Gao Yan's HHLR in the second quarter of the position exposure: optimistic about China stocks, "bottoming the bottom" Ali, and adding new energy

Author:Daily Economic News Time:2022.08.16

On August 16th, Beijing time, the US Securities and Exchange Commission (SEC) website showed that HHLR Advisors announced the latest US stock positioning data.

As of the end of the second quarter, the total market value of HHLR in the US stock market was 4.7 billion US dollars (about RMB 3.2 billion), which was basically the same as the previous quarter and still held 64 stocks.

Throughout the 64 stocks, the re -supporting Chinese stocks, the bottom of Ali, and the direction of new energy in the position of the positions are obvious.

Sino -stock assets account for 64%

In the first half of 2022, the U.S. market generally presented double -bond killing situation: higher interest rates, and the stock index fell.

At the end of the first quarter of the first quarter, HHLR held 64 stocks in the US stock market, a decrease of 12 from the fourth quarter of 2021, with a total market value of 4.79 billion US dollars.

At the end of the second quarter, the total market value of HHLR in the US stock market was 4.7 billion US dollars (about RMB 3.2 billion), which was basically the same as the previous quarter, and the number of stocks still held 64.

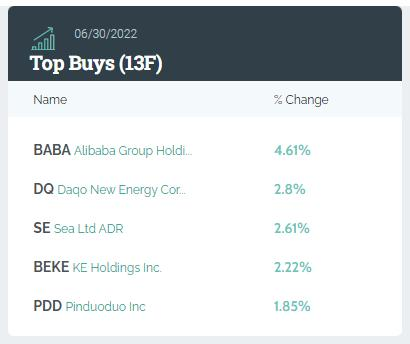

Data show that as of the end of the second quarter of 2022, HHLR's top ten heavy warehouses were Baiji Shenzhou, JD.com, Saifu Shi, Doordash, SEA, Vipshop, legendary creatures, Alibaba, shells, and new energy. Compared with at the end of the first quarter, the new face was Alibaba, Shell and Great new energy, while Yizi International, on Ang Run and iQiyi were transferred.

It is worth noting that at the end of the second quarter, the top ten heavy stocks accounted for 73.20%, and 7 of them were only Chinese stocks, and the other three were overseas Internet platforms.

Among all US stocks in the second quarter of HHLR, the total market value of China stocks was nearly 3 billion US dollars, accounting for 64%. At the same time, HHLR conducted positions such as increasing holdings and new buying and buying new stocks, including JD.com, Shell, Vipshop, etc., showing that its confidence in Chinese stocks is still firm. During the first quarter of this year, HHLR had increased its holdings, newly purchased buying and other positions, including JD.com, Vipshop, Manfu, Futu and other Chinese stocks such as JD.com.

Copy Alibaba

Previous information shows that during the fourth quarter of 2021, HHLR adopted the attitude towards Alibaba. I did not choose to buy during the first quarter of this year.

However, in the newly disclosed positions at the end of the second quarter, HHLR once again built Alibaba and bought 1.89 million shares.

Earlier on August 12, a well -known private offering Jinglin submitted to the US Securities Regulatory Commission in the second quarter of 2022 U.S. stock holding reports. The U.S. stock positions of Jinglin's overseas main body disclosed this time are US stocks that do not include domestic main body and products. Data show that during the second quarter, it increased its holdings of 936,000 Alibaba shares, and the number of shares reached 1.2425 million shares, ranking sixth among the top ten heavy stocks of its US stocks in one fell swoop.

Belaide also bought 57,700 Alibaba ADR during the second quarter of this year, with a position of 1%.

At the same time, HHLR also bought 1.39 million shares. Jinglin also chose to add a lot of Pinduang to buy 240,000 shares.

Data show that during the second quarter, Alibaba's minimum stock price was US $ 78/share, a 34%decrease from the end of the fourth quarter of last year. The minimum stock price of Pinduoduo was only 31 US dollars per share in the same period, which was close to the church compared with the end of the fourth quarter of last year.

Jinglin believes that since May, the government's attitude towards platform companies has changed. In the future, normalized supervision and red and green light settings will allow Internet platform companies to return to the normal track of development. Essence This may gradually bring a reasonable profit margin regardless of retail or services.

"In the first half of this year, due to the disturbance of the epidemic, the staged interruption of logistics and service, but at the same time, we also observed the online trend of retail and living services to continue to strengthen. The platform company has become commercial services and circulation. Infrastructure in the field. At present, Internet platform companies are in a three -bottom stack of performance+policy base+valuation bottom. The low -based effects starting in the second half of last year will bring most companies back to the up orbit. "

"We firmly believe that China's long -term competitive advantage still exists. Intellectual clusters, industrial supporting clusters, improvement of infrastructure and energy resource guarantee will definitely enable the Chinese manufacturing industry to be further upgraded and iterated. ","

Heavy warehouse New Energy and Technology

In HHLR's investment logic, new energy and technology have always been the direction of its key investment.

It is worth noting that HLLR's attitude towards the new energy vehicle sector has changed significantly. As of the end of 2021, HHLR held 5007,300 ideal cars, 666,500 shares of Xiaopeng Automobile, and 350,000 shares in Weilai.

In the first quarter of 2022, HHLR chose to clear Xiaopeng and Weilai directly to clear the position, and at the same time cut off half of the warehouse of the ideal car, and its position directly fell to 14th.

In the freshly baked second -quarter report data, the ideal car that rose 48%of the stock price during the second quarter was directly cleared by HHLR. However, HHLR's new energy sources increased to 1.8859 million shares. Great brand new energy has also become the tenth largest heavy stock of HHLR.

At the same time, HHLR newly bought Tesla and Jingke Energy Holdings. Public information showed that crystal energy started from silicon wafers and turned to photovoltaic components production and operation.At present, the company has established vertical integrated production capacity from the production of rod/ingot, silicon wafers, battery films to photovoltaic component production.In the direction of science and technology, in the case of continuing to hold back to HHLR, HHLR also bought Amazon, Microsoft, and other technology companies such as Saifu Shi, DOORDASH, Sea, and Coupang.

Daily Economic News

- END -

The lecture and entrepreneurial empowerment symposium of the Liwan District Entrepreneurship Competition was successfully held

In order to further promote the development of the Liwan District Entrepreneurship...

Directly hit the shareholders' meeting | Spring and Autumn Airlines: It is expected that Shanghai flight volume will be recovered quickly in July

It's been a long time, on the afternoon of June 27, Spring and Autumn Airlines (SH...