Strengthen the support of corporate listing policies to support Shaanxi as an equity investment "finger road"

Author:Securities daily Time:2022.08.15

In order to further promote the listing of provincial -level listing reserve enterprises, the Local Financial Supervision Bureau of Shaanxi Province recently released the "Leading Investment", "Following Investment" and "Rotary" of Shaanxi Province Listing Reserve Enterprise Equity Investment Fund "(hereinafter referred to as" Guidelines " ), And publicly collected the shareholding fund cooperation institutions of Shaanxi Province's listing reserve enterprises.

According to the "Guidelines", in order to attract the outer private equity and venture capital institutions of the province to invest in Shaanxi, settle in Shaanxi, and strengthen the policy support for the introduction of equity investment in provincial listing reserve enterprises, Shaanxi Province plans to promote the establishment of a series of listing reserve enterprises equity Investment funds (hereinafter referred to as "reserve funds"). It is reported that the first fund intends to operate recently.

"The goal of" Guidelines "is clear and precise, and the functional positioning is clear, which brings great benefits to the equity financing of the Shaanxi Provincial Listing Reserve Enterprise." Wang Yan, deputy general manager of CCB Beijing Branch, said in an interview with the Securities Daily reporter Essence

Shaanxi invests in "finger roads" for equity investment

According to the "Guidelines", the reserve funds have carried out equity investment in the way of listed backup companies and cooperation agencies in "led", "follow -up" and "transfer".

Listing reserve enterprises will be selected and released by the Local Financial Supervision and Administration Bureau of Shaanxi Province in accordance with the relevant provisions of the "Management Service Measures for the Shaanxi Provincial Listing Reserve Enterprise Management". The cooperation agency is selected and released with the relevant provisions of the Shaanxi Capital Market Service Center in accordance with the relevant provisions of the Guideline.

"Leading" refers to the leading fund manager to conduct due diligence, determine reasonable valuations, carry out business negotiations, complete investment decisions, and jointly invest in cooperation agencies.

"Follow -up" means that under the premise that the reserve fund manager can share its due diligence report, confirm its valuation price, agree to its business negotiation content, and unanimously, the core terms of the investment agreement can be shared. invest.

"Transfer" means that if the cooperation agency needs to transfer the equity of the reserve enterprise to invest in the reserve of the reserve enterprise due to its own reasons such as its management fund expires, the reserve fund manager may accept the transfer of the reserve funds that the reserve fund is managed.

In Wang Yan's view, "Guidelines" is the improvement and standardization of Shaanxi's equity investment ecosystem. By introducing specific partners, it not only brings funds, but also brings advanced management concepts. ", Even the flexible investment institutions with" transfer "to withdraw the arrangement, bringing vitality to the entire equity investment ecosystem.

The industry's recommendations are further strengthened

"The supply of private equity funds, as a new type of financial product, is conducive to promoting the formation of innovative capital. It is playing an increasingly important basic and strategic role in supporting scientific and technological innovation and direct financing." "Securities Daily" reporter said that "Shaanxi Equity Investment Fund has achieved very good results in recent years. Among the 10.9 billion yuan of equity financing last year, the semiconductor industry accounted for 4.9 billion yuan, accounting for 45% of the total scale of 45%. At the same time, the number of equity funds through investment companies has also increased. However, the overall size of the Shaanxi Equity Investment Fund is still small, which is less than 1%of the country's total. Moreover, the financing volume of single projects is small. There are fewer single projects. "

From the perspective of Qu Fang, the launch of "Guidelines" can not only further promote the listing of high -quality companies in Shaanxi, but also promote the development of Shaanxi equity investment funds. Shaanxi is a large province of science and technology resources. There are a large number of scientific and technological enterprises, which can bring a lot of investment opportunities to private equity funds.

From the perspective of Dr. Ding Bingzhong, a partner of Wuwu assets, Shaanxi's steps of supporting equity investment can still be greater. The "Guidelines" set up a threshold for management scale of 3 billion yuan. In one place, it must have better investment vitality. Not only should we focus on the introduction of head investment institutions, but also more excellent small and medium -sized investment institutions.

"At present, there are better places in this regard, and the intensity of innovation and opening up is even greater." Ding Bingzhong further stated that taking Shenzhen as an example, there are 2,316 PE/VC managers registered in Shenzhen, second only to Beijing, ranking second in the country, ranking second in the country. The number of management funds is nearly 7,000, and the scale of funds reaches 1.52 trillion yuan, ranking third in the country. "Although there is such a good result, Shenzhen continues to introduce a series of support policies, such as the highlights of the new investment industry in April 2022, including increasing support for the venture capital industry, increasing the rewards of settlement, etc., and will motivate will be inspired. The policy covers the full process of the "fundraising, investment, management, and retreat of the venture capital industry."

Wang Yan also made two suggestions: First, the group's combat capabilities of venture capital companies that give full play to the background of bank financial institutions, prompting them to cooperate with the group's parent company to bring comprehensive financial services such as stocks, debt, and loans to target companies ; On the basis of the transfer mechanism arrangement, timely learn from the experience of advanced areas such as Shanghai, establish a private equity fund trading market in Shaanxi regional systems, and through the "reserve funds as market guidance+market entities actively participate in+professional consulting service agencies to intervene "The model, create a smooth institution withdrawal channels.

- END -

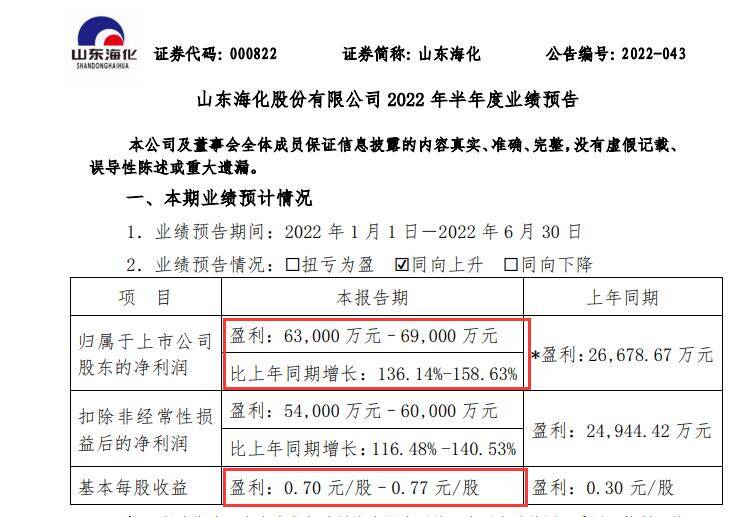

Fortune Lightning | Shandong Haihua's semi -annual performance forecast: Net profit in the first half of the year is expected to increase by more than 136% year -on -year

Qilu.com · Lightning News July 6th Shandong Haihua Co., Ltd. (referred to as Shan...

Zhong'an Online withdrawn from Shanghai Hezhen Private Equity Investment Fund

The science and technology corner material learned that Shanghai Hezhen Private Eq...