In the first half of the year, Qingdao's medium -range loss of about 7.95 million yuan for investors claims have been filed by the court

Author:Public Securities News Time:2022.08.17

Qingdao Middle Division (300208) recently released the 2022 semi-annual report. During the reporting period, the company realized operating income of 307.5995 million yuan, a decrease of 64.08%over the same period last year; Increase losses.

Qingdao's middle range said that the main reason for losses is: First, affected by the epidemic and market conditions, the trade business has not been carried out during the reporting period [Is this quoting the original text? If not, it is recommended to change to "First, affected by the epidemic and market conditions, the trade business has not been carried out during this reporting period;] The second is that the Indonesian nickel power project enters the end of the post -ending stage, which has led to a significant decrease in the revenue of this reporting period; the third is the book. The reporting of overseas employee subsidies and the license license to handle the management expenses has increased significantly; fourth is that the impact of impairment preparations in this period has a greater impact on profits.

In addition to the loss of performance, Qingdao's medium range also faces investors' claims. Lawyers Wu Lijun, a lawsuit of Shanghai Dongfang Cambridge Law Firm because of extended disclosure to the revocation of the mining license of Indonesia's subsidiaries, stated that investors can apply for civil compensation to the company on the matter.

On August 3, Qingdao issued the "Announcement on Cumulative Demonstration of Major Litigation" stating that because the company's Indonesian subsidiary IPC Coal Mine and Madani Nickel Mine Mining Rights Certificate were revoked, the company filed a lawsuit with the Jakarta Administrative Court of Indonesia. Yuan (calculated by the book value of the intangible assets of each company), accounting for 12.92%of the company's audited net assets in the previous year. It should be noted that the acceptance time of the two cases is May 31, 2022 and July 13, 2022.

According to the announcement of the progress disclosed by Qingdao Middle Division on August 11, the above cases are still under trial, and the final judgment results have certain uncertainty. The company prompts that Indonesia is a developing country, and government policies are variant, and some industries have restrictions on foreign investment. Follow -up, whether the Indonesian government will further introduce restrictive policies for foreign -owned stocks or sales -related products, and there is a certain uncertainty. The company may still face the adverse effects of the changes in Indonesia's national policy.

Lawyer Wu Lijun reminded that any damaged investors who still hold the stock when they close from July 13, 2022 to August 3, 2022, and they still hold the stock when they close on August 3, 2022. The "Public Securities News" (feature code: 18018) is registered and participated in claims. A few days ago, the case of Qingdao medium -range investors represented by Lawyer Wu Lijun had been accepted by the Qingdao Intermediate Court.

- END -

Don't despise the power of rebound!CICC said that the economic recovery depends on the next 6-12 months

Zhongxin Jingwei, June 16 (Ma Jing) The Federal Reserve has landed on the largest interest rate hike since 1994. As of the closing on the 16th, the three major indexes of China's A -share were divided...

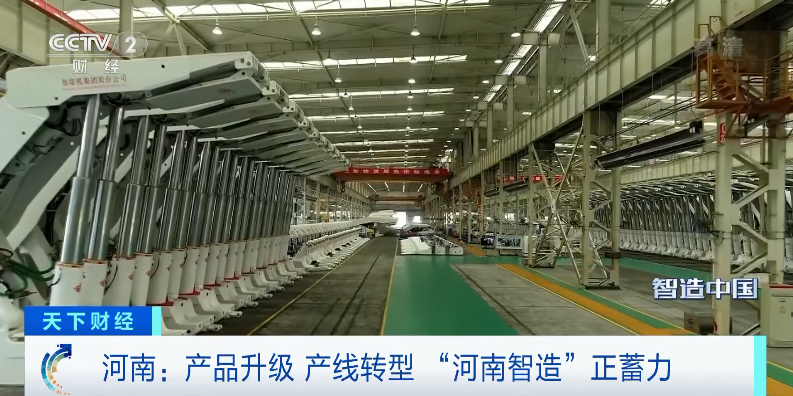

Deputy Governor of Henan Province: It will create 7 trillion -level advanced manufacturing clusters

From the Five -Year Plan to Fourteen Five -Year Plan, a group of national key indu...