Will the interest rate of some urban investment bonds below 2% of the low interest rate market will continue?

Author:Daily Economic News Time:2022.08.16

Dozens of ticket rates have fallen below 2%of the urban investment bonds issued this year.

The reporter found that the interest rate of urban investment bonds fell below 2%such a large scale, and it also appeared in 2020. Among the urban investment bonds issued by 20120, there were more than 200 ticket interest rates of less than 2%. In other years since 2015, urban investment bonds with a non -issued interest rate of less than 2%have only a single digit each year.

Urban investment bonds are a credit bond issued by local urban investment platforms, which are mainly used for investment purposes such as urban infrastructure construction. Generally speaking, there are not many opportunities for urban investment bond ticket rates to be less than 2%. So, now the city investment bonds have reproduced a large number of ticket interest rates in 2020 falling below 2%. What is the reason behind it?

Data Source: China Debt Credit Credit Debt Financing Research Report Liu Hongmei Map

The interest rate of urban investment bond ticket fell below 2%

"Daily Economic News" reporter found that with Flower Shun iFind statistics, it was found that there were already 56 of the current ticket rates of urban investment bonds issued from January to July this year, accounting for 1.24%of the only 1.24%of the urban investment bonds in the same period. For example, the "22 Guangzhou Metro SCP005" issued on July 25 shows that the current ticket interest rate is only 1.51%. In addition, the issuance time of the above ticket interest rates of 2%of urban investment bonds is concentrated in May or after, and there are 37 in July alone.

At the same time, the scale of the issuance of urban investment bonds this year has also shown a significant decline. The same flowers iFind showed that the actual issuance scale of urban investment bonds from January to July was 3.34 trillion yuan, a year -on -year decrease of 6.96%.

Back to 2020, a large number of ticket interest rates issued by the city investment bonds fell below 2%. According to the statistics of the same flowers, there are 191 of the current ticket rates of urban investment bonds issued from January to July of that year, accounting for 5.18%of the number of urban investment bond issuance in the same period. The number of urban investment bonds issued by the current ticket rate of 2020 was 270, accounting for 270, accounting for 4.13%of the total number of urban investment bond issuance of the year.

In comparison, in other years since 2015, the number of tax rates fell below 2%of the urban investment bonds. For example, only 3 ticket interest rates issued in the urban investment bonds issued in 2021 are below 2%.

According to the data statistics statistics from the Flower Flowers, it can also be found that the ticket rate issued from January to July this year fell below 2%of the city investment bonds. Short -term financing vouchers (SCP). In addition, the province where the above issuers are located are concentrated in East China and South China, such as Jiangsu, Guangdong, Jiangxi Province, Zhejiang Province, etc. Among them, the urban investment companies in Jiangsu Province have the most, and the tax rates issued from January to July have a 2%urban investment debt of 2%.

"Indeed, the interest rate of the city's voting is very low." Yuan Quanquan Yuan Quanquan, a senior R & D director of Sino -C Secort, said in an interview with reporters that under the current market situation, AAA -level urban investment, especially large -scale infrastructure projects such as rail transit, highways, highways, highways, highways The bonds of the bonds will be significantly compressed. "The economy now depends on infrastructure investment, which will definitely allow urban investment companies that engage in large -scale infrastructure projects to obtain a larger credit blessing."

IPG China Chief Economist Bo Wenxi told reporters that at present, the fell below 2%of the city investment bonds is mainly concentrated in the strong qualifications such as East China, which shows that the funds are under the current expected decline of investment security and avoidance of investment security and avoidance. The risk is more valued, and this game is quite detrimental to the maintenance and liquidity of weak qualified urban investment.

In addition, a solid income analyst expressed his point of view to reporters, "The yield of the entire bond market is declining, not only the city investment."

The scarcity of urban investment bonds is prominent

Why did the interest rate of urban investment bonds issued during the year fell below 2%? A public pointed to the "asset shortage."

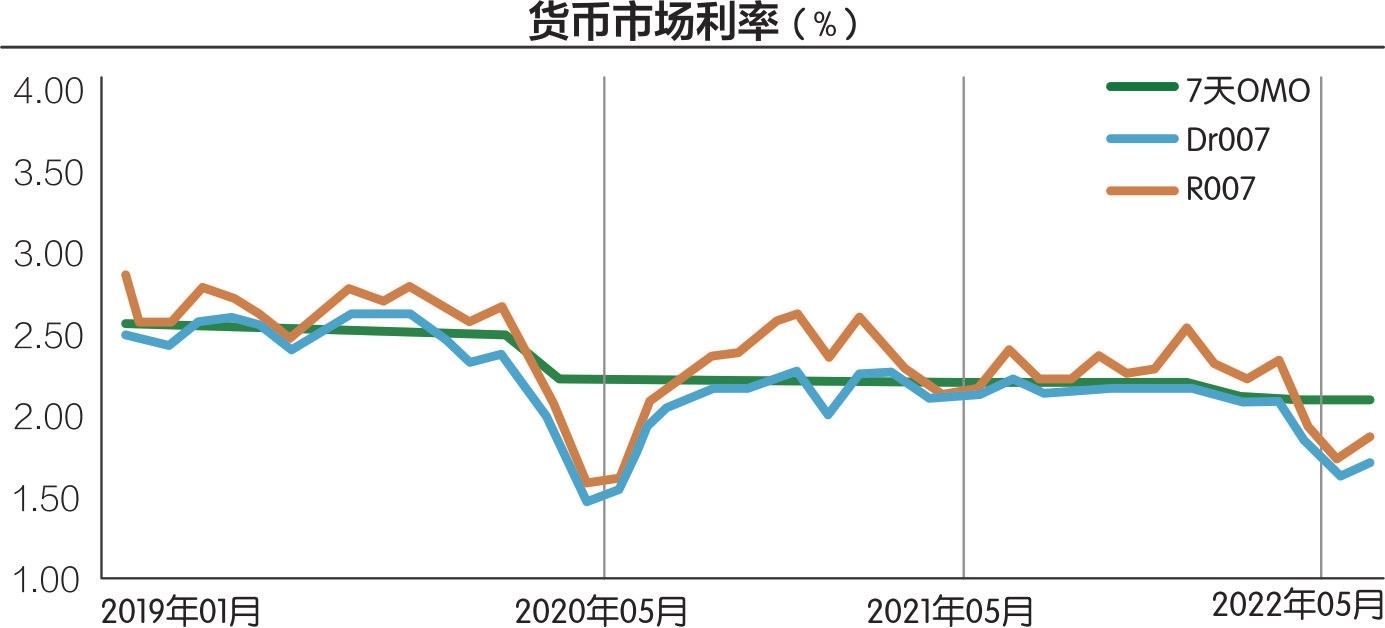

For example, China Debt Credit Research in the credit bond financing report in July this year pointed out that the wide monetary policy continued, the currency market interest rates decreased; the liquidity supply increased, and the level of credit interest differences in the "asset shortage" was compressed, and the grade spread was spread, and the hieraris spread was spread. Continue to narrow.

The research report of Haitong Securities pointed out that in the first half of this year, credit spreads, grade spreads narrowed, and the deadlines were expanded. Cultivation and control are still tight, and the scarcity of urban investment bonds still exists. Looking back at the debt market in July, Haitong Securities Research Report summarized, the capital surface remained abundant, the bill interest rate fell, the market risk aversion was heating up, and the expected expected of economic restoration was weak.

Yuan Quanquan told reporters that in the context of "asset shortage", urban investment bonds, as the only "just redeeming assets" in the credit bond market, are highly scarce and will be sought after by the market. Coupled with the high economic downward pressure and the improvement of infrastructure importance, the importance of urban investment companies can be consolidated, and urban investment faith has been strengthened in stages.

"The regulatory 'red line' of preventing hidden debt risks has continued to tighten, and the policy of urban investment debt issuance is still very strict. It has not substantially relax due to the 23 yuan of financial rescue of the city. The average of negative growth. The trend tightening of the supply side and the extremely strong stack of the demand side will inevitably cause the interest rate of urban investment bonds to be significantly compressed. "Yuan Quanquan added.

For the saying "asset shortage", the above -mentioned solid income analyst introduced to reporters: "The word 'asset shortage' seems to be professional, but it is actually because the liquidity is loose."

According to the data released by the central bank, since April, the M2 growth rate has maintained a double digit, the M2 growth rate in April is 10.5%, the M2 growth rate in May is 11.1%, and the M2 growth rate in June is 11.4%. In July Singapore high, reaching 12%. China Currency Network shows that since July, DR007, interbank liquidity observation indicators, has maintained around 1.5%. The decline in August was obvious, below 1.5%. On August 8, DR007 fell to the lowest value since August, 1.2850%. On August 15, the weighted interest rate of DR007 was 1.3633%.

Low interest rate market in 2020

It is worth noting that the interest rate of urban investment bond tickets fell below 2%, which also appeared in 2020.

"Similar places are loose liquidity. Now this situation is similar to 2020." Zhang Xu J, chief fixed income analyst of Everbright Securities, said in an interview with reporters that the decline in interest rates is the overall trend of the bond market, not Personal cause of urban investment bonds.

Looking back at the 2020 city investment bond issuance summary research report issued by China Debt Calculation, the content pointed out that the relevant policy environment of the urban investment industry in 2020 remained relatively loose, and bond financing showed a "quantity rise and price drop" throughout the year. Since the outbreak of the new crown pneumonia, the stable monetary policy has become more flexible and moderate, maintaining reasonable and plenty of liquidity and actively guiding market interest rates to decline, and effectively reduces the cost of financing in the real economy.

The research report of CICC analyzes the source of "asset shortage" in recent years, and pointed out that after the tide of private enterprises in 2018 and the 2020 Yongmei incident, the actual investment sector is getting smaller and smaller. In the second half of 2021, the supervision of urban investment bonds became tight, resulting in a small supply.

The research report also pointed out that one of the commonality of the "asset shortage" and 2020 is the loose capital. At the macro level, the supply of funds has risen, but the demand for financing has declined or the overall weakness features; the monetary policy is loose, and the capital interest rate is lower. Another commonality is the growth of demand institutions. Starting from the mediaization of finance in 2008, off -balance sheet financial management has become a force that cannot be ignored in fund supply, which largely determines the demand and behavior of credit bond investment. In recent years, the scale and proportion of widely held credit bonds have increased. The growth of financial management.

Luo Pan, a financial analyst, believes that the current low interest rate market for urban investment bonds is unlikely. He analyzed: "First, the currency executive department will also notice this phenomenon, and the increase in the amount of currency is still pouring in. Whether it meets its policy purposes. The flow of funds is guided; the second is the continuous decline of interest rates, which will inevitably attract more urban investment enterprises to actively issue debt, replace high interest rate debt at low interest rates, and adjust the debt structure; In terms of quota, its credit conditions will change, and the currency will be priced again. Therefore, I think it is impossible for urban investment bonds to continue to be low interest rates. "

For fund liquidity supply, Zhang Xu told reporters that since the second quarter, the central bank has put on liquidity through various methods such as surrender, re -loan re -loan, interim loan convenience, and public market operations. The downward settlement has relaxed the liquidity and interest rate constraints of bank credit supply, which helps enhance the stability of the total credit growth and promote the steady decline of the comprehensive financing cost of the enterprise. "With the consolidation of economic recovery and the increase in endogenous growth momentum, the next stage of DR007 is more likely to be steadily upward, and finally returns to the open market operation interest rate."

Daily Economic News

- END -

SOHO China Chief Financial Officer was suspected of inside the stock trading and was investigated by the police!Company response →

07.07.2022Number of this text: 2396, the reading time is about 4 minutes olderGuid...

The new regulations require that the moon cake packaging does not exceed three floors. Is the Jiangcheng gift box "slimming" successful?

Jimu News reporter Shi QianPhotography reporter Li HuiOne month before the Mid -Au...