It is planned to raise 2.6 billion yuan!Another A -share IPO of Henan Enterprise was accepted

Author:Dahe Cai Cube Time:2022.08.14

[Dahe Daily · Dahecai Cube] (Reporter Chen Yuyao Pei Molly) Another Henan enterprise officially submitted a listing application to the exchange.

On August 14th, Henan Guangyuan New Materials Co., Ltd. (hereinafter referred to as Guangyuan New Materials) GEM IPO was accepted by the Shenzhen Stock Exchange.

Guangyuan New Materials is located in Linzhou City. The main products are electronic yarn and electronic cloth. Electronic gauze and electronic cloth are one of the key basic materials for producing copper -covering plates and printing circuit boards. The copper -covering board and printing circuit board are the key upstream industries of various electronic products. , Semiconductor packaging, aerospace and other fields.

At present, Guangyuan New Materials has built the largest electronic gauze and electronic cloth production bases in the central region, and the production capacity of electronic yarn accounts for about 10%of our country. Through independent technological innovation, the company has become the only very few domestic manufacturers that can stabilize and provide super fine yarn, extremely fine yarn and ultra -thin cloth, and extremely thin cloth.

Its main customers include electronic cloth manufacturers such as Honghe Technology, Fuqiao Industry, Dehong Industry, as well as copper -covering manufacturers such as Shengyi Technology, South Asia New Materials, Jinbao Electronics, and Lianmao Electronics.

The prospectus (declaration draft) disclosed by Guangyuan New Materials shows that the company is the top 50 companies in the Chinese electronic material industry and has been awarded the "China Electronic Glass Fiber Production Base" by the China Broken Fiber Association. Class Glass Fiber Products Engineering Technology Research Center, Henan Provincial Postdoctoral Innovation Practice Base, Henan Province Technology Innovation Demonstration Enterprise.

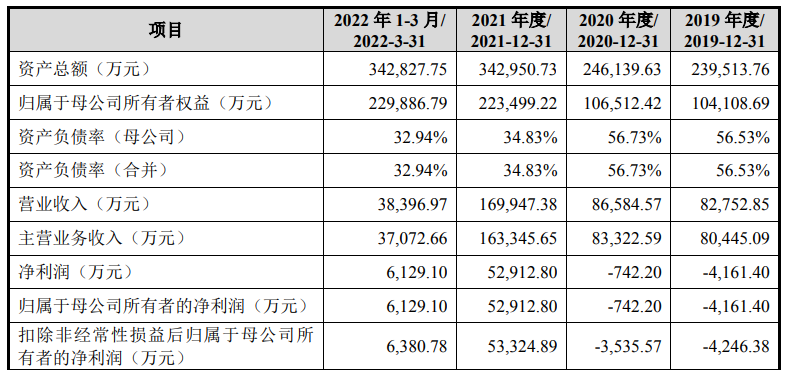

Since 2019, the main financial indicators of Guangyuan New Materials (Source: Guangyuan New Materials Prospectus) This IPO, Guangyuan New Materials intends to issue no more than 166 million new shares, raised 2.6 billion yuan, for an annual output of 70,000 The construction project of tons of high -performance ultra -fine electronic yarn production line, an annual output of 100 million meters of high -performance electronic cloth intelligent production line project, an annual output of 80 million meters of high -performance ultra -thin electronic cloth production line project and supplementary mobile funds.

For the biggest fundraising project of this IPO -an annual output of 70,000 tons of high -performance ultra -fine electronic yarn production line construction projects, Guangyuan New Materials believes that the implementation of the project is conducive to the company's accelerated layout of the ultra -fine electronic yarn field and obtaining the market to obtain the market. The first advantage is to be developed; on the other hand, the implementation of the project is conducive to optimizing the company's product structure, promoting the company's industrial upgrading, in line with the company's long -term development strategy, and promoting the sustainable development of the company's business.

Combined with the previous financing valuation of Guangyuan New Materials, the valuation level of A -share listed companies in the same industry, and the overall valuation level of listed companies related to the GEM industry, Guangyuan New Materials is expected to be higher than 1 billion yuan after the first public issuance.

Earlier this year, Li Zhiwei, chairman of Guangyuan New Materials, said in an interview with the reporter from the Dahe News Daily · Dahecai Cube that in 2021, the various business indicators of Guangyuan New Materials reached a record high. The company overcomes the pressure of global supply chain supply, the development of high -end customer market continues to break through, and the market share of high -level products and foreign market share has increased significantly. The 5G high -performance low -performance low -profile electronic material project has moved to the market in batches, solving the 'card neck' problem in this field, which will become a new growth point of Guangyuan New Year. At present, Guangyuan New Materials can produce 20 million meters of high -grade electronic cloth every month, with an annual output of nearly 90,000 tons, and the overall production capacity is at the forefront of the industry.

In 2021, the financial data of Guangyuan New Materials is also dazzling. Throughout the year, the operating income of Guangyuan New Materials was 1.699 billion yuan, and the net profit attributable to the owner of the parent company was 529 million yuan. Two years ago, Guangyuan New Materials's business revenue was 827 million yuan, only half of the current. As of the end of the first quarter of 2022, the total assets of Guangyuan New Materials were 3.428 billion yuan, and the rights and interests of the owner of the parent company were 2.298 billion yuan.

In summary, Guangyuan New Material this time the A -share IPO is selected. Article 22 of the "Shenzhen Stock Exchange GEM of the GEM of the GEM" stipulates that the listing standard "is expected to not be less than RMB 1 billion, recently The annual net profit is positive and operating income is not less than RMB 100 million. "

Responsible editor: Chen Yuyao | Review: Li Zhen | Director: Wan Junwei

- END -

JD.com 6 · 18 Henan's purchasing power is the eighth place in the country.

[Dahe Daily · Dahecai Cube] (Reporter Chen Wei) From 8 pm on May 31st, during JD....

Xinhua Full Media+丨 Summer Rice Wheat Main Production Area has entered the peak of acquisition

Xinhua News Agency, Beijing, July 5th (Reporter Wang Libin) In July, summer grains...