Many central enterprises such as Sinopec announced the delisting from the New York Stock Exchange, and the CSRC responded

Author:Red Star News Time:2022.08.12

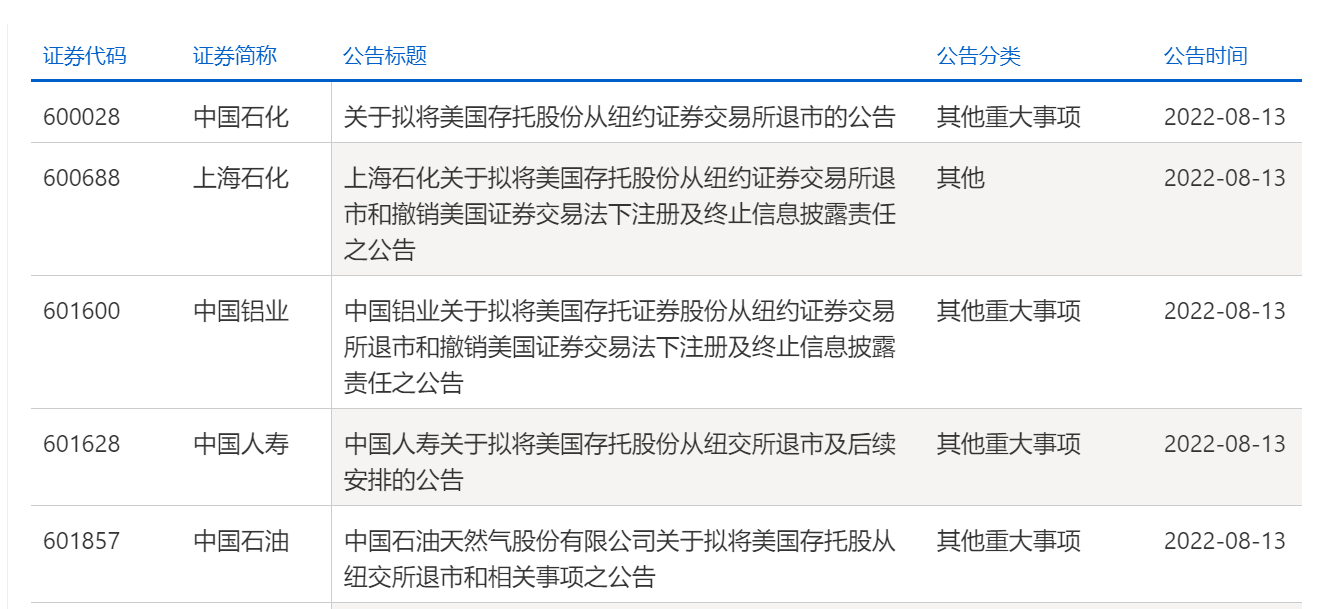

On August 12, Sinopec (600028.SH), Shanghai Petrochemical (600688.SH), China Aluminum (601600.SH), China Petroleum (601857.SH), China Life (601628.SH) stated that they intended U.S. depository shares are delisted from the New York Stock Exchange.

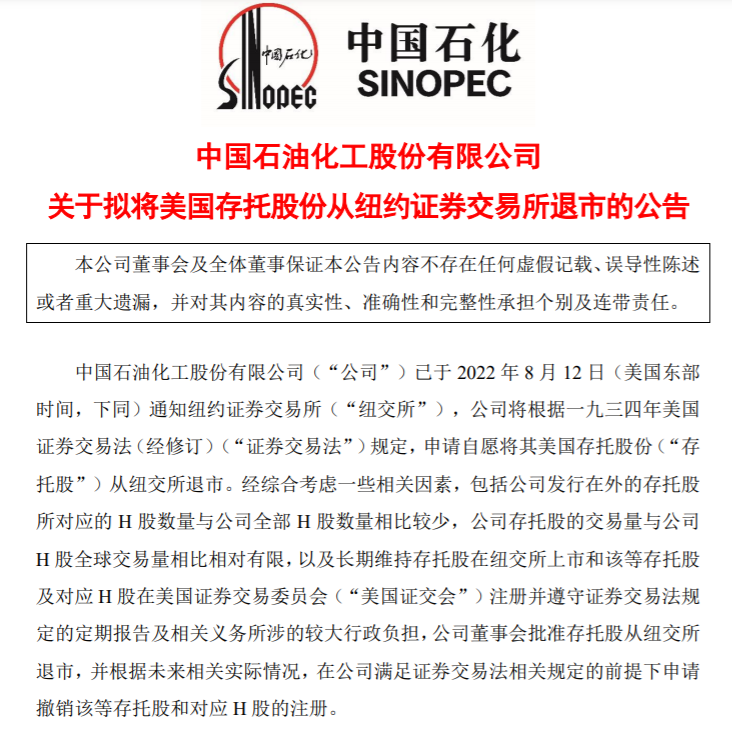

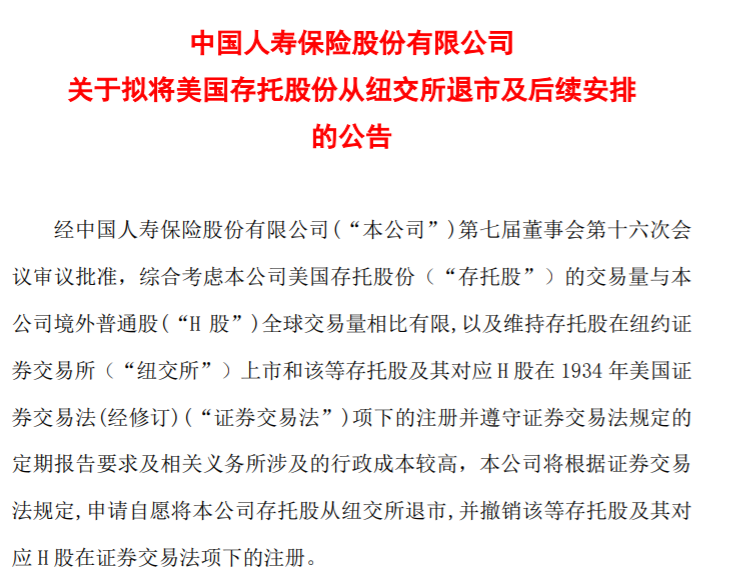

↑ Announcement Screenshot

Five companies have stated that after comprehensive consideration, some related factors, including the number of H shares corresponding to deposit stocks issued by the company, compared with the total number of H shares in the company, and the company's deposit stock transaction volume and the company's H shares global transaction Compared with relatively limited quantities, and long -term maintenance of deposit shares listed on the NYSE, and those depository shares and corresponding H shares registered in the US Securities and Exchange Commission (SEC) and comply with the regular reports stipulated in the securities trading law and related volunteers involved For a large administrative burden, the company's board of directors approves the withdrawal of the deposit shares from the New York Stock Exchange, and in accordance with the relevant actual situation in the future, apply for the application of the registration of these depository shares and the registration of the corresponding H shares under the premise of meeting the relevant provisions of the securities trading law. Essence

Sinopec said that the company plans to submit a form 25 form to SEC on August 29, 2022 or before and after, in order to delist it from the New York Stock Exchange. These delisting is expected to take effect 10 days after the submission of form 25.

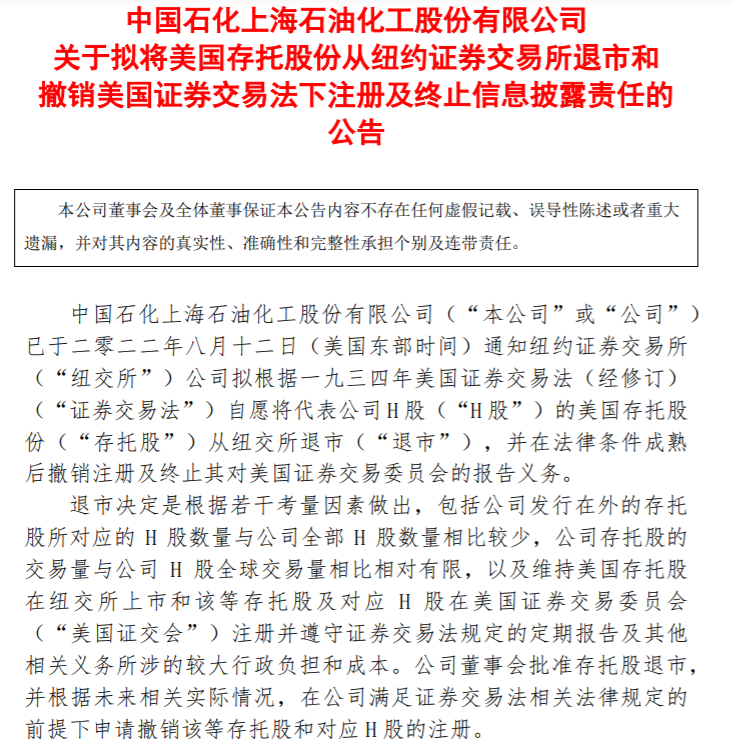

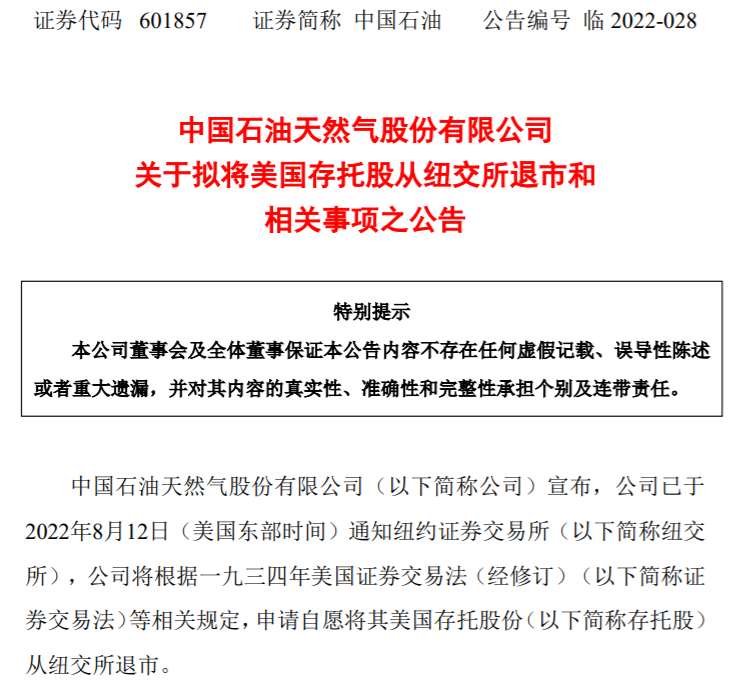

↑ Announcement Screenshot

Shanghai Petrochemical stated that the company plans to submit a form 25 application to the SEC on August 26, 2022 or before and after, and deliver its deposit shares from the New York Stock Exchange. These delisting is expected to take effect 10 days after the submission of form 25.

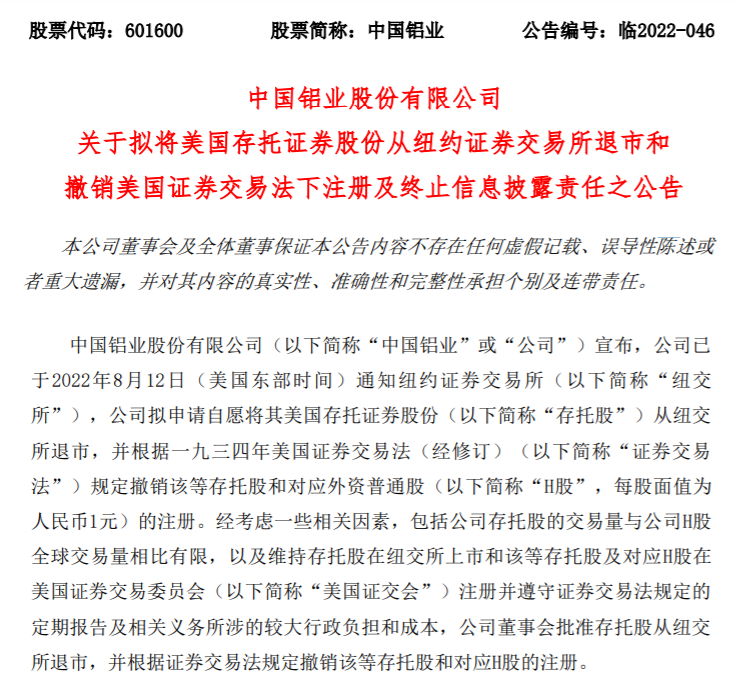

↑ Announcement Screenshot

China Aluminum said that the company plans to submit a form 25 form 25 to the SEC on August 22, 2022 to delist its deposit shares from the New York Stock Exchange. These delisting is expected to take effect after submitting 10 days in Form 25. The last date of deposit shares in the New York Stock Exchange is September 1 or around 2022. After this date and the date, the company’s deposit shares are no longer listed on the NYSE, and whether the company’s deposit stocks will be traded on the off -site trading market after that will depend on the actions of shareholders and independent third parties. It does not involve the company's participation.

↑ Announcement Screenshot

China Life stated that the company plans to submit a form 25 form 25 to the SEC on August 22, 2022 to deliver the company's deposit shares from the NYSE. These delisting is expected to take effect after 10 days of submission of form 25. The last date of deposit shares in the New York Stock Exchange is expected to be September 1, 2022.

↑ Announcement Screenshot

PetroChina said that the company plans to submit Table 25 to the SEC on August 29, 2022 or before and after, in order to delist it from the New York Stock Exchange. The delisting of the depository stock is expected to take effect after the 10 -day submission of Table 25. The last trading date of the deposit stock on the NYSE is September 8, 2022 or around.

↑ Announcement Screenshot

On August 12, the person in charge of the relevant department of the CSRC answered the reporter.

In response to individual Chinese companies that announced the start of the issue of Zero's delisting, the Securities Regulatory Commission replied that the relevant situation was noticed. Listing and delisting belong to the normal capital market. According to relevant companies' announcement information, these companies have strictly abide by the US capital market rules and regulatory requirements since the listing of the United States, and the delisting option is due to its own business considerations. These companies are listed in many places, and the proportion of securities listed in the United States is very small. The current delisting plan does not affect the continued use of domestic and foreign capital market financing and development. The China Securities Regulatory Commission respects the decision made by enterprises in accordance with its actual situation and in accordance with the rules of overseas listing. It will maintain communication with relevant overseas regulatory agencies and jointly safeguard the legitimate rights and interests of enterprises and investors.

↑ Screenshot of the official website of China Securities Regulatory Commission

Red Star News reporter Yu Yao Tao Yanyang

Editor Deng Yiguang Editor Yang Cheng

- END -

Changchun high -tech crash, Grand was dragged again?Company response: normal operation

On August 18, Changchun High -tech (000661.SZ) fell in the afternoon. The company'...

Edible fungus industry picking and promoting income increase

In recent years, the Daxinganling Forestry Group Corporation of Heilongjiang Daxin...