New model of growth blue chip!The leaders of the hundred industries are fulfilled.

Author:Discovery net Time:2022.08.15

The Outstanding Representative of the A -share core assets "CSI 100 Index" has recently evolved to version 2.0. With the five major upgrades, it has become the new favorite of the "ETF Factory" product line layout. The recently listed Huabao CSI 100ETF (562000), which is the "CSI 100 Index" after the upgraded upgrade. After listing, since August 4, with the recovery of the A -share leader market, Huabao CSI 100ETF (562000) has also shown a "V" type rebound.

Enshio! Huabao CSI 100ETF rebound rebound

In June, the "CSI 100 Index", which has the reputation of "A -share Blue Chips" and "Beautiful 100", ushered in the maximum upgrade of 16 years. This adjustment is "reborn". The recently listed Huabao CSI 100ETF (562000), that is, the "CSI 100 Index" after the upgrading and upgraded, Huabao CSI 100ETF (562000) is also the largest public fund -raising fund in China.

The CSI 100 Index Ruction of the CSI has been replaced by 45 constituent stocks, which greatly reduces the weight of the traditional industry. It is newly included in dozens of emerging growth leaders such as chips, photovoltaic, energy storage, new materials, military workers, electronics, etc. More balanced, including "100 billion chip faucets" SMIC, Zhaoyi Innovation, Northern Huacuchu, "Photovoltaic Last" Central Co., Ltd., "Lithium Electricity Last" Ganfeng Lithium, Huayou Cobalt, "Electronic Last" song In the new economic leader of "Military Organization", "Military Organization".

According to Wind data statistics, the average median ROE and ROE median in 2021 after the CSI 100 Index was adjusted, as high as 21.96%and 19.67%, an increase of 5.86%and 5.85%from before the position. After the upgrade of the ingredients of the 100 indexes of the CSI, the growth of growth has been significantly improved. In addition, data from the official website of the CSI Index show that as of June 13, 2022, the top ten of the 10th Index of the CSI accounted for over 38%. In the Ming Kangde and other hard technology leaders, the industry leaders have both breadth and depth.

It is worth mentioning that the ingredients of the CSI 100 indexes after the positioning are "interconnected." According to Wind data statistics, as of June 30, 2022, the total market value of 100 ingredients of China Securities' 100 equity shares was held by the Land Stock Connect, accounting for over 54%of its total market value of A shares. As of the end of the second quarter of 2022, 72%and 60%of the TOP 50 stocks of the A -share market value of A shares were 100 ingredients of CSI. It can be seen that the CSI 100 Index ingredients coincide with the "smart money" buying direction, which greatly enhances its attractiveness to overseas funds.

The CSI 100 Index is also "the first CSI core broad -foundation index that is included in the ESG index", which increases the ESG screening of the sample. As we all know, the ESG index focuses on the standardization of the operating behavior of listed companies and the performance of social responsibility, which helps reduce operating risks and improve the quality of assets.

All in all, the five major advantages of "equilibrium configuration", "growth and upgrading", "industry leader", "interconnection", and "responsible investment" are perfectly fitted with the five major characteristics of one body. The changing trend of the industry is a typical representative of "A -share Core asset 2.0".

A -share core asset 2.0! Top Ten ETF Manager Professional escort

As one of the A -share classic broad -based broad -based indexes, the CSI 100 Index reflects the overall performance of the core leading listed company of the Shanghai and Shenzhen market, and is positioned in Shanghai, which reflects the Shanghai and Shenzhen market, the Shanghai and Shenzhen markets, large medium markets and small disk companies. Deep 300, CSI 500, CSI 800, and CSI 1000 have differentiated.

From the historical performance, Wind data statistics, the last eight years from June 1, 2014 to May 31, 2022, the CSI 100 Index has increased by 101.07%, far exceeding the Shanghai Stock Exchange 50 and Shanghai with the Blue -chip Broad -based Index 50 and Shanghai. Deep 300 performed during the same period. From the last 5 full year from 2017 to 2021, the net assets yield (ROE) and dividend rates of the CSI 100 Index are significantly better than the mainstream index of A shares such as CSI 300, CSI 500, and CSI 1000 Performance.

In recent years, my country's economy has shifted from high -speed growth to high -quality development. At present, most industries in my country are less concentrated than mature European and American economies. With the development of the economy, the share of leading companies in some industries is expected to continue to increase, and the strong is Hengqiang. In recent years, the A -share investment style has transformed into a preferred leading company. It reflects this expectation.

Among the many fund companies, Huabao Fund has made industry characteristics and business advantages on the ETF track due to early layout and large investment. From 2019 to 2021, Huabao Fund was awarded the "Top Ten ETF Managers" on the Shanghai Stock Exchange for three consecutive years. In July 2021, the Huabao Fund won the "Gold Fund Passive Investment Fund Management Company Award" in the 18th "Gold Fund" award selection organized by the Shanghai Securities News. According to statistics from Galaxy Securities, as of July 31, 2022, the total scale of A -share stocks of Huabao Fund's A -share stock category reached 57.288 billion yuan, ranking 6th in the entire market, full coverage -Broad -based index fund, ETF, Smart Beta index product Essence

The Huabao Fund Index R & D investment department is one of the longest and largest index investment teams in the industry management index fund. At the same time, the largest domestic CSI 100 Index Fund is managed. Fund regular reports show that Huabao CSI 100 Index A (240014) was established on September 29, 2009. As of June 30, 2022, the cumulative yield rate of Huabao CSI 100 Index A has reached 86.31%since its establishment. In the performance benchmark, excess returns reached 37.34%, and the Shanghai Stock Exchange Index rose only 22.98%at the same time. At present, Huabao CSI 100ETF (562000) has already been listed on the Shanghai Stock Exchange. Investors can make a convenient buying and selling and redeeming transactions in the secondary market like buying and selling stocks. One finger packages the core leader of the entire industry industry in the entire field of A shares, and shares the high -quality investment weapon for China's new economic development dividends.

Note: At present, there are 14 public funds (including ETF and off -site index funds, excluding ETF connection funds) with the domestic tracking 100 index. August 1), the largest ones are 100ETF of Huabao CSI.

Data source: Galaxy Securities, Fund regular reports, Wind. The CSI 100 Index was upgraded at 2022.6.13, involving 45 stocks of component stocks. The ROE, dividend rate, and cumulative gains of the index are the historical data before the CSI 100 Index 2022.6.13. After the positioning of the position, the component of the CSI 100 indexes changed, and its historical performance did not indicate the future performance of the index. The individual stocks mentioned in the article are all the ingredients of the CSI 100 Index. The index component stocks are only displayed. The individual stock description does not act as an investment proposal in any form, and does not represent the position information and transaction trends of any fund of the manager. Huabao CSI 100 Index Fund 2017-2021 annual net value growth rate and its performance comparison benchmark growth rates were 33.33%, -18.91%, 40.88%, 38.43%, -6.14%and 28.58%, -20.85%, 33.66 33.66 %, 22.93%, -9.95%. Huabao CSI 100 Index Fund's performance comparison benchmark is the yield of the CSI 100 Index × 95% + the return on the bank's interbank deposit yield × 5%.

risk warning:

The index of Huabao CSI 100 Trading Open Index Securities Investment Fund is the CSI 100 Index. The base date of the index is 2005.12.30 and the release date is 2006.5.29. This product is issued and managed by Huabao Fund. The agency of the agency shall not bear the responsibility for investment, redemption and risk management of the product.

Investors should carefully read the legal documents such as the Fund Contract, the Recruitment Manual, and the Fund Product Information Outline, and understand the fund's risk income characteristics, and choose products that are compatible with their own risk tolerance. Fund's past performance does not indicate its future performance, and fund investment needs to be cautious!

The fund manager's risk level of this product is rated as R3 (medium risk). Sales institutions (including fund manager direct sales agencies and other sales agencies) conduct risk evaluation of the fund in accordance with relevant laws and regulations. Investors should pay attention to the appropriate opinions issued by the fund manager in time. And the evaluation results of the fund product risk level issued by the fund sales agency shall not be lower than the risk -level evaluation results made by the fund manager. There are differences in fund risk income characteristics and fund risk levels due to different considerations. Investors should understand the fund's risk income, and choose fund products with their own investment destination, investment experience and risk tolerance and bear risk.

Files do not constitute any investment suggestions or commitments. Huabao Fund Management Co., Ltd. (hereinafter referred to as "Huabao Fund" or "Fund Managers") or relevant departments and employees of Huabao Fund shall be responsible Essence

The fund manager promises to manage and use fund assets with the principles of honesty, trustworthiness and diligence, but not guarantee that the fund is profitable or the minimum return. The fund's past performance and its net worth do not indicate its future performance. The performance of other funds managed by the fund manager does not constitute a guarantee of the performance of the fund. The fund manager reminds you that the "buyer is responsible" by the fund investment. After making investment decisions, the fund operation status and the investment risk caused by the changes in the fund's net worth shall be borne by yourself. Fund managers, fund custodians, fund sales agencies and related institutions do not make any commitments or guarantees to fund investment income.

- END -

The Fed keeps putting the "eagle" gold price weak oscillation

On June 20th, the international gold price was slightly affected by the Federal Re...

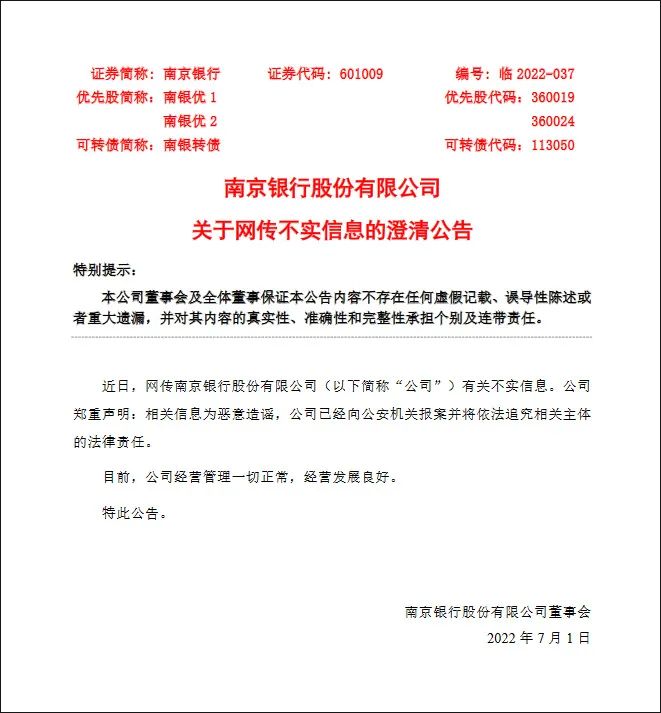

Nanjing Bank report

According to the website of the Shanghai Stock Exchange, on July 1, Nanjing Bank i...