Heavy!The central bank suddenly "interest rate cuts" 10 basis points, and the mortgage interest rate will be reduced again?Employment, property market, consumption, latest data announcement

Author:Daily Economic News Time:2022.08.15

Today (August 15), the central bank adjusted the medium and short -term policy interest rates simultaneously.

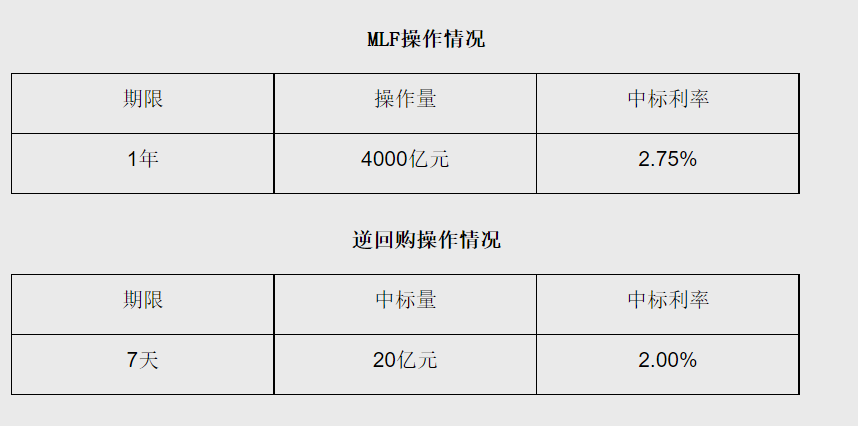

The People's Bank of China performed a 1 -year MLF operation of 400 billion yuan today, with an interest rate of 2.75%, and the previous time was 2.85%. 600 billion yuan of MLF expired this month.

The People's Bank of China conducted an 2 billion yuan 7 -day reverse repurchase operation today, with a bid interest rate of 2.00%, which was 2.10%before.

In addition, this morning (15th), a press conference was held. Fu Linghui, a spokesman for the National Bureau of Statistics and the director of the National Economic Comprehensive Statistics Department, introduced the operation of the national economy in July 2022.

In July, the supply of production continued to recover, the employment price was generally stable, the foreign trade had increased well, the people's livelihood was strong, and the economic continued recovery trend.

10 basis points of the central bank "interest rate cut"

According to the website of the People's Bank of China, on August 15th, in order to maintain a reasonable liquidity of the banking system, the central bank carried out 400 billion yuan in interim borrowing facilities (MLF) operations (including the continuation of MLF expiration on August 16) and 2 billion yuan The open market reverse repurchase operation fully meets the needs of financial institutions. The bid interest rates of the mid -term borrowing convenience (MLF) operation and public market reverse repurchase operations were 2.75%and 2.0%, respectively, all decreased by 10 basis points from the previous period.

This is the open market operation of the central bank's short -term policy interest rate. The 7 -day reverse repurchase interest rate and the representative banking system from the central bank's marginal funding for the marginal funding of the medium -term basic currency will be reduced again year -on -year after January 17 this year.

At the same time, in terms of period, the MLF expiration scale in August was 600 billion yuan, so the central bank's "shrinkage price reduction" this month continued to make "spicy powder". Since April, the central bank has continued "equivalent" operations in MLF operations in the middle of the month for 4 consecutive months.

According to surging news reports, a person from the financial market department of a joint -stock bank said, "Because the funding surface has maintained a few months of looseness and the capital interest rate continues to be low, the MLF interest rate is significantly higher than that of the same period of the same period. The bank's willingness to declare is definitely not strong. "The person also said that financial data in July showed that the demand for real economy financing was weak, and the reduction of MLF interest rates also provided the possibility for subsequent LPR reduction.

Affected by the favorable interest rate reduction of policy interest rates, the stock and bond markets responded strongly. In the morning, China's 10 -year Treasury Bond and Treasury Bonds were short -term. The 10 -year Treasury Activation Coupon 220010 fell below 2.7%. It is now reported to 2.6800%, and the daily decline is 4.75bp. In terms of government bond futures, the 10 -year main contract rose 0.37%, the 5 -year main contract rose 0.20%, and the 2 -year main contract rose 0.13%.

Expert: mortgage interest rate or further adjustment

The central bank launched LPR reform in 2019. The new LPR formation mechanism was formed on the basis of MLF interest rate. The upward or downward increase of MLF interest rates is generally transmitted to LPR interest rates and eventually affects loan interest rates.

According to the Securities Times, Wang Qing, chief macro analyst of Dongfang Jincheng, pointed out that the policy reduction of policy reduction in August fully shows that the current monetary policy is based on steady growth. The central bank's policy interest rate cut constitutes substantial obstacles. This also means that the current market liquidity that is currently in a state of partiality will continue for a period of time. Next, the regulatory layers will increase the assessment efforts and promote wide currency to wide credit transmission.

Due to the policy interest rate reduction, the quotation interest rate (LPR) quotation of the new round of loan market on August 20 will also be reduced. Experts believe that the probability of LPR downgrade of more than 5 years on August 20 may be greater than one -year LPR, and the mortgage interest rate has therefore further adjusted space.

Wang Qing said that with the large decline of loan interest rates, coupled with structural monetary policy tools and newly established policy financial instruments, the financial data in August will be significantly recovered. This will hedge the recent economic downturn, laying the foundation for the return of GDP as soon as possible in the second half of the year.

The long -term fundamentals of my country's economy have not changed

In addition, it is worth noting that the National Bureau of Statistics announced the operation of the national economy in July 2022 this morning.

In July, the added value of industries above designated size increased by 3.8%year -on -year, 0.1%from the previous month;

In July, the national service industry production index increased by 0.6%year -on -year, a decrease of 0.7%over the previous month;

In July, the total retail sales of social consumer goods was 3587 billion yuan, an increase of 2.7%year -on -year, a decrease of 0.4 percentage points from the previous month;

In July, the total import and export of goods was 3806.4 billion yuan, an increase of 16.6%year -on -year, which was 2.3 percentage points accelerated from last month;

From January to July, 7.83 million new employment in the country. In July, the national urban survey unemployment rate was 5.4%, a decrease of 0.1 percentage points from the previous month. The employment situation is generally stable, and the unemployment rate of urban investigation continues to fall;

In July, consumer prices (CPIs) across the country rose 2.7%year -on -year, an increase of 0.2 percentage points from the previous month.

The long -term fundamentals of my country's economy have not changed

Fu Linghui said that in the second quarter, due to the fact factors of super expected, the economy declined in April. Under the influence of a package of stable economic policy measures, it gradually stabilized and rebounded in May and June, and the second quarter achieved positive growth. However, from the current point of view, the economy is still in the process of recovery. The restriction role of market demand is still relatively large, the difficulty of enterprise operations is still more, and the foundation of economic recovery needs to be consolidated. Although facing these difficulties and challenges, my country's economic toughness, great potential, and wide space have obvious characteristics. The long -term good fundamentals have not changed. With a series of policies and measures that prevent epidemic, stabilize the economy, and ensure development security, The economy is expected to recover better and run in a reasonable range. The real estate market shows a downward situation

Fu Linghui said that since this year, the real estate market has shown a downward trend as a whole, and real estate investment has also declined, which may have also had some impact on related consumption. Everyone pays more attention to real estate operations. In general, the real estate industry is large, long, and widely involved, and has a greater impact on economic growth and social livelihood. Since the beginning of this year, local housing has not been speculated. Due to the policy of the city, support the demand for rigidity and improvement of housing, and introduce a number of stable real estate market policies, the overall downward trend of the real estate market has slowed down.

Although there have been recent real estate project delivery problems, from the whole country, most of the construction period is more than two years. The construction of real estate development projects close to the delivery period has remained stable, and the overall risk is controllable.

In general, the real estate market is showing a downward trend, and the current stage is at the bottom stage. With the continuous improvement of the long -term mechanism of the real estate market, due to the gradual performance of urban policy, the real estate market is expected to gradually stabilize and maintain stable and healthy development, and the impact on the economy will gradually improve.

Keeping basic employment disk is basically stable

Fu Linghui said that from the situation in July, the employment status mainly presents the following characteristics:

The first is that the employment of employment is continued to improve. In July, the unemployment rate of adults at the age of 25-59 was 4.3%, a decrease of 0.2 percentage points from the previous month, which was close to the same period last year, indicating that the basic employment inventory remained basically stable.

Second, the employment group of migrant workers improves. In response to the employment assistance policy of key groups such as migrant workers continued to work, the unemployment rate of migrant workers continued to fall. In July, the unemployment rate of foreign agricultural household registration population was 5.1%, which fell 0.2 percentage points from last month, and continued to be lower than the overall unemployment level. We see that in April, due to the impact of the epidemic, the unemployment rate of foreign agricultural household registration population was higher than the overall unemployment rate. As the economy gradually recovered, the unemployment rate of foreign agricultural household registration population was rapid. The level of unemployment.

In general, my country's employment situation is generally stable, and the unemployment rate has continued to fall. But we must also see that the pressure and structural pressure of the total employment still exist. In July, the overall level of unemployment rate in the country was higher than the same period last year, and the unemployment rate of young people was still at a high level.

Edit | He Xiaotao Dubo

School pair | Sun Zhicheng

Cover picture source: Every reporter Zhang Jian

Daily Economic News integrated the People's Bank of China, surging news,

Daily Economic News

- END -

1257 households in Xinghuaying District, Taiyuan promised to return the goods without reason

News on August 18th, in order to strictly implement the main responsibility of the market, optimize the market environment, and boost consumer confidence, the Market Supervision and Administration Bur

Innovate the "beautiful picture" of the village's revitalization

Innovate the beautiful picture of the village's revitalizationLi JuanAccording to the regulatory requirements of returning to the origin, focusing on the main business, and serving the local regul...