Xia Lei: Why did social merit in July reverse?

Author:Zhongxin Jingwei Time:2022.08.15

Zhongxin Jingwei, August 15th: Why did social merit in July reverse?

Author Xia Lei Guohai Securities Research Institute joint director

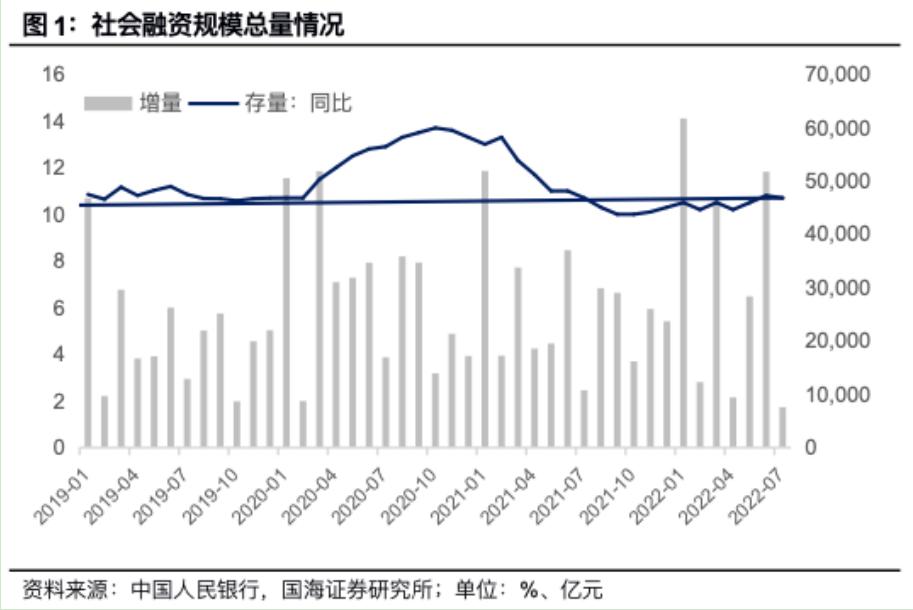

The central bank announced the preliminary accounting financial data in July: At the end of July, the scale of social financing was 33.49 trillion yuan, an increase of 10.7%year -on -year; 756.1 billion yuan in the month, 319.1 billion yuan less than the same period last year; M2 balance was 25.781 trillion yuan , A year -on -year increase of 12%; M1 balance of 6.618 trillion yuan, an increase of 6.7%year -on -year.

In July, Social Sunac's 6 -year low, the structure weakened

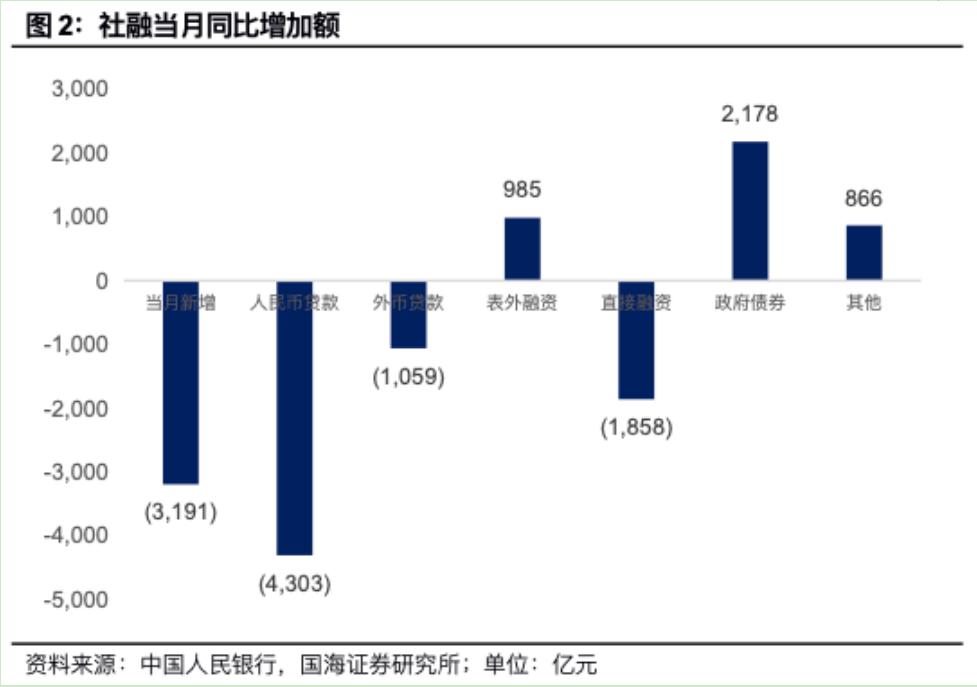

In July, social fusion increased by 10.7%year -on -year, and 0.1 percentage points fell at the top of the growth rate. Affected by the weakening of the real economy and the overdraft overdue last month, social finances increased by 756.1 billion yuan in month, an increase of 319.1 billion yuan year -on -year, which was significantly lower than market expectations (Wind consistency prediction was 1.39 trillion yuan). The main dragging items are RMB loans, corporate bonds and foreign currency loans, which are less than 433 billion yuan, 235.7 billion yuan and 105.9 billion yuan from year -on -year. 217.8 billion yuan, 98.5 billion yuan and 86.6 billion yuan.

In response to other items, we are expected to be mainly due to the increase in loans caused by small and medium -sized banks to dispose of non -performing assets. In the first half of the year, a total of 670 billion yuan in non -performing assets for small and medium -sized banks in the country, an increase of 164 billion yuan year -on -year.

M1M2 scissors difference is slightly narrowed, the social merger growth rate continues to be lower than M2. In July, M2 increased by 12%year -on -year, M1 increased by 6.7%year -on -year, an increase of 0.9 and 0.6 percentage points from the previous month. Essence The growth rate of social finances was lower than M2 for the fourth consecutive month, and the difference in scissors expanded to -1.28%.

July data is significantly lower than the main reasons for expected

First, the six -year node credit intensity has increased significantly, pre -pre -pre -pre -saving July credit demand, and issuing a large number of short -loan derivatives at the same time.

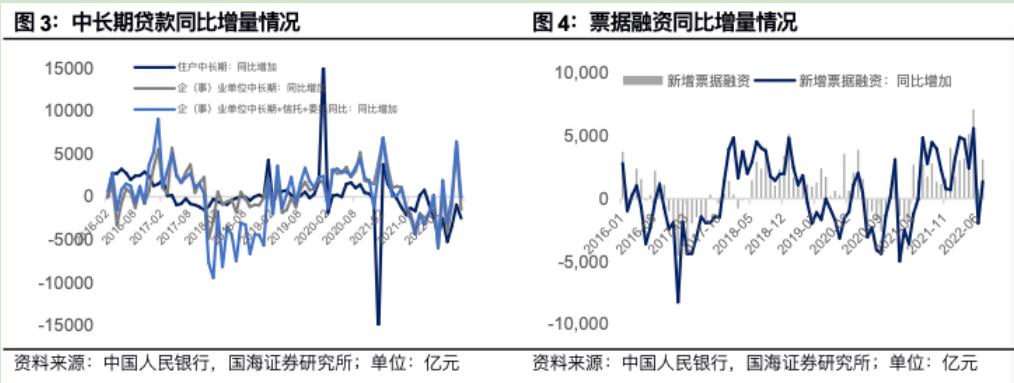

One of the main supports of social merges in June was RMB loan, which increased by 735.8 billion yuan in the month, and in July RMB loan increased by 430.3 billion yuan year -on -year. The loans of financial institutions in June were significantly enhanced, and the credit demand in July was pre -saved in advance. In addition, short -term loans in June increased by 4620.08 billion yuan year -on -year, and in July, a year -on -year decrease of 132.3 billion yuan. We believe that it may be that financial institutions in June increased short -term loans. short-term loan.

Second, at the end of June, the local government's special debt quota has been basically issued, and the growth momentum of social integration is insufficient.

In June, government bonds increased by 870.8 billion yuan year -on -year, and in July, it was only 217.8 billion yuan in July. It is mainly active in fiscal policy. At the end of June, the cumulative issuance of special bonds of local government issued 3.41 trillion yuan, which was few in this year. In July, the issuance of government bonds reached a new high, reaching 1.05 trillion yuan. The net financing of 394.038 billion yuan in the month, an increase of about 535.8 billion yuan year -on -year, supporting government bonds to increase slightly year -on -year.

Third, the adverse factors continued in the early stage, and the market expectations were not fundamentally improved.

The above phenomena are mainly manifested in the weak risk preferences and the demand for the real economy. The medium- and long -term loans of enterprises (affairs) increased 345.9 billion yuan in medium- and long -term loans, an increase of 147.8 billion yuan year -on -year. On the contrary, bill financing increased by 313.6 billion yuan this month, an increase of 136.5 billion yuan year -on -year; real estate sales continued to slump. In July, residents' medium- and long -term loans increased by 148.6 billion yuan, which was less than 248.8 billion yuan year -on -year. Fall, the issuance of urban investment bonds is limited. In July, the net financing of urban investment bonds increased by about 140 billion yuan year -on -year. Federal Reserve ’s interest rate hikes and other factors have caused the average exchange rate of the RMB against the US dollar to depreciate, the cost of foreign currency loans has increased. In July, foreign currency loans decreased by 113.7 billion yuan in the month, a year -on -year decrease of 105.9 billion yuan.

There is no need to worry too much about social finance data in July

Affected by factors such as rushing and financial payment, social finance data will naturally show a periodic change. From January to July, the social integration increased by 2.88 trillion yuan year -on -year, and the overall credit environment was loose. With the steadyness of the real economy, the industrial structure is constantly adjusted, the quality of economic development has continued to improve, the endogenous growth momentum is gradually released, and the use of sustainability of enterprises and residents' funds will be strengthened, and the future development foundation will be more stable.

Just as the central bank's "Evolution and Trends of the Credit Structure and Trends in recent years" in the column of the monetary policy report column is less than expected to increase credit increases. This is a reflection of adapting the economy to enter the new normal, which does not mean that the financial support of the financial support is weakened. "(Zhongxin Jingwei APP)

This article was selected by the Sino -Singapore Jingwei Research Institute. The copy of the work produced by the selected work, the copyright of the work, is not authorized by any unit or individual. The views involved in the selected content only represent the original author and do not represent the view of the Sino -Singapore Jingwei.

Editor in charge: Li Huicong

Pay attention to the official WeChat public account of JWVIEW (JWVIEW) to get more elite financial information.

- END -

The price of gold has fallen, and many banks tighten your precious metal business. Experts: Gold is more important to functional functionality

Jimu Journalist LeiharaRecently, international gold prices have continued to decli...

Help "Novice" to open the "blocking point"!"First Loan Center" in Anshan area launched

Recently, with the coordination of multiple departments such as the Municipal Gove...