Why is the manufacturing financing difficulty?Where is it?

Author:China Newspaper Time:2022.06.17

At the end of February this year, an exciting news came -after 10 years, the value -added of my country's manufacturing industry accounted for GDP and the proportion of GDP was increasing again, ranking first in the world for a total of 31.4 trillion yuan for 12 consecutive years. But since April, the manufacturing industry has been severely hit due to the recurrence of the epidemic. The experts interviewed believed that the production and operation of manufacturing enterprises with different degrees of encounters was blocked. Many of the small and medium -sized enterprises entered the "limit state" of survival. profound.

On May 26, the central bank issued the "Notice on Promoting the Establishment of Financial Services for Small and Micro -Enterprises Dare to Loan the Loan Loan Council" (referred to as "Notice"), starting with the factors that restrict financial institutions lending loan, and for small and micro enterprises, small and micro enterprises Bitter. The experts interviewed said that the policy may also be more "quenching" and find the way to break the situation from the aspects of policy guidance, risk sharing, digital technology and other aspects.

"Why does the bank loan you?"

The universal consensus in the industry is that to the difficulty of financing, large enterprises and small and medium -sized enterprises show polarization.

Zeng Gang, deputy director of the National Financial and Development Laboratory of the Chinese Academy of Social Sciences, told a reporter from China Report that large enterprises, especially those with a state -owned background, are often convenient for production and operation. Get financial support. Small and medium -sized enterprises are small in scale, insufficient pledge, and low credit qualifications. Due to risk control considerations, financial institutions are not motivated to provide them with financing support.

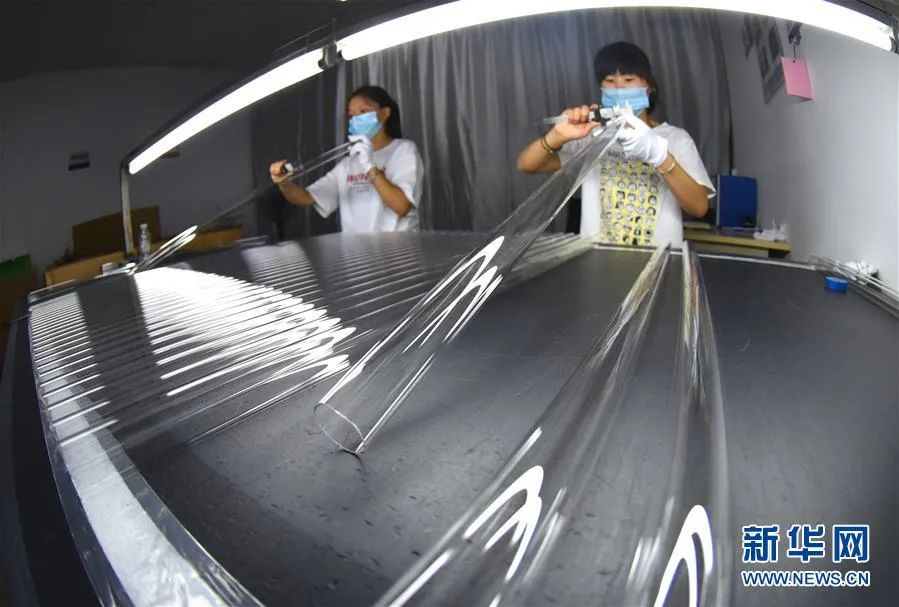

△ Workers of a quartz glass Co., Ltd. in Jinping Industrial Park, Haizhou District, Lianyungang City, Jiangsu are inspecting a group of quartz tube products.

my country is a large manufacturing country, and the number of manufacturing enterprises is huge, reaching more than 3.84 million in 2020. In the national economic census every five years, the recent census data also showed that among 18.07 million small and medium -sized enterprises' legal entities at the end of 2018, small and medium -sized and micro -manufacturing companies accounted for 3.243 million.

"Small and medium -sized enterprises are generally difficult to finance, but manufacturing companies are not the most prominent." From the perspective of Gu Weiyu, director of the Financial Innovation and Risk Management Research Center of the Central University of Finance and Economics, such enterprises generally heavy asset operations, production equipment, medium -sized enterprises, and medium -sized enterprises There are even their own factories, which use these assets as pledges. "It is often more likely to be accepted by financial institutions than trading companies or other enterprises for terminals."

Xu Hongcai, deputy director of the Economic Policy Committee of the China Policy Science Research Association, agrees with this. He pointed out that the assets of manufacturing enterprises are still in, and the most impact on the epidemic is transportation, catering hotels, cultural entertainment, leisure tourism and other service industries. In the first quarter of this year, my country's manufacturing added value accounted for the highest value since 2016, and the role of investment and exports on the manufacturing industry was obvious. "It also shows that the difficulty of manufacturing financing is not so serious."

However, Gu Weiyu emphasized that the production equipment and other assets of manufacturing enterprises are different from assets such as land -generally have the dedicated assets, and it is difficult for banks to deal with it. According to his observations, these enterprises have faced two difficulties after the integration of funds. One is the pressure of interest rates; the other is that the financing scale is small. "Therefore, compared with financing, companies usually feel more expensive to financing. But if the epidemic continues to impact, the situation will be completely different." Gu Weiyu admitted to the reporter of "China Report".

Xu Hongcai attributed the dilemma faced by the manufacturing enterprise to two aspects. On the one hand, the epidemic control in the local area impacts the stability of the supply chain, which causes the parts to be disconnected and the factory cannot start construction normally; on the other hand, oil, steel, cement, food, etc. The rise in the price of basic raw materials has directly increased production and operation costs. Under the two -phase pinch, the corresponding pressure is also transmitted to small and medium -sized manufacturing enterprises downstream.

"But the conduction mechanism is not smooth." Xu Hongcai analyzed to the reporter of "China News" that the downstream small and medium -sized enterprises have overcapacity and the competition is sufficient. It is difficult for enterprises to digest the increase in the cost of increasing prices. In addition, many of their products and service relationships people's livelihood, "From this perspective, it cannot increase the price at will." Under the continuous cost squeeze and the impact of the supply chain, most small and medium -sized enterprises are basically in a state of stopping or half -stop. Even "lying down".

According to the person in charge of a new material processing enterprise in Shantou, Guangdong, it is basically difficult to accumulate profits in the early stage. The cost of metal materials, the cost of oil, and the cost of employment are currently rising. In addition, the customer's cash flow is seriously insufficient. He said to the reporter of "China Report" that the environment is not good, and special production equipment such as machines can not soon turn to other production. "The bank can't see the repayment ability, why do you want to loan you? This is for you to rely on a loan It's too difficult to support the past. "

To establish a risk sharing mechanism

△ Private small and micro enterprises in the Jiangbei District Administrative Service Center in Chongqing City.

Policies, including tax cuts, fees, tax reduction, tax rebate, tax exemption, financing, etc., have been introduced densely. The reporter sorted out and found that in 2020, my country has implemented 7 batches of 28 tax reductions and fees and fees, and the scale of tax cuts and fees exceeds 2.6 trillion yuan. This year's tax refund and tax reduction scale is the highest in history, reaching 2.5 trillion yuan, and the support direction includes manufacturing, small and micro enterprises, etc.

Various banks have also launched financial services related to the prevention and control of epidemics and re -production and re -production. For example, the loans of small and medium -sized enterprises that meet the conditions and liquidity encounters temporary difficulties, and give the temporary extension of the repayment of the principal and interest arrangement. The latest "Notice" starts with the factors restricting financial institutions' loan, enhance their willingness and sustainability of small and micro enterprises to serve small and micro enterprises, and stabilize market entities. Experts interviewed said that the reasons for financing difficulties for small and medium -sized micro -manufacturing enterprises are currently more complicated, and they must be clarified from multiple aspects. From the perspective of the enterprise itself, it may not meet the bank's lending conditions because of insufficient capital and high asset -liability ratio. The 2020 annual report from the six major state -owned banks shows that wholesale retail and manufacturing are still industries with high non -performing loan rates. Among them, the non -performing loan ratio of the manufacturing of the Bank and Agricultural Bank of China has reached 6.03%and 5.08%, respectively.

"There are also some constraints in banks." Xu Hongcai pointed out that some banks also face the problem of insufficient capital. In addition, from the perspective of management and management, when the macroeconomic downlink pressure increases and the risk of business operations is increasing, financial institutions have cyclical behaviors. In addition to the bank's lifelong accountability system, the pressure of the person in charge becomes greater and dare not rashly loan; From the perspective of business development, internal financial institutions lack inspiration to inclusive finance, and it is difficult to mobilize the enthusiasm of relevant staff.

The "Notice" requires the improvement of fault -tolerant arrangements and risk slow release mechanisms, strengthen positive incentives and assessment and assessment, do good funding and channel construction, promote scientific and technological empowerment and product innovation, so that financial institutions dare to loan, wish loan, loan, loan, and loan, and loans Meeting loan.

Xu Hongcai said that the fault -tolerant arrangement mechanism is very important. It means that in the "very period", from government regulatory agencies, enterprises to individuals, they must change their thinking to improve the tolerance of adverse rates. Financial institutions themselves must also explore a set of simplicity and easy running. , Objective and quantitative internal identification standards and business processes. He pointed out that the risk slow release mechanism involves further improving the risk control management system and improving the risk identification and warning capabilities of small and medium -sized enterprise loans. In particular, the supervision requirements for the poorly tolerance of inclusive small and micro loans are implemented. Nuclear sales.

Gu Weiyu has been paying attention to the stability of the financial system for a long time and emphasized that the government must play a better role. He said that the main financing channels of small and medium -sized enterprises in my country are banks, and other direct financing markets, such as equity financing and debt financing, accounted for only more than 20 % of the total social financing. At present, the three stress of the demand for economic development, the impact of supply, and the expected weakness and the weakening of the epidemic, the international situation is superimposed, and the risk of small and medium -sized enterprises has increased its operating risks. Based on the two characteristics of credit management and scale economy, banks will reduce the enthusiasm of lending loan and cautiously. Control risks, "But when the risk of bad debts occurs, when the profit is eroded, the risk is large or the risk is large, it may erode bank capital and even cause systemic impact."

Gu Weiyu told reporters that what the government should do is to use funds to play a leverage, establish risk funds, and establish a risk sharing mechanism with banks providing financing services to SMEs. "If the risk is borne, or if there is a mechanism to share the risk, the bank earns less to earn a little more, but it is just a matter of profit."

"After the enterprise gets funds, when encountering factors such as logistics sealing and control affecting production and operation, the government has also passed various measures such as unblocked supply chain, including the establishment of a national unified market in the country. Conditions. "Gu Weiyu said.

Digital technology cannot solve all problems

The "Notice" requires that the use of fintech means, innovative risk assessment methods, improving loan approval efficiency, and broadening small and micro customer coverage. Accelerate the application of credit information -related information -related information sharing, and make precise portraits of small and micro enterprises. In terms of improving the level of "loan", policies emphasize the importance of digital technology.

Not only manufacturing, but for all small and medium -sized enterprises, inclusive finance is very meaningful and has risen to a national strategy. Experts interviewed said that basically all commercial banks have used inclusive finance as one of the main businesses, which also challenges the digital transformation of manufacturing digital transformation and financial institutions to improve digital technology.

Gu Weiyu pointed out that through digitalization methods, especially the development of IoT technology, financial institutions can easily obtain small and micro enterprises that are difficult to obtain traditional inclusive finance, evaluate enterprises more accurately, and provide financing support for normal manufacturing companies that provide financing support for normal manufacturing companies At the same time, the operation of enterprises is monitored in real time, and bank risks are reduced. For example, due to information asymmetric, the reverse selection risks brought by banks, and the moral risks caused by the use of loans to change the use of loans.

Zeng Gang said that digital inclusive financial innovation meets the requirements of serving the real economy and supporting weak links of financial supply -side structural reforms, and some banks have also made useful attempts. For example, the Construction Bank actively approved credit through the early whitewashing list to explore the "small and micro -fast loan" of the entire process online financing model; online merchant banks mainly rely on the Internet operation model to achieve three minutes of loan application, one -second payment, and zero manual intervention The "310" loan model provides digital credit services for 45.53 million small and micro operators.

But in Gu Weiyu's view, digitalization cannot solve all problems. "Precision drip irrigation" means refined cultivation. Banks must subdivide the customer group and design some differentiated specialty products. "This must increase the customer manager." The ideal situation is that the society achieved digitalization as a whole, and financial institutions can completely capture data online and conduct recognition and risk management. However, Gu Weiyu said that for small and medium -sized enterprises, especially manufacturing SMEs, if there is no data accumulation internally, there is no driving force in the business to allow them to invest in related aspects. The role of digital means may be limited. "It is certain that with the construction of digital economic infrastructure and the digital transformation of industry companies, technology will play an increasingly important role in financing for small and medium -sized enterprises, including manufacturing." Digital transformation should be accelerated, so as to reduce information asymmetry, make banks accurately identify and evaluate and manage risks, further expand the scale of business, and exert the economic effects of scale.

Text | "China Report" reporter Chen Ke

- END -

"Hand in hand" to relieve difficulties and solve difficulties, "mind" to help enterprises develop

Hand in hand to relieve difficulties and solve difficulties, mind to help enterpri...

Fine End of Tianya Road Jiangong Port | Baoqian Village to get out of the new model of "Village Collective+State -owned Enterprise+Company"

June 13thSanya Daily special reportTianya District Hangqian Village actively explo...