Once announced: delisting

Author:Hubei Daily Time:2022.08.13

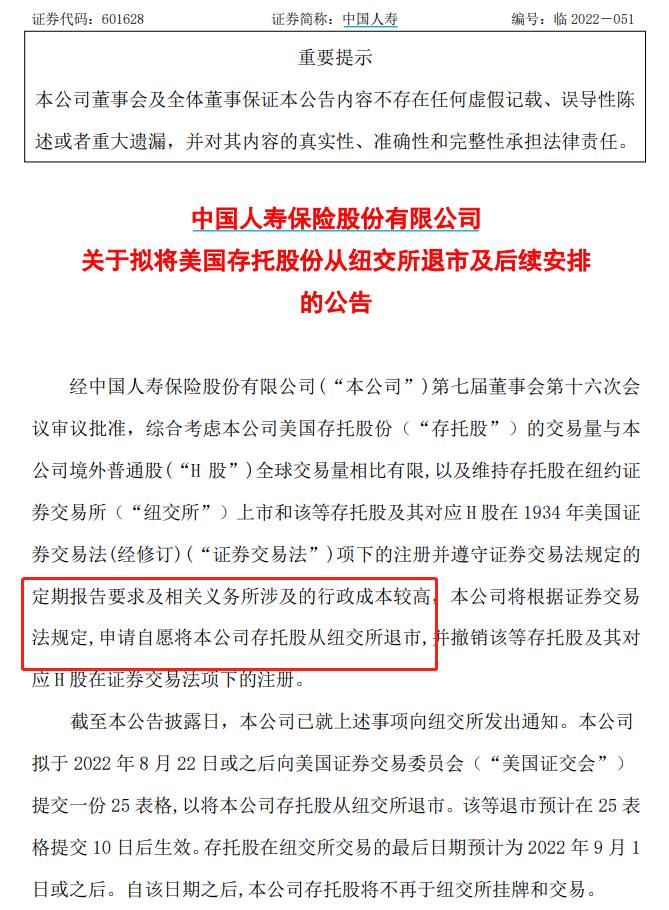

China Life Insurance:

It is intended to deliver US deposit shares from the New York Stock Exchange

China Life announced on August 12 that the transaction volume of the company's deposit shares compared to the company's overseas ordinary shares ("H -shares") global transaction volume is limited, and the maintenance of deposit stocks on the NYSE and such deposits and such deposits The shares and its corresponding H shares registered under the 1934 US Securities Trading Law (revised) item and complied with the regular report requirements stipulated in the securities trading law and the administrative costs involved in the relevant volunteers are relatively high. The company will follow the securities transaction law. Applying for voluntary company deposit shares from the York Stock Exchange, and revoking the registration of these depository shares and its corresponding H shares under the securities transaction law. The company has issued a notice to the NYSE above. The company plans to submit a form 25 form 25 to the US Securities and Exchange Commission on August 22, 2022 to deliver the company's deposit shares from the NYSE.

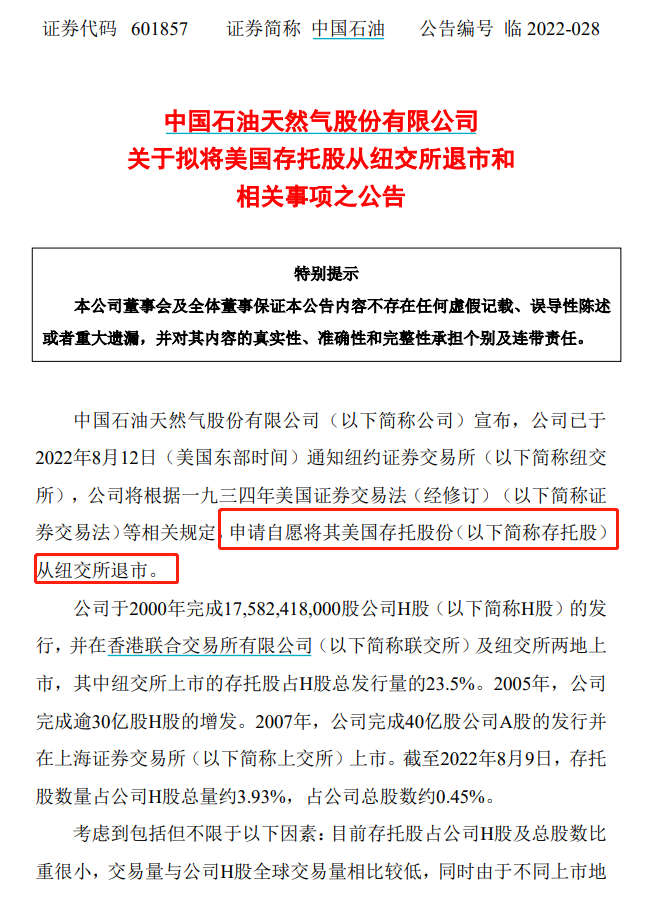

PetroChina: Applying for voluntary US deposit shares from the New York Stock Exchange

China Petroleum announced on August 12 that the company has notified the New York Stock Exchange (hereinafter referred to as the New York Stock Exchange) on August 12, 2022 (Eastern United States). ) (The following referred to as the Securities Trading Law) and other relevant regulations, applying for voluntarily delisting its US deposit shares (hereinafter referred to as depository shares) from the New York Stock Exchange.

Considering that it includes but not limited to the following factors: At present, deposit stocks account for a small proportion of the company's H shares and total shares, and the transaction volume is relatively low from the company's global transaction volume. At the same time, due to the differences in the regulatory rules of different listed areas The disclosure obligation of deposit stocks on the NYSE requires the company to pay a large administrative burden, and the company has never used the NYSE secondary financing function and the Stock Exchange and Shanghai Stock Exchange are strongly replaceable, which can meet the company's normal operation In order to better safeguard the interests of investors, after comprehensive assessment, the company's board of directors approves the deposit shares to delist from the New York Stock Exchange, and in accordance with the actual situation of the follow -up actual situation, the company applies for the company to cancel the relevant provisions of the securities trading law. EMU's registration shares and corresponding H shares are registered at the US Securities and Exchange Commission (hereinafter referred to as SEC).

The company plans to submit Table 25 to the SEC on August 29, 2022 to submit its deposit shares from the New York Stock Exchange. The delisting of the depository stock is expected to take effect after the ten -day submission of Table 25. The last trading date of the deposit stock on the NYSE is September 8, 2022 or around. After this date and the date, the company's depository shares are no longer listed on the New York Stock Exchange. The company will continue to fulfill the disclosure obligations under the Securities Trading Law until the company submits the SEC 15F to the SEC to seek to cancel the deposit stock and the corresponding H shares under the US Securities Law under the US Securities Law after meeting the cancellation conditions specified in the 12H-6 rules.

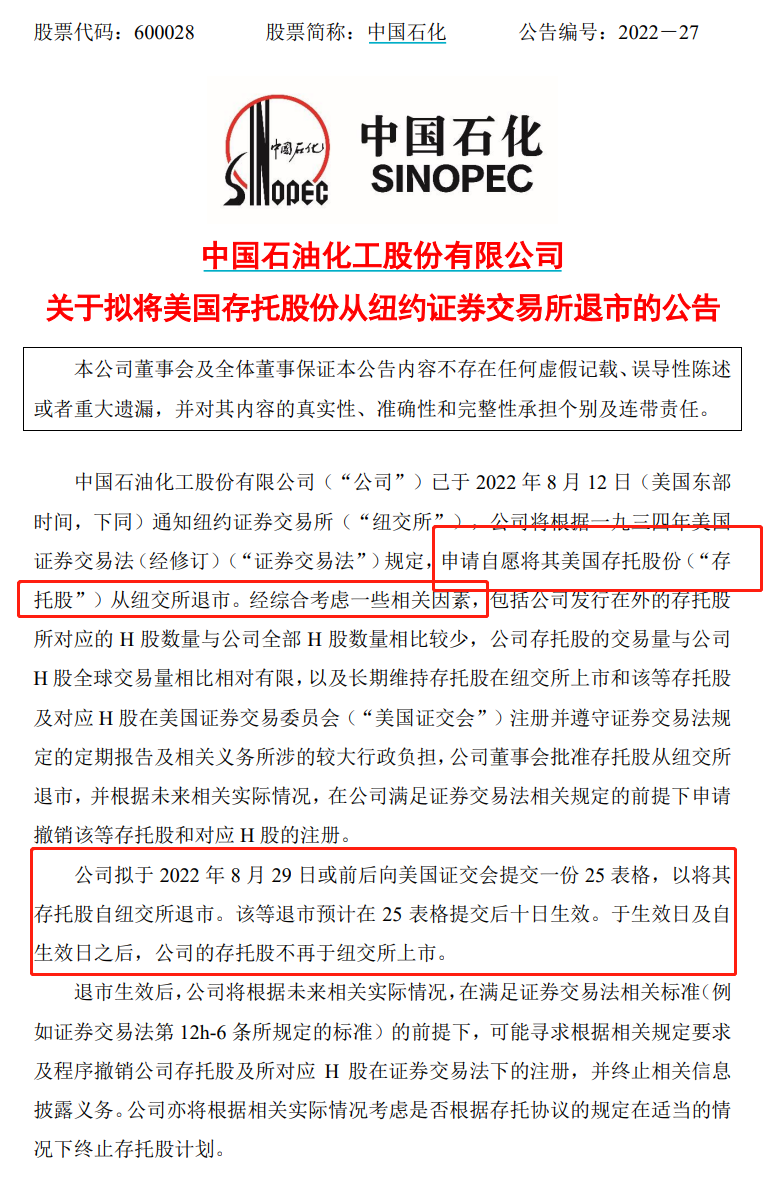

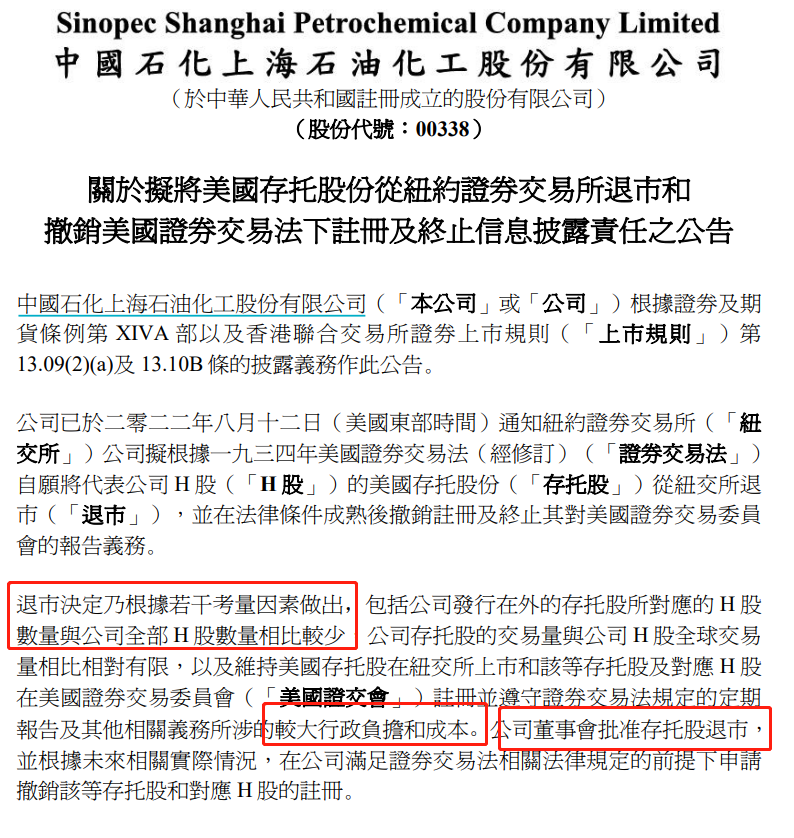

Sinopec: Apply to voluntarily delist US deposit shares from the New York Stock Exchange

Sinopec announced on August 12 that the company has notified the New York Stock Exchange on August 12 (Eastern United States time, the same below). The company will apply for voluntary application in accordance with the US Securities Exchange Law (revised) regulations in 1934. Its US deposit shares delist from the New York Stock Exchange. After comprehensive consideration, some related factors, including the company's corresponding number of H shares issued by the company's depository stocks, is relatively small than the total number of H shares in the company. As well as long -term maintenance stocks listed on the NYSE, and those depositable shares and corresponding H shares registered in the US Securities and Exchange Commission and abide by the regular reports stipulated in the securities trading law and a large administrative burden involved in the relevant volunteers, the company's board of directors approved The deposit shares are delisted from the New York Stock Exchange, and in accordance with the actual situation in the future, the company is applying for revocation of these depository shares and corresponding H shares to the relevant provisions of the company to meet the relevant provisions of the securities trading law.

The company plans to submit a form 25 form 25 to the US Stock Exchange on August 29, 2022 to deliver its deposit shares from the NYSE. These delisting is expected to take effect ten days after the submission of form 25. After the effective date and the date of effectiveness, the company's deposit stocks are no longer listed on the NYSE.

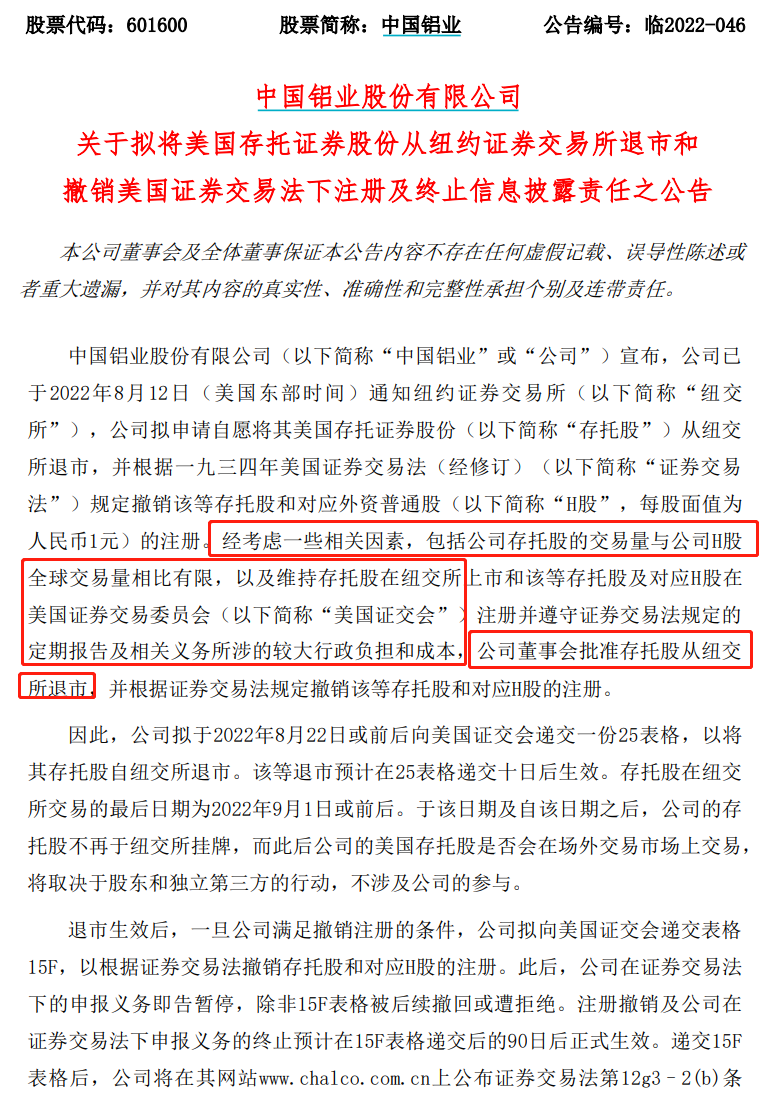

China Aluminum:

It is intended to deliver US deposit shares from the NYSE

China Aluminum announced on August 12 that the company has notified the New York Stock Exchange on August 12 (Eastern United States time) that the company intends to apply for voluntary US deposit securities shares from the New York Stock Exchange and in accordance with 1933, according to 1933 The four -year US Securities Trading Law (revised) stipulates the revocation of these depository shares and the registration of corresponding foreign shares. After considering some related factors, the transaction volume of the company's deposit stock is limited compared to the company's global transaction volume, and the maintenance of deposit stocks on the NYSE and these depository shares and the corresponding H shares in the US Securities and Exchange Commission in the US Securities and Exchange Commission Register and abide by the regular reports stipulated in the securities trading law and the large administrative burden and costs involved in the relevant volunteers. Registration of H shares.

Therefore, the company plans to submit a form 25 form 25 on August 22, 2022 or before and after, in order to delist its depository shares from the New York Stock Exchange. These delisting is expected to take effect after ten days of submission of form 25. The last date of deposit shares in the New York Stock Exchange is September 1 or around 2022. After this date and the date, the company’s deposit shares are no longer listed on the NYSE, and whether the company’s deposit stocks will be traded on the off -site trading market after that will depend on the actions of shareholders and independent third parties. It does not involve the company's participation.

The company intends to terminate its depository stock plan in an appropriate manner in an appropriate manner after the depository shares are delisted in an appropriate time. Shanghai Petrochemical Co., Ltd.: It is planned to delist from the NYSE

Shanghai Petrochemical Co., Ltd. announced on August 12 in the Hong Kong Stock Exchange that the company has notified the NYSE company on August 12, 2022 (Eastern United States) to voluntarily voluntarily in accordance with the US Securities Trading Law (revised) in 1934 (revised) in 1934 (revised) The US deposit shares, which will represent the company's H -shares from the New York Stock Exchange, and revoke the registration and terminate its reporting obligations to the US Securities and Exchange Commission after the legal conditions are mature.

The delisting decision is made according to several considerations, including the number of H shares corresponding to deposit shares issued by the company is compared with the total number of H shares in the company. The relatively limited comparison, as well as maintaining the listing of US deposit shares on the NYSE, and those depository shares and corresponding H shares registered in the US Securities and Exchange Commission and abide by the regular reports stipulated by the Securities Trading Law and other relevant volunteers involved in the greater administrative office involved Burded and cost. The company's board of directors approves the delisting of deposit shares, and in accordance with the actual situation in the future, the application for shall be applied to the company's registration and the registration of the corresponding H -shares on the premise of meeting the relevant laws and regulations of the securities trading law.

The company plans to submit a delisting application form 25 to the US Stock Exchange on August 26, 2022, and the deposit shares are delisted from the NYSE. These delisting is expected to take effect ten days after the submission of form 25. After the delisting is effective, the company's deposit shares will no longer be traded on the NYSE. The company expects that in the future, under the premise of meeting the relevant standards of the securities trading law, the termination of these depository shares and the corresponding H shares under the securities trading law, and termination of relevant information disclosure obligations. The company will also consider whether to terminate the deposit agreement under the actual situation in the future.

The CSRC responded to individual Chinese companies to announce the start of the US delisting

According to the news of the CSRC's website on August 12, the person in charge of the relevant departments of the CSRC answered a reporter.

Question: Recently, some Chinese companies have announced the launch of the U.S. delisting. What does the CSRC think?

Answer: We noticed the relevant situation. Listing and delisting belong to the normal capital market. According to relevant companies' announcement information, these companies have strictly abide by the US capital market rules and regulatory requirements since the listing of the United States, and make delisting options for their own business considerations. These companies are listed in many places, and the proportion of securities listed in the United States is very small. The current delisting plan does not affect the continued use of domestic and foreign capital market financing and development.

The China Securities Regulatory Commission respects the decision made by enterprises in accordance with its actual situation and in accordance with the rules of overseas listing. We will maintain communication with relevant overseas regulatory agencies to jointly safeguard the legitimate rights and interests of enterprises and investors.

Screenshot of the SFC website

Source: Interface News, China Fund News, China Securities Regulatory Commission

- END -

Payment Clearance Association: In 2021, the over 70 % of the payment institution achieved profitability, and the concentration of the network payment market decreased slightly.

On June 15th, China Payment and Clearance Association organized a series of financial street forums-China Payment Industry Annual Report 2022 (hereinafter referred to as the Annual Report) online

Jilin City Ice and Snow Industry Chain and Asian Data Group develop cloud docking

On June 28, Jilin City held the ice and snow industry chain with the Asian Data Gr...