When listed companies disclosed the semi -annual report of the public, private equity nuggets in the field

Author:Economic Observer Time:2022.08.16

Economic Observation Network reporter Hong Xiaotang, with the intensive disclosure of the semi -annual report of the listed company, the performance of some listed companies also surfaced, and some companies with continuous growth and high performance have become the key targets of public and private funds.

From the perspective of many fund managers interviewed, with the increase in the selection of science and technology boards and the improvement of quality, technology companies with high growth and growth are the objects of increasing research and holding.

Increased performance

In recent years, with the continuous expansion of the science and technology board and the continuous increase in the segment industry, institutional investors have continued to increase their attention to science and technology boards, and the financing capabilities of the secondary market have also continued to increase.

According to Wind data, as of August 16, the science and technology board expanded from the initial 25 companies to 455, and the total market value has also expanded from 553.496 billion yuan to 644,44016 billion yuan.

Among them, companies with better performance growth capabilities in the science and technology board are more popular in the market.

For example, on August 15, Changguang Huaxin issued an announcement that the company's operating income of 250 million yuan in the first half of 2022, an increase of 31.26%year -on -year; net profit attributable to shareholders of listed companies was 59.1818 million yuan, an increase of 24.73%year -on -year. Among them, in the second quarter of 2022, the company's main revenue in a single quarter was 138 million yuan, a year -on -year increase of 22.76%; net profit attributable to mothers in the single quarter was 31.5538 million yuan, an increase of 10.75%year -on -year; the non -net profit in single quarter was 20.405 million yuan, an increase of 13.83 year -on -year increased by 13.83. %; Liability ratio of 9.67%, investment income of 2.53 million yuan, financial expenses of 933,800 yuan, and gross profit margin of 53.43%.

According to public information, Changguanghua Core belongs to the semiconductor laser industry, focusing on the research and development, design and manufacturing company of semiconductor laser chips. The company consists of four categories of semiconductor laser chips, devices, modules and direct semiconductor laser. Industrial chain company.

Earlier, Puyuan Electric Electric, the company, which was also listed on the science and technology board this year, also released a interim. The interim reported that the company's main income of 261 million yuan, an increase of 23.25%year -on -year; %; Non -net profit of 7.705 million yuan, an increase of 132.11%year -on -year. Among them, in the second quarter of 2022, the company's main revenue in a single quarter was 145 million yuan, an increase of 20.92%year -on -year; net profit attributable to mothers in the single quarter was 24.2738 million yuan, an increase of 396.45%year -on -year; %, Investment income of 4.6793 million yuan, financial expenses -3482,600 yuan, gross profit margin 51.98%.

According to public information, Puyuan Electric Electric is a general -purpose measurement instrument field. It is a high -tech enterprise for the development, production and sales of well -known general -purpose electronic measuring instruments in the industry. Its products are based on general electronic measurement instruments and their solutions. The direction of the frequency domain test measurement and measurement application has achieved diversified industries, and provides scientific research, product research and development and manufacturing test guarantee for education and scientific research, industrial production, communication industry, aerospace, transportation and energy, consumer electronics and other industries. In the development of cutting -edge science and technology, new generation of information technology, and new infrastructure construction, it helps to achieve domestic replacement.

A Beijing securities company is a public investment research person in Beijing believes that the institutions' attention to science and technology board companies has more concentrated companies with good profitability, including semiconductor chips, photovoltaic and other fields, and key technologies involving the problem of "card neck". Companies, these companies have not only supported national policy support, but also favored market funds.

Layout

In fact, in the third year of the science and technology board opening market, institutional investors have continued to increase their attention to science and technology board companies. The field of Nuggets and Creative Board is also one of the key directions that some public and private fund managers are concerned.

As of the end of the second quarter, the top ten circulation stocks of Puyuan Electric Power included many public and private institutions such as Huaxia Fund, Guangfa Fund, Wells Fund Fund and 10 billion private equity capital capital. Among them, Guangfa Fund, Huaxia Fund, and Fund of Xiangju Capital held a shareholding of 1.7502 million shares, 824,100 shares, and 540,000 shares, respectively.

Compared with the first quarter, the number of investors in Puyuan Sebled Institution also increased from 331,300 shares to 4.0245 million shares, an increase of 12 times.

Coincidentally, Changguang Huaxin also won the grabbing of investors in public and private institutions during the same period.

As of the end of the second quarter, the top ten circulation stocks of Changguang Huaxin include social security funds, Gaoyi Assets, Favi Fund and Investment Promotion Fund. Among them, the number of funds of Wells Farmers, Social Security Fund, and Gaoyi Assets holds 34.341 million shares, 1.1631 million shares, and 960,000 shares, respectively.

The number of institutional investors increased from 796,300 shares in the first quarter of 2022 to 7.5029 million shares, and the number of consolidated shares increased by more than 9 times.

The above cases are just a microcosm. In fact, due to the institutional advantages and clear positioning of the science and technology board, some companies with high growth in science and technology boards are also constantly attracting funds.

According to the statistics of Wind data, as of the end of the second quarter of this year, 235 listed companies have been in active equity public funds (including ordinary stock funds, partial stock hybrid funds, balanced hybrid funds, etc.). Da heavy warehouse stocks, accounting for 53.05% of all companies in the Innovation Board, significantly higher than the proportion of 32.87% and 35.33% of GEM and motherboards. In addition, the proportion of partial stock funds holding the science and technology board listed companies has steadily increased since the third quarter of 2019. As of the second quarter of this year, the investment ratio of science and technology board investment accounted for 5.5%of the entire partial stock fund.

In response to the continuous attention and operation of the fund manager for the science and technology board listed company, a public investment research person in Shanghai told reporters that with the increasing number of listed companies, the Alpha income of the more segment of the section of the section is currently currently being excavated. One of the focus of work.

"Some high -tech industries, especially the tracks with the most policy support and industrial trends, will receive more funds." The aforementioned brokerage public offerings are also pointed out.

A personal public fund manager in Beijing also said that as the market fluctuates, the best -performing stocks with potential and high performance have become the key to their confidence.

- END -

Wenxian, Henan: "Digital" to see reserved tax refund promotion to development

Elephant News • Correspondent Yang Jiying Correspondent Meng Shengjie Li LingThis...

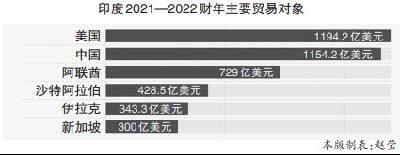

How does Meicheng India's "largest trading partner" affect China?

Indian workers work in the coal wholesale market. Coal is an energy product import...