Runben's IPO: The problem of "interbank competition" of the actual controller's close relatives provokes attention

Author:Public Securities News Time:2022.08.12

Recently submitted the prospectus and submitted the prospectus, and the Spring Biotechnology Co., Ltd. (hereinafter referred to as "Runben shares"), which launched a sprint to the main board market of the Shanghai Stock Exchange, recently received the first feedback from the Securities Regulatory Commission. The reporter from the Public Securities News Daily Mirror Finance Studio noticed that the newspaper signed multiple "gambling agreements" to Runben's shares during the reporting period on August 5. The doubts of the cousin include the recoveable clauses were also inquired in the first feedback.

The reporter also noticed that the two brothers and sisters of Runben Co., Ltd., including the two younger brothers and a sister, have been similar to the main business of Runben shares control or holding the shares. And sales, the company's interbank competition issues are equally concerned.

Inquiry about the gambling agreement

Requirement further disclosure

Runben's sales model is mainly online. In recent years, the company's operating performance has continued to grow. Earlier, the newspaper reported that during the "expansion" of Runben's shares, with multiple capital increase agreements, the process of capital increase was also accompanied by signing the gambling agreement. According to the prospectus, the company and the actual controller had signed a gambling agreement with the capital increase in the capital increase in November 2020 and March 2021 with the capital increase shareholders Jin Guoping, Yan Yufeng, Li Yiqi, and Jnry VIII. If the issuer fails to realize the publication and listing in the capital market, the subscriber has the right to ask the company or the actual controller to repurchase the company's shares they hold, and the gambling agreement with JNRY VIII has agreed that the company or the actual controller Severe violations of the agreement of transaction documents or major changes in related laws lead to serious difficulties in the company's operation; or when other shareholders require the company, actual controller to repurchase shares or other cases of triggering repurchase People repurchase their company shares.

In December 2021 before submitting the prospectus, Runben shares and all of its shareholders agreed that the repurchase clauses contained in the above agreement involved the company's agreement or arrangement of the company's negative repurchase obligations or responsibilities for investors. It is not effective since the date of signing the above agreement, and has not attached any efficiency recovery clauses. However, the clauses of other special shareholders shall submit a listing application to the securities exchanges or other rights to review the listing application and the date of acceptance will be terminated automatically. When failing to go public, it will be recovered automatically.

So, before the submission of the prospectus of Runben's shares, is it just to deal with the needs of the gambling agreement? Except for the agreed and arrangement of the repurchase obligation, what is the clause of some of the special shareholders that can be restored? The above question issued a letter to Dian Run Ben's shares, but did not receive a reply.

However, in the premiere feedback of the CSRC announced on August 5th, Runburn shares were questioned by the CSRC in the issue of the letter of the letter. The specific content, performance of the agreement, the impact of the issuer's possible existence, etc., and make risk prompts. Please check whether the gambling agreement meets the relevant requirements of the "Several Questions of the First Business" and publish it. Clarify the inspection opinion. "

The actual controller brother and sister, etc.

Both sell mosquito repellent and infant protection products

According to the prospectus, Runben shares with the main sales model have three core products -mosquito repellent products, infant care products and essential oil products. Series; baby care series products include baby soothing cream, plant lip balm, baby purple grass skin care oil, baby bubble shampoo, children's moisturizing mask, moistor dingling soothing stick, purple grass soothing cream, moisture bin Ding Ding Ding Ding Ding Ding Ding Ding Ding Ding Ding Ding Ding Dingding Soothing the pearl ice dew, crack cream, and infant mouth wipes; the essential oil product series include plant essential oil stickers, plant essential oil aromatherapy, pop -up bracelets, lemongrass aromatherapy boxes.

This newspaper has previously reported that Runben shares are "husband and wife shops" controlled by Zhao Guiqin and Bao Songjuan. Zhao Guiqin and Bao Songjuan's couple controlled 85.38%of Runben's share voting rights. The two served as chairman, general manager and deputy general manager position in the company. Zhao Hanqiu, the company holding 1.33%of the company's shareholders, is the father and deputy general manager of the company, and the company's 0.89%of Bao Xin's brother of Bao Songjuan. In addition, Bao Songjuan's son Lin Ziwei also served as a director in the company. Zhao Jiasui, an assistant to the company's JD operation, Zhao Jiaying, the general manager of the new media operation manager and the company's controlling shareholder Zhuo Fan, also indirectly holds 1.78%of the company's shares, while Zhao Jiaying is Zhao Guiqin's daughter, and Zhao Jiasui is the close relative of the actual controller.

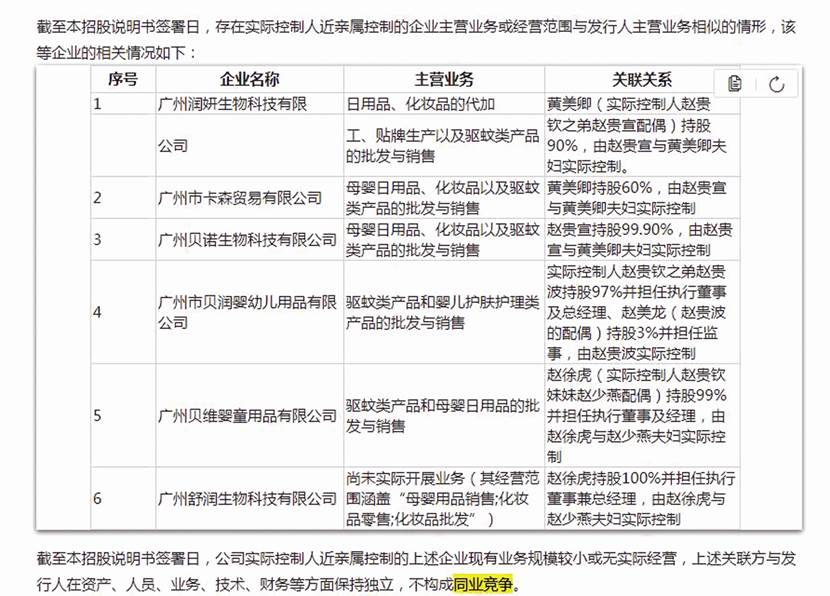

In addition to multiple relatives of the actual controller holding or serving as executives in Runben shares, the actual controller also has a number of corporate business or business scope controlled by close relatives. Two younger brothers Zhao Guiqin and six companies controlled or holding shares control or holding shares.

According to the prospectus, Guangzhou Runyan Biotechnology Co., Ltd., Guangzhou Bino Biotechnology Co., Ltd., and Guangzhou Carson Trading Co., Ltd. are all actually controlled by Zhao Guiqin's brother Zhao Guixuan and Huang Meiqing Zhao Guiqin's younger brother Zhao Guibo holds 97%and controls it. Zhao Guibo's spouse Zhao Meilong holds 3%of the shares and serves as a supervisor. The main business of the above six companies may include maternal and infant products, or wholesale and sales of mosquito repellent products. The business scope of Guangzhou Runyan Biotechnology Co., Ltd. also includes agency processing and OEM production (see Figure 1). Figure 1: The actual controller's close relatives control the enterprise is similar to the issuer's business scope

Regarding many companies controlled or holding the shares of the actual controller's brother or sister engaged in the business scope similar to the company's business scope, the doubts about the competition of the industry, Run Ben shares did not respond more, just said in the prospectus: " As of the date of the signing of the prospectus, the existing business of the above -mentioned enterprises controlled by the actual controller of the company's actual controller is small or without actual operation. Establish competition competition. "

There are standards for the identification of interbank competition

However, the reporter found a seven -star ladybug brand store on Taobao, claiming to be Guangzhou Beno Biotechnology Co., Ltd. (see Figure 2). Mosquito repellent products, including skin care purple grass oil, lip balm, electric mosquito coils, peach leaf essence exposed natural peach water newborn babies, dedicated tweezers, purple grass paste, etc., and the functions of the series of products operated by Runben Co., Ltd. Similarly, the specified manufacturers or responsible enterprise products marked are the three companies of Guangzhou Runyan Biotechnology Co., Ltd., or the three companies of Guangzhou Beno Biological Co., Ltd., or Guangzhou Market Carson Trading Co., Ltd.

Figure 2: Seven Star Ladybug Brand Stores Taobao screenshot

Especially the Guangzhou Bewei Baby Products Co., Ltd. controlled by Zhao Guiqin's sister Zhao Shaoyan and her husband Zhao Xuhu. The "Beave flagship store" opened in Tmall is a seven -year -old store with a number of fans of 25,000. 1 The number of people with a number of people. The store shows that Bewei Electric Mosquito Mosque 5,000 people+payment, Baiwei's antipruritic ointment anti -mosquito dingling 30,000 people+payment, Baiwei children and clean bath, 100,000 people+payment, Baiwei plant essential oil mosquito repellent stickers 50,000 stickers People+payment, 10,000 people+payment of infant peach water Bolun Nutrition cream+payment. Although the business scale is not as good as moisturizing, the business scale is already considerable. Runburn shares have similar product categories.

Compared with the operating category of Runben and many of the above -mentioned actual controllers, it was found that it was sold with Guangzhou Runyan Biotechnology Co., Ltd., Guangzhou Beino Biotechnology Co., Ltd. and Guangzhou Bewei Baby Products Co., Ltd. Similar products are similar, and the above companies may have online marketing paths with Taobao or Tmall, and Guangzhou Runyan Biotechnology Co., Ltd. also has the same ability to produce related products like Runben.

In fact, judging from the relevant explanation of the issue of competition in the industry, the exclusion of interbank competition is not only in terms of scale, and according to the "Several issues of the starting business of the starting business (revised in June 2020)", the problem 15 shows: 1. Scope of verification: The issuer's controlling shareholder (or actual controller) and its wholly -owned or controlled by their close relatives. 2. Principles of judgment: The "peer" for competition in the industry refers to the same or similar business as the competitors engaged in the issuer's main business. When verifying whether the same or similar business constitutes a "competition" with the issuer, it shall be in accordance with the principle of essentially focusing on the form, and in conjunction with the historical revolution, assets, personnel, and main business of related enterprises (including but not limited to the specific characteristics of products and services, the specific characteristics of product services , Technology, Trademark Business, customers, suppliers, etc.), as well as the issuer's relationship with the issuer, as well as whether the business is alternative, competitive, whether there is a conflict of interest, whether it is sold within the same market, etc., to demonstrate whether it is composed of the issuer constituted with the issuer. Competition; Do not simply determine that the product sales areas are different and the grade of the product does not constitute the competition in the industry.

Around Runben's actual controllers, many relatives at the same time operating mosquito repellent and infant products have caused a series of questions: from the above company's historical sales and sales products on Taobao or on Tmall Online Store Does the company opened by the actual controller relatives does not constitute the competition of the same industry? Does the sponsor expressed their opinions on this? Whether the company controlled by Runben and the actual controller's brother and sister has the same situation of the same outsourcing processing manufacturer. Or is there a situation where the finished product is purchased from the same foreign purchase manufacturer, is there a consistent target customer base? Whether the relevant relatives and the company's controlling shareholders and close relatives have the arranges Is there any difference in the use and direction of the above -mentioned enterprises and the above -mentioned enterprises. Is there a substitution and competition relationship?

In June of this year, the reporter sent a letter to the above issues and called Runben's shares. As of press time, no reply was received. In the feedback of the CSRC announced on August 5th, the first feedback on Runben shares issued an inquiry on the company's interbank competition, requiring it to "further sort out the actual controller's relative control or invest in the company's use of the same or similar business as the company's use of business operations. The situation, including but not limited to affiliated relationships, main business, product types, actual business conditions of related enterprises, the income scale and profitability of related enterprises, whether there are overlap in customers, suppliers and issuers and suppliers of related enterprises, suppliers and issuers and suppliers. If so, disclose the relevant procurement or sales content and amount, and analyze the fairness of the issuer's transaction price with such customers and suppliers, whether there is a situation of mutual padding for procurement or pricing; Whether there is a situation in which the company and their subsidiaries are engaged in the same or similar business. If there is, please explain the impact on the independence of the company. It is determined that when there is no competition between the same industry The actual controller and its close relatives are directly or indirectly controlled by all related companies; the actual business business of the above -mentioned enterprises is simple based on the business scope to judge the competition of the industry. Different to determine that it does not constitute the competition for the same industry; the relationship between the historical revolution, assets, personnel, business and technology of the above -mentioned enterprises and the issuer, whether to purchase and sell channels, customers, suppliers, etc. affect the independence of the issuer. During the reporting period Related companies and related parties, whether there are transactions or capital exchanges between the issuer and the actual controller. Please ask the sponsor and the issuer's lawyer to check and express opinions. "It is worth noting that the company's investigation shows that the real of Runben shares the real of Runburn shares Control Zhao Guiqin was also a 49%shareholder of Guangzhou Runyan Biotechnology Co., Ltd., and Zhao Hanqiu, the father of the actual controller, had 51%of the shares. After September 28, 2014, Zhao Guiqin withdrew from his father.

In July 2022 after Runben shares submitted the prospectus, the actual controller of Guangzhou Runyan Biotechnology Co., Ltd. changed from Huang Meiqing to Huang Zekai and Huang Meiqing withdrawn from the company's shareholders (see Figure 3).

Figure San Guangzhou Runyan Biotechnology Co., Ltd. Shareholders' change situation

Reporter Yin Yan

- END -

The list of high -growth enterprises in the Greater Bay Area announced that 21 valuations were valued at over 1 billion yuan, with a maximum of 10 billion yuan

On the morning of July 21, at the Shiyan Lake International LP Summit Forum held a...

Fenjiu Group was invited to participate in the eleventh China liquor T8 summit

On June 17, the 11th Chinese liquor T8 summit was held in Luzhou, Sichuan. Yuan Qi...