Back 55%of net profit margins: Hundreds of complaints of "training loan" of Haier Consumer Finance

Author:Discovery net Time:2022.08.17

Discovering the reporter: Luo Xuefeng Financial Researcher: Wei Yi

"It's annoying, I'm annoying when I think of Haier."

Recent

So, how did these college students become the target of Harr consumer finance?

(Picture source: reporter survey)

All of this must start with "original painting part -time".

Part -time loan, college students' living expenses are squeezed against

"Learn painting for an hour a day, and you can easily enter 10,000 a month at home."

In terms of Douyin, station B, and secondary vocational schools, such publicity advertisements have frequently appeared. Several college students said: Originally, they just wanted to use their spare time to learn the original paintings to make some living expenses, but they did not expect to be squeezed out of living expenses in the end.

Lu Yu is a sophomore student. The university is a major in animation. One day when Douyin brushed Douyin, a part -time advertisement of the original painting aroused her interest.

(Picture source: reporter survey)

"I think that Douyin should be reviewed, not a liar, but also the original painting that is relatively counterproductive with my professionalism, so I left the couplet

Method. "Lu Yu said that within two days, a training institution named Shengye Education contacted her.

(Picture source: reporter survey)

Lu Yu learned that the tuition tuition of the original painting course of the training institution was 10680 yuan. He needed to pay 200 yuan for registration reservation, and other tuition fees can be paid in 12 phases.

In the face of such a high tuition, Lu Yu was a little worried, but the staff of the training institutions explained that "you can apply at the age of 20. This is a student loan. There is no interest."

Before Lu Yu thought carefully, the staff sent her a QR code and started to teach her to fill in the information of the application loan.

Under the director's speech guidance, Lu Yu was packaged into a "unemployed youth" and successfully applied for a loan from Haier's consumer finance. After that, according to the agreement, the loan directly entered the account of the training institution.

(Picture source: reporter survey)

Lu Yu originally thought that after the tuition problem was resolved, she could study with peace of mind, but she did not expect her nightmare to have just begun.

Just a few days after class, Lu Yu discovered a problem. The live lesson promised by Sound Education was actually recording and broadcasting. "The teacher is very irresponsible, and the quality of the course is also very poor. The recording and broadcasting courses are still recorded in the previous two years." Lu Yu said angrily.

After aware of the problem, Lu Yu first sought the educational education to coordinate his retirement and terminate the installment. After many discounts, the sound education agreed to repay her 70%of the loan amount, and the two parties signed a refund agreement. But later, Sound Education did not comply with the promise, and only helped Lu Yu pay the loan for one issue and did not pay anymore.

Due to the overdue loan, Lu Yu now receives a call from Haier consumer finance every day. For the sophomore Lu Yu, the amount of loan of tens of thousands of yuan is like a mountain, which is overwhelmed by her. In the face of the vocal education, she can only embark on the road of rights protection.

Xiaolin, a freshman student, has experienced the same experience as Lu Yu. A few months ago, the staff of Sound Education contacted him through WeChat and told him that as long as he learned the simple drawing, he could pick up orders to make money.

"In a month, earning more than 10,000, the overall tuition fee is made, and this is equivalent to a permanent skill." Speaking, the staff sent a screenshot of some teachers 'works and screenshots of other students' orders. Kobayashi, who originally wanted to reduce the burden of parents through part -time job, was finally persuaded.

Same as Lu Yu's experience, Kobayashi was packaged into a "unemployed" staff member and successfully applied for a loan from Haier consumer finance to 7,680 yuan.

However, after studying for a while, Kobayashi did not receive the so -called outsourcing order. The reason given by the staff of the educational education was "not painting", and later he even blackened him.

In desperation, Kobayashi can only complain through 12345 and other channels. Sound Education agrees to deduct 30%of the fee and refund the tuition fee. "The reasons are obscured.

Like Lu Yu, Xiaolin now receives a call from Haier's consumer finance every day. He said helplessly, "The attitude of collection is very bad, the parents give the living expenses enough to repay the loan, and the current pressure of life is getting greater. How to do."

The routine "training loan" is rampant, Haier consumer finance is accurately "stepped on the mine"

Public information shows that Sound Education is affiliated with Chengdu Shengxian Education Technology Co., Ltd., and its business scope is clear, and it is not possible to operate education and training activities involving license approval.

The shareholders' information of Sound Education shows that its major shareholders are Chengdu Light Education Technology Co., Ltd. The reporter understands that its major shareholders are also frequently complained for the problem of "training" because of the routine, and they are also one of the training institutions of Haier's consumer financial cooperation.

According to incomplete statistics from reporters, on the black cat complaint website, only one month in July, more than 320 complaints about Haier's consumer financial routine "training loan".

(Source: Black Cat Complaint Platform)

Through the content of statistical complaints, there are more than ten training institutions involved. In addition to the above two training institutions, there are also culverts education, Longcheng Education, Baiyue Course, etc. Video editing, original painting and other fields.

More than a dozen training institutions of Haier Consumer Finance cooperation are frequently complained due to the "training loan" of the routine. filter. According to a teacher who worked at the Light School of Light Reserve, "(Company) More than 99%of people in the (company) are sales and class teachers. The salary for teachers is particularly low. The boss and sales are divided. "

The teacher also said, "They also used recording as a live broadcast, not only cheating students, but also squeezing the teacher, they wanted to be empty gloves."

Because he was unable to take the business model of the college, he chose to leave and advised the students he had taught, "I want to learn to paint, to find a good teacher, not an institution, and to study the original painting."

Another teacher who has worked at the original painting training institution also gives a similar point of view. "This training institution does not value the teacher's painting ability when choosing a teacher, but will be 'bragging. Cake 'and other routines allow students to apply for a loan when they are hot, so they can't be calm and there is no way. "

This teacher believes that the so -called one month can receive orders is deceiving, but the selling point of the curriculum sales. "Some teachers will spend hundreds of dollars for outsourcing by themselves. The tuition fee is 3880 to 13,800 yuan, earning steadily. "

"There are only a few reliable institutions in the industry. In fact, it is mainly depending on whether the teacher has a fame. If you are determined to enter the industry, you should go to the physical class to study. The family must be supported." Said Wu Yi, a senior original painting practitioner, said.

Wu Yi said that Xueyuan painting was smashed by money in the early stage. When he studied in the early stage, he only spent 50,000 yuan in the physical class tuition and purchase equipment. During the same period, there were only two successful entrances.

"Outsourcing paintings are generally incomplete to the game R & D company. It has high requirements for professionalism. The four -month study of physical class is also the level of intern. At least three years after entering the industry, we can receive outsourcing from the company's channels to receive outsourcing outsourcing "He added.

When he saw the work of institutional teachers sent by the staff of the Light School, he commented, "It is like a student painting, and many of them are copied. This kind of work cannot find a job."

On March 30, Red Star Macalline Home Furnishing Group Co., Ltd. announced its 2021 financial report, which disclosed the net profit of 191 million yuan during the reporting period during the reporting period during the reporting period, a year -on -year increase of 55.28%.

Undoubtedly, these training institutions have become the import of traffic of Haier's consumer finance. The growth of the net profit margin of Haier's consumer finance is inseparable from its expansion of its "training loan" business.

However, while the pursuit of high profits, Haier consumer finance seems to have forgotten the responsibility of risk control.

After several years of rectification, the education and training industry market has become standardized, but Haier Consumer Finance can still accurately "step on the mine" and become the "accomplice" of such training institutions' recruitment enrollment. Whether its risk control is in place is worth asking.

The routine "training loan" has been banned repeatedly. Haier consumer finance really has no responsibility?

Since 2016, the regulatory authorities have successively issued a number of policies to rectify campus loan. In March 2021, the regulatory authorities noticed that some Internet financial platforms aimed at university campuses and issued Internet consumption loans through induce marketing to induce college students to excessively advance consumption, which led to some students in the phenomenon of high traps.

In response to this phenomenon, the five ministries and commissions such as the China Banking Regulatory Commission jointly issued the "Notice on Further Regulating the Supervision and Management of University Student Internet Consumption Loans", which clarified that small loan companies shall not issue Internet consumer loans to college students, and further strengthen consumer finance companies, commercial banks, etc. The business risk management of college students of the brand of financial institutions, and institutions that clarify that they shall not provide credit services for college students without the approval of the regulatory authorities.

In the above -mentioned "training loan" incident, the staff of the training institutions will pack college students into "unemployed" loans through teaching talked and other methods. But in this case, what responsibilities should consumer financial institutions bear?

In response to the routine "training loan" incident, there are practitioners in the consumer finance industry saying that "theoretically, this situation should not occur again, and the current golden institution will pass the name and ID information to verify it in the public security system. In the process of identity, the information filled in by the user is actually very 'subjective', so it is usually strictly controlled by the method of verification of the age to strictly control the loan of college students. "

At present, consumer finance companies generally face a major problem, that is, the information of Xuexin.com cannot be obtained. Haier Consumer Finance once told the media that it would clearly inform users that they would not issue loans to the student groups of all -time college colleges and technical colleges, and requested that adult users under 23 years of age (inclusive) to sign the "Non -Student Promise letter".

However, it can be seen from the attitude and method of handling the confmenting of the customer that Haier's consumer finance still does not attach importance to the issue.

The recording provided by Lu Yu shows that although the recipients of Herr consumer finance have shown their students' identity many times and explained to the recipients that the training institutions induced the loan, Haier's consumer finance still repeatedly collects it and allows irresponsible ways to allow it Users push to training institutions and regulators.

Faced with the relevant complaints of more than 300 pieces of black cat complaints in a single month, and the content of the complaint on the local leadership message board, Haier consumer finance still did not take out an attitude of actively handling guest complaints, and did not adopt corresponding rectifications to the cooperation agencies.Measures to jointly negotiate solutions.In the "training loan" incident in this routine, the rights and interests of financial consumers were damaged. Haier Consumer Finance did not bear the responsibility of financial institutions.Users who are only about 20 years of age do not have the obligation to verify their identities strictly. They will lend to university students in violation of regulations. In the final analysis, they are still not strict with risk control. "Another consumer finance practitioner said.

The reporter sent an interview letter to Haier Consumer Financial Company on the issue of "training loan". As of the release, no relevant reply was received.

- END -

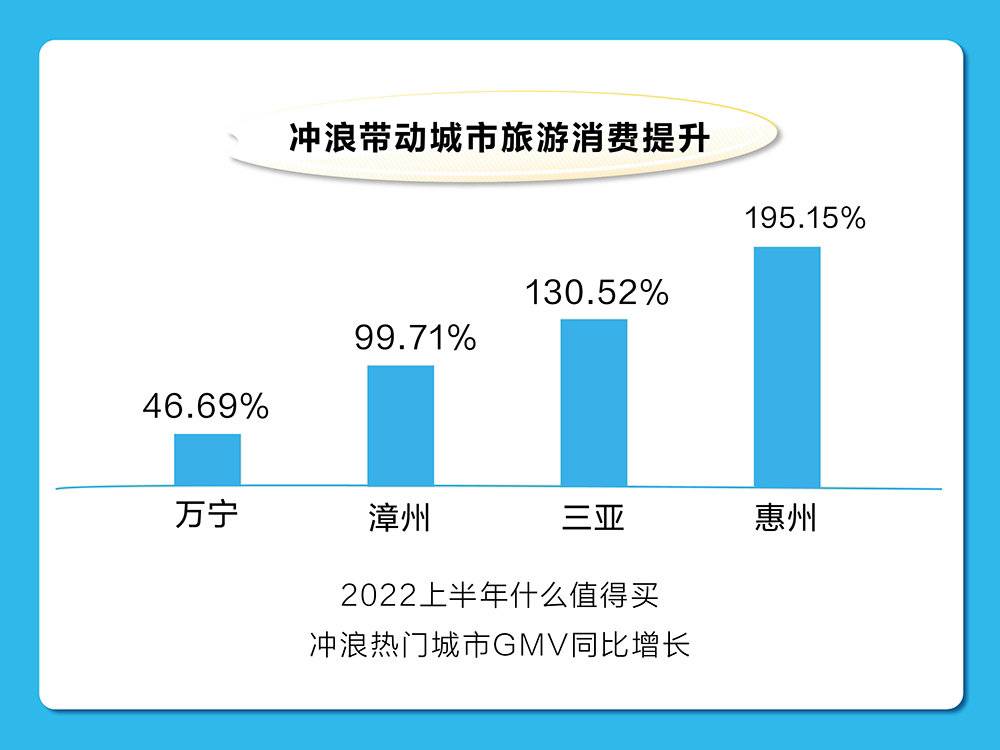

New consumption observation 丨 domestic surfing boom gradually starts, and the field of rinse consumers is still in its infancy

Cover reporter Wu YujiaIn the past, there was a wave of national movement in the W...

What makes Ningbo people love money?

Recently, the People's Bank of China Ningbo Center Sub -branch announced the finan...