industry-decoding LP learned that Nanning announced that it will set up a high-quality development fund with a total scale of 20 billion yuan. After amp...