Rising 164%!Southern funds and accurate bottoming

Author:China Fund News Time:2022.06.17

China Fund reporter Yao Bo

After the interest rate hike, the US stocks turned again, and most of the global stock markets fluttered. Hong Kong stocks turned stubbornly, and came out of a wave of "A shares" independent market.

On June 17, the Hang Seng Index rose 230 points to recapture the 21,000 mark, up 1.1%; the technology index rose 2.33%. Recently, the leading sector is mainly based on medicine, technology, raw materials and consumption. Among them, the leading biological leadership approved by the Angels and New Pharmaceuticals in the era of medical beauty, the increase of 11%of the increase has exceeded 11%.

There are two news in the Hong Kong stock market today worth paying attention to:

First, Lin Zhengyue, Chief Executive of the Hong Kong Special Administrative Region today, said in the media that even in the face of the challenge of the new crown epidemic, the Hong Kong financial system is still firm and the business is still booming. Despite the increasingly complicated geopolitical politics, the global economy has faced many challenges, and she is confident in the future development of the country and Hong Kong.

Data show that the Hong Kong dollar contact rate system is well operated. Hong Kong foreign exchange reserves exceeded 3.7 trillion Hong Kong dollars at the end of March 2022, about 1.8 times the currency base, effectively maintaining Hong Kong's currency stability and maintaining market confidence. The banking system remains stable. The total deposit in 2021 increased by 4.6%year -on -year. The four months before 2022 increased by 0.8%. The liquidity coverage ratio and capital adequacy ratio of major banks were much higher than that Such as the securities and insurance markets are operating in an orderly manner. The stock market was booming, and the average daily turnover of more than HK $ 160 billion in a daily turnover.

Second, Hong Kong stocks will usher in Russian funds.

The Russian Stock Exchange began to actively open up the channels for investment in Hong Kong stocks. The St. Petersburg Stock Exchange of Russia (SPB Exchange), next Monday (20th), allows local brokers to buy and sell 12 shares listed on the Hong Kong Stock Exchange. In the future Increase to 1,000. Securities will be traded and settled in Hong Kong dollars, and the transaction period is from 08:00 to 18:00 Moscow time. Securities will be settled on the second trading day (T+2), and the trading calendar will be synchronized with the Hong Kong Stock Exchange trading calendar.

A spokesman for the Hong Kong Stock Exchange said that the Hong Kong Stock Exchange has not cooperated with the St. Petersburg Stock Exchange in Russia at present, and believes that this is part of Russia's own global issuer promotion plan.

Twelve Hong Kong stocks approved by the St. Petersburg Stock Exchange include Tencent, Alibaba, Meituan, Xiaomi, JD.com, Shunyu Optics, Country Garden, Jinsha China, Changhe, Changshi Group, Zhongsheng Pharmaceutical and Wanzhou International.

New Oriental fell

The transformation of New Oriental live broadcast has been successfully transformed, and the number of fans and the amount of goods has soared, attracting a large number of mainland customers to go south to gold. The New Oriental Online held by the Hong Kong Stock Connect of Shenzhen City has increased from 11%to 21%in just a few days, and the shareholding ratio has increased by 10 percentage points!

Compared with the restrictions of the limit board and T+1, the amount of capital brought by retail investors is released faster in H shares. After 539%soaring in 5 days, today's New Oriental Online opened low and unable to control. The market once fell by 20%. Following the stock of HK $ 11.1 billion yesterday, today's volume can shrink significantly, with a turnover of about 6.2 billion Hong Kong dollars.

The institution is still singing, and Tianfeng Securities predicts that New Oriental is expected to sit on the litter e -commerce leader.

The securities firm issued a report yesterday that in recent days, GMV (commodity turnover) and fan growth are concerned. At present, conservative expectations are about 30 million yuan in daily stability (40 to 50 million per day and continued growth). At about 10 billion, considering its own traffic and resource tilt, and the proportion of its own brands, the net interest rate may be around 5%. It is expected to have an annual net profit of 50-700 million. Tianfeng Securities is expected to reach 650 million, 1.38 billion and 1.8 billion yuan from 2022 to 2024, respectively.

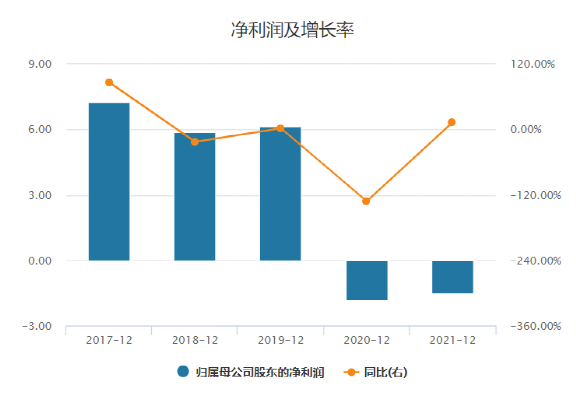

Affected by the epidemic and double reduction policies, New Oriental Online has suffered losses in the past three years, and has recently lost 1.6 billion yuan in fiscal year.

Even if it takes 10 billion yuan a year, the profit is 700 million yuan during the year. Based on the current market value of New Oriental Online, the company's 30x valuation is not low.

New Oriental Online is the most outstanding case for Hong Kong stocks to reverse at the end of this year. From the historical low on May 12 to yesterday, it rose 903%, and the current increase is still 777%.

Southern funds and accurate bottoming

New Oriental drives the mainland market to pay attention to high -quality Hong Kong stocks. In fact, the stocks favored by funds south are easier to surge at the bottom.

On June 17, Baoxin Financial rose straight in the afternoon, climbing all the way, an increase of 164%to close HK $ 0.082. Today's turnover has been rapidly enlarged to nearly HK $ 600 million, while the downturn is only millions.

After the history of history was refreshed in the middle of last month, the company obtained a large scale of Beishui. At present, a total of about 17 percentage points are added.

According to data from the Stock Exchange, the proportion of new financial finances in the southward funds reached 35.12%, and on May 12 this year, the stock price hit a new low of HK $ 0.024, and the southward capital holding was 18.49%. For more than a month, the capital capital has been nearly doubled.

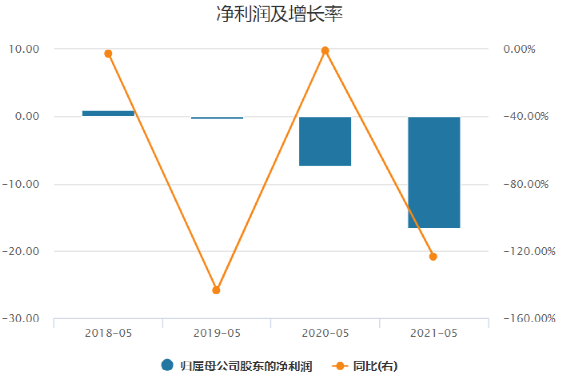

Judging from the data as of May 12, Baoxin Financial's major shareholders hold about 22%of the shares, and the concentration of major shareholders holds a low concentration.The company is mainly engaged in financial services, property investment and development, automation and securities investment, and the profit has been impacted since the epidemic.In May of this year, when Baoxin Financial's stock price fell by 90 %, it became a fairy stock.After the rise today, Baoxin Financial's market value reached HK $ 2.6 billion.

In fact, the southward funds have now become the engine of Hong Kong stocks, and the H -shares of Everbright Securities are an example.

Compared with A -share 6 days and 5 boards up to 70 %, Everbright Securities H shares rose less than 30 % at the same time.At the same time, the Hong Kong stock price was premiered and the news was superimposed. Today, Hong Kong stocks came out of the cross -star form and closed up 1.06%.AH's stock price difference is 250%.

The Shanghai market holding the most shares in the south has not changed much, and it has stabilized at about 10%in recent days.

Edit: Joey

- END -

Accelerated the development of China Hongtai's development of China's Hongtai business section accelerated development of the first property.

On June 17, China Jinmao's underwriting Jinmao Property Service Development Co., Ltd. (00816.HK) issued an announcement saying that its wholly -owned subsidiary invested in RMB 450 million to start th...

"Chinese bayberry 60 yuan per exported to Dubai" is so expensive?

Recently, China Baymeter 60 yuan exports Dubai appeared on Weibo hot search, which...