Five Chinese companies including PetroChina and Sinopec announced at the same time: to start from the United States to delist!CSRC responded →

Author:First financial Time:2022.08.12

12.08.2022

Number of this text: 889, reading time for about 1 minute

Guide: "We will maintain communication with relevant overseas regulatory agencies and jointly safeguard the legitimate rights and interests of enterprises and investors."

Author | First Finance Du Qingqing Zhang Yuanke

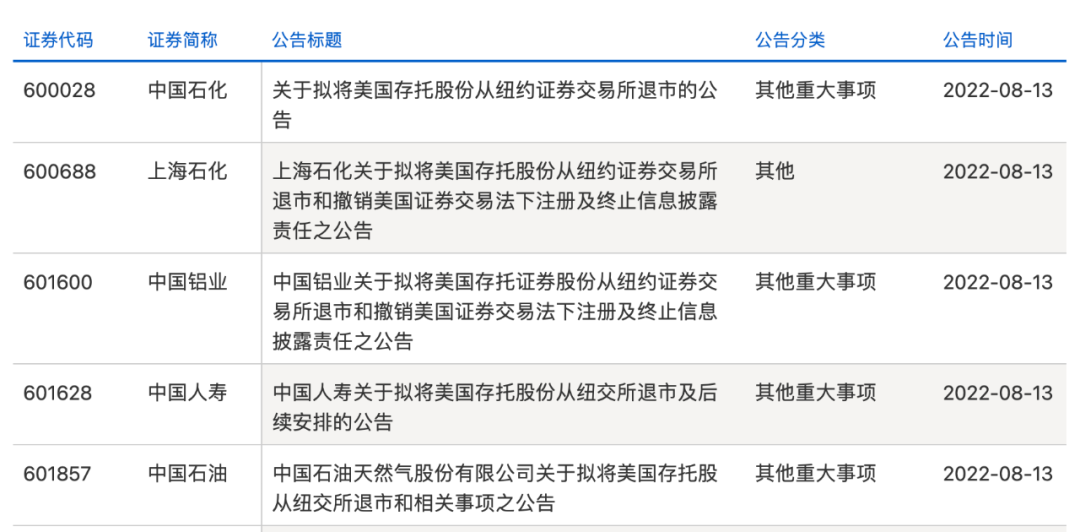

On August 12, China Life, China Petroleum, Sinopec, Shanghai Petrochemical, and China Aluminum issued announcements, announcing an announcement of the application for delisting from the United States.

Picture source: Shanghai Stock Exchange official website

"Recently, some Chinese companies have announced the start of the US delisting. What does the CSRC think?" In response to this issue, the China Securities Regulatory Commission responded in the evening.

"We have noticed the situation. Listing and delisting are the normal capital market. According to the announcement of relevant companies, these companies have strictly abide by the US capital market rules and regulatory requirements since listing in the United States. "The Securities Regulatory Commission pointed out that these companies are listed in many places, and the proportion of securities listed in the United States is small. The current delisting plan does not affect the continued use of the domestic and foreign capital market financing and development.

The China Securities Regulatory Commission respects the decision made by enterprises in accordance with its actual situation and in accordance with the rules of overseas listing.

"We will maintain communication with relevant overseas regulatory agencies to jointly safeguard the legitimate rights and interests of enterprises and investors," said the CSRC.

Taking PetroChina as an example, the company has completed many places in the market for 22 years. At present, the total amount of stocks in the United States is small.

In 2000, PetroChina was listed in Hong Kong and New York, of which the NYSE -listed deposit stocks accounted for 23.5%of the total H -shares issuance. In 2005, China Petroleum completed more than 3 billion H -shares. In 2007, PetroChina completed the issuance of A shares of 4 billion shares and listed on the Shanghai Stock Exchange. As of August 9, 2022, the number of deposit stocks accounted for about 3.93%of the company's total H shares, accounting for about 0.45%of the company's total shares.

"At present, deposit stocks account for a small proportion of the company's H shares and total shares, and the transaction volume is lower than the company's global transaction volume. At the same time The disclosure obligation requires the company to pay a large administrative burden, and the company has never used the NYSE secondary financing function and the Stock Exchange and the Shanghai Stock Exchange have strong replaceability, which can meet the company's normal operation of financing needs, "Petroleum PetroChina It is said that in order to better safeguard the interests of investors, after comprehensive assessment, the company's board of directors approved the delisting of deposit shares from the New York Stock Exchange, and in accordance with the actual situation of the follow -up actual situation, the company applies for the company to meet the relevant provisions of the securities trading law. Stocks and corresponding H shares are registered at the US Securities and Exchange Commission.

PetroChina has further stated that after the deposit shares are delisted from the NYSE, the company continues to retain the Stock Exchange and Shanghai Stock Exchange as the trading market of the company's shares. The holders of the depository shares can replace the deposit shares back to H shares to trade on the Stock Exchange.

- END -

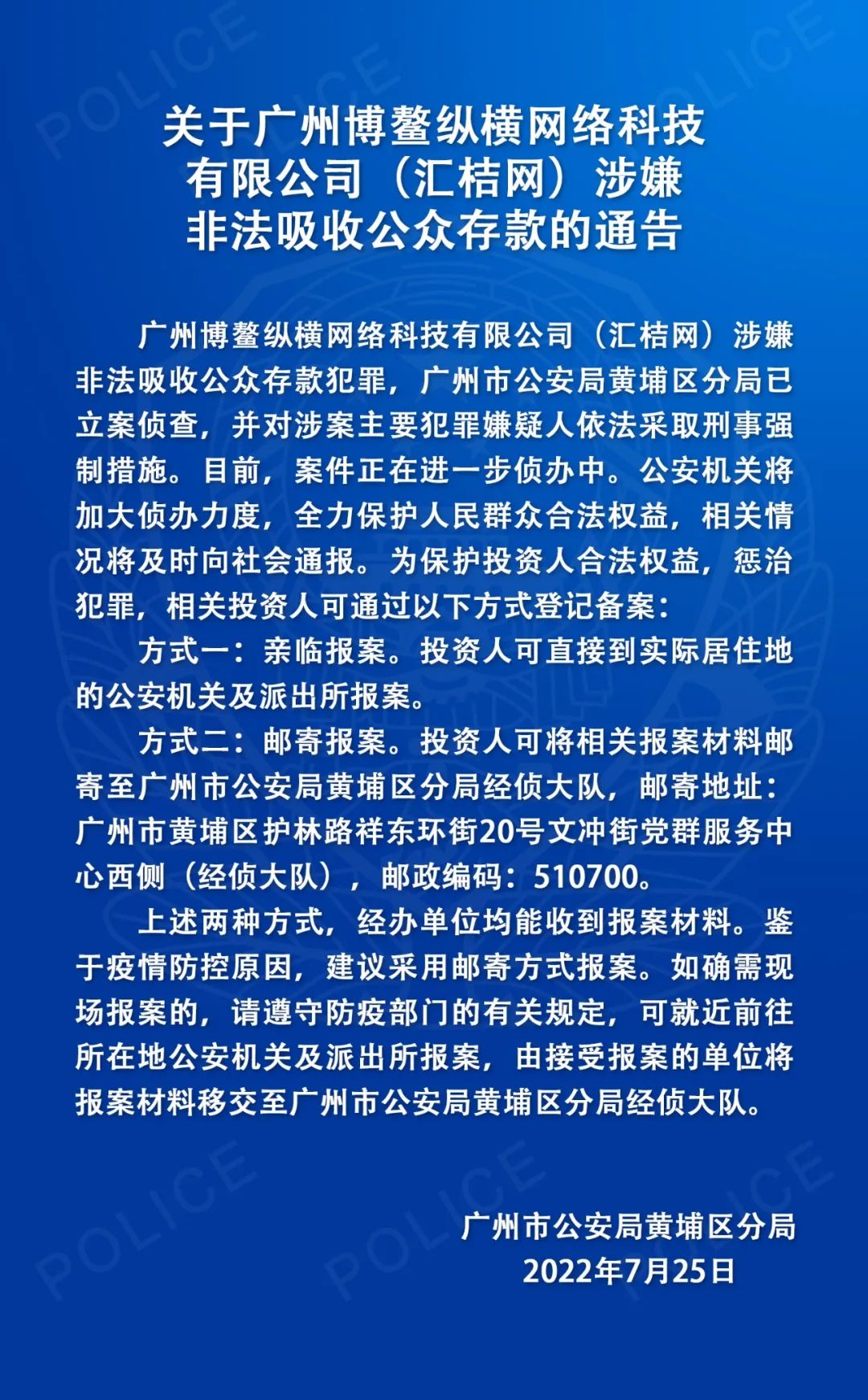

Huiji.com was suspected of illegally absorbing public deposits and was investigated

Zhongxin Jingwei, July 26th. The former tens of billions of unicorn enterprises Hu...

The medical sector continues to rise, the sector rises nearly 5%, and the valuation is still lower than the time interval of 99%of history

On the afternoon of the 4th, the medical sector continued to rise and stronger, Nu...