Huimin's plan to cross -border layout of photovoltaic materials target companies have been established in less than 1 year

Author:Daily Economic News Time:2022.08.16

Walman shares of abrasion -resistant material manufacturers intend to acquire the controlling stake in photovoltaic materials companies cross -border.

On the evening of August 15th, Huamin (SZ300345, stock price of 9.23 yuan, market value of 4.073 billion yuan) issued an announcement saying that the company intends to acquire Hunan Jianhongda Industrial Group Co., Ltd. (hereinafter referred to as Jianhongda Group), Hongxin Xinxin, Energy Technology (Yunnan) Co., Ltd. (hereinafter referred to as Hongxin Technology) 80%equity.

"Daily Economic News" reporter noticed that Liu Pingjian, a spouse of Huamin's actual controller Ouyang Shaohong, held 65%of Jianhongda Group. Hongxin Technology was established in January 2022 a few years ago. The main products are the current hot single crystal silicon rods and single crystal silicon wafers.

The subject project is still in the planning stage

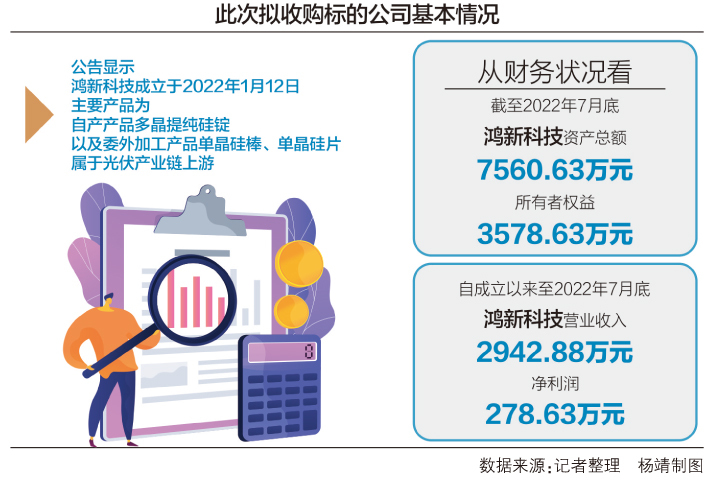

The announcement shows that Hongxin Technology was established on January 12, 2022. The main products are self -produced products polycrystalline purified silicon ingots and external processing products single crystal silicon rods and single crystal silicon wafers, which are upstream of the photovoltaic industry chain.

Hongxin Technology also has a subsidiary of Hongxin Dahai New Energy Technology (Shandong) Co., Ltd. (hereinafter referred to as Hongxin Dahai), which is mainly engaged in the research and development, production and sales of polysilicon purification, production of ingots. Processing methods to produce, sell single crystal silicon rods and single crystal silicon wafers.

From the perspective of financial situation, as of the end of July 2022, Hongxin Technology's total assets were 75.6063 million yuan, and the owner's equity was 35.7863 million yuan. Since its establishment to the end of July 2022, Hongxin Technology's operating income was 29.4288 million yuan and net profit was 27.863 million yuan.

Hongxin Dahai started to ignite production in April 2022 and began to make profits. As of the disclosure date of the announcement, Hongxin Technology's "10GW Efficient N -type single crystal silicon rod and silicon film project" of the annual production of Hongxin Technology is still in the preliminary planning stage, and the construction and production time are uncertain.

"After Hongxin Technology '10GW Efficient N -type single crystal silicon rod and silicon film project' were completed and put into operation, Hongxin Technology will form the industrial layout of the" silicon regeneration cycle+single crystal silicon rod/silicon wafer ', Hong As a single crystal supporting base in Hongxin Technology, Xindahai can achieve its own production and self -selling. "Huamin shares said in the announcement.

From the perspective of the evaluation value -added rate, as of the end of July, the evaluation value of the owner of Hongxin Technology was 73.545 million yuan, the value of value was 41.039 million yuan, and the value -added rate was 126.00%. In the end, after negotiation between the two parties, the total equity value of Hongxin Technology's shareholders was 70 million yuan, and the transfer price of 80%of the equity was 56 million yuan. Huamin's shares reminded the risk of high value -added rate in the announcement.

It is worth noting that the transaction also stipulates performance commitments. Jianhongda Group promised that Hongxin Technology's net profit in 2022 was not less than 7.5 million yuan, the net profit in 2023 was not less than 14.5 million yuan, and the net profit in 2024 was not less than 16 million yuan. In 38 million yuan.

Cross -border layout of new photovoltaic materials

The photovoltaic industry of Hongxin Technology, the target of the transaction, is currently in a high prosperity state. It has attracted many new players to enter the game in the capital market. Traditional photovoltaic giants have increased production.

In this transaction, Huamin, a player who chose to buy new photovoltaic materials through the acquisition of new photovoltaic materials, is a wear -resistant material manufacturer. Its main business includes two major pieces. One is a wear -resistant material field. Abrasion -resistant products and crusher hammer heads, the other is the controlled ion penetration (PIP) technology processing. The main products and services are metal ceramic PIP products and PIP technology processing.

In recent years, due to factors such as rising raw materials and tight industrial electricity, Huimin's net profit performance has not been ideal. In 2020 and 2021, the net profit attributable to mothers was 5.1649 million yuan and 4.7183 million yuan, respectively, a year -on -year decrease of 89.23. %, 8.65%.

The other party of the transaction Jianhongda Group is the affiliated party of Huamin. Jianhongda Group holding 65%of the shareholders Liu Jianping, the spouse of 65%of the shareholders of Huamin and the actual controller Ouyang Shaohong, and Ouyang Shaohong himself holds 30%of Jianhongda Group. In addition, Luo Feng, director of Huamin Co., Ltd., holds 5.00%of Jianhongda Group and serves as the general manager of Jianhongda Group. The supervisor Tan Zhongming is the deputy general manager of Jianhongda Group.

"Daily Economic News" reporter noticed that Ouyang Shaohong became the actual controller of Huamin's shares through equity and transfer in August 2021. According to the announcement of Huamin's May 2021, the original controller Lu Jianzhi was arrested by the branch of the Changsha Public Security Bureau directly under the Changsha Public Security Bureau for suspected bribery.

Although the layout of Huamin's new photovoltaic material business belongs to cross -border investment, the major shareholders and many executives of the target company are also related to Huamin's shares, but another shareholder of the target Hunan Lixin Silicon Material Technology Co., Ltd. already has polysilicon projects Investment. According to the Dali Daily, on June 18, the first phase of the first phase of the 10,000 -ton solar -grade polysilicon project of the Dali Dali base was held in Yunnan Xiangyun Economic and Technological Development Zone.

Daily Economic News

- END -

National Intellectual Property Office: As of the end of May, the online application rate of trademark registration business has reached 99.45%

Cover news reporter Teng YanOn June 23, the State Intellectual Property Office hel...

up to date!Henan and Anhui: The single-person single-person amount of village and township banks starts to pay at 150,000 to 250,000

Source: Securities Times ID: wwwstcncomThe Henan Banking Regulatory Bureau and the...