What is the independent market for the Federal Reserve's interest rate hike

Author:Economic Observer Time:2022.08.13

The China -US stock market is reversed, but in terms of future expectations, the market's attractiveness to the two places still has its own logic.

Author: Liang Ji

Figure: Tuwa Creative

A year -on -year increase of 8.5%. On August 10, 2022, local time, the US Labor Statistics released the data of the July consumer price index (CPI) data (CPI). The previous value of 9.1%, the market expects 8.7%; the core CPI increases by 5.9%year -on -year, which is the same as the previous value. The market expects 6.1%.

The soothing inflation dispelled the market's concerns about the Fed's continued radical interest rate hike, and US stocks rose sharply. As of the closing on the 10th, the Dow Jones Industrial Average has risen by 1.63%, the S & P 500 Index rose 2.13%, and the Nasdaq index rose 2.89%. It is worth noting that the Nasdaq index has increased by more than 20%since mid -June, entering the bull market.

Since July, overseas markets have rebounded. The Nasdaq index rose sharply 12.35%in July, and the S & P 500 and the Dow Jones Industrial Average also rose by 9.11%and 6.73%, respectively. During the same period, the European market also rose year -on -year, and the French CAC40, Germany's DAX and the British FTSE 100 index rose 8.87%, 5.48%, and 3.54%in the month. Domestic aspects, A shares fluctuated in July.

The China -US stock market is reversed, but in terms of future expectations, the market's attractiveness to the two places still has its own logic.

Xia Fengjing, manager of Rongzhi Investment Fund, told the Economic Observer that on August 10 and 11, the northern direction funds bought -6236 billion yuan and 13.295 billion yuan, respectively. The index to the United States' major stock indexes are re -priced that the Fed's monetary policy has shifted; the possibility of continuing the current loose capital in China has also increased, thereby increasing the attractiveness of A -share assets.

Roddi, director of UBS Asset Management (Shanghai) and the manager of the asset allocation fund manager, the current Chinese economy is in recovery, and the policy is expected to continue to relax, and the macro environment is more beneficial to the stock market. At the same time, A shares have the valuation level at the valuation level. Attraction, as long as the fundamentals continue to improve, the stock has corresponding upward space. In terms of U.S. stocks, its current attraction is still insufficient: From the perspective of valuation, US stocks are still lower than U.S. bonds; from the perspective of market sentiment, the current volatility of US stocks Further pressure; from the perspective of profitability, with the weakening of the fundamental fundamentals of the US economy, it will lead to a decline in profit growth in corporate profit.

The Federal Reserve turns to pigeons?

Since the beginning of the year, the United States' inflation has "high fever", and the Federal Reserve raises interest rates to suppress inflation. The Federal Federal Studential interest rate raised from nearly half a year to 2.25%-2.5%. After two consecutive interest rate hikes 75 basis points, the US CPI cooling in July made the market's concerns about the Federal Reserve's three -time interest rate hikes, but many market participants pointed out that inflation should not be taken lightly.

Data show that the US CPI declined to 8.5%year -on -year in July, and the core inflation was flat at 5.9%. Both data were lower than the expectations of overseas markets. It was the first time since the U.S. inflation was raised at the beginning of last year. 1.3%to zero growth is also the minimum growth rate since the second half of 2020.

Specifically, energy is the main reason for the year -on -year period of CPI and decline in CPI in July. In terms of year-on-year, energy prices fell from 41.6%to 32.9%year-on-year, affecting CPI by 0.58 percentage points; from the previous month, gasoline (-7.6%) and natural gas (-3.6%) fell. 77%of the fall. In addition, travel -related products and services drag the core inflation have slowed down from the previous month. The prices of cars, casual durability and vehicles, clothing and shoes have fallen or fell.

However, in July, the rents increased by 0.6%month -on -month. The Macro team of Huachen Securities pointed out that on the one hand, it was affected by the rise in housing prices in the early stage, and on the other hand, it confirmed with strong US employment data. Strong rental demand supported the toughness of rent.

Zhang Yu, the chief macro analyst of Huachen Securities, said that from the current situation, it is difficult to conclude that "American inflation sees the top". It is expected that the US CPI will still run in the range of more than 7%year -on -year. Both still have the risk of rebound in August to September, and it may not be seen in the first quarter of next year to see the significant decline of inflation reading.

Zhang Yu believes that the number of inflation in July was caused by the decline in oil and gas prices, but the price of oil and gas fluctuated greatly, and the impact on inflation was extremely unstable. In addition, the slowdown in the core inflation and the slowdown in travel related products and services. The price of the price of the price is still strong, and the largest weight of the proportion is still strong, which is the pillar of core inflation and even overall inflation toughness. In the context of employment, especially the employment of service, and the rise in salaries, core inflation price increase pressure is still high.

CICC also pointed out that it should not underestimate the toughness of the United States due to a single month. Generally speaking, although inflation has slowed down, it is difficult to obtain strong evidence of the risk of inflation from the sub -data. Instead, the non -agricultural employment data announced the previous week is extremely strong, or it means Essence

On August 6, the U.S. Labor Bureau of Labor Statistics released data showing that the number of non -agricultural employment in July increased by 528,000, with a previous value of 398,000; the unemployment rate was 3.5%, and the previous value was 3.6%. The strong employment data impressed the market and confirmed that Powell had not fallen into a real decline before. Powell previously said at a press conference after the July interest rate resolution announced that the Fed will slow down the pace of interest rate hikes at some time, but he also claimed that the Federal Reserve believes that the labor market is still strong, which offsets the impact of slow demand. Although both inflation and employment data are both good, the market is expected to not turn interest rate hikes. The Federal Reserve has previously stated that only CPI declines for several consecutive months to relax the monetary policy. However, the current level of 8%of the United States is still far from the target level of 2%.

Goldman Sachs believes that in the second half of July, investors in the United States have begun to pricly priced the Federal Reserve to relax their policies. The current US stocks rebound, US debt yields, and the weakening of the US dollar are all the performance of investors' pricing of the Federal Reserve. However, in the short term, inflation in the United States will still maintain a high level and maintain the "uncomfortable" range of the Federal Reserve, which is difficult to make the Fed's direction for adjusting monetary policy.

Roddi said that from the perspective of economic data in the United States, manufacturing and service industry activities are on a downward track, and economic slowdown is a clear fact. Therefore, despite the impact of the supply side in the field of food and energy, the US CPI index continues to rise, but the economic slowdown has also caused the core inflation of the United States to fall. However, in view of CPI, it usually has a certain conductive effect on core inflation, so the Fed still needs to continue to raise interest rates to suppress inflation. Based on the current rhythm, the Fed is expected to continue to raise interest rates by 100 basis points in the year.

What is the independent market of A shares?

Since the end of April to the "bottom of the market", A shares have ushered in a strong round of rebound. From April 27th to June 30th, the Shanghai Stock Exchange Index rose 14.89%, the Shenzhen Stock Exchange Index rose 21.06%, and the GEM index increased by 23.86%. During the period, the northbound funds continued to flow into the layout.

Oriental Fortune Choice data shows that from January to June 2022, the northern direction funds were net inflow of 16.775 billion yuan, 3.980 billion yuan, -45083 billion yuan, 6.300 billion yuan, 16.867 billion yuan and 72.960 billion yuan, with cumulative net inflow of 71.799 billion yuan; In June, a sharp net inflow of 72.96 billion yuan hit a single month in a single month, and the single -month net inflowing in the interconnection mechanism was the third highest in the interconnection mechanism. In July, the flow of funds from the north direction reversed, and the net sold was 21.068 billion yuan.

Earlier, A -shares benefited from domestic liquidity loosening expectations and the support of further warming in the second half of the year. However, since July, the new energy sector has been adjusted, and the financial real estate and consumer sector have also fallen. A shares have become weaker and the prosperity has become weak.

According to data from the National Bureau of Statistics, in July, the manufacturing procurement manager index (PMI) was 49.0%, a decrease of 1.2 percentage points from the previous month. It was below the critical point. From the perspective of enterprises, large and medium -sized enterprises PMIs are 49.8%and 48.5%, respectively, down 0.4 and 2.8 percentage points from the previous month, and decreased to below the critical point; small enterprise PMI is 47.9%, a decrease of 0.7 percentage points from the previous month. Below the critical point. In July, the non -manufacturing business activity index was 53.8%, a decrease of 0.9 percentage points from the previous month. It is still located in the expansion range. Non -manufacturing has recovered for two consecutive months.

Zhao Qinghe, a senior statistician of the Service Industry Investigation Center of the National Bureau of Statistics, said that in general, the level of economic prosperity in my country has fallen, and it is still stable to restore the foundation. In July, affected by factors such as the low season of traditional production, the lack of release of market demand, and the decline in high energy -consuming industry prosperity, the manufacturing PMI dropped to 49.0%; the non -manufacturing industry recovered for two consecutive months, the service industry continued to recover, and the construction of the building, the construction Industry expansion accelerates.

China Merchants Securities Macro team believes that compared with the manufacturing and service industry PMI, the current economic trend still meets the structural characteristics of a round of recovery after the epidemic, that is, the industrial department's recovery rhythm is leading, the speed is faster, and the recovery is earlier; The rhythm is lagging, the speed is relatively slow, and the recovery continuity is higher. The problem is that the current recovery of the industrial sector is far from reaching a sufficient level. Even if July is seasonal production off -season, the performance of the manufacturing PMI is still obviously weak. The obvious exogenous factors are the rebound of the epidemic throughout July, but the epidemic disturbance is not enough to explain all issues. Considering the internal factors, one is that internal and external demand are constrained by various factors, and the other is that energy prices and demand pressure leads to active contraction of upstream supply.

It believes that the potential structural highlights of the domestic economy in the next stage are related to "using the established policy": first, the special debt forms physical workload, policy bank credit and infrastructure investment funds accelerate; The improvement of construction intensity drives the back end; the third is the epidemic disturbance and policy preferential maintenance of the car consumption.

On August 10, the People's Bank of China issued the "Report on the Implementation of the China Monetary Policy in 2022" (hereinafter referred to as the "Report"). The "Report" states that strengthening the implementation of stable monetary policy, giving full play to the dual functions and structural dual functions of monetary policy tools, actively responding, boosting confidence, and doing a good job of cross -cyclical adjustment, taking into account short -term and long -term, economic growth and stable prices, stable prices, and stable prices, and stable prices. Internal equilibrium and external balance, insist on not engaged in "big water", do not exceed currency, and provide more powerful and higher quality support for the real economy. Maintain reasonable liquidity, increase credit support for enterprises, make good use of policy development financial instruments, focus on supporting the construction of infrastructure, maintain a reasonable increase in currency supply and social financing scale, and strive to achieve the best results of economic operation realization. Essence Xia Fengjing said that the US inflation data is not as good as expected, and the market is concerned about the turnover of the Fed's monetary policy, and the possibility of continuing the current loose capital of the domestic currently increases. From the current turnover rate, active funds are still mainly concentrated in small -cap stocks, but the large -cap stocks represented by the above certificate 50 have the characteristics of low valuation and high dividend rate, which can play a role in stabilizing the market. If the total market transaction volume does not have a significant upper step, the market style will still be dominated by small plate growth stocks. The market is expected to maintain a wide range of interval.

Chief Observation of the new law and new signal Zhang Weiying of the central bank's cargo report under the "difficulty", the seventh anniversary of the "convert" 811 exchange reform of an economist: the toughness and background color of the RMB

- END -

The cost of stamping parts has risen, and Wuxi Zhenhua is expected to decrease by 58%-68%in the first half of the year

On July 6, Capital State learned that the A-share listed company Wuxi Zhenhua (code: 605319.SH) released the semi-annual report performance forecast.It was 130 million to 170 million yuan, and net pro

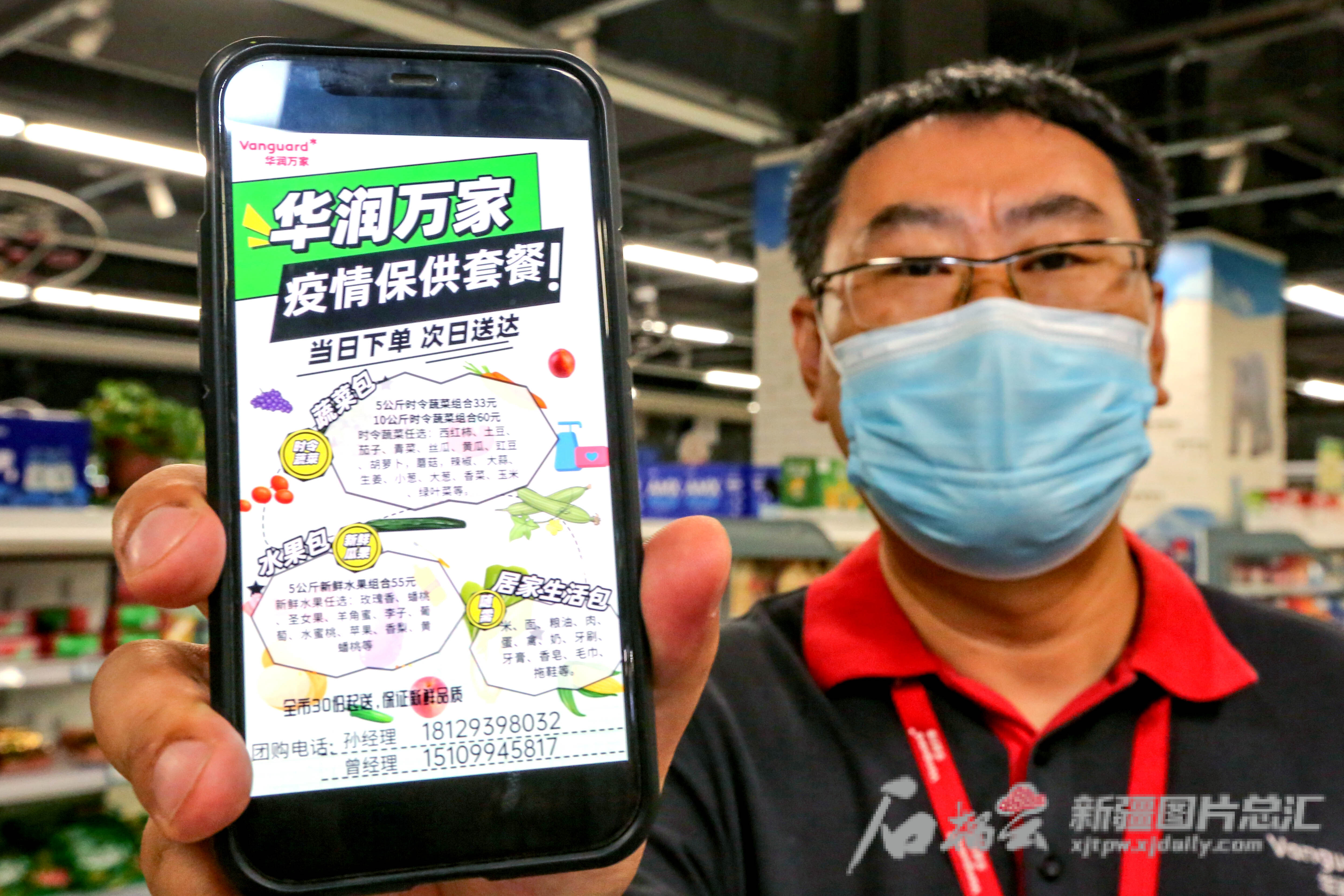

Online orders offline, China Resources Wanjia supermarket launched the "package" package to escort the life of residents in the jurisdiction

Tianshan News (Reporter Gan Xinghua reported) You have new orders, please pay atte...