Evening Announcement | August 12 These announcements are watched

Author:First financial Time:2022.08.12

12.08.2022

On the evening of August 12, many listed companies in Shanghai and Shenzhen issued an announcement. The following is the summary of the First Finance and Economics for some important announcements for investors for reference.

▍ ▍ ▍ ▍

Panjiang Co., Ltd.: Getting the annual construction scale of wind power photovoltaic power generation projects, 21 preliminary planning total investment of about 9.895 billion yuan

Panjiang Co., Ltd. (600395) announced that the controlling shareholder Pangjiang Coal Power obtained the Guizhou SASAC's "Notice on Agree to Agreement of Panjiang Group's" Firefire Fire Pharmacy "Multi -Energy Complement and Integrated Project", and the planned power supply was 6.12 million A kilowatt, of which: 300,000 kilowatts of wind power projects, 3 million kilowatts of photovoltaic projects, and thermal power project "Panjiang Puding 2 × 660,000 kilowatts supercritical coal -fired power generation", and 1.5 million kilowatts of pumping storage projects. The company has obtained 21 annual construction scale projects in Guoling County, Pingding County, Xixiu District, and Zhenning County, Anshun City, with a total scale of 2.58 million kilowatts, and the total investment in a total investment is about 9.895 billion yuan. The company also announced that it is intended to invest in the construction of Panjiangpuding 2 × 660 kilowatt coal -fired power generation projects, and the total investment of the project is 5 billion yuan.

China Life: Applying for voluntary company deposit shares from the New York Stock Exchange

China Life (601628) announced that the application of the company's deposit shares from the New York Stock Exchange will be applied for a voluntary registration of the depository shares and its corresponding H shares under the securities trading law; The final date is expected to be September 1, 2022. The company also announced that from January 1st to July 31st, 2022, the cumulative original insurance premium revenue was approximately 469.6 billion yuan (unaudited).

PetroChina: It is intended to delist from the New York Stock Exchange

China Petroleum (601857) announced that the company has notified the New York Stock Exchange on August 12, 2022 (Eastern United States). The company will apply for voluntary applications in accordance with the relevant provisions of the US Securities Trading Law (revised) in 1934. Its US deposit shares (referred to as depository shares) delist from the NYSE.

Sinopec: It is planned to delist from the New York Stock Exchange from the New York Stock Exchange

Sinopec (600028) announced that the company intends to submit a form 25 form 25 forms to the US Stock Exchange on August 29, 2022 to delist its deposit shares from the New York Stock Exchange. These delisting is expected to take effect ten days after the submission of form 25. After the effective date and the date of effectiveness, the company's deposit stocks are no longer listed on the NYSE.

China Eastern Airlines: Chairman Liu Shaoyong resigned

China China China China Eastern Airlines (600115) announced that due to retirement, Liu Shaoyong resigned to the company's board of directors, chairman, chairman of the board of directors, chairman of the compensation committee, and authorized representatives of the "Hong Kong Joint Trading Institute Co., Ltd. Securities Listing Rules".

Jianzhijia: The State Administration of Market Supervision has decided to not implement further review of the company's acquisition of the Tang people's pharmaceutical equity case

Jianzhijia (605266) announced that recently, the company received the "Concentrated Anti -Monopoly Censorship of Operators in the State Administration of Market Supervision" issued by the State Administration of Market Supervision. Essence The company can implement concentration from now.

Aerospace Power: Suspected of the case of violations of laws and regulations, the CSRC was established

The Aerospace Power (600343) announced that the company received the "Notice of Filing C case" by the China Securities Regulatory Commission's company on August 12. Because the company was suspected of information disclosure and violations, in accordance with the "Securities Law of the People's Republic of China" and the "Administrative Penalty Law of the People's Republic of China" For laws and regulations, decide to investigate the company.

China Material International: It is intended to acquire 100%equity stocks of Hefei Institute to suspend trading

China Materials International (600970) announced that the company is planning to issue shares and pay cash to purchase 100%equity of Hefei Cement Research and Design Institute Co., Ltd. (referred to as "Hefei Institute") held by the General Institute of China Building Materials and raise supporting funds. The plan has not been finalized. The company's shares have been suspended from the market on August 15th, and the suspension time is expected to be suspended without more than 10 trading days; corporate bonds have not stopped trading.

Zhongtian Technology: It is intended to acquire 5%equity of Dongfeng Power and 15%equity of the Three Gorges Nantong Company

Zhongtian Technology (600522) announced that in order to integrate business resources and expand the related industries of offshore wind power, the company and the controlling shareholder Zhongtian Technology Group signed the "Equity Transfer Agreement". Nantong Company's 15%equity, with a total of 470 million yuan in transfer prices.

Hong Tao shares: cooperation with Penguin Education to terminate vocational education

Hong Tao shares (002325) announced that recently, after negotiation with specific cooperation matters in the field of vocational education with Penguin Education, the company believes that cooperation with Penguin Education does not meet the company's development strategic planning and the effect of the existing educational assets is not obvious. The company decided to terminate cooperation with Penguin Education in the field of vocational education.

Hua'an Xinchuang: It is planned to set up a joint venture with Shen Tianma A to lay out smart cockpit -related products

Hua'an Xinchuang (300928) announced that the company and Shen Tianma A intend to jointly invest in a joint venture, named Jiangsu Tianhua Automobile Electronic Technology Co., Ltd. The registered capital of the joint venture is 100 million yuan, of which the company contributed 45 million yuan, the shareholding ratio was 45%, the deep Tianma A invested 55 million yuan, and the shareholding ratio was 55%. Based on the global market of China's independent brand new energy vehicles, the joint venture will establish independent R & D, testing, independent or commissioning production and sales teams to directly deliver related products and services for downstream car manufacturers. Kunlun Wanwei: Investment Company Fun sleeping technology and other listing

Kunlun Wanwei (300418) announced that on August 12, Fun Sleeping Technology was listed on the GEM. The all -funded subsidiary Horgos Kunnuo Tianqin Entrepreneurship Investment Co., Ltd. invested in fun sleep technology in 2016. At present, it holds 46,1850 shares of interesting sleeping technology, accounting for 1.1546%of its total share capital after its issuance. Except for Fun Sleeping Technology, the company and company wholly -owned subsidiaries as an industrial investment fund initiated by ordinary partners and fund managers Kunlun Capital will be listed on the science and technology board. List on the science and technology board.

Haining Picheng: Subsidies invested 20.4 million yuan to participate in the same core fund

Haining Picheng (002344) announced that the company's wholly -owned subsidiary investment company has recently signed a partnership agreement with Tongxinzhi and jointly invested in the establishment of the same core fund. Tongxin Fund's total subscribed capital contribution was 20.6 million yuan, of which investment companies, as limited partners, contributed 20.4 million yuan in their own funds, accounting for 99.03%of the total subscription amount of the Tongxin Fund. Tongxin Fund will invest in equity in the semiconductor industry with its own funds.

Tianqi Model: It is intended to invest in the construction of automotive stamping and welding assembly manufacturing projects of no more than 575 million yuan

Tianqi Model (002510) announced that the company plans to invest in the construction of automotive stamping and welding assembly manufacturing projects in the Economic and Technological Development Zone of Hefei City, Anhui Province. The total investment is expected to exceed 575 million yuan.

▍ ▍ ▍ ▍

Zijin Mining: In the first half of the year, net profit increased by 89.95% year -on -year

Zijin Mining (601899) disclosed the semi -annual report. In the first half of the year, it achieved operating income of 132.458 billion yuan, an increase of 20.57%year -on -year; net profit was 12.63 billion yuan, an increase of 89.95%year -on -year; and the basic earnings per share were 0.48 yuan.

Hikvision: The net profit of the first half of the year was 5.759 billion yuan, a year -on -year decrease of 11.14%

Hikvision (002415) announced that the company achieved total operating income of 37.258 billion yuan in the first half of the year, an increase of 9.90%over the same period last year; the net profit attributable to shareholders of listed companies was 5.759 billion yuan, a decrease of 11.14%over the same period last year.

Perfect World: In the first half of the year, net profit of 1.137 billion yuan increased by 341.51% year -on -year

The Perfect World (002624) disclosed the semi -annual report. The company's operating income in the semi -annual 2022 year was 3.923 billion yuan, a year -on -year decrease of 6.73%; the net profit of the mother was 1.137 billion yuan, a year -on -year increase of 341.51%; the basic earnings per share were 0.60 yuan. During the reporting period, the company's operating income decreased by 6.73%compared with the same period of the previous year. It mainly adjusted the overseas game business layout and sold the US R & D Studio and related European and American distribution teams.

Kodari: The net profit of 344 million yuan in the first half of the year increased by 57.51% year -on -year

Kodari (002850) disclosed the semi -annual report that the company's operating income in the semi -annual 2022 year was 3.388 billion yuan, an increase of 88.00%year -on -year; the net profit of the mother was 344 million yuan, a year -on -year increase of 57.51%; the basic earnings per share were 1.48 yuan. During the reporting period, thanks to the growth of the production and sales of new energy vehicles driving the increase in power battery installed capacity, customers' orders for the company's power battery precision components continued to increase.

Sanhua Zhikong: In the first half of the year, net profit increased by 21.76% year -on -year.

Sanhua Zhikong (002050) disclosed the semi -annual report that the company's operating income in the semi -annual 2022 year was 10.16 billion yuan, an increase of 32.39%year -on -year; net profit of home mother was 10.03 billion yuan, an increase of 21.76%year -on -year; and the basic earnings per share were 0.28 yuan. The company plans to issue a cash dividend of 1 yuan (including tax). During the reporting period, although the company's refrigeration and air -conditioning electrical parts business was suppressed by consumption, due to changes in the competitive pattern, the number of orders flowed sharply and the performance increased significantly; It has achieved good performance growth in half a year.

Shimao Energy: In the first half of the year, net profit increased by 14.77% year -on -year.

Shimao Energy (605028) disclosed the semi -annual report. In the first half of the year, operating income was 201 million yuan, an increase of 9.32%year -on -year; net profit was 95.674 million yuan, a year -on -year increase of 14.77%; and the basic earnings per share was 0.60 yuan. It is intended to send a cash dividend of 2.00 yuan (tax) for every 10 shares of the shareholders.

Yaoshi Technology: The net profit of 153 million yuan in the first half of the year decreased by 59.84% year -on -year

Yaoshi Technology (300725) disclosed the semi -annual report that the company's operating income in the semi -annual 2022 year was 735 million yuan, an increase of 18.23%year -on -year; net profit of returning to the mother was 153 million yuan, a year -on -year decrease of 59.84%; the basic earnings per share were 0.77 yuan. Due to the company's holding of Zhejiang Huishi last year, the original equity fair value re -measured the non -recurring profit and loss of 222 million yuan. This report period realized the net profit of 151 million yuan after deducting the non -recurring profit and loss of the parent company. A year -on -year increase of 4.15%. Cambrian: Lost 622 million yuan in the first half of the year

The Cambrian (688256) disclosed the semi -annual report. In the first half of the year, it achieved operating income of 171 million yuan, an increase of 24.6%year -on -year; net profit was 622 million yuan, a loss of 390 million yuan in the same period last year.

▍ ▍ ▍ ▍ ▍ ▍

Chaoxun Communication: subsidiary signed a contract of 360 million yuan data center construction project

Chaoxun Communication (603322) announced that Chengdu Chaoxun Technology Development Co., Ltd., a subsidiary of all -Asuers, signed the "Gu'an Julong Automation Equipment Co., Ltd. Cloud Computing Data Center (B Building) New project system integration contract ", the contract amount is 360 million yuan (including tax).

Boshi: Sign 52 million yuan polysilicon full -automatic packaging contract

Bo Shi (002698) announced that recently, the company received a business contract signed with Xinjiang Qiya Silicon Industry Co., Ltd., with a contract amount of 52 million yuan. software). The above contract is 460.77 million yuan, accounting for 2.18%of the company's operating income of 2021.

Wind Shares: Winning the bid for about 248 million yuan Southern Power Grid Tendering Project

Fengfen (601700) announced that during the first batch of bidding projects of the main network material in Southern Power Grid Company in 2022, the company's winning product was 500KV AC Steel Structure, 35KV-220KV AC Steel Structure, 500KV AC Corner steel tower, 35KV-220KV AC tower, 35KV-220KV AC steel pipe tower, 35-220kV steel pipe tower, the winning amount is about 248 million yuan, accounting for 7.76%of the company's audited operating income in 2021.

Xiamen tungsten industry: signing a strategic cooperation framework agreement with Chifeng Gold

Xiamen Tungsten Industry (600549) announced that the company and Chifeng Gold signed a strategic cooperation framework agreement. The two parties plan to set up a joint venture company to focus on the development of Lao rare earth resources.

▍ ▍ increase or decrease

Fuda Shares: The controlling shareholder intends to reduce its holdings not exceeding 5%of the shares

Feda (603166) announced that the company's controlling shareholder Feda Group intends to reduce its holdings by centralized bidding and large transaction methods of not more than 5%of the company's shares.

Ha Nengda: The controlling shareholder intends to reduce its holdings not exceeding 3%of the shares

Ha Nengda (002583) announced that Chen Qingzhou, the controlling shareholder and actual controller of the company, plans to reduce the company's shares with a centralized bidding or the transaction method of the company (3%of the company's total share capital).

South Micro Medicine: Shareholders intend to reduce their holdings not exceeding 2.7%of the shares

South Micro Medicine (688029) announced that the company's shareholders' minimally invasive consultation was intended to use the Shanghai Stock Exchange trading system to concentrate bidding and reduce the company's shares in a concentrated bidding system through the Shanghai Stock Exchange trading system. It accounts for 2.7026%of the company's total share capital.

Huayi Technology: Shareholders Wang Feng intends to reduce its holdings not exceeding 2%of the shares

Huayi Technology (688071) announced that 6.86%of the shareholders Wang Feng planned to reduce its holdings through the transaction method of not more than 2%of the company's shares.

Deep Property A: The controlling shareholder intends to reduce the holding of no more than 2%of the shares

Deep Property A (000011) announced that the controlling shareholder's Shenzhen Investment Control Plan will be reduced from 15 trading days from the date of disclosure of this announcement to December 31, 2022 to reduce the company's shares by concentrated bidding or large transactions. No more than 2%of the company's total share capital).

Zhuo Shengwei: Anti -control measures such as actual controller and its consistent active acting minus holding holdings of not exceeding 1.78%of the shares

Zhuo Shengwei (300782) announced that the company's actual controller and its consistent actors Xu Zhihan, FENG Chenhui (Feng Chenhui), and more than 5%of shareholders Huizhi Investment, a total of not exceeding 1.78%of the company.

▍ Re -financing

Southeast Grid Frame: It is intended to issue a convertible bond of not over 2 billion yuan

The Southeast Grid Grave (002135) announced that the total amount of convertible corporate bonds is proposed to issue a total of 2 billion yuan, which will be used for the EPC general contracting project of the second phase of the Hangzhou International Expo Center. Louple funds.

This content is for reference only, not as the basis for your transaction.

- END -

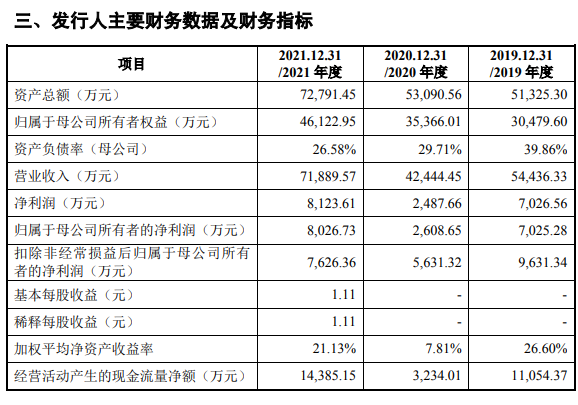

Rui Xing and Starbucks "Common Friends" Hengxin Life Sprint IPO: It is intended to raise funds to expand capacity, but there are difficulty digestion risks

Hengxin Life Technology Co., Ltd. (hereinafter referred to as Hengxin Life) is an ...

SoftBank settlement of 242 million ADS ADS holding ratio dropped to 14.6% in advance

Cover Journalist Ouyang HongyuOn the afternoon of August 10, SoftBank Group announ...