MLF interest rate accident "interest rate cuts" 10bp previously added a new 6 -year low in Society Sunac in July

Author:Daily Economic News Time:2022.08.15

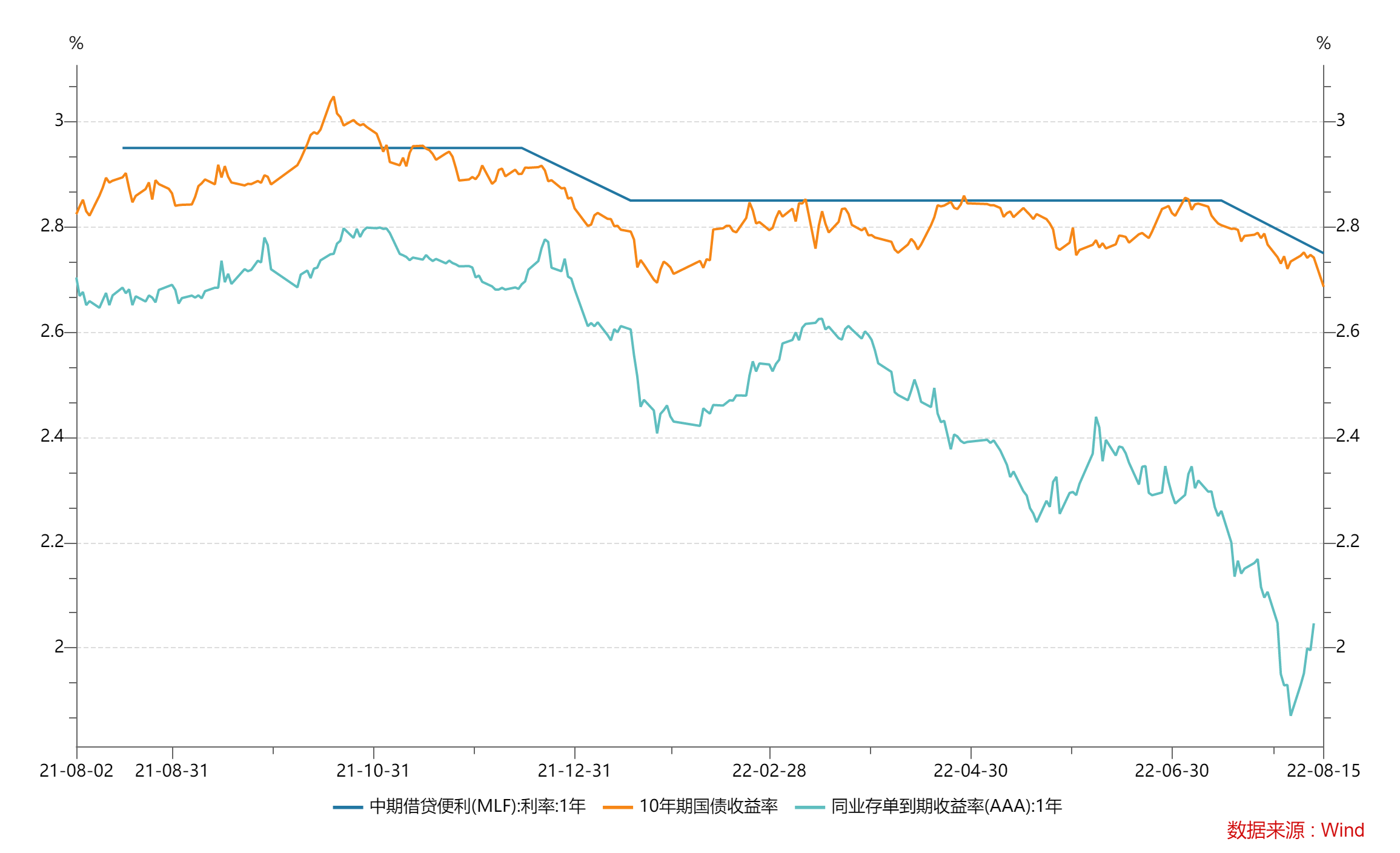

On August 15th, the central bank announced that in order to maintain the banking system reasonable and abundant, today's 400 billion yuan intermediate borrowing facilities (MLF) operation and the 2 billion public market reverse repurchase operation fully met the needs of financial institutions. The reporter noticed that the two bid interest rates decreased by 10bp, which were reported to 2.75%and 2.0%, respectively.

"Daily Economic News" reporter noticed that the MLF expiration scale in August was 600 billion yuan, and the central bank's investment scale was 400 billion yuan. This month's MLF operation was a reduction of price reductions. Prior to this, the central bank has maintained equivalently parity sequels for many months.

Zhou Maohua, a macro researcher at the Everbright Bank Financial Market Department, said in an interview with reporters that the amount of MLF reduced price in August mainly released signals that the central bank cared for the real economy, stabilization of currency, and wide credit. Judging from the recently announced data, the year -on -year growth rate of M2 has reached a 6 -year high. However, new credit and social integration have slowed over expectations, reflecting that the current currency supply has remained sufficient, and the demand for the real economy financing is weak.

"On the one hand, financial data reflects that the current currency supply is sufficient, and the central bank's shrinkage sequels MLF to stabilize the currency supply. In addition, the market liquidity has been abundant in the near future, leading to a decline in market interest rates.利率下方,也一定程度削弱机构对MLF需求;另一方面,金融数据反映国内实体融资需求偏弱,央行调降MLF政策利率,金融机构进一步降低实体经济融资成本,激发微观主体活力,促进消费、 Investment has recovered steadily. "Zhou Maohua explained.

MLF interest rate will be reduced by 10 BP after half a year

After the policy cut in January, the MLF interest rate was lowered for the first time this month.

On August 15, the central bank launched a 1 -year MLF operation of 400 billion yuan, with a interest rate of 2.75%, which was 2.85%before. At the same time, the central bank conducted an 2 billion yuan 7 -day reverse repurchase operation today, with a bid interest rate of 2.00%, which was 2.10%before. Both interest rates were reduced by 10 BPs from the previous period.

Analyzing the cause of the "spicy powder" interest rate, Wang Qing, chief macro analyst of Dongfang Jincheng, believes: "First of all, the recent macroeconomic restoration momentum is relatively slow, and monetary policy is required to further develop. Macro policies, including monetary policy, take time in time to increase the control of counter -cyclical regulation and moderate stimulation of total demand. This is the main reason for the interest rate cut in August. "

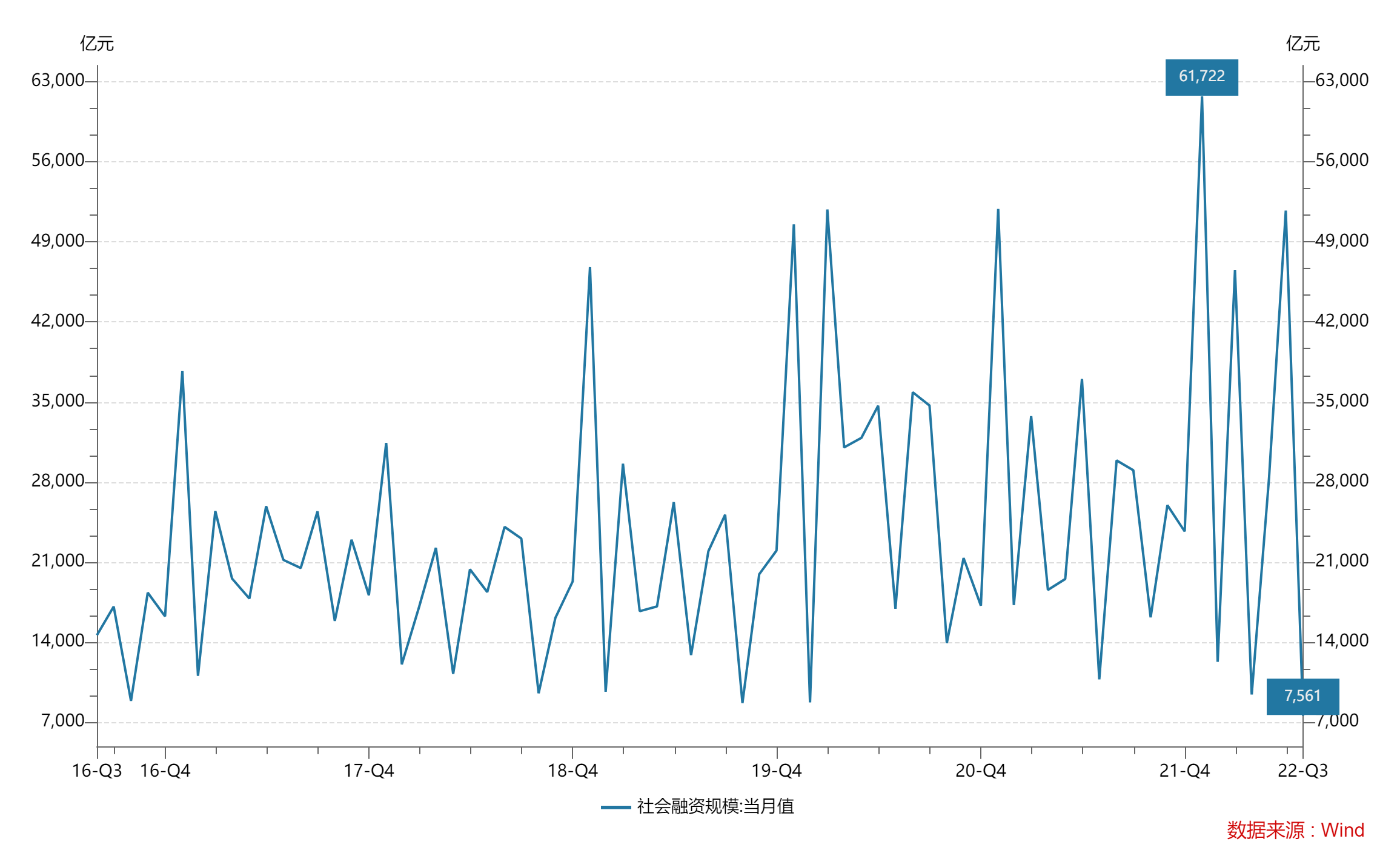

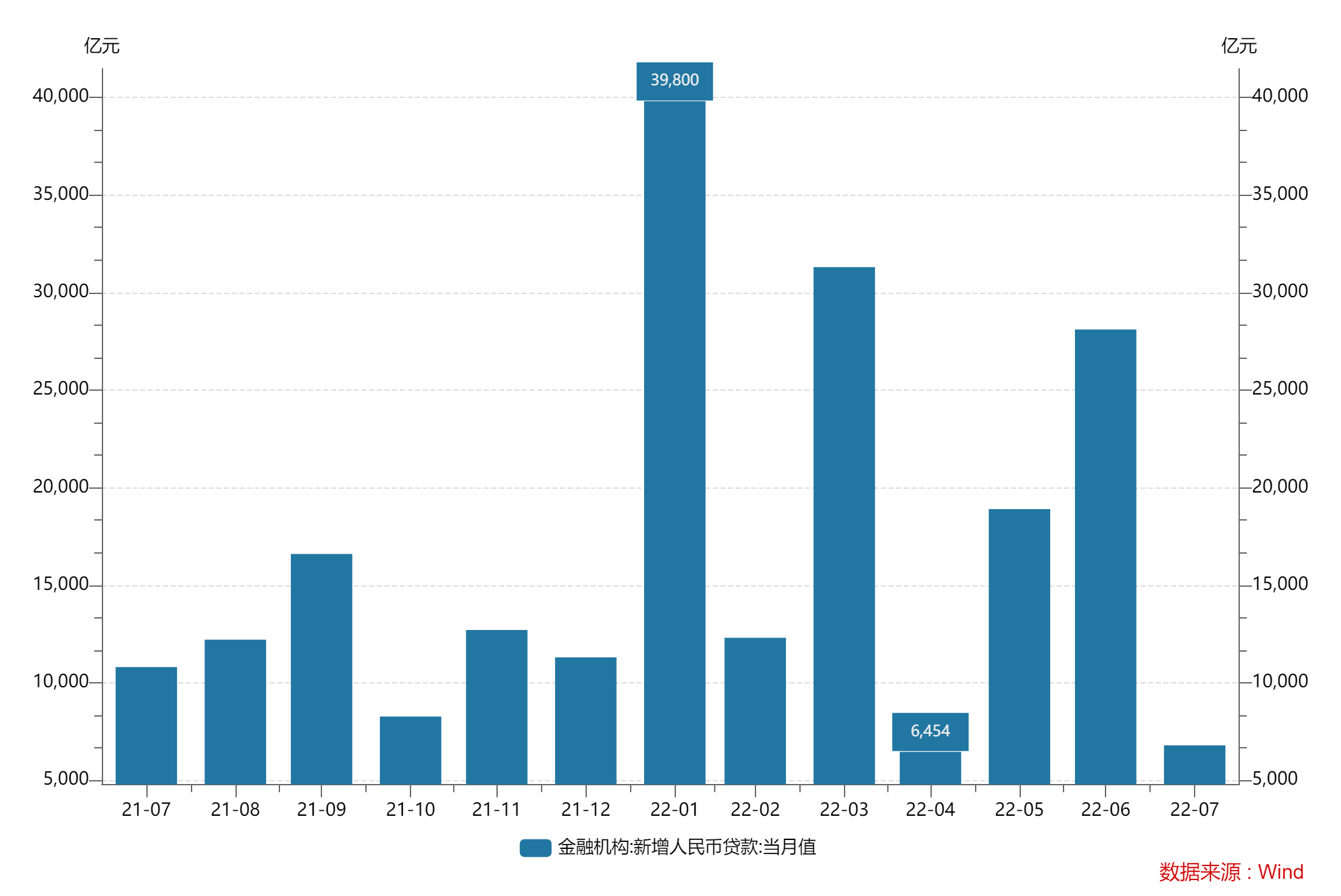

Earlier, the central bank announced in July financial data. The growth rate of M2 continued to rise, but the increase in new loans and social merges fell sharply. In July 2022, the increase in social financing increased by 756.1 billion yuan, 319.1 billion yuan less than the same period last year, a 6 -year low. In addition, RMB loans increased by 679 billion yuan in July, an increase of 404.2 billion yuan year -on -year.

In Wang Qing's opinion, the performance of financial data in July is not as expected to be reduced by MLF interest rate. He said: "In July, the scale of new credit and social integration fell sharply, and the year -on -year growth rate also declined, and the wide credit process reproduced twists and turns. The main reason behind it was that the current economic restoration progress was slow and the demand for real economy financing was insufficient. In August, interest rate cuts indicated that the interest rate cuts indicated in August. By reducing financing costs to stimulate the demand for the real economy financing, it is becoming an important force for the current policy. Finally, the property market has turned cold again since July, and the interest rate reduction of the mortgage loan through policy interest rate reduction has become a reversal market expectation, promoting the property market as soon as possible as soon as possible as soon as possible The key to recovering. "

On the impact on the market after interest rate cuts, Wang Qing said: "August policy reduction is implemented, which fully shows that the current monetary policy is based on steady growth. Domestic structured inflation pressure and overseas central bank tightening have not faced the domestic central bank Policies and interest rate cuts constitute substantial obstacles. This also means that the current liquidity of market liquidity that is currently in a state of partiality will continue for a period of time. Next, the regulatory level will increase the assessment and promote wide currency to wide credit conduction. "

Affected by the favorable interest rate reduction of policy interest rates, the bond market response was strong. The reporter noticed that the main contracts of the ten -year, five -year, and two -year Treasury bond futures have risen sharply.

Screenshot source: Wind

Zhou Maohua believes that financial data in July shows that the demand for real economy financing is weak. In addition, the MLF policy interest rate is an anchor of the LPR quotation rate. The MLF interest rate will be reduced by the LPR interest rate this month. Accelerating the recovery of the real economy will help boost the market optimistic expectations for the market.

Analyst: There is no suspense in August LPR quotation

The reporter noticed that the size of the MLF expired this month was 600 billion yuan, and the central bank invested 400 billion yuan. This month's MLF operation was a reduction of price reductions. However, just a few months ago, the central bank continued the equivalent sequel model.

Regarding why MLF shrinks, Wang Qing said that the MLF shrinkage in August broke the equivalent sequel model of the previous four consecutive months, which met the market's general expectations. The background is the current market liquidity at a significant level. In July, the average yield of the 1 -year interbank deposit deposit in commercial banks (AAA) was 2.21%. Since August, the indicator has further declined, which has significantly lower than the 1 -year MLF operating interest rate. As a result, the MLF bidding volume of the first -level dealers in August will not be ruled out, and the MLF shrinkage sequel will be driven.

Wen Bin, chief economist of China Minsheng Bank, said that MLF gently shrunk by MLF for 200 billion yuan in August, which meets market expectations and meets the bank's accompanying city and central bank's "passive" recovery. However, compared to the previous round of MLF shrinkage, the scale of the reduction is not large, indicating that the central bank does not want to release the signal of excessive tightening monetary policy, and it will still maintain a state of reasonable and abundant basic currencies. Looking forward to the trend of monetary policy at the next stage, Wen Bin said that due to the large amount of MLF expiration in September to December, in the current environment of abundant liquidity, subsequent MLFs may continue to shrink and continue. With the slowdown of the Federal Reserve ’s interest rate hike rhythm and the policy tone of“ I ’m dominated”, the possibility of cutting interest rates again does not rule out. The probability of decline in the third quarter is not high, but if the real estate financing has improved in the fourth quarter, the process of wide credit is accelerated. With the recovery of structural liquidity shortages, it provides long -term liquidity to the banking system and further reduces liabilities for liabilities. The cost is not ruled out that 0.25 percentage points will be performed in a timely manner.

When predicting whether LPR will be reduced simultaneously this month, Wang Qing believes that the MLF interest rate in August means that the price of LPR quotation in the month has changed. In addition suspense. Considering that the recent reflection of the property market, the mortgage market tilted towards the lender, and it does not rule out the possibility of a 5 -year LPR quotation exceeding 10bp.

Wen Bin believes that after the decline in interest rates of the policy, the possibility of simultaneously lowering LPR in the first and 5 -year LPR of the month, but the probability of the asymmetry of LPR more than 5 years is greater.

Daily Economic News

- END -

Fang Xinghai: The CSRC will maintain and develop the listing channels for overseas markets and maintain steadily growth of the IPO scale | Happy News

Text/Song JieOn August 5th, the China -Foundation Association announced that at th...

"Chengdu manufactured" Wanjia Industrial Enterprise Promoting Consumption Insurance Growth Cloud Sales Hundred Days of Times Start

Today, with the leaders of the Chengdu Municipal Government, the Chengdu Economic ...