V Guan Finance Report | Cold acid Ling parent company intends to go public: "outsourcing" has doubled production capacity for three years, and more than half of the fundraising funds are used for marketing

Author:Zhongxin Jingwei Time:2022.06.17

Zhongxin Jingwei, June 17th. "Cold and hot and sour, eat it if you want to eat." The classic advertising words of cold sour spirit have been used for more than 20 years and are still in use. (The following referred to as "Dengkang's mouth") Recently disclosed the prospectus and intended to impact the main board of the Shenzhen Stock Exchange. The sponsor was CITIC.

Dengkang's mouth (formerly known as "Chongqing toothpaste Factory") is mainly engaged in the research and development, production and sales of oral care products. Oral cleaning care products. The Chongqing State -owned Assets Supervision Commission indirectly controlled 79.77%of the shares of Dengkang's oral cavity to be the company's actual controller.

In this IPO, Dengkang's mouth is planned to raise 660 million yuan, which are specifically to invest 370 million in the upgrading of omni -channel marketing networks and brand promotion and construction projects, intelligent manufacturing and construction projects, Oral Health Research Center construction projects, and digital management platform construction projects. Yuan, 220 million yuan, 35 million yuan, 35 million yuan.

Dengkang Oral Ramping Project (Source: Prospectus)

The annual output of toothpaste excesses 30,000 tons

In recent years, with the rapid development of my country's economy and the continuous improvement of national per capita income, the per capita investment in the field of oral cleaning care has continued to increase. The prospectus shows that from 2017 to 2021, the market size of the oral cleaning care products industry in my country increased from 38.848 billion yuan to 52.173 billion yuan, with an average annual compound growth rate of 7.65%. According to Euromonal International data, the market size of the domestic oral cleaning care supplies in 2026 will further increase to 67.805 billion yuan.

The market size and growth rate of Chinese oral cleaning care supplies (Source: prospectus)

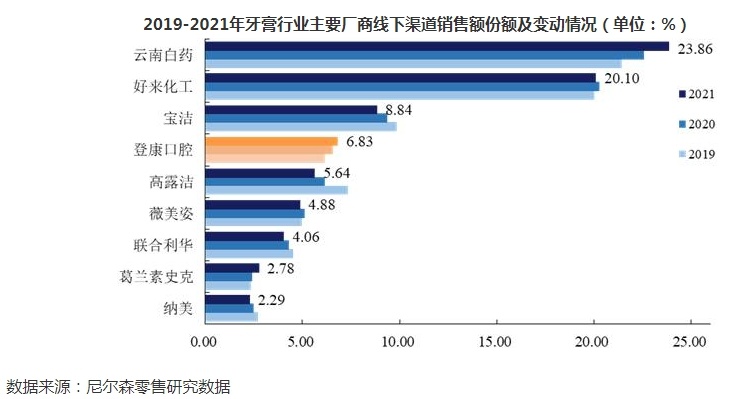

At the same time, the domestic consumer market has set off a "national tide" style in recent years. According to Nielsen retail research data, from 2019 to 2021 (hereinafter referred to as the "reporting period"), Procter & Gamble, Gaoling, and Lianlihua overseas brand offline channel sales shall continue to decline. Correspondingly, domestic brands Yunnan Baiyao and Haolai Chemical (its brands have "Darlie", once called "black toothpaste"), and Dengkang's oral market share has risen as a whole.

2019-2021 Toothpaste industry Main manufacturer offline channel sales share

In this context, the total output of toothpaste during the Dengkang Oral Report was 33199 tons, 34289.22 tons, and 35437.16 tons. The output of toothbrushes was 75.233 million, 64.853 million, and 9,386,700. Although the company's product production and sales have steadily increased, from the perspective of offline channel sales of the toothpaste industry, Dengkang's oral cavity accounted for 6.83%in 2021, from the head enterprise Yunnan Baiyao (23.86%), Hao Lai Chemical (20.1 %) There is still a significant gap.

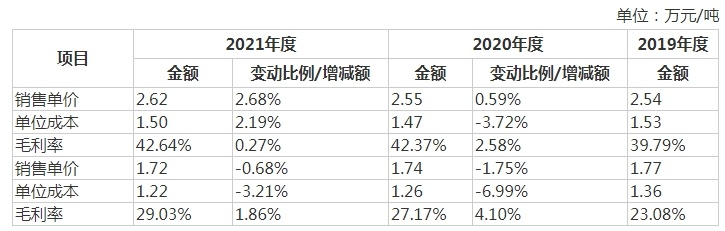

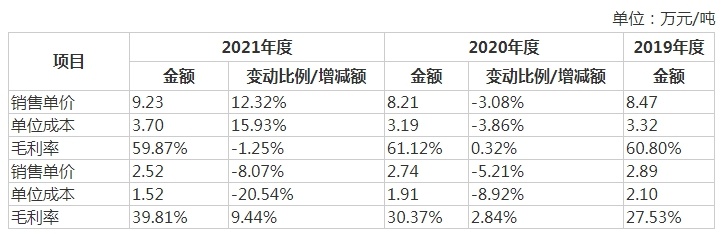

In terms of revenue, during the reporting period, Dengkang's oral revenue was 944 million yuan, 1.03 billion yuan and 1.143 billion yuan, respectively, with net profit of 63 million yuan, 95 million yuan and 119 million yuan. Among them, toothpaste (including adult toothpaste and children's toothpaste) revenue accounted for nearly 90%, gross profit margin is about 44%, toothbrushes (including adult toothbrushes and children's toothbrushes) revenue accounted for slightly more than 10%, and its gross profit margin was about 30%.

It is worth noting that the gross profit margin of Dengkang's mouth children's products is significantly higher than adult products. Taking the gross profit margin of toothpaste in 2021 as an example, the cost of children's toothpaste units is 3.7 yuan, while the sales unit price reaches 9.23 yuan, and the gross profit margin is 59.87%. In contrast, the cost of adult toothpaste units is 1.5 yuan, the sales unit price is 2.62 yuan, and the gross profit margin is 42.62%.

The situation of the nursing product of the population, the upper part is toothpaste, and the lower part is toothbrush (source: prospectus)

Children's mouth care products are the situation of toothpaste, and the lower part is toothbrush (source: prospectus)

More than half of the fundraising funds are used for marketing

Dengkang Oral Program raised 660 million yuan, of which the omnicocal marketing network upgrade and brand promotion and construction project intended to invest 370 million yuan, accounting for more than 56%.

Specifically, the company plans to invest 5.7788 million yuan to broaden and upgrade offline channels, and 91.2 million expanded online channels, including business cooperation with e -commerce platforms, O2O home platforms, community group purchase platforms, and online celebrities. The remaining more than 200 million yuan is used for brand promotion, of which 99 million yuan is used for new media integrated marketing, 73 million yuan for image advertising, and 40 million yuan for outdoor media.

During the reporting period of Dengkang's dental, it attached great importance to marketing. The company not only hired Wu Lei as an image spokesperson in 2021, but also deployed Douyin interest e -commerce. From 2019 to 2021, the sales cost of Dengkang's mouth was 276 million yuan, 266 million yuan, and 279 million yuan, respectively, with revenue accounting for 29.24%, 25.8%, and 24.45%, which was significantly higher than the industry average of the same period (24.25%24.25% , 20.40%, 23.43%) and median (14.32%, 15.13%, 12.24%).

During the period of Dengkang's Oral Report, the sales expenses change (source: prospectus)

In addition, the prospectus shows that in 2021, due to the impact of the epidemic factors, Wu Lei's endorsement advertisement and promotional video that was scheduled to be launched in the second half of the year failed to complete it. The corresponding integrated communication plan was postponed. 46.66%to 047 million yuan. However, this does not affect the overall investment of sales costs for Dengkang's mouth. The company turned in 2021 to increase the promotion cost, resulting in the year -on -year increase of 121%to 115 million yuan. Talking about marketing investment, the company said that the oral cleaning care products industry has a wide audience. Its brand value and channel value are the core of the rapid development of industry companies. Oral cleaning care products are directly applied to consumers' mouth. Its product quality and functional function With the high attention of consumers. Therefore, the comprehensive competition of brands, channels and products has become the mainstream of market competition.

Among the competitive products, Yunnan Baiyao said in the 2021 annual report for oral care tracks that the company will be committed to using oral nursing hardware as a platform, big data and AI as the background support, professional functional products as tentacles, through introducing talents through the introduction of talents , Innovate the business model, link the industry to lead the dental medical team, and build the first oral care intelligent system with a complete personalized service system in the industry to build technical barriers and customer viscosity for Yunnan Baiyao in the field of oral care. Oral comprehensive nursing solution.

The use of its own capacity and utilization rate is not full, but the production is increased.

According to the prospectus, Dengkang's oral production model is divided into the company's independent production and commissioned production.

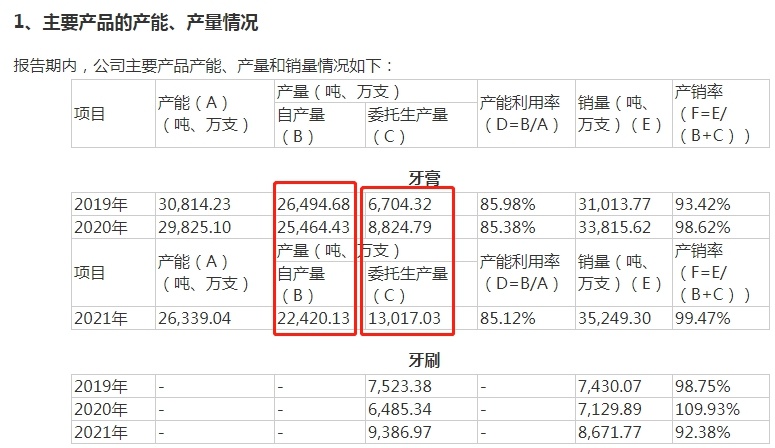

Dengkang's mouth said that with the continuous development of the company's business in recent years, the internal capacity can no longer fully meet the needs of the market. The company uses some toothpaste products to be effectively supplemented by commission production methods. Other oral cleaning care products such as toothbrushes and electric toothbrushes are currently mainly commissioned.

From the perspective of production capacity and output, Dengkang's dental toothpaste has decreased from 26,500 tons in 2019 to 22,400 tons in 2021, and its own production capacity has also shrunk from 30,800 tons to 26,300 tons. The capacity utilization rate remains in three years. At a level of about 85%, production capacity is not fully used.

At the same time, the company's toothpaste commissioned production volume has increased rapidly from 06,700 tons in 2019 to 13,000 tons in 2021. The output is close to double the production. Rising to 93.87 million in 2021.

The production capacity and output of the main products of Dengkang's mouth (Source: prospectus)

In addition, the prospectus shows that at the end of each period of the reporting period, the book value of Dengkang's mouth inventory was 139 million yuan, 138 million yuan, and 165 million yuan, respectively, accounting for 22.84%, 22.10%, and 27.60%, of which inventory goods were Long -term maintenance at a level of about 100 million yuan.

It is worth noting that the 220 million yuan in the fundraising funds will be used for intelligent manufacturing upgrade and construction projects. Dengkang's mouth stated that it will use the existing production plant and related supporting facilities to purchase the industry's leading paste production equipment, automated toothpaste irrigation machine and film thermal contraction packaging machine, rear equipment and product code traceability system for the filling workshop, DIY production lines and other equipment, build an intelligent manufacturing information management system.

According to the prospectus, the above project is an upgrade project for production capacity replacement. After the project is implemented, the comprehensive strength of Dengkang's mouth in the aspects of production capacity, efficiency, equipment automation and intelligence level will be significantly improved. (Zhongxin Jingwei APP)

(The views in the article are for reference only, do not constitute investment suggestions, have risks in investment, and need to be cautious to enter the market.)

- END -

Green Lianlian IPO: Eat dividends, it is difficult to hide anxiety

Author | KarongEdit | Tang FeiThe Data Line company, which started Yu Huaqiangbei,...

"Selection of the Top Ten Enterprise Social Responsibility Cases of Wuhan" Starting today