Qinhuangdao Port's 6 billion yuan copper concentrate is bizarre disappeared. How did 290,000 tons of goods "steal"?

Author:Poster news Time:2022.08.14

In the absence of the owner's instruction, the total value of the 13 cargo owners was close to 6 billion yuan of copper concentrate, which was transported away by a third party.

First Financial was exclusively informed that in early August, 13 main stores were stored in nearly 300,000 tons of copper concentrates at Qinhuangdao Port, and they suddenly "disappeared."

According to the First Financial Survey, 13 companies purchased a number of copper essence mining to Qinhuangdao Port, entrusted China Qinhuangdao Foreign Run Agency Co., Ltd. (hereinafter referred to as "Qinhuangdao Outside Run Agent") or Qinhuangdao Waigao Logistics Co., Ltd. Age logistics ") Customs declaration, cargo warehousing, cargo storage and other related work. The two cargo generation companies are the relationship between mother and subsidiaries.

The above -mentioned third parties were pointing to a key figure -Liu Yu. Ningbo He Sheng International Trade Co., Ltd. (hereinafter referred to as "Ningbo He Sheng") and Huludao Ruisheng Trading Co., Ltd. (hereinafter referred to as "Huludao Ruisheng"), which were actually controlled by Liu Yu, were accused of involving the copper concentrate incident.

"According to our understanding, around August 1st, a total of 13 cargo owners were called by the freight forwarding company to inform the goods." Zhang Ming, the relevant person in charge of the trader involved, told First Financial that after the goods were accidentally accidentally, the relevant parties held an inquiry of inquiry. At the meeting, the freight forwarding company made some explanations on the relevant situation, and admit that there was no single -handed goods when the cargo owner was released. "

According to the owner's report, at the inquiry, Liu Yu claimed that he and the affiliated parties issued a release instruction to the freight forwarder. The freight forwarding company also admitted that the goods were released under the instructions of no parties. Some person in charge of traders said that Liu Yu confessed that he had long -term existence of uniquely put the goods with the Logistics of Qinhuangdao, and the Logistics outside Qinhuangdao failed to deny it at the scene.

In addition to Liu Yu and the two freight forwarding companies, whether Qinang Co., Ltd. (601326.SH), who is responsible for the actual operation of the port, is responsible for being responsible for the disappearance of the goods, has also caused the owner of the cargo.

According to information, the freight forwarding company and Qingang shares signed a port operation contract, and entrusted Qinang Co., Ltd. to be responsible for the loading and unloading, stacking and entry -exit management of the port.

Qinhuangdao Outside Logistics, Qinhuangdao Outer Run Agent, and Qingang shares are all companies under Hebei Port Group. Regarding the passage of the "missing" of the huge amount of copper concentrate, the first financial reporter asked the Hebei Port Group and its subordinate companies to verify, and the relevant persons from the companies received the call said that the specific situation is currently unclear. At the same time, the First Financial reporter also contacted Liu Yu and its related parties many times. Among them, Liu Yu and Huludao Ruisheng's telephone were not connected. Ningbo and Sheng relevant personnel said that they did not understand the relevant situation.

According to the First Financial Reporter, 13 companies have reported to the police. After preliminary investigation, the Public Security Bureau believed that Liu Yu was suspected of contract fraud and issued the "Notice of File Case".

Nearly 300,000 tons of copper concentrate disappearance

First Financial learned from a number of cargo owners that most of the copper essence mines stored at Qinhuangdao Port's ports were lost around August 1st. The number of goods involves nearly 300,000 tons.

"On August 1st, our company was informed by the Logistics of Qinhuangdao on behalf of the Qinhuangdao. Without the instructions of the goods, our company’s copper sedthroughs were all transferred out of the yard. Under our strong demands, the logistics outside Qinhuangdao was issued only the Logistics outside the Qinhuangdao. The situation explained. "Xiao Li, the relevant person in charge of a trader, told reporters.

In addition, Guo An's trading company also encountered similar situations. He told reporters that the company's company was there when they went to the database and monitoring the goods. "Suddenly received a notice on August 1 that the goods were gone. Logistics outside Qinhuangdao provided a situation instructions that the goods were put on the third parties without our written goods instructions without our written goods instructions. Not stored in the yard. "

So what is the normal release process? Many cargo owners reported that according to their contract with the Logistics of Qinhuangdao, the owner issued a notice of release of goods for the special chapter of the owner's company through the designated contact Email. The authenticity of the information, and the identity of the goods pick -up personnel, can go through the delivery procedures for the consignee.

"Qinhuangdao Outside Logistics gave each family a statement stamped with its official seal, admitting that they had no single goods, that is, the instructions of the owner of the unparalleled rights in order to put the goods." Luo Hui said.

According to the first financial understanding, among the 13 companies mentioned above, except for a private enterprise, the other 12 companies are from Beijing, Shaanxi, Anhui, Jiangxi, Guangdong, Hunan, Zhejiang, Shandong and other provinces, covering the central, provincial, municipalities, etc. State -owned enterprises.

According to multiple cargo owners, the number of "lost" copper concentrates of 13 companies involved was close to 300,000 tons, and the total value was close to 6 billion yuan.

"From the perspective of our mastery, more than 290,000 tons of goods were transferred," Guo An said, according to the recent copper concentrate prices, the overall value of these copper essences that was transferred away was about 6 billion yuan.

According to the owner's report, after the exposure of the unmanned release incident, the 13 cargo owners had reported the case to the public security, set up a case with contract fraud and received acceptance.

Key figure Liu Yu

As many as 300,000 tons of copper concentrate may not really be "lost", but was transferred by third parties.

Many cargo owners said that the "missing" copper concentrate was transferred by a man of a man named Liu Yu and its related parties, and the pick -up party was Huludao Ruisheng/Ningbo and Sheng.

Public information shows that the business scope of Huludao Ruisheng, Ningbo and Sheng all includes metal materials, mineral products, chemical raw materials and products (excluding chemical dangerous goods and monitoring chemicals), hardware electricity, building materials, etc Sheng is also self -employed and represents the import and export business of various types of goods and technology. According to various industries, the actual control of the above two companies is Liu Yu. The information of Tianyancha shows that Liu Yu holds 30%of Ningbo and Sheng's shares; he became the person in charge and executive of Huludao Ruisheng in 2013, but withdrawing in 2018, Cui Lei replaced him as the person in charge. At present, Cui Lei, the legal representative of Huludao Ruisheng and 90%of the shareholders holding the shares.

Qinhuangdao and Rui Technology Co., Ltd., wholly -owned Huludao Ruisheng, is Liu Yu. According to public information, Cui Lei and Liu Yu have many intersections. For example: Cui Lei once held Ningbo and Sheng Sheng, but withdrew in 2019, Liu Yu entered in January 2022. Cui Lei also interspersed with Liu Yu at Ruhebaitai (Beijing) Trading Co., Ltd. in November 2016. The change in business registration in November 2016 showed that Liu Yu was the executive director and manager of the company at the time. Cui Lei was a supervisor. In November 2018, Liu Yu withdrew from the company's shareholders, directors, and managers. In March of the following year, the supervisor of Cui Lei changed.

"After the owner of our cargo rushed to the scene, the Qinhuangdao Outer Run Agent, the relevant person in charge of the external logistics, and Liu Yu all explained to everyone. Liu Yu said that he and the related parties issued the goods instructions to the freight forwarding company. The goods of all parties have released the goods under the instructions. "Guo An told reporters.

Xiao Li added, "At the inquiry, Liu Yu said that (operation) was not so complicated, basically it was to call the cargo company to put goods.

According to the information obtained by First Finance, the next buyer did not pay the payment to the freight forwarder and the current owner did not instruction to release the goods. The goods and goods were owned by the current owner. The current owner's release notice is the only proof of the cargo owner notifying the freight company.

Why does Liu Yu have such a large energy, can you easily transfer such a huge amount of goods?

According to a senior analyst at a copper industry, Liu Yu used to be the leader of a copper company's procurement department. Later, he came out to do a single trade business for copper concentrate raw materials.

"Liu Yu has done in the copper concentrate market for about eighty -nine years. At present, the trading volume of the national copper concentrate trade market is among the best. The annual trade volume of the company is about 1 million tons." Some people who know to report to reporters.

Is the goods of the 13 companies really transferred from Liu Yu and its related parties? The first financial reporter contacted Liu Yu many times and his control of Ningbo and Sheng Sheng and Huludao Ruisheng. However, Liu Yu and Huludao Ruisheng have not been connected. Ningbo and Sheng related personnel said they did not understand the relevant situation.

How did the goods miss?

Although the influence of the copper concentration trade industry is not small, it is not easy for Liu Yu to break through the normal business management process alone. Many cargo owners questioned that the Qinhuangdao Logistics/Qinhuangdao Outer Run Agent, as a freight agency company, was also difficult to blame in this incident.

Many cargo owners told the First Financial reporter that on August 2nd, the cargo owner, the freight forwarder, and Liu Yu held a three -party question meeting. Liu Yu acknowledged that Ningbo and Sheng and Huludao Ruisheng went through the logistics outside the Qinhuangdao to implement the main instructions of the owner of the goods. Extract the cargo for resale.

"At the inquiry, Liu Yu said that the two parties had cooperated for many years. The main operation method was to take the goods first, and then replenish the goods." The owner said.

Why the two cargo generation companies agree with Liu Yu's request, it is unknown. However, a number of cargo owners involved believe that in the business process, the status of freight forwarding companies has enabled them to cooperate with Liu Yu's convenience and conditions.

According to industry insiders, at present, Qinhuangdao Logistics is the only state -owned freight forwarding company in the entire Qinhuangdao Port, a wholly -owned subsidiary of the Qinhuangdao round. According to the information of the official website of the Qinhuangdao Outside Wheel, there are three business departments: the storage and transportation department, the container department, and the customs declaration bank under the logistics of the Qinhuangdao.

The cargo owners, including Xiao Li and Guo An, told reporters that the logistics outside the Qinhuangdao and the Qinhuangdao agent. These two are cargo generation companies. Sign the operating contract and settlement of ports with port operators. Therefore, the owner will sign a contract with the Logistics/Qinhuangdao Outside Delivery Agent of the Qinhuangdao.

According to the owner, after signing the relevant agreement with the cargo owner, the two freight forwarding companies signed a port operation contract with Qingang Co., Ltd. in the form of commissioned operations. This is because the operation of the port, cargo storage and other operations are actually operated by Qingang.

Luo Hui said that in terms of specific operations, when the goods were entered, the logistics outside the Qinhuangdao needed to issue the product acceptance library to the goods with an official seal (not any form of the goods can be used for replacement, misappropriation of this batch of goods in any form. Or mortgage "), the goods are placed in the yard of Qinhuangdao Port Grocery Company.

Many cargo owners believe that in the process, the loopholes in the business management of freight forwarding companies may also leave a hidden danger for the incident.

"Comparison of the photos taken by the goods when the goods were taken before the incident, the comparison of the photos taken after the incident. From the shape of the roof shape and reference (comparison), the number has been reduced. It shows that the batch of goods is not ours, and suspects that there are fake cargo stacking, cargo information, and replacement of signs in advance for fixed stacks. "Xiao Li said that the management of port stacking is chaotic, and the stacking of taxes and unlimited taxes does not meet the specifications. Qin Port Co., Ltd. is a large operator of the Grand Satal Sattays Public Pier, of which Qinhuangdao Port operated is an important coal water port in the country. According to the first quarter report of Qingang Co., Ltd., Hebei Port Group is the controlling shareholder of Qingang, holding 54.27%of the equity. In addition, Hebei Port Group is a major shareholder of the Qinhuangdao wheel, holding 63.81%.

The owner of the goods also said that due to the absolute market advantage of the freight forwarding company in the Qinhuangdao Port, Liu Yu has a greater control over the downstream channels of the goods, allowing the cargo owner of the selection of goods to rely on Hong Kong in Qinhuangdao, "there is not much choice space."

Guo An said that the goods on Qinhuangdao cannot turn around the Qinhuangdao logistics/Qinhuangdao outsiders. At the same time, Liu Yu has a greater control of direct sales channels on the downstream of Hong Kong goods. Liu Yu, or other partners sold to Liu Yu. "

Regarding whether the information described by the above traders is true, the First Financial reporter contacted Hebei Port Group and its subsidiaries. Among them, relevant people from the Qinhuangdao logistics from the Qinhuangdao received a call and said, "The leaders are not there now, and I don't say it clearly." An employee of the Qinhuangdao outsiders also said that the specific situation is not clear, and it is also waiting for the company to treat the company. The specific response of this matter.

The Ministry of Securities Affairs of Qinang Co., Ltd. responded that the company does not involve major matters that should be disclosed, and it is necessary to wait for the investigation results of the relevant departments to come out clearly.

The first financial reporter contacted the public phone call of the official website of Hebei Port Group. The other party said that the relevant situation is currently not understood.

Where is the flow of copper ore?

"At the inquiry, Liu Yu claimed to predict the price of copper, so he invested a lot of funds in June for unilateral investment, but soon after buying, the copper price fell sharply. Everbright. So after the cargo was rested this time, the goods could not be filled back, causing a mine. "A cargo owner revealed to the First Financial reporter.

From the perspective of the Shanghai Copper 2209 contract, the steep slopes started on June 10 this year. Until July 15th, it fell 53310 yuan/ton in a period of 53310 yuan, and a total of 26.52%was reduced during the period.

It is difficult for Luo Hui to agree with this statement. "We asked professionals in the industry to calculate how to lose nearly 300,000 tons of goods." He said, where did the goods go? What is the truth, the public security organs and relevant agencies are urgently needed to find out.

From the perspective of the owner, the "missing" goods can only be realized by being rested. So, who was the goods that were sold by Ningbo and Sheng/Huludao Ruisheng, who eventually sold it to? Where does the funds flow? Can you recover the goods? ... The owners are anxious about these questions.

"Police and us told us that there were more than two companies that Liu Yu's actual control. As for the whereabouts behind the goods, it is unknown." Guo An said.

In addition to the two companies mentioned above, Liu Yu also controlled many other companies with business scope involving trade and investment.

The information of Tianyancha shows that Liu Yu has actual control of 10 companies. In addition to Ningbo and Sheng, it also holds 100%equity of Beijing Longshun Tongyun Technology Co., Ltd. and 90% Equity, 88%equity of Ningbo Junrun Hengzhi Investment Partnership (Limited Partnership), and 50%of Inner Mongolia Yonuo Financial Consulting Co., Ltd.

According to the information of Tianyan Check, Liu Yu worked as a general manager in 11 companies in the storage state. , Legal representative.

As for Liu Yu's control, whether the above -mentioned company is related to this copper concentrate incident, it still needs further investigation by the relevant departments.

How to fill the cave

Copper essence worth nearly 6 billion yuan disappears. If you do not pay, the goods are transferred away. Once the payment cannot be recovered, the 13 cargo owners may suffer major losses.

According to industry insiders, in general import and export trade, credit certificates are commonly used payment methods. In international trade, the buyer may be worried that the seller will not ship according to the contract; the seller is also worried that the buyer will not pay after the delivery or submission of freight documents. Therefore, the credit certificate is paid through the credit certificate.

"Regardless of the breach of contract, we must pay for the payment, and we will deduct our money without paying the bank. At present, we are taking various measures to recover the goods. Economic losses. "Xiao Li said.

In addition, according to the information obtained by First Financial, if the freight company is put on the goods without authorization, in addition to the loss caused by compensation, the remaining direct economic and legal responsibilities will be borne by the freight forwarding company.

Judging from the registered capital, the two companies under Liu Yu did not seem to have such capital strength. The information of Tianyancha shows that the currently exposed registered capital of Ningbo, Sheng and Huludao Ruisheng is 50 million yuan and 10 million yuan, respectively, and the real -capital of real payment is 3.22 million yuan and 10 million yuan, respectively.

Regarding how to make up for the victim's losses, according to the owner, Liu Yu said at the inquiry meeting that he still has 30,000 tons of goods in the port and there is one office building and factory in Qinhuangdao. Compensation. "In addition to the losses that the owner may suffer, the incident may have a certain impact on the credit and market liquidity of the copper concentrate trade industry.

Xiao Li told reporters that its company's choice of transaction opponents was more strict, requiring warehouses and cargo managers to be state -owned companies, but they did not expect that there was still a risk, and the business development would be more cautious in the future.

Xiao Li told reporters that the incident caused state -owned enterprises and traders to no longer be assured of the safety of the supervision of goods in the port, and then shrinking the business and affecting the normal operation of physical factories.

"In the future, whether the goods are relying on the Qinhuangdao Hong Kong, you need to consider it carefully." Guo An also said that after the incident, the risk control loopholes in the port are worrying.

For the impact of the copper essence industry, people in the industry said that for the copper concentrate trade industry, this matter may have an impact on the liquidity of the market in the short term. After the flow of copper concentrates involved in the market, it may be due to the existence of potential because there are potential existence Legal risks are recovered. In addition, this time it may impact the reputation of warehouses and port supervision companies, which will cause market trust crisis.

Guo An believes that the market has certain expectations for the inventory of the copper essence of various ports. The consumption and import volume of Chinese copper is about 20 million tons per year. At present, 300,000 tons of goods account for a large proportion. The impact is not great.

(Xiao Li, Zhang Ming, Guo An, and Luo Hui in the text are all pseudonyms)

- END -

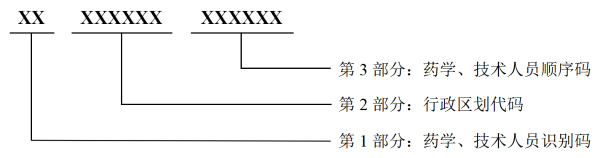

The Office of the State Medical Security Bureau's notice of the unified coding rules and methods of pharmatology and technical personnel of designated medical insurance institutions for medical insurance

Medical Insurance Office letter [2022] No. 39Provincial, autonomous regions, munic...

Strengthen fiscal support to promote digital transformation of SMEs

Reporter Guo JichuanOn August 4, the Ministry of Industry and Information Technology showed that Xu Xiaolan, deputy minister of the Ministry of Industry and Information Technology, hosted a seminar on