The Federal Reserve's fierce interest rate hike "Domino effect": European and American stocks encountered vacant tide, the yen was sniped

Author:21st Century Economic report Time:2022.06.17

21st Century Business Herald reporter Chen Zhi Shanghai report

After the Fed's significant interest rate hike 75 basis points caused the economic recession to worry about heating up, hedge funds once again set off a new round of short -selling waves.

According to Breakout Point, a short -term information website that tracks the short -term European company, the world's largest hedge fund -Qiaoshui Fund is short -scale European companies. Since June, Qiaoshui Fund has established a short position worth about $ 5.7 billion in 17 European companies, betting on these European companies' stocks, including banks in Paris, Pharmaceutical Giants, Bayer, Financial Services, and semiconductor manufacturer ASML Wait, the short position of the bridge water accounts for about 0.5%of the stocks of the above -mentioned large European companies.

At the same time, Jim Chanos, a large-scale short-selling hedge fund manager of Wall Street, said that a large number of short positions have been established in his investment portfolio, mainly for those US listed companies with almost no profit but still reach 30-40 times cash flow. Essence

He also emphasized that the high interest rate environment will bring "no different attacks" to U.S. stocks. Even electric power companies, consumer companies and low price -earnings ratio listed companies that belong to defensive assets will also encounter a decline in similar technology stocks under the high interest rate environment. Trend.

A Wall Street Hedie Fund Manager revealed to reporters that after the Fed's 75 -basis points, the short -selling European and American stock market has become a new investment darling of hedge funds. The reason is that the first is that the global central bank ’s high interest rate hike will increase the risk of global economic recession, causing the European and American stock markets to face a greater valuation back pressure. Now that it is accelerating the return of valuation, the risk of economic recession has led to a lack of profit for listed companies for large -scale stock repurchase, which has lost important support for European and American stocks.

"At present, some Wall Street Hedie Fund's European and American stock short positions account for 15%of the entire investment portfolio, which is much higher than the normal level-5%-8%." He pointed out.

From the perspective of the Wall Street hedge fund manager, it indicates that more and more hedge funds are "planning" for economic recession.

The reporter asked a bridge water fund to verify that the European stocks currently held by Qiaoshui Fund, and the other party said that there is no specific information that can be disclosed at present.

It is worth noting that Ruida Dalio, the founder of Bridge Water Fund, said on June 16 that he was buying assets that resisted inflation, avoided bond assets, and national assets with domestic conflicts or international geopolitical risks.

The person in charge of a Wall Street Macro Economy Hedie Fund believes that most hedge funds currently also adopt similar short -selling strategies -under the influence of the global central bank's expected increase in interest rate hikes, bond assets are no longer reliable assets, but instead, they are instead. The victory of short -selling high -valuation assets is even greater.

Hedge funds are also willing to sell short European stock markets

Before and after the Fed's significant interest rate hikes, US stocks have experienced a sharp decline. Among them, the Dow Jones Industrial Index has fallen below 30,000 points since January 2021. The S & P 500 has fallen into a technical bear market.

Behind this is the hedge fund's continuous "helping the flames" of U.S. stocks.

"Today, the investment model of most Wall Street hedge funds will significantly raise the proportion of the negative correlation between interest rates and US stock trends -as long as the Federal Reserve is stored in 75 basis points in continuous interest rate hikes, their investment model will automatically issue short -selling sales. The operating signal of US stocks. "The manager of the Wall Street hedge fund revealed to reporters.

A US -stock broker revealed to reporters that the Wall Street Hedge Fund's short -selling US stocks have caused CBOE to see the decline/bullish option ratio to the highest level since 2020.

In addition, more and more hedge funds are continuing to buy Cambria Tail Risk ETFs, known as the "Black Swan Fund", indicating that they think they are increasingly increasing.

Reporters have learned that more and more hedge funds are willing to bet on European stocks. The reason is that in terms of economic fundamentals, European economic growth is inferior to the US economy; as far as inflation pressure is concerned, the upgrade of Russia and Ukraine's conflict is putting pressure on Europe's larger prices of energy and agricultural products.

"This has made hedge funds gambling in Europe more likely to fall into the risk of economic stagflation, leading to a bigger decline in the European stock market." The US stock broker analyzed. In addition, the European Central Bank held an emergency meeting to discuss urgent rescue of high -debt European countries when necessary (avoiding the outbreak of new sovereign debt crisis), and even made hedge funds see the huge risks facing the European economy.

From the perspective of many hedge fund managers, this is also the main reason why Bridge Fund dares to make huge sums of money to sell European stocks, but their short -selling European stocks are significantly different from bridge water -compared to bridges and water, they are heavy. For large companies stocks, they bought the European Stock 50 Index Futures short -selling.

A European hedge fund manager revealed to reporters that the bridge water fund is actually the same as them -because the 8 large European companies stocks that have a short -term sales of bridges are precisely the European Stock 50 Index.

The reporter learned that as early as April, Qiaoshui Fund had already started buying a basket of credit debt derivatives involved in short -selling European and American corporate bonds. Phenomenon.

It is worth noting that while the currency short -selling trendy trendy is that at the same time as the large -selling European and American stocks, many hedge funds have suddenly lacked interest in short -selling currency.

"This is indeed abnormal. In the past, when hedging funds premonitioned the risk of economic recession, currency would use currency as an important short -selling object." The above European hedge fund manager bluntly said to reporters. The reason why hedging funds did not sell short -selling currencies were mainly affected by two major factors. One was that most countries followed the United States to raise interest rates sharply, which made them difficult for them to speculate on the disadvantages of the spread and sold short -selling in some countries. More and more countries have recently released signals to intervention in the exchange market in the exchange market, which also causes them to taboo.

However, hedge funds still quickly found short -selling sniper targets -the yen. As Japan continues extremely loose monetary policy and the Japanese economy is facing a greater risk of slowing down, more and more hedge funds have begun to bet on the yen against the US dollar exchange rate will fall below the 150 integer mark in the short term, which is more than 10 from the current exchange rate. %.

"However, the short -selling method of these hedge funds is also special." A foreign exchange broker revealed to reporters that on June 16, many hedge funds suddenly bought a 10 -year Japanese Treasury bond, which caused its yield twice to break through twice. The 0.25%limit set by Japan to test whether the Bank of Japan will take currency tightening measures.

As the Bank of Japan decided to continue the existing extremely loose monetary policy on June 17 and control the upper limit of 10 -year Japanese Treasury yields at 0.25%, these hedge funds suddenly increased their short -selling yen operations. At 19:00 on June 17, Beijing time, the exchange rate of the yen to the US dollar fell sharply to 134.56, which was only one step away from the previous 24 years.

"Behind this is that the hedge fund discovered that the Bank of Japan continued its extremely relaxed monetary policy by tentatively, and began to determine that the Bank of Japan may not interfere with the exchange rate of the stable yen in the exchange market, and they have boldly increased their short -selling yen." The foreign exchange broker pointed out. Nowadays, more and more hedge funds will concentrate on the short -selling of currencies that bet on the economic recession on the yen, thereby increasing the success rate of currency speculative short -selling.

The reporter learned that the currencies of high -debt emerging markets have also received close attention -as long as the central banks of these countries followed the Fed with a sharp interest rate hike, the risk of their country's economic recession increased and the risk of repayment of foreign debt was heating up. Solding arbitrage.

- END -

The development of the tea industry in Longnan, Gansu entrusted the rich in golden leaves

In the midsummer season, in Longnan, Gansu, and in the territory of Kang County, the tea gardens in Manshan were busy. Tea farmers who had already ended spring tea were carried out tea trees trimming,

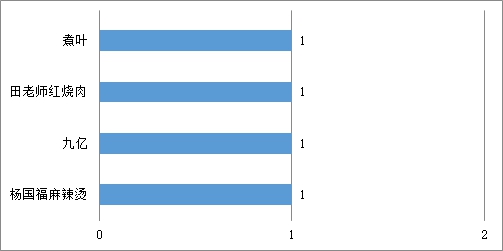

Beijing Consumers Association Publicity Food and Safe Catering Store: Yang Guofu Malace and Hotel, etc.

Zhongxin Jingwei, June 16th. According to the website of the Beijing Consumers Ass...