Daily discussing gold | International gold prices rose continuously, retreating is still an opportunity

Author:China Gold News Time:2022.08.17

Today's guest: Chengdu Fengye Co., Ltd. Lu Jun

With the release of the US Consumer Price Index (CPI) data in July, the market's expectations of the Fed's 75 -basis point in September have significantly cooled down, which is basically in line with what the author emphasized before. After the Federal Reserve raised interest rates in June and July, the Fed's future interest rate hikes and the rate of interest rate hikes will gradually decrease and slow down. However, recently, the yield of the US dollar and US debt has a certain rebound correction, which has formed a certain suppression of international gold prices.

Previously, the author also reminded the article that the first pressure of the international gold price was $ 1810/ounce. Judging from the recent trend of international gold prices, the international gold price successfully exceeded the $ 1,800/ounce mark last week, but finally retracted after touching the $ 1807/ounce, which shows that the pressure near $ 1810/ounce is indeed strong.

This week's two trading days this week's international gold prices showed oscillating retracement and correction. Monday was large, and on Tuesday, it was a weak arrangement, and it did not expand its decline. This shows that the short -term international gold price has not changed the previous oscillation upward pattern, but it is just a normal retracement correction after facing the pressure area. From a structural point of view, international gold prices are currently in the oscillation upward pattern. The current 20 -day moving average is an important support area and $ 1765/ounce.

With the arrival of mid -August, the market will pay attention to the annual Jackson Hall Central Bank Annual Meeting. Each year's global central bank annual meeting, the main central bank will release obvious policy signals. Therefore, before the market pays attention to the Fed's interest rate resolution in September, can the Federal Reserve President Powell's speech more clearly release the next Fed's monetary policy direction? The author believes that with the emergence of the top signal of inflation in the United States, the Fed will release more gentle signals in the next speech in considering the economy and the mid -term elections of the United States. Chance.

In the past two trading days, the trend of oscillating retracement has been shown in the past two trading days, but the strength is indeed limited, which shows that the short -term gold price has a correctional needs after encountering the pressure level. After the short -term revision of two trading days, international gold prices should gradually stabilize. Especially near the support area of the 20 -day moving average, the motivation of the gold price is obviously insufficient. Therefore, the author is expected to oscillate the trend in daily.

(The above content does not constitute an investment suggestion or operating guide, entered the market according to this, and the risk is on its own)

- END -

The game sector comprehensively outbreak game ETF (516010) rose more than 3% in the market

Today, the game sector performed strongly, opened early, online games broke out, and multiple stocks daily limit. The ETF (516010) of the relevant industry ETF (516010) once increased by more than 3%,

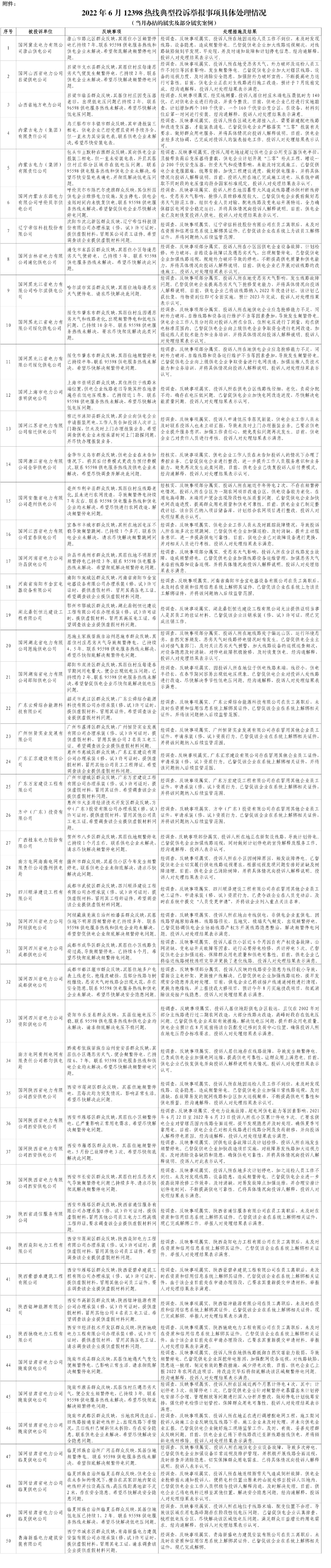

National Energy Administration: 1351 complaints in the power industry in June, mainly involving fault power outage, etc.

Zhongxin Jingwei, July 27th. The WeChat Agency of the National Energy Administrati...