The accounts receivable of Taiji shares have doubled in the first half of the year.

Author:Daily Economic News Time:2022.08.12

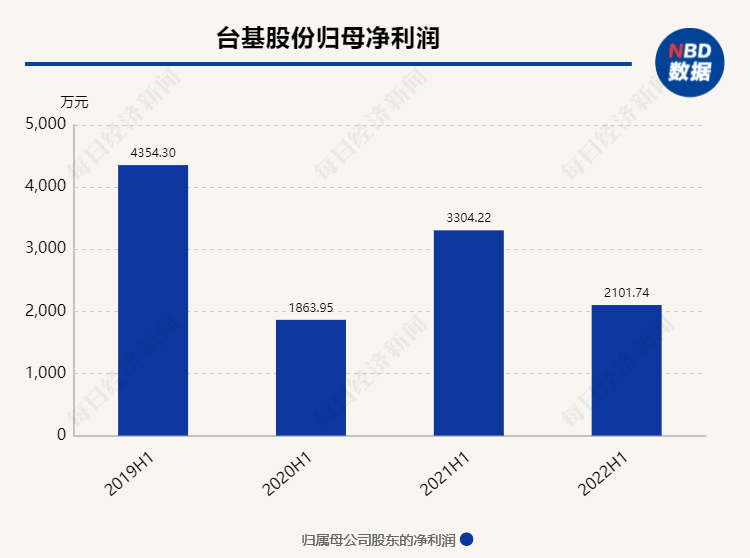

On the evening of August 11, Taiji (SZ300046, a stock price of 20.37 yuan, and a market value of 4.831 billion yuan) released the 2022 semi -annual report. In the first half of the year, the company's net profit fell by 36.39%year -on -year in operating income by 10.60%.

Behind the increasing income and increasing benefits is that During the reporting period, Taiji shares calculated the credit impairment loss of receivables. "Daily Economic News" reporter noticed that in the first half of this year, the receivables of Taiji shares increased by more than doubled compared with the end of the previous year.

In addition, the average net asset yield of Taiwan -based shares in the first half of the year was only 2.02%. In addition, the reporter noticed that as of the end of the first half of the year, Taiji still had about 422 million yuan of wealth management products, accounting for 36.60%of the company's total assets.

Accounts receivable increased by more than double the end of the previous year

The main power semiconductor device of Taiji Co., Ltd. is the research and development, manufacturing, sales and service of the main product. The main products are power semiconductor devices such as high -power crystal tubes, rectifier pipes, IGBT, power semiconductor modules, solid -state pulse power switches. Power equipment.

In the first half of 2022, Taiji achieved operating income of 178 million yuan, an increase of 10.60%year -on -year. The net profit of his mother was 21.174 million yuan, a year -on -year decrease of 36.39%.

In the first quarter of 2022, the operating income and net profit recorded by Taiji fell 3.32%and 37.54%year -on -year, respectively. In the second quarter, Taiji shares revenue increased significantly year -on -year.

Taiwan -based shares said that the company's sales in the first half of the year in the fields of network energy, polysilicon power supply have increased significantly, and the product structure and market structure have been further optimized. Among them, in the first half of the year, the sales of network energy leading customers exceeded the whole year of the previous year, and became the main growth point of the company's business.

The reason why the revenue increased in the first half of the year did not increase, and Taiji said that during the reporting period, the company calculated the credit impairment loss of receivables. After Taiji shares in 2021, the asset impairment preparation of asset impairment was 1,7327,400 yuan, and in the first half of 2022, it was planned to withdraw a credit impairment loss of 11.0593 million yuan.

The reporter noticed that as of the end of the first half of 2022, Taji's receivables increased by 118.06%compared with the end of 2021 to 117 million yuan. The explanation of Taiji shares as "affected by the epidemic, and the increase in the receivables during the credit period of the customer."

In addition, in addition to the loss loss loss, the gross profit margin of Taiji shares in the first half of the year fell 3.58 percentage points year -on -year, which undoubtedly also had an impact on the changes in net profit of returned mother.

The progress of the fixed increase investment project is not obvious

With the opening of market space such as policy support and new energy and electric vehicles, power semiconductors are considered to have good development prospects.

The recent report by the China Business Institute predicted that the market size of China's power semiconductor will rise from US $ 17.2 billion in 2020 to 19.1 billion US dollars in 2022. However The market share of the ministerial company will rise from 22.05%in 2020 to 37.11%in 2022.

Taiji also faces the pressure of market competition and technological progress. It stated in the semi -annual report that the company will accelerate the development of new devices and the development of high -end customers, actively expand the application fields, increase market share; at the same time, it will increase independent research and development Strong, seek external technical cooperation to improve the level of technological innovation.

In the first half of 2022, the R & D investment of Taiji shares was 96.595 million yuan, an increase of 49.08%year -on -year, and the R & D cost rate was 3.877%.

However, as of the end of the first half of 2022, the investment progress of the "High -power Semiconductor Technology R & D Center project" of Taiji shares was only 7.09%, which was not obvious compared to the 6.14%of the investment progress at the end of 2021. In December last year, Taiji stated that due to factors such as the epidemic, the "project reached the expected status date" of the above -mentioned additional investment projects was postponed from November 30, 2021 to the end of this year.

So, for more than 4 months, can the above -mentioned fund -raising project reached the available status at the end of this year?

In this regard, the reporter of "Daily Economic News" led to radio base shares on the afternoon of August 12. The other staff member said that the company's securities affairs representatives went to the Finance Department and asked reporters to call for interviews after half an hour, but there were many follow -up reporters. For the secondary radio base shares, the phone was unable to connect. The reporter then sent an interview letter to Taiji, and as of the time being, he had not received a reply.

The amount of wealth management products accounts for 36.60% of the company's total assets

The reporter noticed that in the first half of this year, the weighted average net asset yield of Taiji Co., Ltd. was only 2.02%.

Behind this, as of the end of the first half of 2022, the amount of wealth management products held by Taiji shares reached 422 million yuan, accounting for 36.60%of the company's total assets. Of the above 422 million wealth management products, 400 million yuan invested in the financial product of the brokerage company, and 20 million yuan was invested in bank wealth management products.

In addition, Taiji announced on August 11 that according to the company's operating development needs and fund arrangements, the comprehensive credit line was planned to apply to the bank of not more than 50 million yuan.

Why hold so many wealth management products, and at the same time apply for comprehensive credit to the bank?"Daily Economic News" reporter tried to interview Taiji shares by phone and email, but as of the time of press time, he did not receive a reply.Earlier, investors have also asked Taiji shares on the Shenzhen Stock Exchange's interactive Easy Platform, instead of using funds to purchase wealth management products, why not use shares to repurchase or cash dividends, foreign mergers and acquisitions, etc.In this regard, Taiji shares said that the company's use of temporary idle funds for cash management will help increase the company's income.

However, the 2022 semi-annual report showed that the investment income brought by the company in the first half of the year to the company was only 1.2424 million yuan. At the same time, the profit or loss of the fair value of the unprepared wealth management products was -16.154 million yuan.

Daily Economic News

- END -

Li Keqiang presided over the hold of the State Council's executive meeting to determine the measures for policy development financial instruments to support major project construction, etc.

Li Keqiang presided over the executive meeting of the State CouncilDetermine polic...

Ningbo Zhoushan, the top ten in the world!

On July 11, the Report on the Development Index of the Xinhua Baltic Sea Internati...