Cambrian lost 2.58 billion years ago in half a year ago to raise 2.58 billion yuan to increase by 2.65 billion

Author:China Economic Network Time:2022.08.15

China Economic Net, Beijing, August 15th News Cambrian (688256.SH) The 2022 semi -annual report disclosed on Friday night showed that the company achieved operating income of 172 million yuan in the first half of the year, an increase of 24.60%year -on -year; The net profit was -622 million yuan, the same period of -392 million yuan in the same period last year; the net profit attributable to shareholders of listed companies was -757 million yuan, which was -515 million yuan in the same period last year. The net cash flow was -833 million yuan, which was -539 million yuan in the same period last year.

Cambrian said that the operating income of this period increased by 33.914 million yuan compared with the same period of the previous year, mainly due to the growth of the cloud product line business; the net profit attributable to shareholders of listed companies expanded a loss of 23,082 million yuan year -on -year. It is mainly caused by the company's R & D expenses increased by 21,379,700 yuan from the same period last year. During the reporting period, the company continued to increase the research and development of new products, introduced R & D talents, and the number of R & D personnel and average salary increased compared with the same period of the previous year. At the same time There are also some increases. The net profit attributable to the shareholders of listed companies to the shareholders of the listed company has expanded a loss of 24,21.435 million yuan year -on -year. In addition to the factors that affect the changes in net profit above, it is mainly the effect of confirming other income from the same period of the previous year. The net cash flow generated by operating activities decreased by 294.44 million yuan year -on -year. It was mainly the company actively introduced outstanding talents. Personal salary -related expenditure increased by 17,721,200 yuan, an increase of 42.15%year -on -year. Purchasing expenditure increased by 11,39,900,500 yuan, an increase of 50.26%year -on -year.

The Cambrian was listed on the Shanghai Stock Exchange Science and Technology Board on July 20, 2020. The number of public offering was 4010 million shares, and the issuance price was 64.39 yuan/share. The fourth trading day of listing, also known as on July 23, 2020, reached 297.77 yuan, and then fell all the way (there was no dividend distribution after the Cambrian listing). Cambrian fell below the issue price on March 16, 2022, with a minimum of 62.17 yuan. As of the closing of last Friday (August 12), Cambrian's stock price was reported at 67.65 yuan.

The total amount of funds raised by the Cambrian IPO was 2.582 billion yuan. After deducting the issuance costs, the net raised funds were 2.498 billion yuan. The final raised funds raised by the Cambrian period were 303 million yuan less than the original plan. The prospectus disclosed by Cambrian on July 14, 2020 shows that the company intends to raise 2.801 billion yuan, which is used for the new generation of cloud training chips and system projects, a new generation of cloud reasoning chips and system projects, a new generation of edge -end artificial artificial artificial artificial manual Smart chips and system projects, supplementary funds.

The sponsors (main underwriters) listed in Cambrian are CITIC Securities Co., Ltd., and the sponsorship representatives are Peng Jie and Wang Bin. company.

Cambrian's first public offering of new shares was 84.3661 million yuan (excluding value -added tax). Among them, CITIC Securities Co., Ltd., China International Financial Co., Ltd., Guotai Junan Securities Co., Ltd., and Anxin Securities Co., Ltd. received underwriting and sponsorship costs of 63.688 million yuan.

On the evening of June 30, 2022, Cambrian released the A -share stock plan to specific objects in 2022. The company's total amount of shares raised to specific objects this time does not exceed 2.650 billion yuan (including the number). The net is intended to invest in the advanced process platform chip project, the stable process platform chip project, the technology research and development project for the universal intelligent processor for emerging application scenarios, and supplemented the mobile funds.

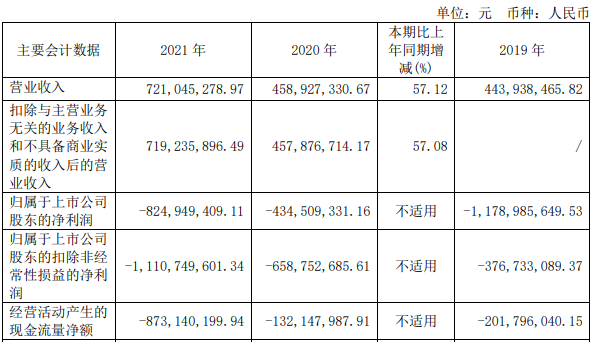

After listing, Cambrian performance continued to lose money. In 2020 and 2021, Cambrian's operating income was 459 million yuan and 721 million yuan, respectively; net profit attributable to shareholders of listed companies was -435 million yuan and -825 million yuan, respectively; The net profit of sexual profit and loss was -659 million yuan and -1111 million yuan, respectively; the net cash flow generated by operating activities was -132 million yuan and -873 million yuan, respectively.

- END -

Sichuan Qingchuan: Beef beef and sheep industry "beef" up

Sichuan Province is a large agricultural province and an important nationwide cow ...

CICC and Haitong Securities Receiving Supervision Alert Letter!Involved Bonds incident

[Dahecai Cube News] On August 11, the Liaoning Securities Regulatory Bureau adopted a warning letter supervision measure on China International Financial Co., Ltd. and Haitong Securities Co., Ltd..Aft